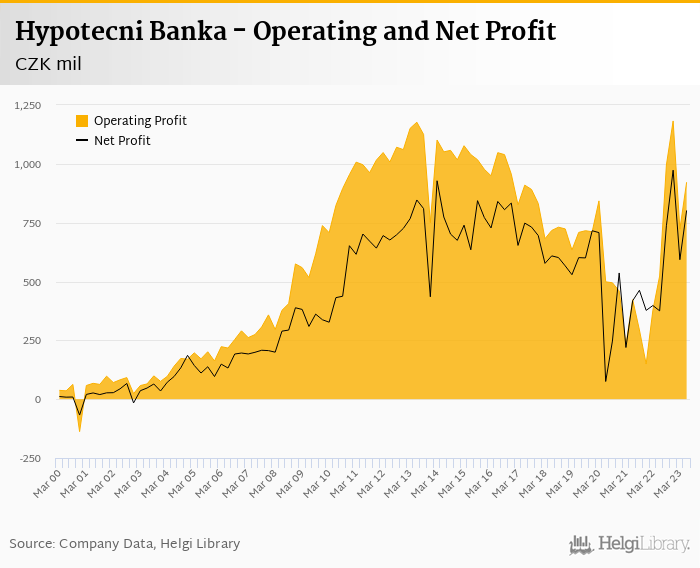

Hypotecni Banka rose its net profit 114% to CZK 802 mil in 2Q2023 and generated ROE of 5.60%.

Revenues increased 59.1% yoy thanks to hedging gains and cost fell 1.12%, so cost to income decreased to 13.7%

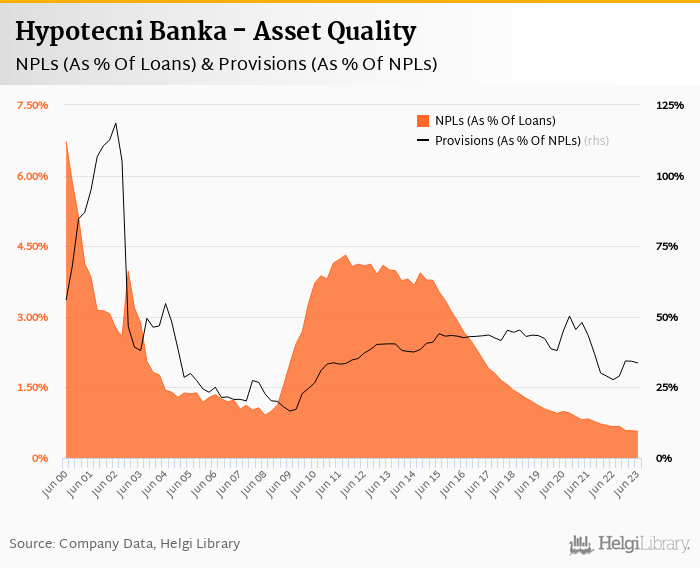

Asset quality remains very good and the Bank released further provisions boosting bottom line.

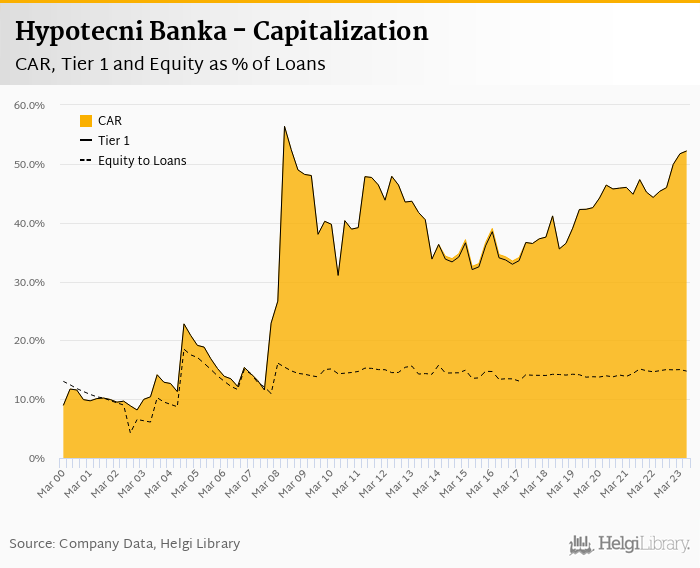

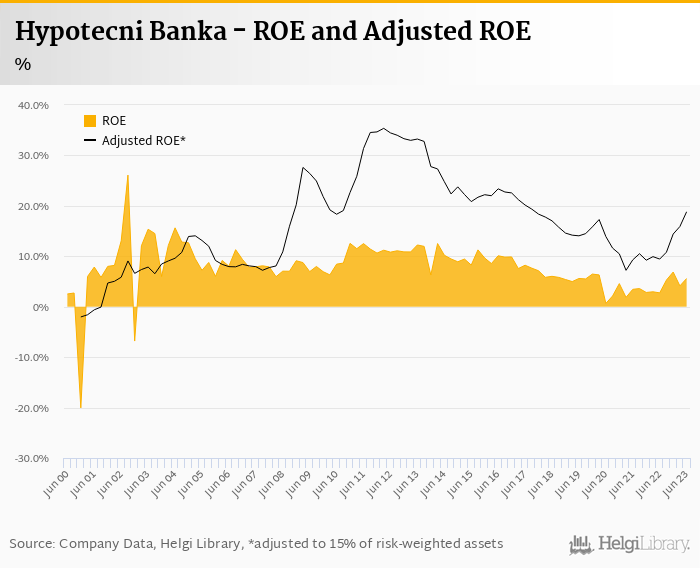

We assume capital adequacy stayed above 50%. When adjusted to 15%, the Bank generated ROE of 18.8% in 2Q2023.

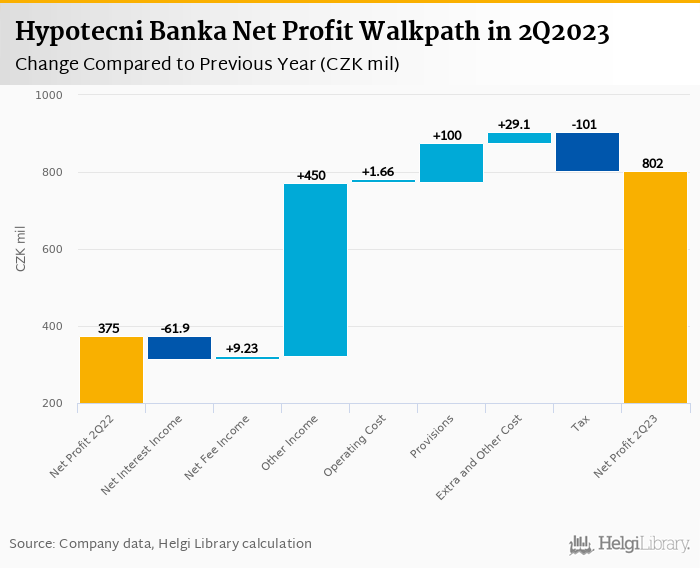

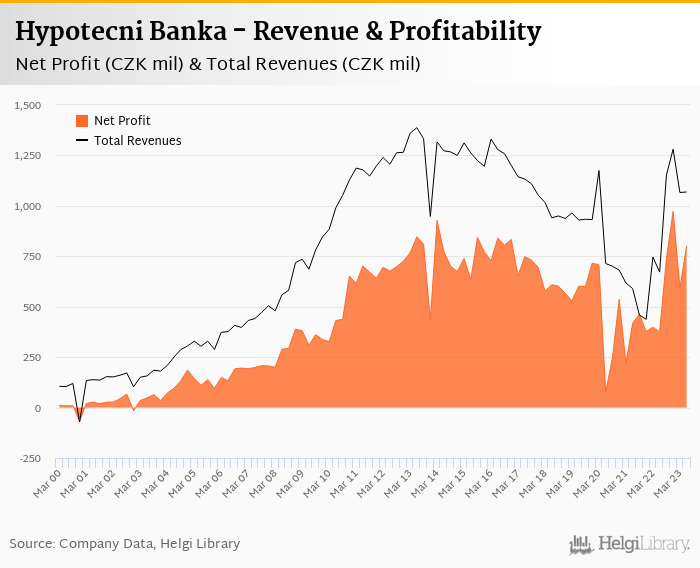

Hypotecni Banka made a net profit of CZK 802 mil in the second quarter of 2023, up 114% yoy, or increase of CZK 427 mil in absolute terms. The improvement came mainly from other income, or gains on hedging operations and lower provisions when compared to last year. All in all, operating profit grew 76% yoy and pre-tax profit more than doubled when compared to last year:

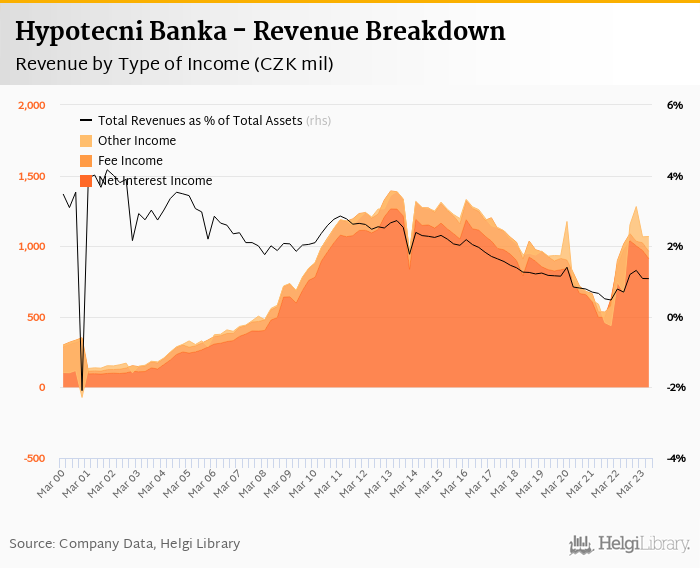

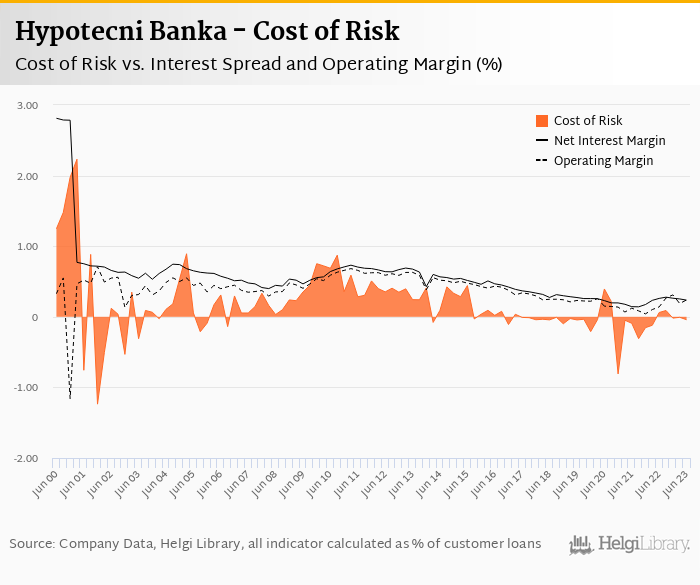

Revenues increased 59.1% yoy to CZK 1,069 mil in the second quarter of 2023. Net interest income fell 6.4% yoy as net interest margin decreased 0.095 pp to 0.925% of total assets (and further 7 bp qoq). Fee income grew 21.8% yoy and added a further 4.83% to total revenue, but gains on hedging operations was the main difference compared to last year (a difference of almost CZK 450 mil when compared to losses made in 2Q2023). When compared to three years ago, revenues were up almost 50%:

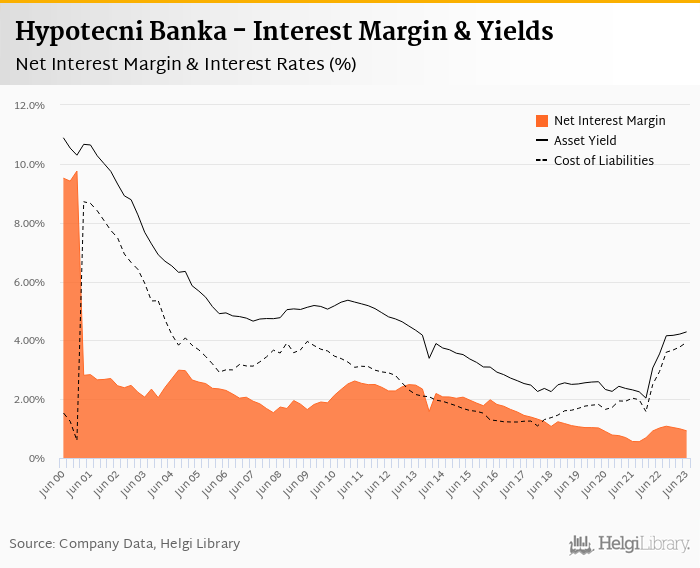

Average asset yield (and effectively a mortgage loan yield) was 4.29% in the second quarter of 2023. It increased from 3.54% a year ago and 4.21% a last quarter. It's therefore the cost of funding, where the Bank feels the pressure. The cost of funding (or cost of mortgage-backed securities to be precise) rose to 3.94% in 2Q2023 and increased from 2.94% last year. The quarterly increase is approximately 17 bp:

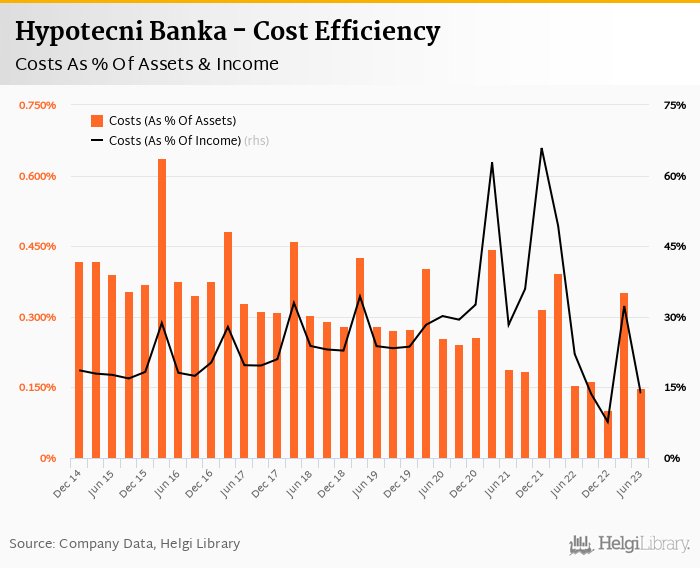

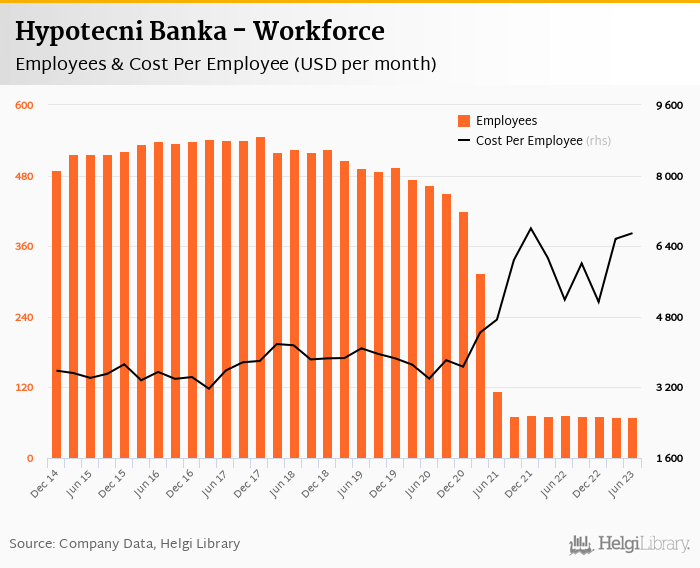

Costs decreased by 1.12% yoy as the Bank has been getting integrated into CSOB structures, so the Bank operated with very impressive cost to income of 13.7% in the last quarter:

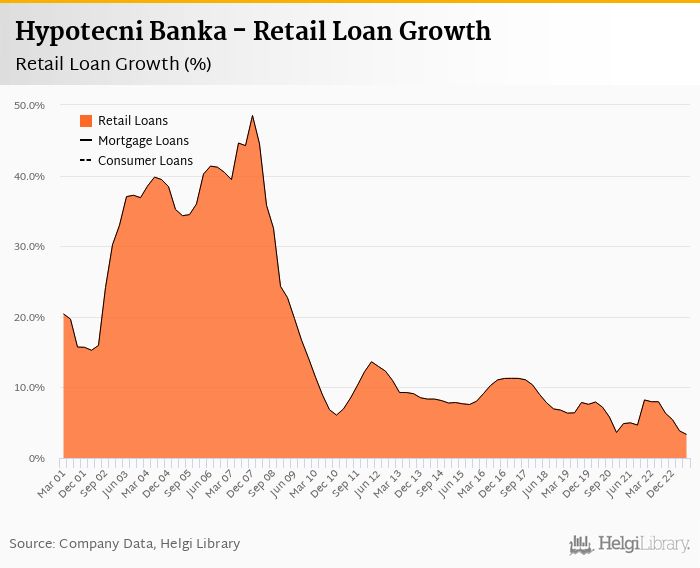

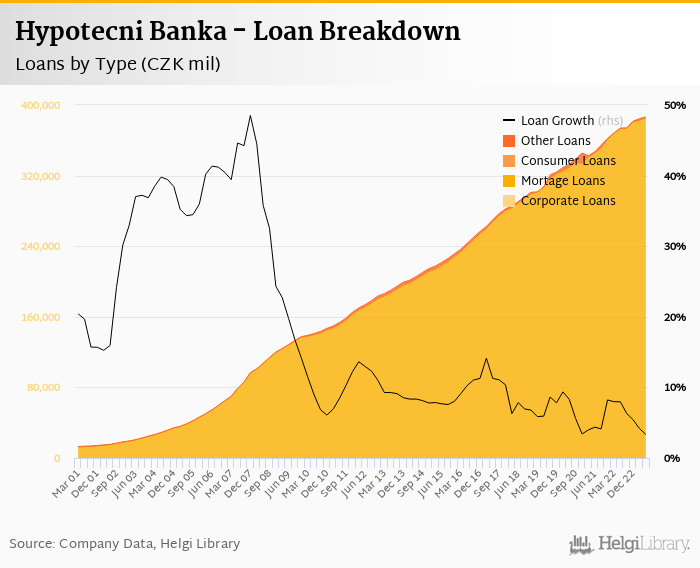

Without having details on Bank's loan portfolio, we assume Hypotecni Banka's mortgage loans grew approximately 0.5% qoq and 3.3% yoy in the second quarter of 2023. That’s compared to average of 5.4% average annual growth seen in the last three years.

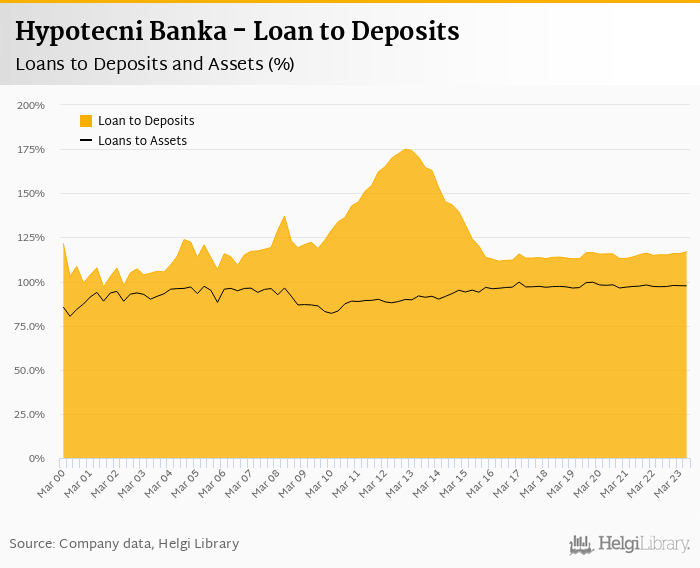

At the end of second quarter of 2023, Hypotecni Banka's loans accounted for 117% of mortgage-backed bonds and 97.6% of total assets.

Hypotecni Banka is a pure retail bank, so the loans are provided to households only:

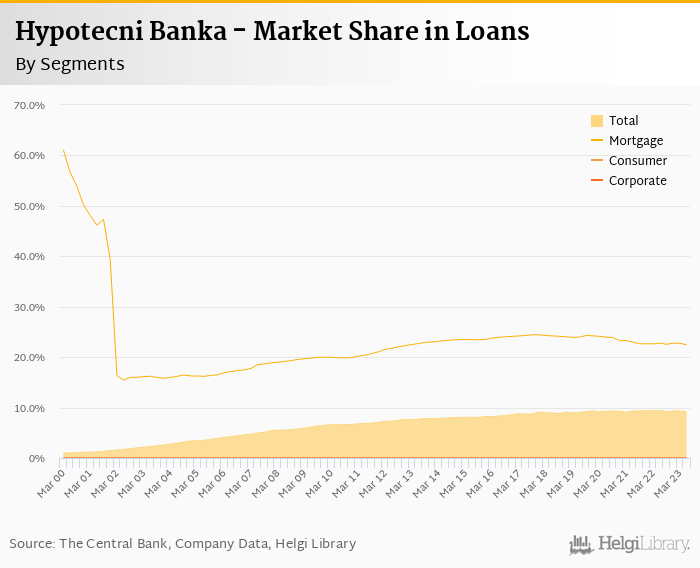

We estimate that Hypotecni Banka has been maintaining its 22.5-22.8% market share in residential mortgage lending, which translates into a 9.2% share on the customer loan market:

Based on the net release of provisons in the last three quarters, we assume Hypotecni Banka's asset quality further improved last quarter. We therefore expect the non-performing loans to have reached approximately CZK 2.2 bil, or 0.57% of total loans in the middle of the year. Provisions might have covered a third of NPLs at the end of the second quarter of 2023, up from 27.7% for the previous year.

We expect Hypotecni Banka's capital adequacy ratio stayed above 50% assuming strong profitability and loan growth while bank equity remains stable at around 15% of loans:

Overall, Hypotecni Banka made a net profit of CZK 802 mil in the second quarter of 2023, up 114% yoy. This means an annualized return on equity of 5.60% in the last quarter or 5.45% when the last four quarters are taken into account. When equity "optimalized" to 15% of risk-weighted assets, Hypotecni Banka would be generating ROE of more than 15%:

Though nicely profitable when adjusted for the massive overcapitalization, Hypotecni Banka's business remains under pressure from high interest rates, which have been pushing interest margin down and keep demand for lending low. Fortunately, asset quality remains good and hedging contracts provide an extra income, both supporting bottom line for 3-4 quarters now.