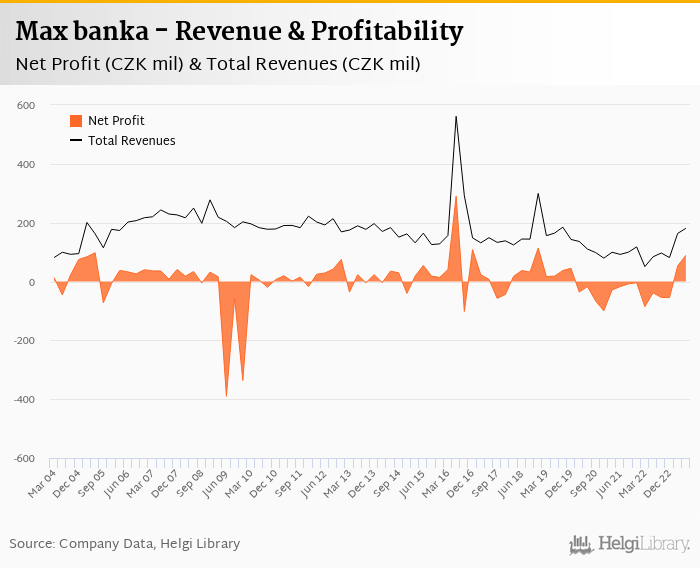

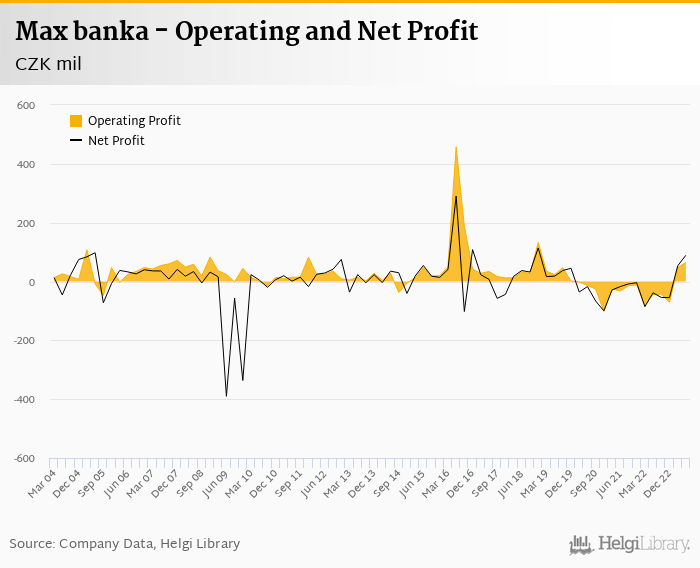

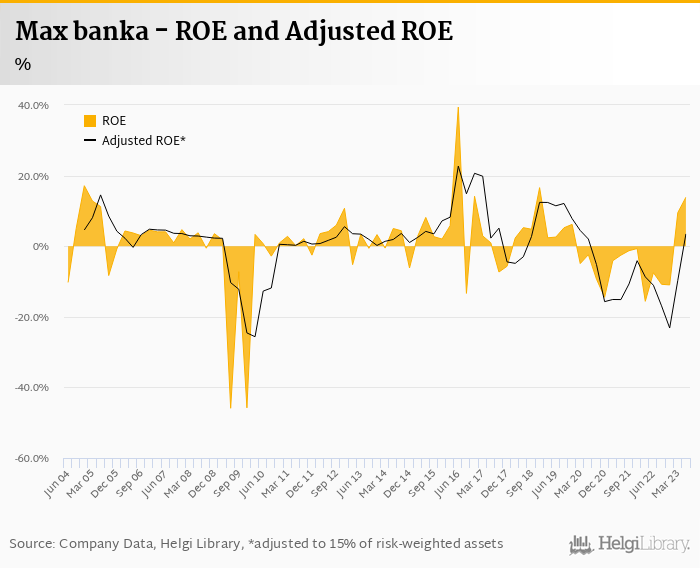

Max banka posted a record net profit CZK 89.3 mil in 2Q2023 and generated ROE of 13.9%.

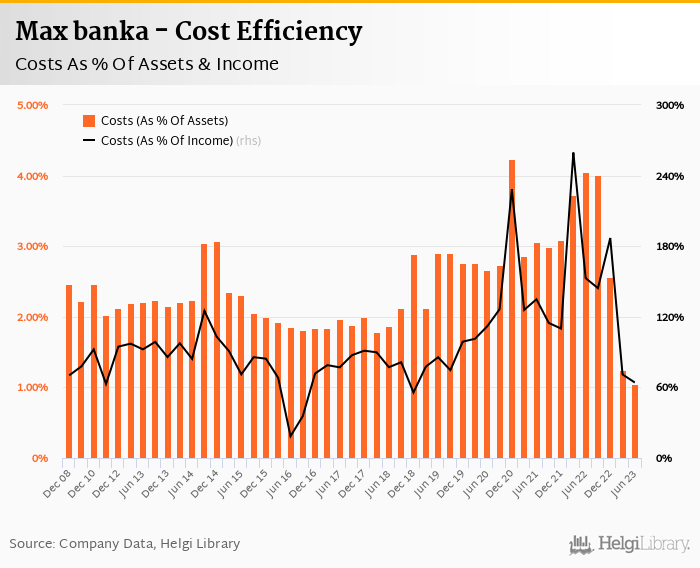

Revenues more than doubled as deposits increased four-fold. Cost fell 9.7%, so cost to income decreased to 64.1% from more than 100% last year.

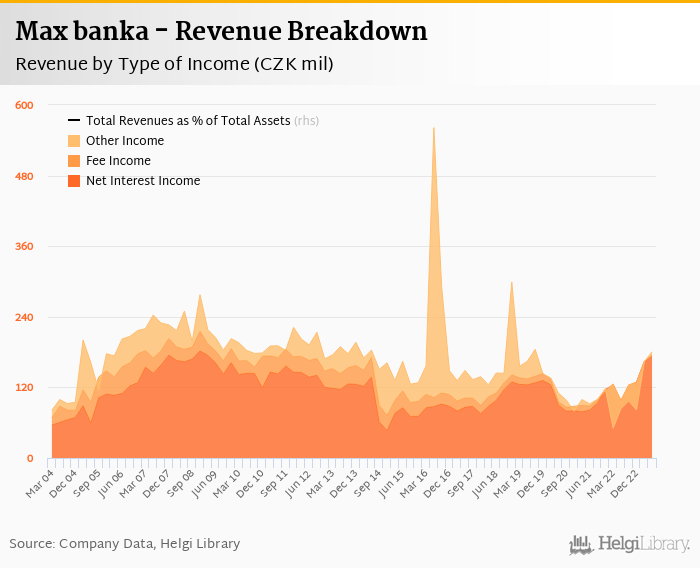

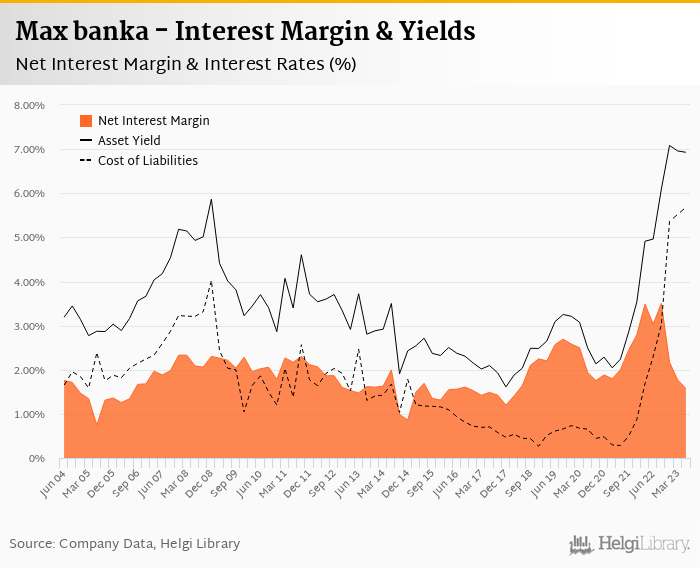

With almost 90% of its assets placed with Central Bank and 97% of its revenues coming from interest income, further challenges lay ahead.

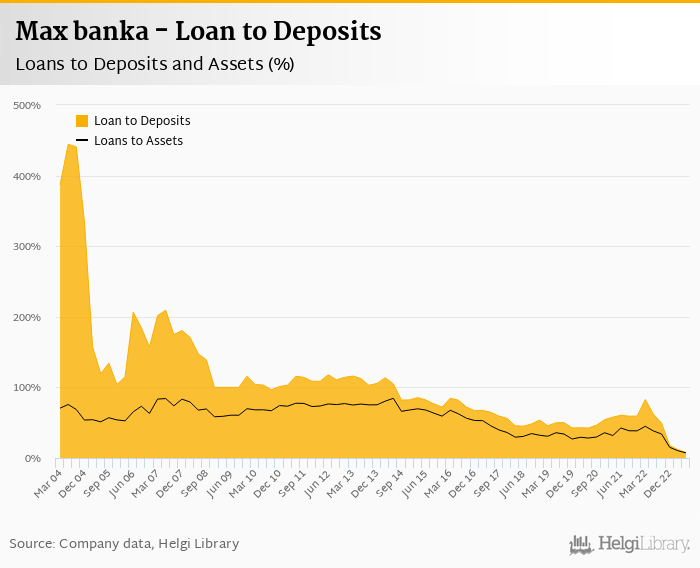

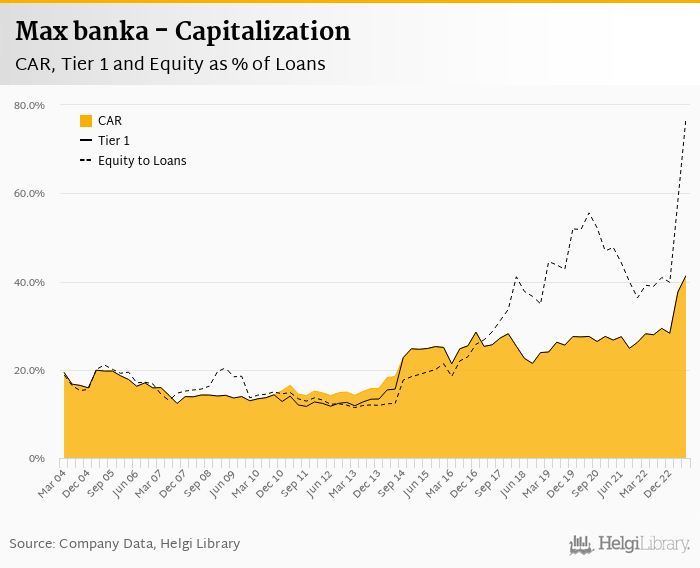

With loan to deposit at 7.9% and capital adequacy in access of 30%, the Bank is well positioned to address the asset side when the interest rate differential narrows.

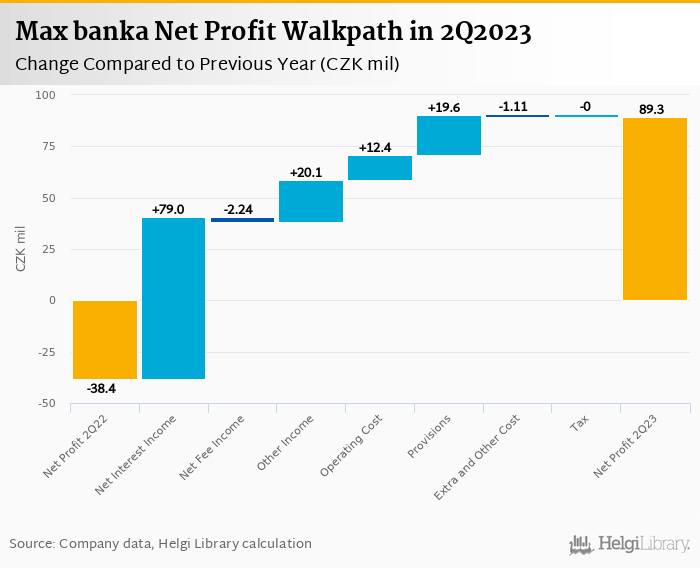

Max banka made a second consecutive quarterly net profit of CZK 89.3 mil improving its bottom line by hefty CZK 128 mil when compared to last year. A jump in interest income from a 4-fold increase in deposits, absence of trading losses, good cost control and additional provision writebacks all contributed to the strong performance last quarter:

Revenues increased 115% yoy to CZK 181 mil. With net interest margin falling further 21 pp last quarter (down 1.46 pp yoy) to 1.58% of total assets, the increase is driven purely by a massive volume growth in retail deposits. Absence of other income/trading losses helped also last quarter when compared to last year:

Average asset yield was 6.93% in the second quarter of 2023 (up from 4.96% a year ago) while cost of funding amounted to 5.68% in 2Q2023 (up from 2.30%). With CZK 42.5 bil, or almost 90% of total assets placed with Central Bank, Max banka continues to rely heavily on attracting new customers at high deposit rates and "parking" its access liquidity with the Central Bank:

Having said that, costs decreased by 9.7% yoy and the bank operated with average cost to income of 64.1% in the last quarter. That's a great improvement from a figure of more than 100% seen in the past. Good cost control has been seen particularly at the personnel with staff costs falling almost 20%:

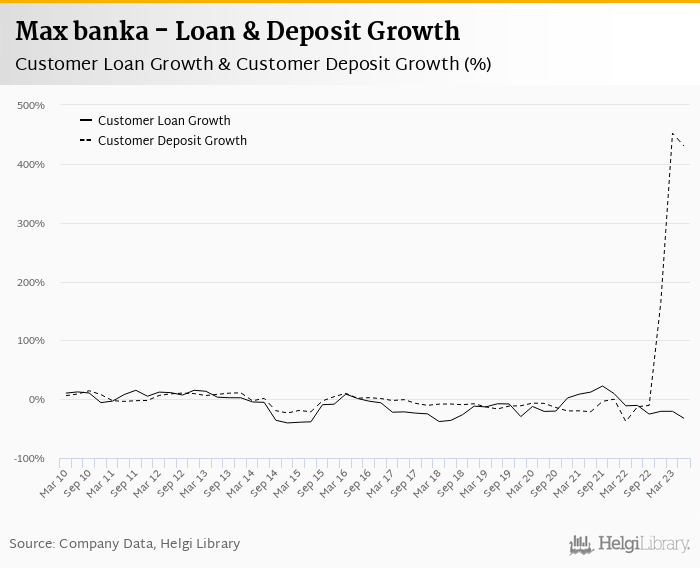

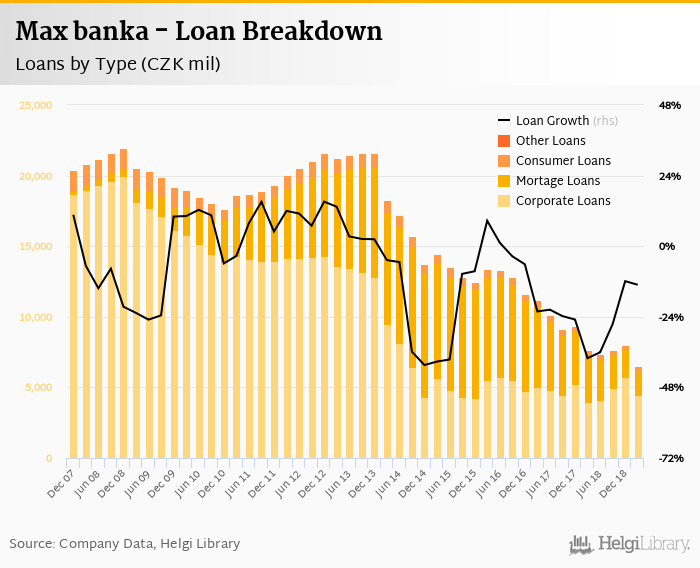

Max banka's customer loans decreased further 18.1% qoq in the second quarter of 2023 as post-acquisition clean up continues. At the end of second quarter of 2023, loans accounted for only 7.9% of total deposits and 7.3% of total assets.

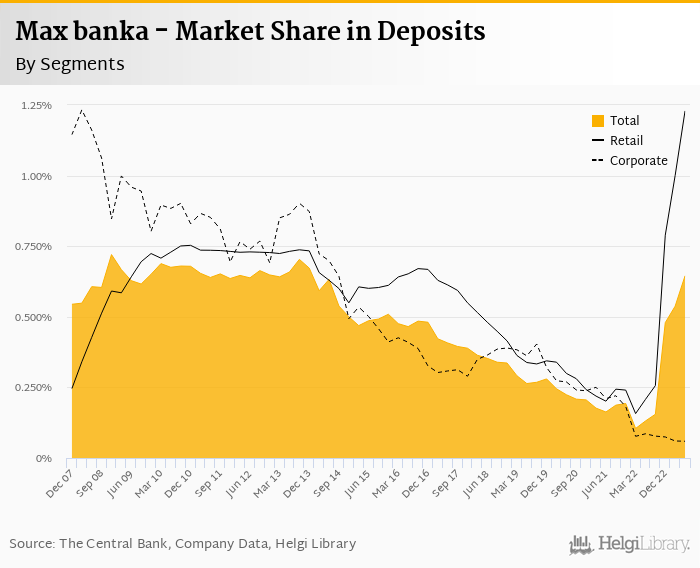

On the other hand, retail deposits continued flowing in and they increased further 23.7% qoq last quarter. When compared to last year, they rose more than 4-times:

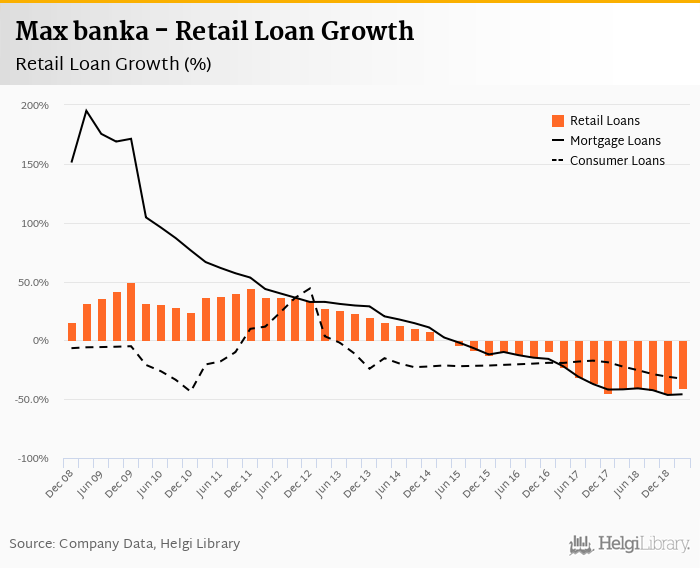

However irrelevant given their low volumes and part of assets, retail loans fell 5.3% qoq and were 22.3% up yoy. They accounted for 21.5% of the loan book at the end of the second quarter of 2023 while corporate loans decreased 23.7% qoq (down 36% yoy, respectively):

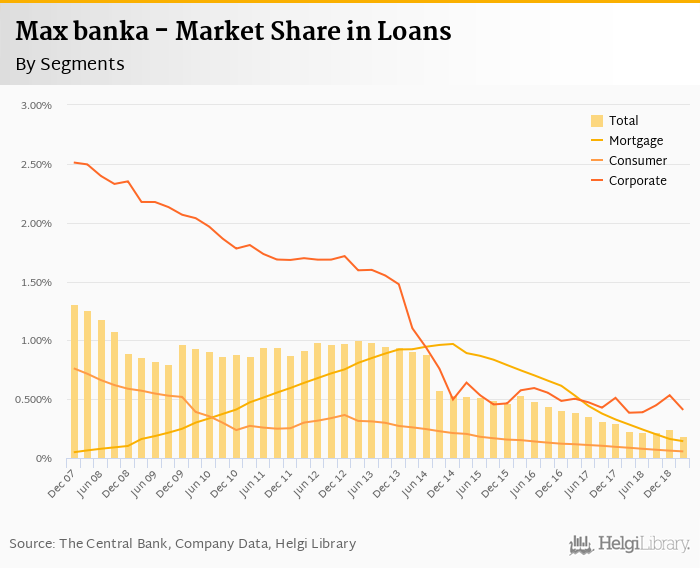

Based on the above, we estimate that Max banka has lost 0.048 pp market share in the last twelve months in terms of loans (holding 0.083% of the market at the end of 2Q2023). On the funding side, the bank seems to have gained 0.514 pp and held 0.645% of the Czech deposit market:

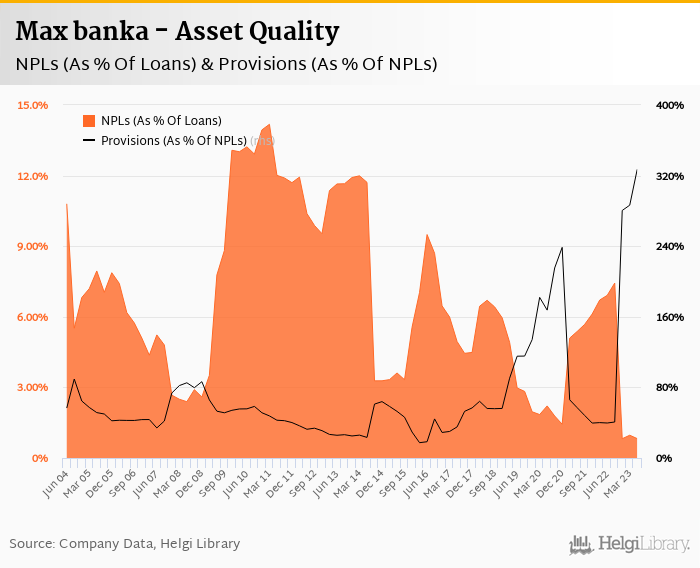

With no official data on asset quality in the last two quarters, we assume Bank's numbers remained good. This is due mainly to a post-acquisition clean up of the loan portfolio (NPL ratio of 0.8% at the end of 2022) and further CZK 30 mil provision write-back we have seen in the first half of 2023.

We therefore assume NPLs to stay at around 1.0% of loans and to be well covered by provisions:

With low exposure to customer lending (and no official details), we assume Max banka's capital adequacy ratio has reached 30-40% in the second quarter of 2023, up from 27.9% for the previous year:

Overall, Max banka made a net profit of CZK 89.3 mil in the second quarter of 2023, up CZK 128 mil when compared to last year. This means an annualized return on equity of 13.9%, or 3.49% when equity "adjusted" to 15% of risk-weighted assets:

The profit turnaround of Max banka looks impressive and the Bank seems to be reaping benefits of its price-aggressive deposit-taking campaign started in the last quarter of 2022. The volumes bring economies of scale, though it's still a long way to go for the Bank when having a vast majority of the new deposits "parked" with the Central Bank. The Bank has a plenty of liquidity and funding to utilize its asset side, though this is also where the bigger challenges lay ahead...