By Helgi Library - May 21, 2023

Alza.cz made a net profit of CZK 2,497 mil with revenues of CZK 44,995 mil in 2021, up by 16.7% and up by 20.3%, resp...

By Helgi Library - May 21, 2023

Alza.cz made a net profit of CZK 2,497 mil with revenues of CZK 44,995 mil in 2021, up by 16.7% and up by 20.3%, resp...

By Helgi Library - May 21, 2023

Alza.cz made a net profit of CZK 2,497 mil with revenues of CZK 44,995 mil in 2021, up by 16.7% and up by 20.3%, re...

| Profit Statement | 2019 | 2020 | 2021 | |

| Sales | CZK mil | 29,165 | 37,397 | 44,995 |

| Gross Profit | CZK mil | 5,671 | 4,029 | 5,140 |

| EBITDA | CZK mil | 1,567 | 2,935 | 3,708 |

| EBIT | CZK mil | 1,414 | 2,803 | 3,265 |

| Financing Cost | CZK mil | 16.4 | 38.6 | 85.8 |

| Pre-Tax Profit | CZK mil | 1,320 | 2,633 | 3,092 |

| Net Profit | CZK mil | 1,055 | 2,140 | 2,497 |

| Dividends | CZK mil | 1,055 | 0.488 | ... |

| Balance Sheet | 2019 | 2020 | 2021 | |

| Total Assets | CZK mil | 7,723 | 9,789 | 16,334 |

| Non-Current Assets | CZK mil | 367 | 651 | 4,611 |

| Current Assets | CZK mil | 7,187 | 8,969 | 11,354 |

| Working Capital | CZK mil | 1,651 | 3,134 | 7,650 |

| Shareholders' Equity | CZK mil | 1,110 | 2,195 | 2,551 |

| Total Debt | CZK mil | 110 | 261 | 4,951 |

| Net Debt | CZK mil | -748 | -755 | 4,191 |

| Ratios | 2019 | 2020 | 2021 | |

| ROE | % | 98.9 | 130 | 105 |

| ROCE | % | 67.4 | 73.8 | 31.1 |

| Gross Margin | % | 19.4 | 10.8 | 11.4 |

| EBITDA Margin | % | 5.37 | 7.85 | 8.24 |

| EBIT Margin | % | 4.85 | 7.49 | 7.26 |

| Net Margin | % | 3.62 | 5.72 | 5.55 |

| Net Debt/EBITDA | -0.477 | -0.257 | 1.13 | |

| Net Debt/Equity | % | -67.3 | -34.4 | 164 |

| Cost of Financing | % | 15.4 | 20.8 | 3.29 |

| Cash Flow | 2019 | 2020 | 2021 | |

| Total Cash From Operations | CZK mil | 831 | 1,623 | 1,503 |

| Total Cash From Investing | CZK mil | -202 | -410 | -4,330 |

| Total Cash From Financing | CZK mil | -969 | -1,055 | 2,571 |

| Net Change In Cash | CZK mil | -340 | 158 | -256 |

| Cash Conversion Cycle | days | 20.0 | 31.3 | 62.8 |

| Cash Earnings | CZK mil | 1,208 | 2,273 | 2,940 |

| Free Cash Flow | CZK mil | 629 | 1,213 | -2,827 |

Get all company financials in excel:

| overview | Unit | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 |

| income statement | |||||||||||||||||||||

| Sales | CZK mil | 13,677 | 17,369 | 20,954 | 24,910 | 29,165 | |||||||||||||||

| Gross Profit | CZK mil | ... | ... | 1,696 | 2,812 | 3,737 | 4,689 | 5,671 | |||||||||||||

| EBIT | CZK mil | ... | ... | 749 | 853 | 1,059 | 1,311 | 1,414 | |||||||||||||

| Net Profit | CZK mil | ... | ... | 568 | 644 | 808 | 969 | 1,055 | |||||||||||||

| ROE | % | ... | ... | 101 | 98.8 | 103 | 103 | 98.9 | |||||||||||||

| EBIT Margin | % | ... | ... | 5.48 | 4.91 | 5.05 | 5.26 | 4.85 | |||||||||||||

| Net Margin | % | ... | ... | 4.15 | 3.71 | 3.86 | 3.89 | 3.62 | |||||||||||||

| Employees | 629 | 729 | 939 | 1,048 | 1,355 | ||||||||||||||||

| balance sheet | |||||||||||||||||||||

| Total Assets | CZK mil | ... | 3,418 | 4,396 | 5,386 | 6,816 | 7,723 | ||||||||||||||

| Non-Current Assets | CZK mil | ... | 176 | 214 | 234 | 274 | 367 | ||||||||||||||

| Current Assets | CZK mil | ... | 3,159 | 4,030 | 4,926 | 6,192 | 7,187 | ||||||||||||||

| Shareholders' Equity | CZK mil | ... | 604 | 700 | 864 | 1,024 | 1,110 | ||||||||||||||

| Non-Current Liabilities | CZK mil | ... | 394 | 65.3 | 308 | 0 | 0 | ||||||||||||||

| Current Liabilities | CZK mil | ... | 2,306 | 3,352 | 3,962 | 5,470 | 6,166 | ||||||||||||||

| Net Debt/EBITDA | ... | ... | -0.061 | -0.207 | 0.035 | -0.733 | -0.477 | ||||||||||||||

| Net Debt/Equity | % | ... | -8.02 | -27.1 | 4.82 | -107 | -67.3 | ||||||||||||||

| Cost of Financing | % | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | 10.1 | 12.4 | 15.4 | ||

| cash flow | |||||||||||||||||||||

| Total Cash From Operations | CZK mil | ... | ... | 259 | 775 | 549 | 2,105 | 831 | |||||||||||||

| Total Cash From Investing | CZK mil | ... | ... | -51.8 | -97.9 | -105 | -146 | -202 | |||||||||||||

| Total Cash From Financing | CZK mil | ... | ... | -151 | -877 | -401 | -1,117 | -969 | |||||||||||||

| Net Change In Cash | CZK mil | ... | ... | 56.5 | -201 | 43.5 | 843 | -340 |

| income statement | Unit | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 |

| income statement | |||||||||||||||||||||

| Sales | CZK mil | 13,677 | 17,369 | 20,954 | 24,910 | 29,165 | |||||||||||||||

| Cost of Goods & Services | CZK mil | ... | ... | 11,982 | 14,557 | 17,217 | 20,222 | 23,494 | |||||||||||||

| Gross Profit | CZK mil | ... | ... | 1,696 | 2,812 | 3,737 | 4,689 | 5,671 | |||||||||||||

| Staff Cost | CZK mil | ... | ... | 337 | 417 | 573 | 747 | 902 | |||||||||||||

| EBITDA | CZK mil | ... | ... | 799 | 913 | 1,191 | 1,491 | 1,567 | |||||||||||||

| Depreciation | CZK mil | ... | ... | 50.0 | 60.5 | 132 | 180 | 153 | |||||||||||||

| EBIT | CZK mil | ... | ... | 749 | 853 | 1,059 | 1,311 | 1,414 | |||||||||||||

| Net Financing Cost | CZK mil | ... | ... | 40.9 | 62.1 | 68.8 | 117 | 94.0 | |||||||||||||

| Financing Cost | CZK mil | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | 25.5 | 30.8 | 16.4 | ||

| Financing Income | CZK mil | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | 76.1 | 61.4 | 76.9 | ||

| Pre-Tax Profit | CZK mil | ... | ... | 708 | 790 | 990 | 1,194 | 1,320 | |||||||||||||

| Tax | CZK mil | ... | ... | 140 | 146 | 181 | 226 | 265 | |||||||||||||

| Minorities | CZK mil | ... | ... | 0 | 0 | 0 | 0 | 0 | |||||||||||||

| Net Profit | CZK mil | ... | ... | 568 | 644 | 808 | 969 | 1,055 | |||||||||||||

| Net Profit Avail. to Common | CZK mil | ... | ... | 568 | 644 | 808 | 969 | 1,055 | |||||||||||||

| Dividends | CZK mil | ... | ... | 548 | 644 | 809 | 969 | 1,055 | ... | ||||||||||||

| growth rates | |||||||||||||||||||||

| Total Revenue Growth | % | ... | 23.0 | 27.0 | 20.6 | 18.9 | 17.1 | ||||||||||||||

| Staff Cost Growth | % | ... | ... | ... | 27.6 | 23.9 | 37.2 | 30.4 | 20.7 | ||||||||||||

| EBITDA Growth | % | ... | ... | ... | 20.9 | 14.3 | 30.4 | 25.3 | 5.10 | ||||||||||||

| EBIT Growth | % | ... | ... | ... | 19.5 | 13.8 | 24.2 | 23.9 | 7.83 | ||||||||||||

| Pre-Tax Profit Growth | % | ... | ... | ... | 21.5 | 11.6 | 25.2 | 20.7 | 10.6 | ||||||||||||

| Net Profit Growth | % | ... | ... | ... | 20.8 | 13.3 | 25.5 | 19.8 | 8.92 | ||||||||||||

| ratios | |||||||||||||||||||||

| ROE | % | ... | ... | 101 | 98.8 | 103 | 103 | 98.9 | |||||||||||||

| ROA | % | ... | ... | 19.6 | 16.5 | 16.5 | 15.9 | 14.5 | |||||||||||||

| ROCE | % | ... | ... | 47.9 | 45.1 | 47.0 | 63.3 | 67.4 | |||||||||||||

| Gross Margin | % | ... | ... | 12.4 | 16.2 | 17.8 | 18.8 | 19.4 | |||||||||||||

| EBITDA Margin | % | ... | ... | 5.84 | 5.26 | 5.68 | 5.99 | 5.37 | |||||||||||||

| EBIT Margin | % | ... | ... | 5.48 | 4.91 | 5.05 | 5.26 | 4.85 | |||||||||||||

| Net Margin | % | ... | ... | 4.15 | 3.71 | 3.86 | 3.89 | 3.62 | |||||||||||||

| Payout Ratio | % | ... | ... | 96.5 | 100 | 100 | 100 | 100 | ... | ||||||||||||

| Cost of Financing | % | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | 10.1 | 12.4 | 15.4 | ||

| Net Debt/EBITDA | ... | ... | -0.061 | -0.207 | 0.035 | -0.733 | -0.477 |

| balance sheet | Unit | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 |

| balance sheet | |||||||||||||||||||||

| Cash & Cash Equivalents | CZK mil | ... | 504 | 303 | 347 | 1,190 | 850 | ||||||||||||||

| Receivables | CZK mil | ... | 652 | 1,006 | 1,405 | 1,710 | 1,873 | ||||||||||||||

| Inventories | CZK mil | ... | 2,003 | 2,711 | 3,174 | 3,293 | 4,464 | ||||||||||||||

| Current Assets | CZK mil | ... | 3,159 | 4,030 | 4,926 | 6,192 | 7,187 | ||||||||||||||

| Property, Plant & Equipment | CZK mil | ... | 144 | 159 | 157 | 184 | 251 | ||||||||||||||

| LT Investments & Receivables | CZK mil | ... | 0 | 0 | 1.95 | 8.37 | 8.07 | ||||||||||||||

| Intangible Assets | CZK mil | ... | 32.3 | 54.5 | 75.1 | 81.9 | 108 | ||||||||||||||

| Goodwill | CZK mil | ... | 0 | 0 | 0 | 0 | 0 | ||||||||||||||

| Non-Current Assets | CZK mil | ... | 176 | 214 | 234 | 274 | 367 | ||||||||||||||

| Total Assets | CZK mil | ... | 3,418 | 4,396 | 5,386 | 6,816 | 7,723 | ||||||||||||||

| Trade Payables | CZK mil | ... | 1,465 | 2,442 | 2,862 | 4,167 | 4,687 | ||||||||||||||

| Short-Term Debt | CZK mil | ... | 63.1 | 52.3 | 81.8 | 104 | 110 | ||||||||||||||

| Other ST Liabilities | CZK mil | ... | 778 | 857 | 1,019 | 1,199 | 1,369 | ||||||||||||||

| Current Liabilities | CZK mil | ... | 2,306 | 3,352 | 3,962 | 5,470 | 6,166 | ||||||||||||||

| Long-Term Debt | CZK mil | ... | 392 | 61.5 | 308 | 0 | 0 | ||||||||||||||

| Other LT Liabilities | CZK mil | ... | 2.20 | 3.81 | 0 | 0 | 0 | ||||||||||||||

| Non-Current Liabilities | CZK mil | ... | 394 | 65.3 | 308 | 0 | 0 | ||||||||||||||

| Equity Before Minority Interest | CZK mil | ... | 604 | 700 | 864 | 1,024 | 1,110 | ||||||||||||||

| Minority Interest | CZK mil | ... | 0 | 0 | 0 | 0 | 0 | ||||||||||||||

| Equity | CZK mil | ... | 604 | 700 | 864 | 1,024 | 1,110 | ||||||||||||||

| growth rates | |||||||||||||||||||||

| Total Asset Growth | % | ... | ... | 43.3 | 28.6 | 22.5 | 26.6 | 13.3 | |||||||||||||

| Shareholders' Equity Growth | % | ... | ... | 15.7 | 15.9 | 23.5 | 18.5 | 8.41 | |||||||||||||

| Net Debt Growth | % | ... | ... | -160 | 291 | -122 | -2,727 | -31.6 | |||||||||||||

| Total Debt Growth | % | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | -13.9 | -75.0 | 243 | -73.3 | 5.47 | ||||

| ratios | |||||||||||||||||||||

| Total Debt | CZK mil | ... | 455 | 114 | 390 | 104 | 110 | ||||||||||||||

| Net Debt | CZK mil | ... | -48.5 | -189 | 41.6 | -1,094 | -748 | ||||||||||||||

| Working Capital | CZK mil | ... | 1,190 | 1,275 | 1,717 | 836 | 1,651 | ||||||||||||||

| Capital Employed | CZK mil | ... | 1,366 | 1,489 | 1,951 | 1,110 | 2,018 | ||||||||||||||

| Net Debt/Equity | % | ... | -8.02 | -27.1 | 4.82 | -107 | -67.3 | ||||||||||||||

| Current Ratio | ... | 1.37 | 1.20 | 1.24 | 1.13 | 1.17 | |||||||||||||||

| Quick Ratio | ... | 0.501 | 0.391 | 0.442 | 0.530 | 0.442 |

| cash flow | Unit | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 |

| cash flow | |||||||||||||||||||||

| Net Profit | CZK mil | ... | ... | 568 | 644 | 808 | 969 | 1,055 | |||||||||||||

| Depreciation | CZK mil | ... | ... | 50.0 | 60.5 | 132 | 180 | 153 | |||||||||||||

| Non-Cash Items | CZK mil | ... | ... | -4.14 | 155 | 51.4 | 75.0 | 438 | |||||||||||||

| Change in Working Capital | CZK mil | ... | ... | -355 | -85.2 | -443 | 882 | -815 | |||||||||||||

| Total Cash From Operations | CZK mil | ... | ... | 259 | 775 | 549 | 2,105 | 831 | |||||||||||||

| Capital Expenditures | CZK mil | ... | ... | -51.8 | -98.2 | -106 | -146 | -202 | |||||||||||||

| Other Investing Activities | CZK mil | ... | ... | 0 | 0.358 | 0.841 | 0 | 0.326 | |||||||||||||

| Total Cash From Investing | CZK mil | ... | ... | -51.8 | -97.9 | -105 | -146 | -202 | |||||||||||||

| Dividends Paid | CZK mil | ... | ... | -433 | -548 | -644 | -809 | -969 | |||||||||||||

| Issuance Of Shares | CZK mil | ... | ... | 0 | 0 | 0 | 0 | 0 | |||||||||||||

| Issuance Of Debt | CZK mil | ... | ... | 281 | -342 | 276 | -286 | 5.70 | |||||||||||||

| Total Cash From Financing | CZK mil | ... | ... | -151 | -877 | -401 | -1,117 | -969 | |||||||||||||

| Effect of FX Rates | CZK mil | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | 0 | 0 | 0 | 0 | ||

| Net Change In Cash | CZK mil | ... | ... | 56.5 | -201 | 43.5 | 843 | -340 | |||||||||||||

| ratios | |||||||||||||||||||||

| Days Sales Outstanding | days | ... | 17.4 | 21.1 | 24.5 | 25.1 | 23.4 | ||||||||||||||

| Days Sales Of Inventory | days | ... | ... | 61.0 | 68.0 | 67.3 | 59.4 | 69.4 | |||||||||||||

| Days Payable Outstanding | days | ... | ... | 44.6 | 61.2 | 60.7 | 75.2 | 72.8 | |||||||||||||

| Cash Conversion Cycle | days | ... | ... | 33.8 | 27.9 | 31.1 | 9.28 | 20.0 | |||||||||||||

| Cash Earnings | CZK mil | ... | ... | 618 | 705 | 941 | 1,148 | 1,208 | |||||||||||||

| Free Cash Flow | CZK mil | ... | ... | 208 | 677 | 445 | 1,959 | 629 | |||||||||||||

| Capital Expenditures (As % of Sales) | % | ... | ... | 0.379 | 0.566 | 0.504 | 0.585 | 0.693 |

| other ratios | Unit | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 |

| Employees | 629 | 729 | 939 | 1,048 | 1,355 | ||||||||||||||||

| Cost Per Employee | USD per month | ... | ... | 1,870 | 1,891 | 2,165 | 2,714 | 2,460 | |||||||||||||

| Cost Per Employee (Local Currency) | CZK per month | ... | ... | 44,624 | 47,716 | 50,810 | 59,387 | 55,451 | |||||||||||||

| Material & Energy (As % of Sales) | % | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | 79.3 | 75.1 | 72.9 | 71.7 | 69.6 | |||||

| Services (As % of Sales) | % | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | 8.32 | 8.69 | 9.22 | 9.53 | 10.9 | |||||

| Staff Cost (As % of Sales) | % | ... | ... | 2.46 | 2.40 | 2.73 | 3.00 | 3.09 | |||||||||||||

| Effective Tax Rate | % | ... | ... | 19.8 | 18.5 | 18.3 | 18.9 | 20.1 | |||||||||||||

| Total Revenue Growth (5-year average) | % | ... | ... | ... | ... | ... | 19.1 | 20.8 | 22.3 | 22.3 | 21.3 | ||||||||||

| Total Revenue Growth (10-year average) | % | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | 27.4 | 26.9 | 24.7 | 22.7 | 21.3 | |||||

| Customers | mil | 2.19 | 2.44 | 2.90 | 3.70 | 4.00 | ... | ... | |||||||||||||

| Branches | ... | ... | ... | ... | ... | ... | ... | ... |

| clients & arpu | Unit | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 |

| Customers | mil | 2.19 | 2.44 | 2.90 | 3.70 | 4.00 | ... | ... | |||||||||||||

| Sales per Customer | USD | 261 | 282 | 308 | 308 | 323 | ... | ... | |||||||||||||

| EBITDA per Customer | USD | ... | ... | 15.3 | 14.8 | 17.5 | 18.4 | 17.4 | ... | ... | |||||||||||

| Net Profit per Customer | USD | ... | ... | 10.9 | 10.5 | 11.9 | 12.0 | 11.7 | ... | ... | |||||||||||

| ARPU from Total Business | CZK per month | 520 | 593 | 602 | 561 | 608 | ... | ... |

| e-commerce | Unit | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 |

| Web Visits | mil | ... | ... | ... | ... | ... | 121 | 140 | 180 | 240 | ... | ... | ... | ||||||||

| Number of Orders | mil | 5.54 | 6.40 | 7.90 | 10.3 | 12.3 | ... | ... | |||||||||||||

| Number of Products Shipped | mil | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | 37.0 | ... | ... |

| Average Size Per Order | USD | 104 | 108 | 113 | 111 | 105 | ... | ... | |||||||||||||

| Number of Orders Per Customer | 2.52 | 2.62 | 2.72 | 2.78 | 3.08 | ... | ... | ||||||||||||||

| Average Items per Order | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | 3.01 | ... | ... | |

| Number of Products Listed | mil | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | 0.220 | ... | ... |

Get all company financials in excel:

By Helgi Library - May 21, 2023

Alza.cz made a net profit of CZK 2,497 mil with revenues of CZK 44,995 mil in 2021, up by 16.7% and up by 20.3%, respectively, compared to the previous year. This translates into a net margin of 5.55%. Historically, between 2004 - 2021, the firm�...

By Helgi Library - May 21, 2023

Alza.cz made a net profit of CZK 2,497 mil in 2021, up 16.7% compared to the previous year. Total sales reached CZK 44,995 mil, which is up 20.3% when compared to the previous year. Historically, between 2004 and 2021, the company’s net profit reac...

By Helgi Library - May 21, 2023

Alza.cz made a net profit of CZK 2,497 mil in 2021, up 16.7% compared to the previous year. Total sales reached CZK 44,995 mil, which is up 20.3% when compared to the previous year. Historically, between 2004 and 2021, the company’s net profit reac...

By Helgi Library - May 21, 2023

Alza.cz employed 2,112 employees in 2021, up 21.7% compared to the previous year. Historically, between 2002 and 2021, the firm's workforce hit a high of 2,112 employees in 2021 and a low of 15.0 employees in 2002. Average personnel cost stood at USD...

By Helgi Library - May 21, 2023

Alza.cz employed 2,112 employees in 2021, up 21.7% compared to the previous year. Historically, between 2002 and 2021, the firm's workforce hit a high of 2,112 employees in 2021 and a low of 15.0 employees in 2002. Average personnel cost stood at USD...

By Helgi Library - May 21, 2023

Alza.cz invested a total of CZK 4,335 mil in 2021, up 956% compared to the previous year. Historically, between 2004 - 2021, the company's investments stood at a high of CZK 4,335 mil in 2021 and a low of CZK 1.59 mil in 2006. As a pe...

By Helgi Library - May 21, 2023

Alza.cz invested a total of CZK 4,335 mil in 2021, up 956% compared to the previous year. Historically, between 2004 - 2021, the company's investments stood at a high of CZK 4,335 mil in 2021 and a low of CZK 1.59 mil in 2006. As a pe...

By Helgi Library - May 21, 2023

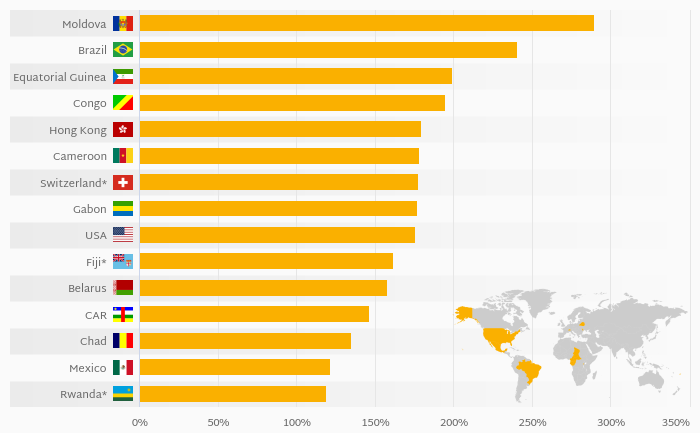

Alza.cz's net debt stood at CZK 4,191 mil and accounted for 164% of equity at the end of 2021. The ratio is up 199 pp compared to the previous year. Historically, the firm’s net debt to equity reached a high of 164% in 2021 and a low of -120%...

By Helgi Library - May 21, 2023

Alza.cz's net debt stood at CZK 4,191 mil and accounted for 164% of equity at the end of 2021. The ratio is up 199 pp compared to the previous year. Historically, the firm’s net debt to equity reached a high of 164% in 2021 and a low of -120%...

By Helgi Library - May 21, 2023

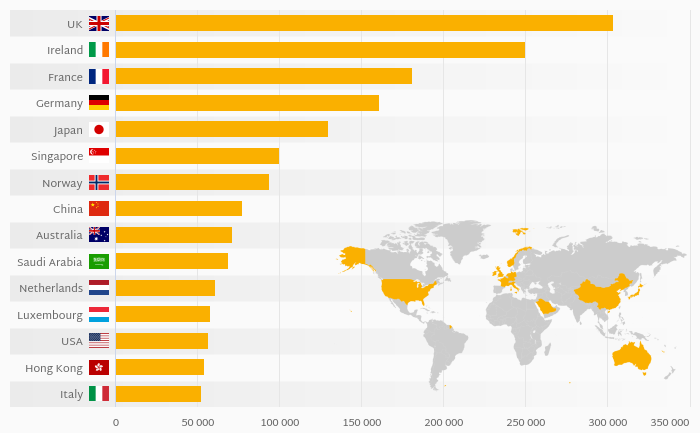

Alza.cz generated sales of CZK 44,995 mil in 2021, up 20.3% compared to the previous year. Historically, between 2002 and 2021, the company’s sales reached a high of CZK 44,995 mil in 2021 and a low of CZK 302 mil in 2002. Over the last three year...

Alza.cz a.s. is a leading Czech seller of computers and electronics. The Company has been established in 1994 and is headquartered in Prague, the Czech Republic. Alza.cz is a retailer offering computers, electronics, household appliances, toys, perfumes, jewelry and also sports and hobby equipment.

Alza.cz has been growing its sales by 21.0% a year on average in the last 5 years. EBITDA has grown on average by 32.4% a year during that time to total of CZK 3,708 mil in 2021, or 8.24% of sales. That’s compared to 6.63% average margin seen in last five years.

The company netted CZK 2,497 mil in 2021 implying ROE of 105% and ROCE of 31.1%. Again, the average figures were 108% and 56.5%, respectively when looking at the previous 5 years.

Alza.cz’s net debt amounted to CZK 4,191 mil at the end of 2021, or 164% of equity. When compared to EBITDA, net debt was 1.13x, up when compared to average of -0.060x seen in the last 5 years.

Helgi Library

Helgi Library