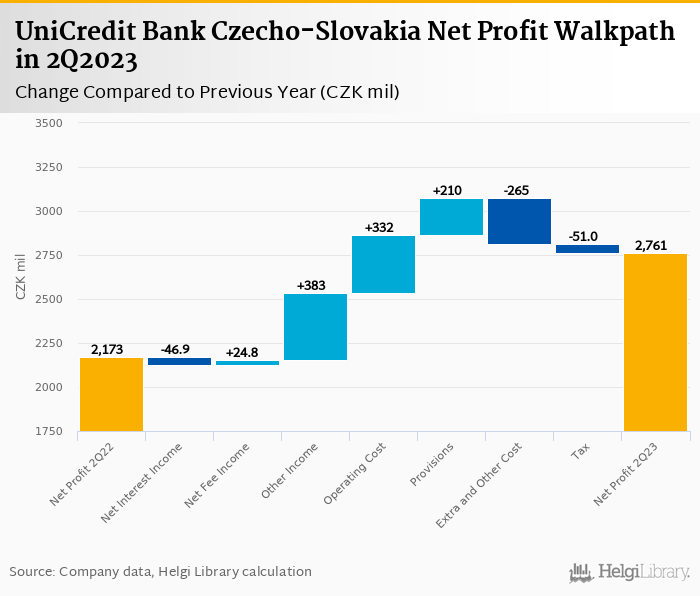

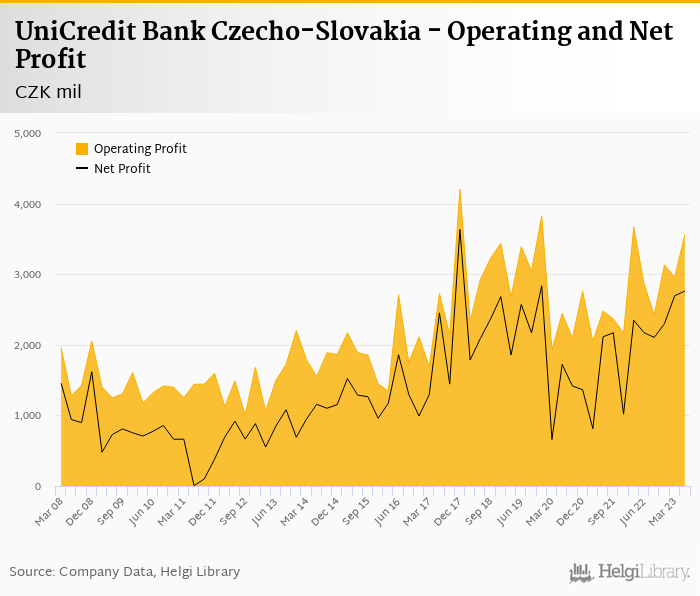

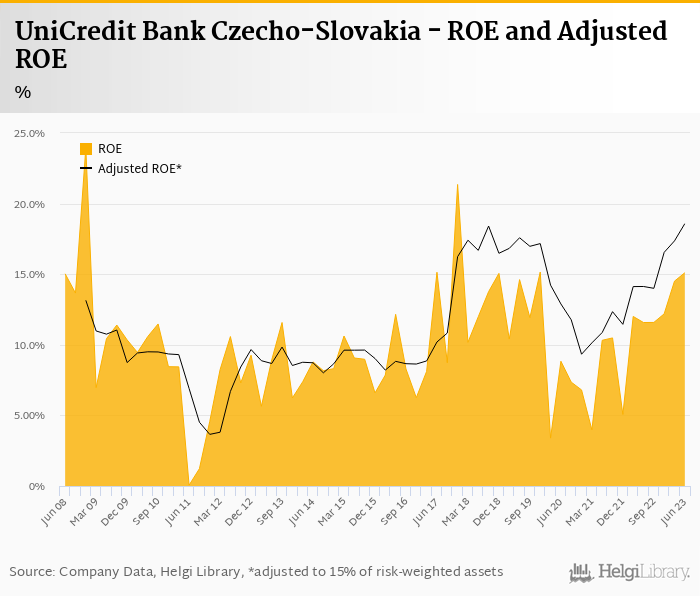

UniCredit Bank Czecho-Slovakia rose its net profit 27.0% to CZK 2,761 mil in 2Q2023 and generated ROE of 15.1%.

The increase in net profit came mainly from stronger trading income, CZK 156 mil reverse on contribution to Depository Fund and lower provision

Adjusted for the contribution, operating profit would have still increase by 18.7% and cost to income ratio would reach impressive 35% in 2Q23

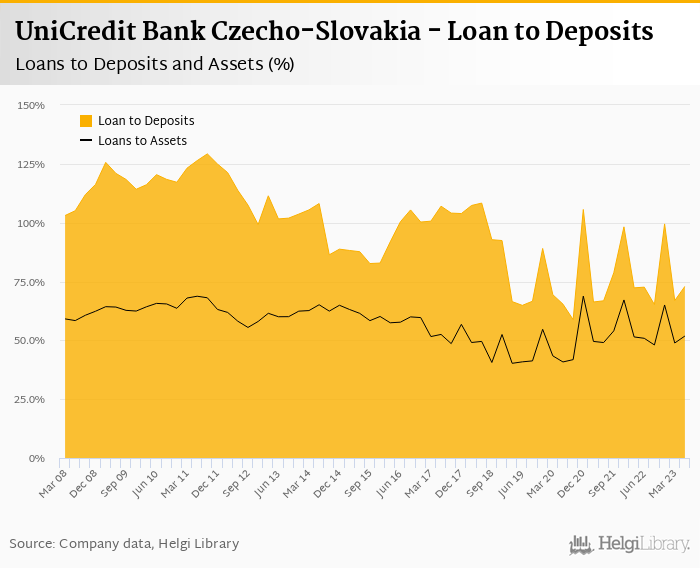

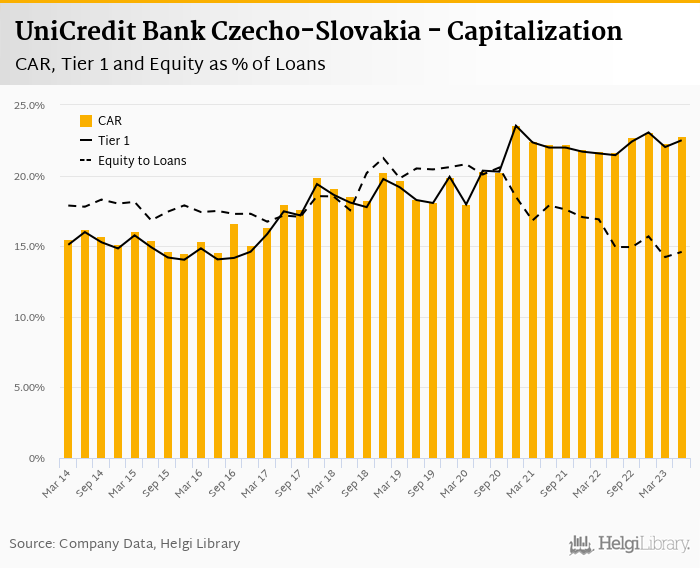

Loan to deposit ratio increased to 72.9% and we estimate capital adequacy reached around 22.5%

UniCredit Bank Czecho-Slovakia made a net profit of CZK 2,761 mil in the second quarter of 2023, or increase of CZK 588 mil in absolute terms. Stronger trading income (by CZK 383 mil), lower admin costs (by CZK 219 mil) and lower provisions (CZK 210 mil) were the main positive drivers behind the numbers:

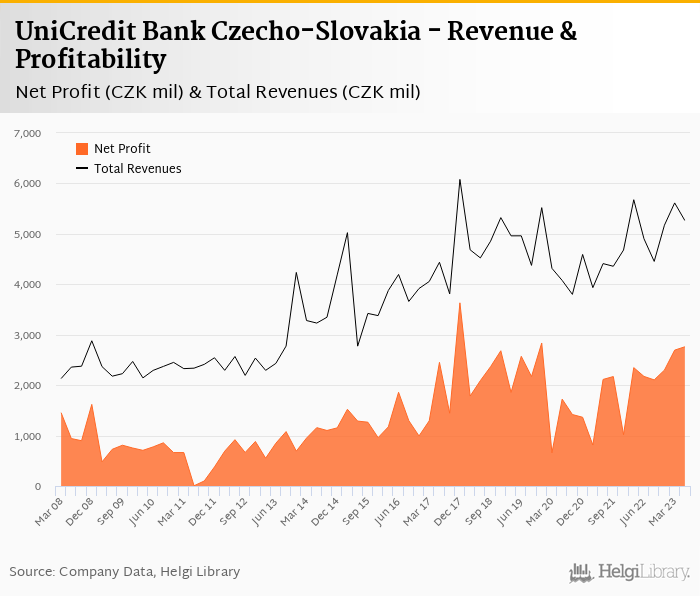

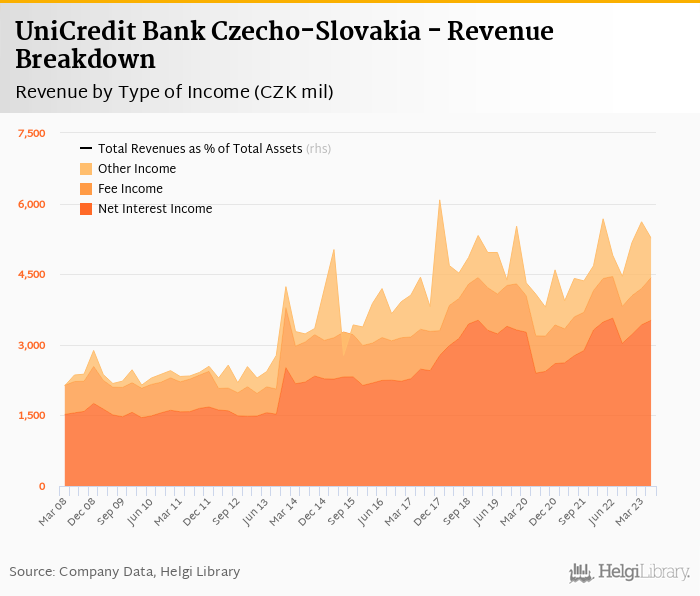

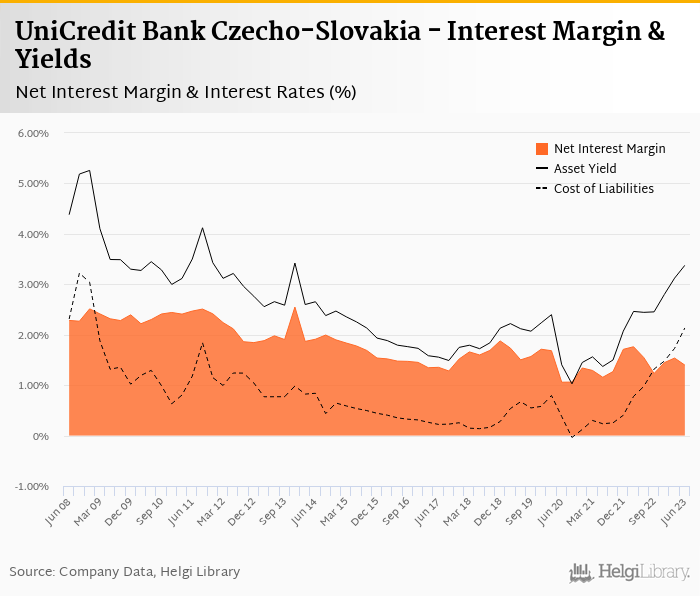

Revenues increased 7.4% yoy to CZK 5,264 mil in the second quarter of 2023 thanks mainly to traing/other income. Net interest income fell 1.33% yoy as net interest margin decreased further 0.14 pp to 1.40% of total assets. When compared to three years ago, revenues were up 29.1%:

Average asset yield was 3.38% in the second quarter of 2023 (up from 2.44% a year ago) while cost of funding amounted to 2.13% in 2Q2023 (up from 0.976%).

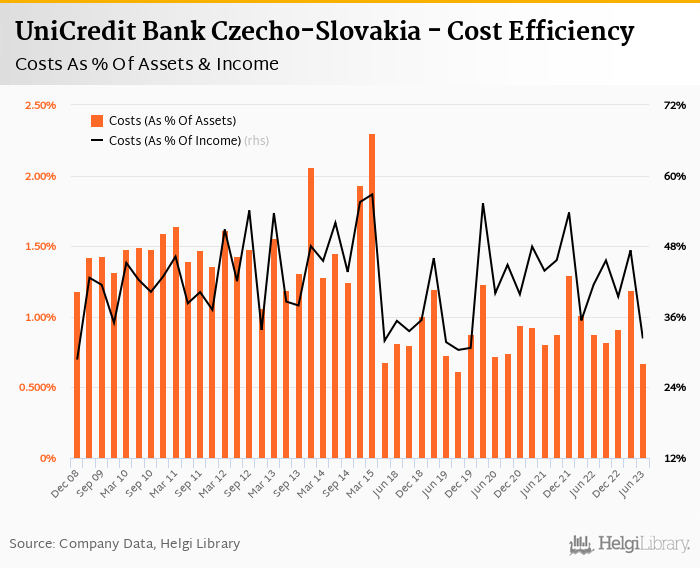

Costs decreased by 16.3% yoy and the bank operated with average cost to income of 32.3% in the last quarter. Some of the improvement came from a CZK 156 mil write-back of contribution to the Guarantee Depository Fund. Still, cost to income would have reach still a very solid 35.3% in 2Q23 and operating profit would have grown 18.7% yoy, so the quarter was good.

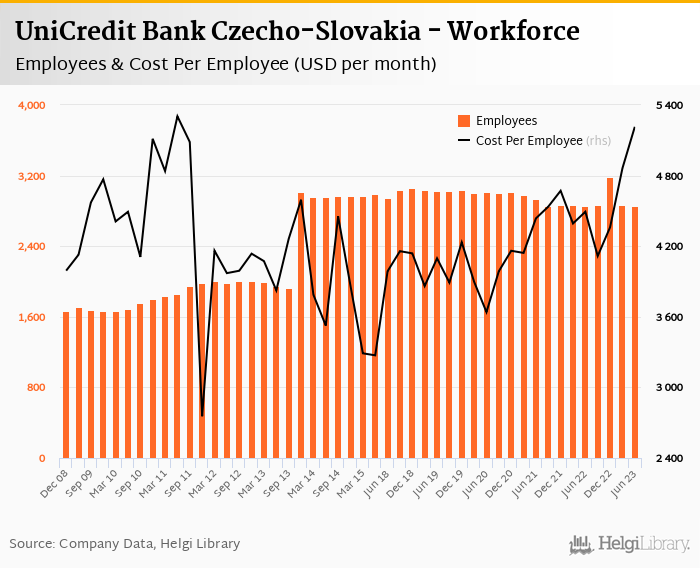

Staff cost rose 9.6% as the bank employed 2,858 persons (flat yoy) and paid CZK 112,624 per person per month including social and health care insurance cost:

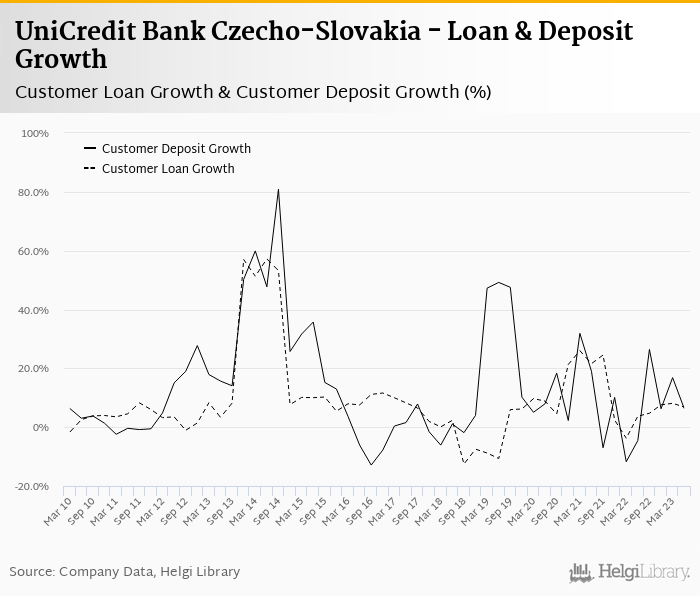

UniCredit Bank Czecho-Slovakia's customer loans grew 2.2% qoq and 6.9% yoy in the second quarter of 2023 while customer deposis fell 6.3% qoq (but rose 6.3% yoy). When adjusted for the exposure to public institutions (CZK 10.7 bil in loans and CZK 186 bil in deposits), loans and deposits increased by solid 2.6% and 7.3% qoq respectively.

At the end of second quarter of 2023, UniCredit Bank Czecho-Slovakia's loans accounted for 73% of total deposits and 52% of total assets. Interestingly, large part of the deposits from public institutions was "parked" at the central banks as CZK 264 bil (or 27% of Bank's assets) has been lent here in the middle of 2023:

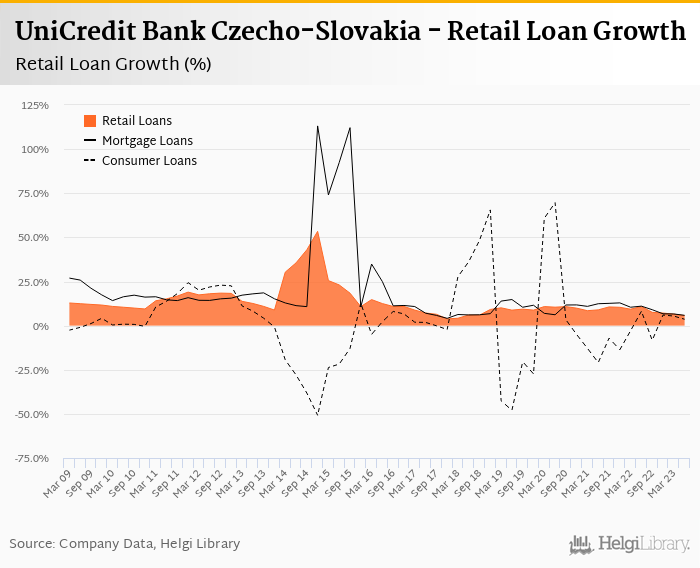

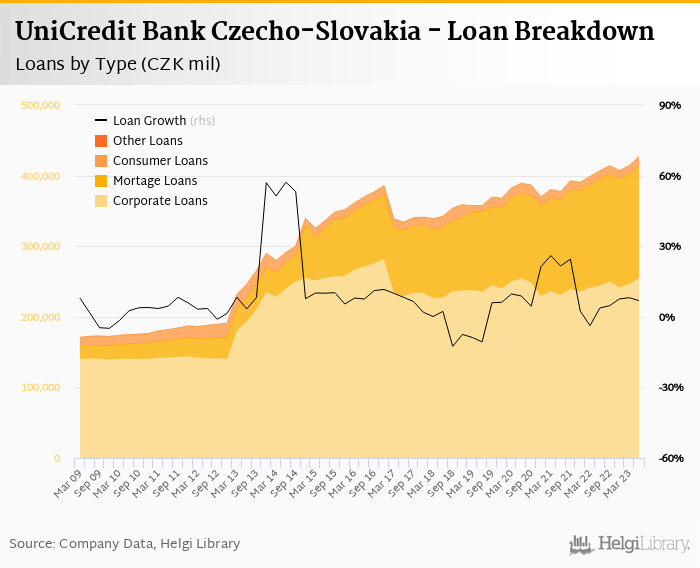

Retail loans grew 2.6% qoq and were 5.7% up yoy. They accounted for a third of the loan book at the end of the second quarter. Corporate loans increased 3.5% qoq and 4.5% yoy, respectively. We estimate that mortgages represented around 30% of the UniCredit Bank Czecho-Slovakia's loan book, consumer loans added a further 2.0% and corporate loans formed half of total loans in the middle of the year:

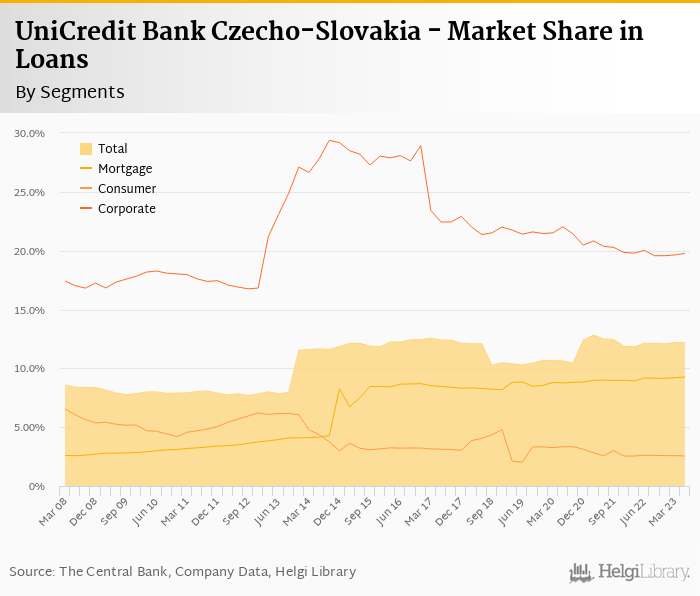

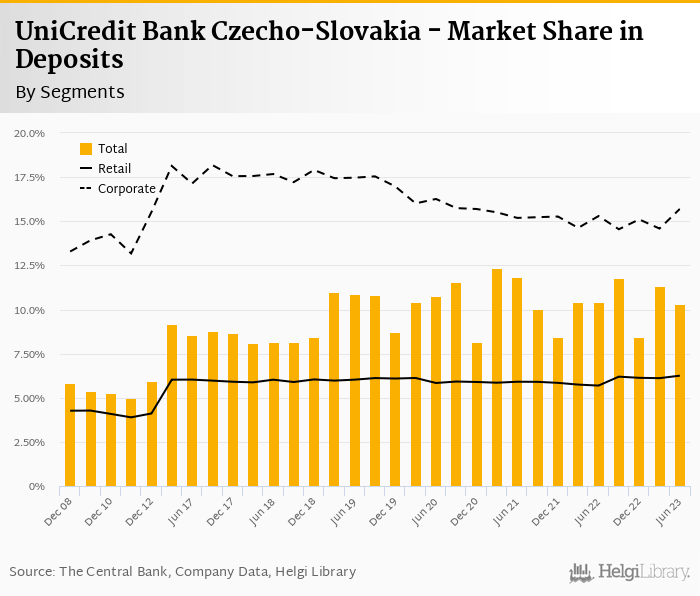

We estimate that UniCredit Bank Czecho-Slovakia has gained 0.067 pp market share in the last twelve months in terms of loans (holding 12.2% of the market at the end of 2Q2023). On the funding side, the bank seems to have lost 0.136 pp and held 10.3% of the deposit market. That's when compared the Bank's data (incl. Slovak business) to Czech banking sector only, so the real figures will be somewhat smaller:

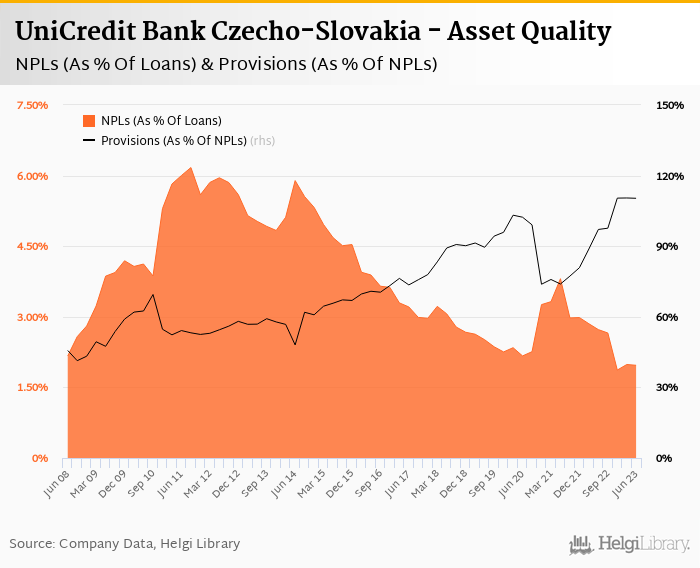

Without providing any details on the asset quality in the second quarter, we "guesstimate" UniCredit Bank Czecho-Slovakia's non-performing loans amounted to around 2.0% of total loans, down from 2.7% when compared to the previous year. We also assume provision coverage stayed high exceeding 100% of NPLs at the end of the second quarter of 2023.

Provisions have "eaten" some 7.5% of operating profit in the second quarter of 2023 as cost of risk reached 0.21% of average loans:

We also estimate UniCredit Bank Czecho-Slovakia's capital adequacy ratio reached approximately 22.5% in the second quarter of 2023, up from 21.7% for the previous year:

Overall, UniCredit Bank Czecho-Slovakia made a net profit of CZK 2,761 mil in the second quarter of 2023, up 27.0% yoy. This means an annualized return on equity of 15.1%, or 18.6% when equity "adjusted" to 15% of risk-weighted assets:

Good set of results when adjusted for a couple of one-offs including reduction of contribution to the Deposit Insurance Fund. Apart from a solid loan and deposit growth in both retail and corporate segments, strong trading income, good cost control and lower provisions are worth mentioning when looking at the published results.