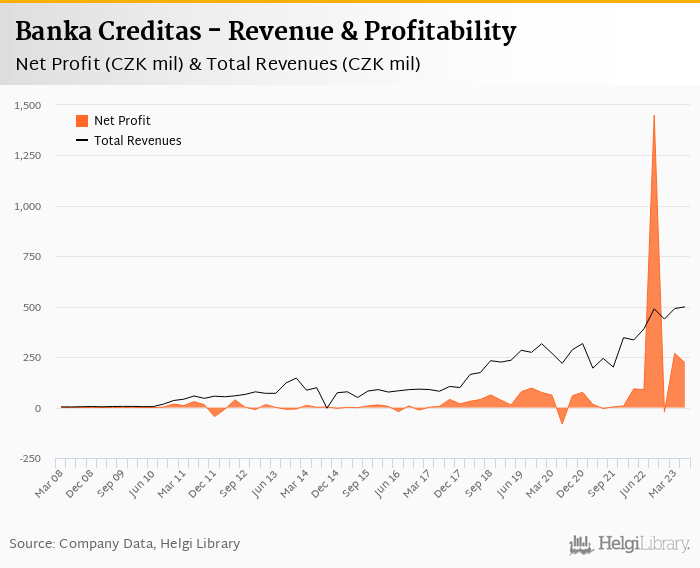

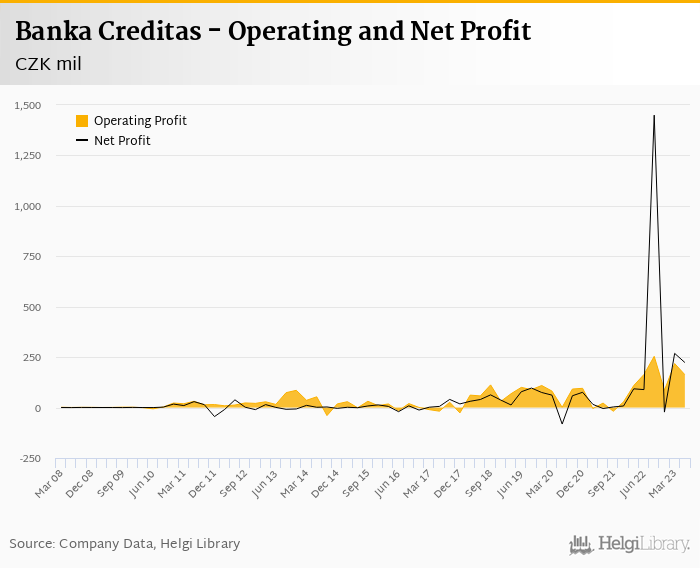

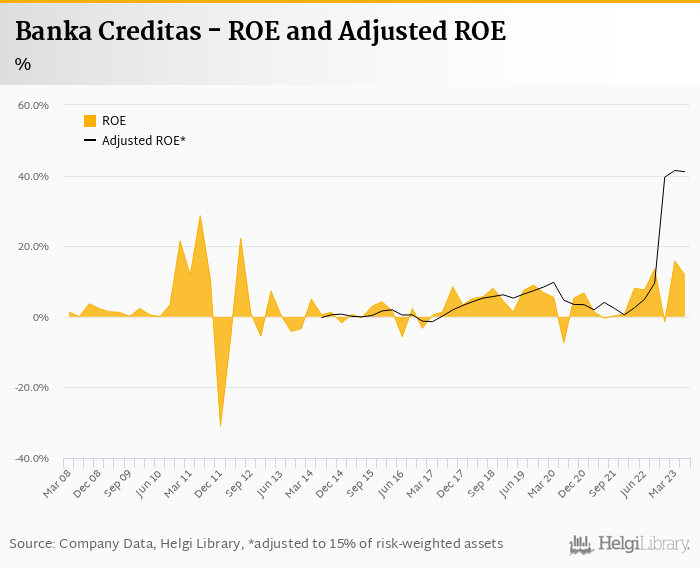

Banka Creditas rose its net profit 150% to CZK 223 mil in 2Q2023 and generated ROE of 11.8%.

With flat operating profit and increase in provisons, the jump in profits came mainly from contribution of subsidiaries.

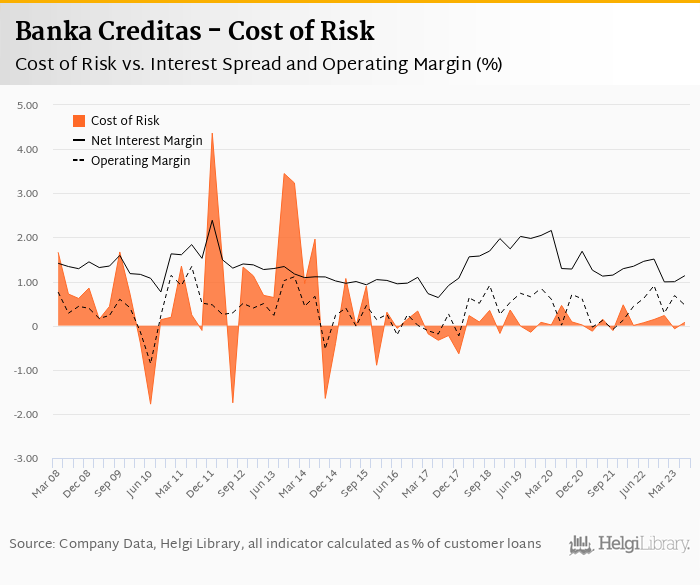

Cost of risk amounted 0.27%, so we assume bad loans fell to 4.5-5.5% of total loans.

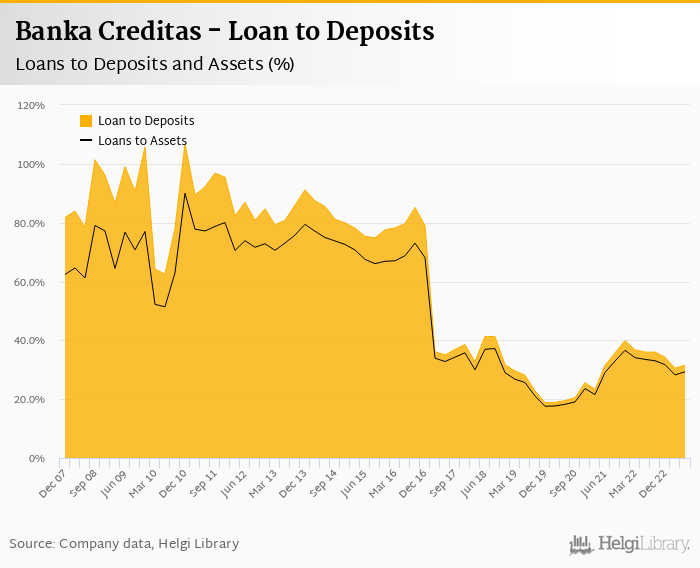

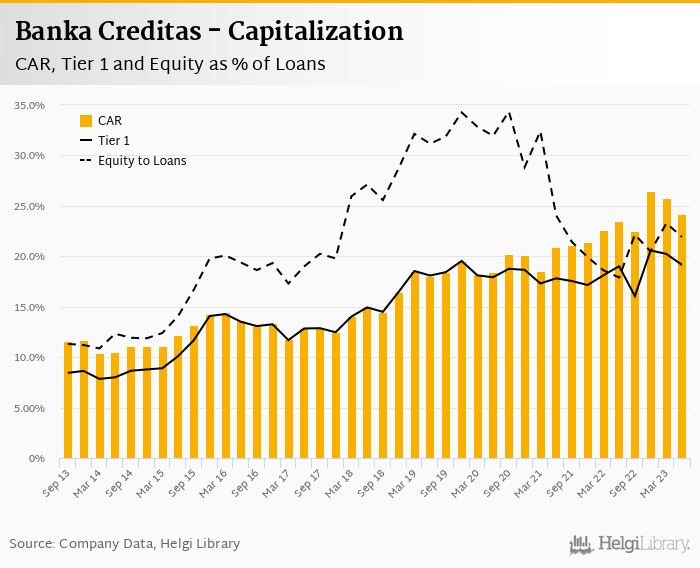

With loan to deposit ratio at around 32% and capital adequacy at app. 24%, the Bank is well positioned to grab more of the market.

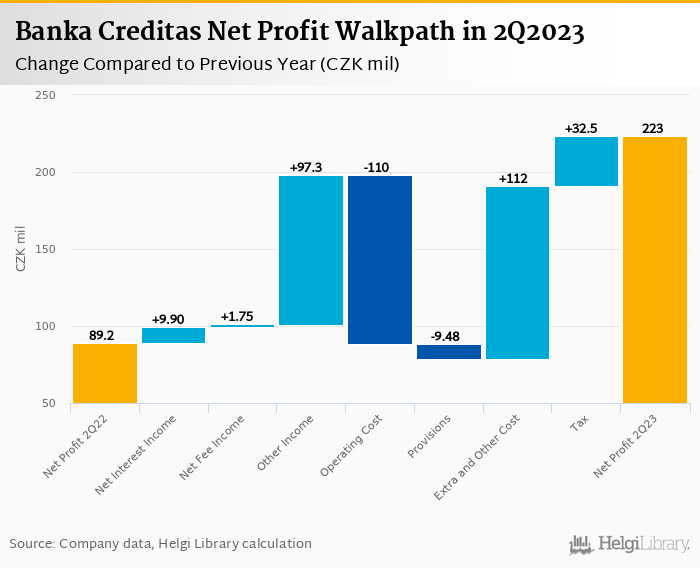

Banka Creditas rose its net profit by CZK 134 mil in absolute terms when compared to last year. As seen at the chart below, it was a bumby road last quarter. Operating profit fell 1.0% yoy as big gain in other/trading income was offset by hefty increase in non-personnel cost. Cost of risk increased only slightly, so most of the profit improvement was generated by a contribution from Bank's subsidiaries (Maxbanka we assume) and lower effective tax rate:

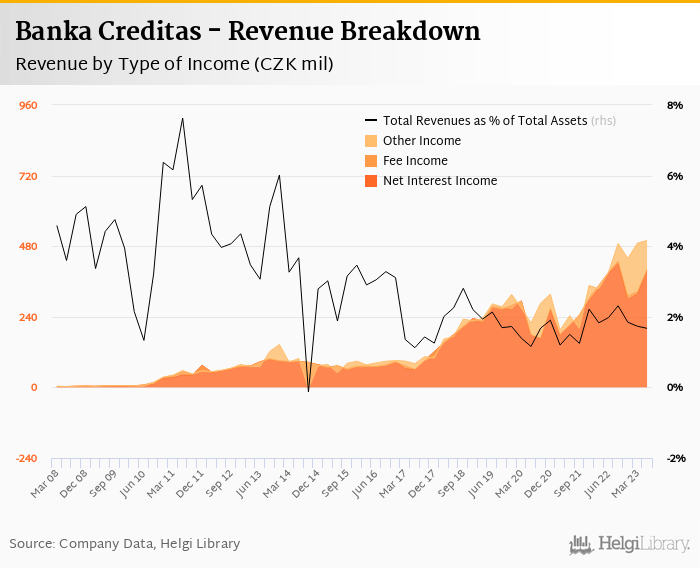

Revenues increased 27.9% yoy to CZK 499 mil in the second quarter of 2023. Net interest income rose 2.6% yoy as a two-quarter fall in interest margin was stopped with a 14 bp improvement (to 1.36% of total assets). Other income added CZK 96.5 mil (vs. a loss of CZK 1 mil last year) adding further fifth to the revenue line. When compared to three years ago, revenues were up 128%:

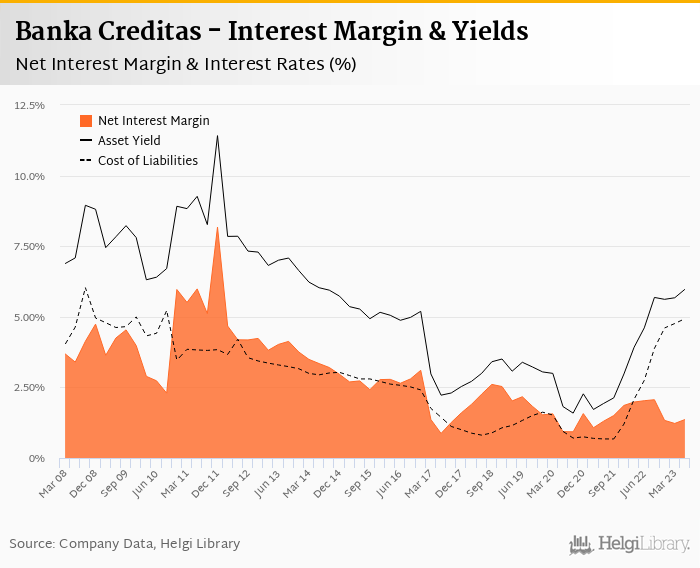

Average asset yield was 5.97% in the second quarter of 2023 (up from 4.61% a year ago) while cost of funding amounted to 4.93% in 2Q2023 (up from 2.75%).

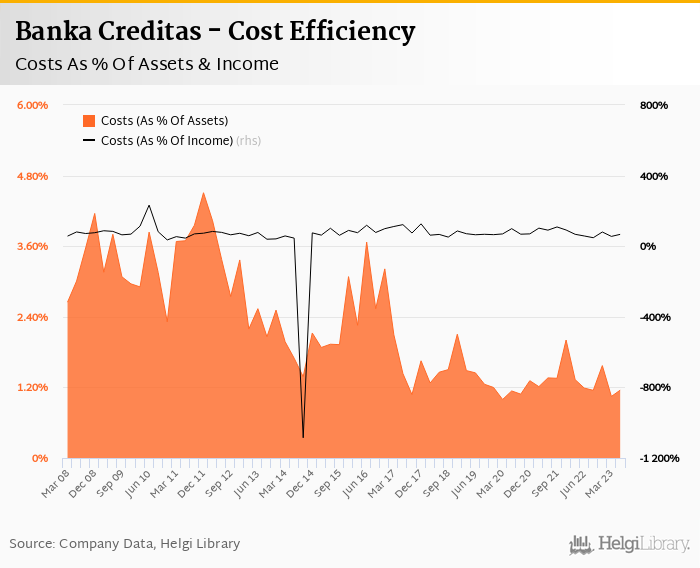

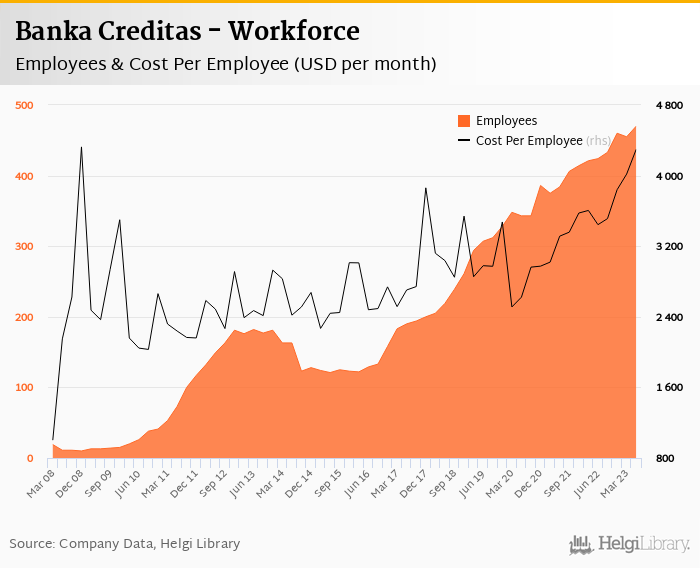

Costs increased by 48.6% yoy and the bank operated with average cost to income of 67.4% in the last quarter. Staff cost rose 30.5% as the bank employed 470 persons (up 10.8% yoy) and paid its people better. But it mainly was the non-personnel cost, which drove the costs so high. When compared to last year, they more than doubled:

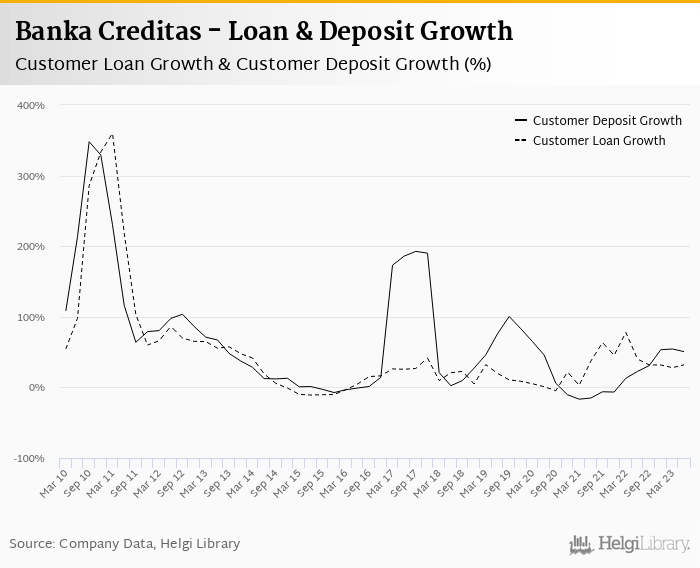

With no official breakdown of customer loans and deposits, we assume Banka Creditas's customer loans grew 9-10% qoq and by a third when compared to last year. We still assume the Bank to attract new clients via attractive pricing, so we expect customer deposit to grow around 6.0% qoq and by a half compared to last year.

At the end of second quarter of 2023, we therefore guesstimate Banka Creditas's loans accounted for around 32% of total deposits to form approximately 30% of total assets.

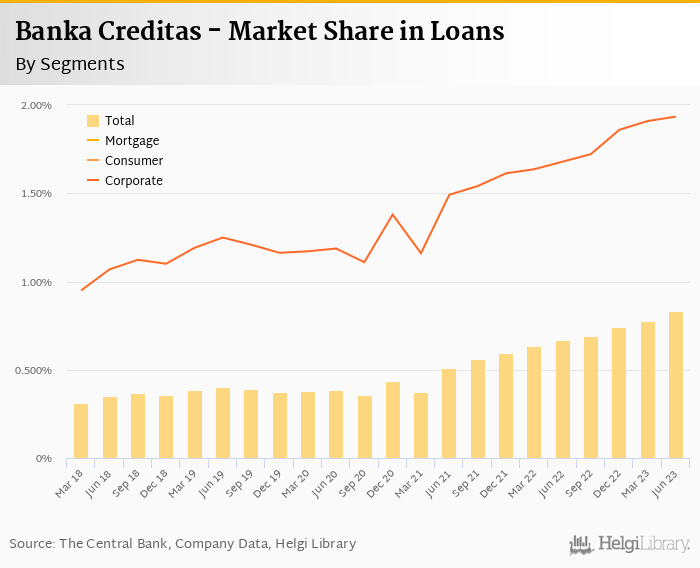

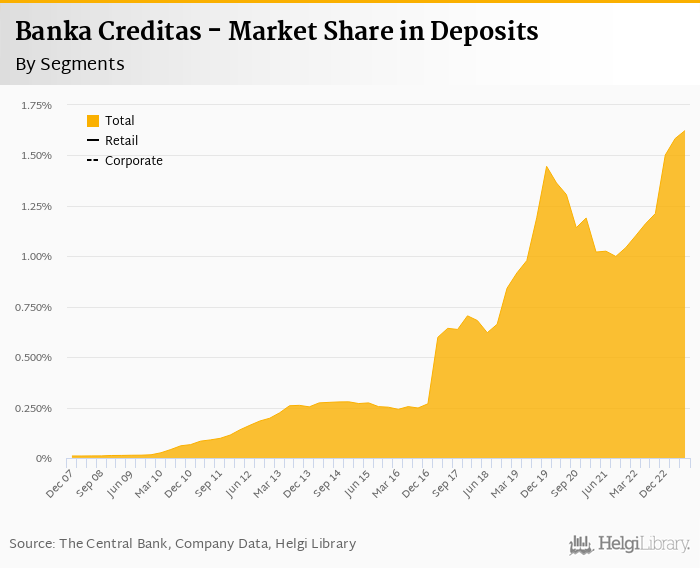

We estimate that Banka Creditas has gained some 0.16 pp market share in the last twelve months in terms of loans (holding approximately 0.83% of the market at the end of 2Q2023). On the funding side, the bank seems to have gained 0.462 pp and held 1.6% of the deposit market:

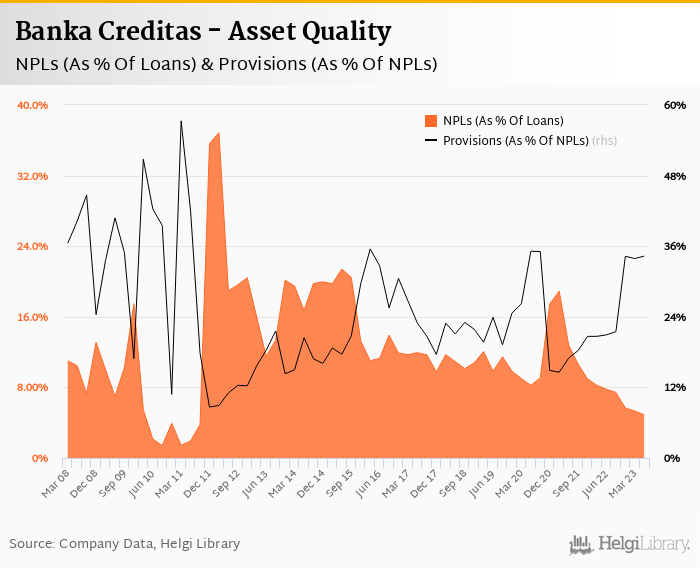

Cost of risk reached 0.270% of loans in the second quarter, so we "guesstimate" that Banka Creditas's non-performing loans reached 4.50-5.50% of total loans, down from 7.79% when compared to the previous year. Provisions might be covering around a third of NPLs as Bank Creditas is heavily exposed to the well-collateralised real estate sector.

Based on the profit and asset growth numbers since the beginning of the year, we expect Banka Creditas's capital adequacy ratio to have reached around 23-24% in the second quarter of 2023. The Tier 1 ratio might have been a few notches lower, at around 19%, on our estimates while bank equity accounted for 21.9% of loans:

Overall, Banka Creditas made a net profit of CZK 223 mil in the second quarter of 2023, up 150% yoy. This means an annualized return on equity of 11.8%, or 41.1% when equity "adjusted" to 15% of risk-weighted assets:

Stabilisation of the interest margin/strong trading income on the revenue side and a jump in non-personnel on the cost side were the main events to address on the operational performance of the Bank last quarter. But, it's the CZK 100 mil contribution from subsidiaries (we assume Max banka) and lower effective tax rate (further CZK 30 mil saving), which drove the bottom line compared to last year.