Trinity Bank decreased its net profit 51.2% to CZK 155 mil in 3Q2023 and generated ROE of 11.6%.

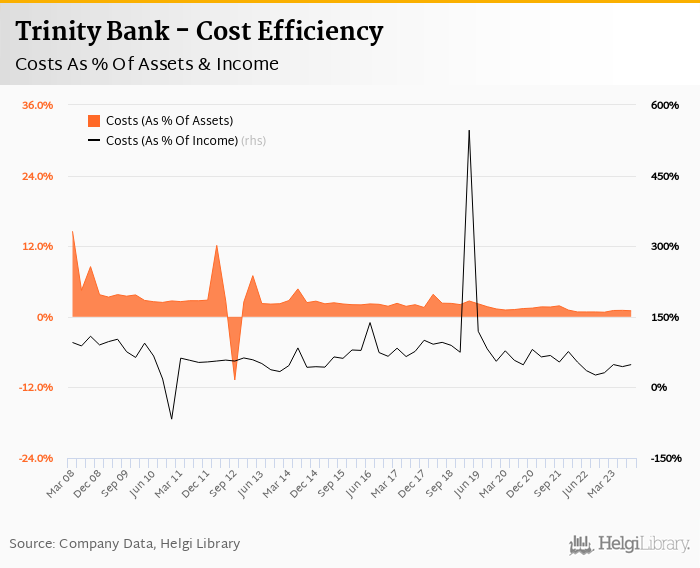

Revenues decreased 28.8% yoy and cost rose 31.8%, so cost to income increased to 48.6%

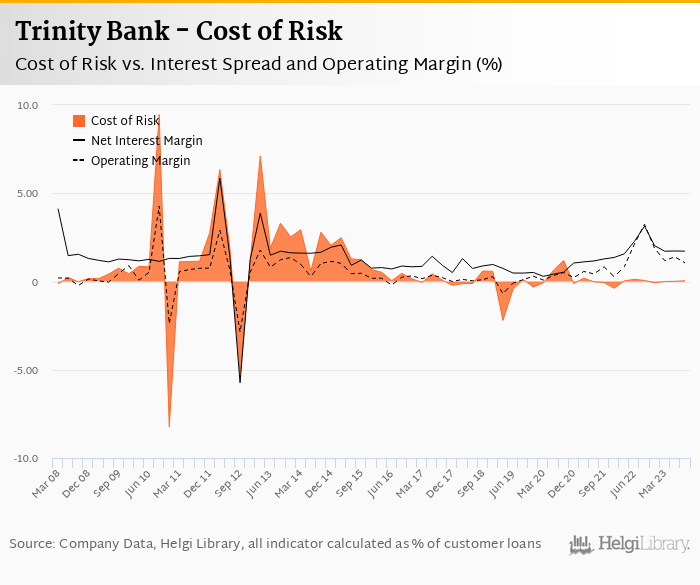

Asset quality appears good with cost of risk at 0.19% and provisions "eatening" only 4.4% of operating profit

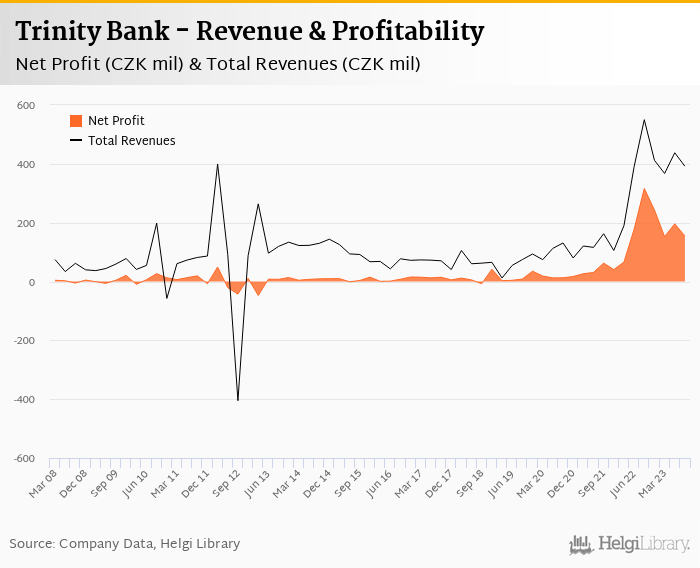

Both revenues and profits have been under pressure when compared to last year's record profitability, though 3Q2023 numbers suggest good trends in terms of volume growth and stabilisation of interest margin, two key profit drivers of the Bank.

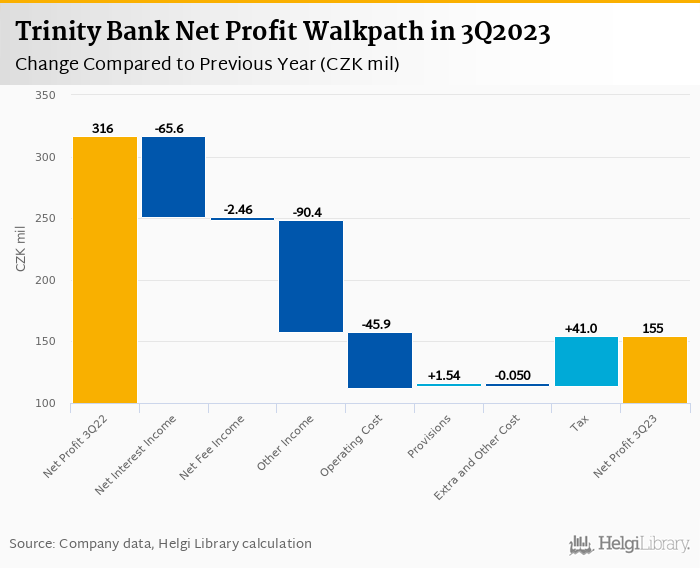

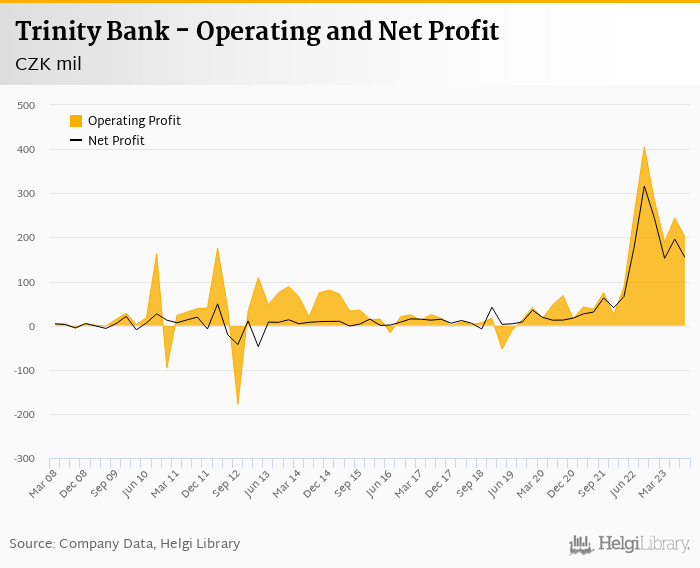

Trinity Bank made a net profit of CZK 155 mil in the third quarter of 2023, down 51.2% yoy, or decrease of CZK 162 mil in absolute terms. The revenue and profit comparison is negatively affected by last year's record numbers in net interest income, though profits would be still a third lower when adjusted for that. When looking at the chart below, all main operating lines were worse off when compared to last year, from fee and other income and operating costs:

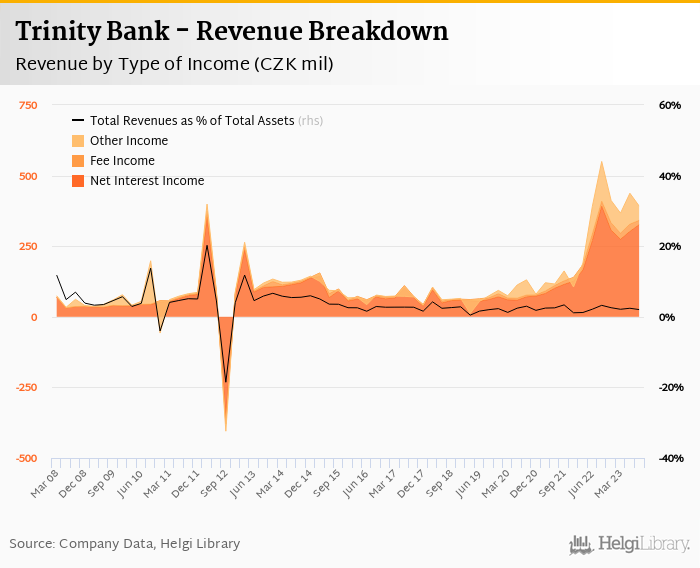

Revenues decreased 28.8% yoy to CZK 392 mil in the third quarter of 2023, or 12% when adjusted for record numbers last year. Net interest income fell 16.7% yoy and formed 83.4% of total. More importantly, however, net interest income has been growing the last three consequtive quarters as interest margin stabilised and deposit growth remains strong.

A lack of and a fall in fee and other non-interest income might be therefore more disappointing on the 3Q2023 results implying a difficulty for the Bank to sell additional products and services to its newly arriving clients Bank gained by attractively-priced deposits:

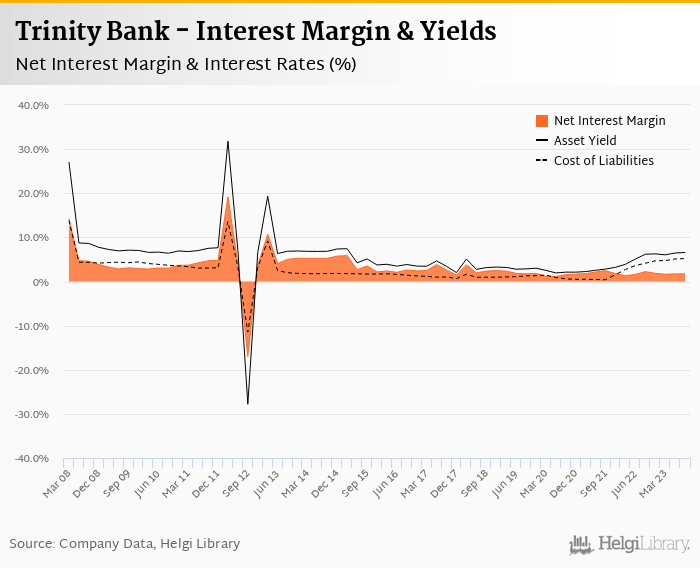

Net interest margin fell 47 bp to 1.75% from a record high last year's numbers (2.23%), though a stabilisation and slight increase within the third consequtive quarter is a good sign. This is especially important since interest income forms vast majority of Bank's revenues (and profitability) and inflow of new deposits and clients seem to continue.

Average asset yield was 6.58% in the third quarter of 2023 (up from 6.18% a year ago) while cost of funding amounted to 5.20% in 3Q2023 (up from 4.14%).

Operating costs increased by 31.8% yoy and the bank operated with average cost to income of 48.6% in the last quarter. This is well above last year's record numbers, but better than long-term average seen in the last years.

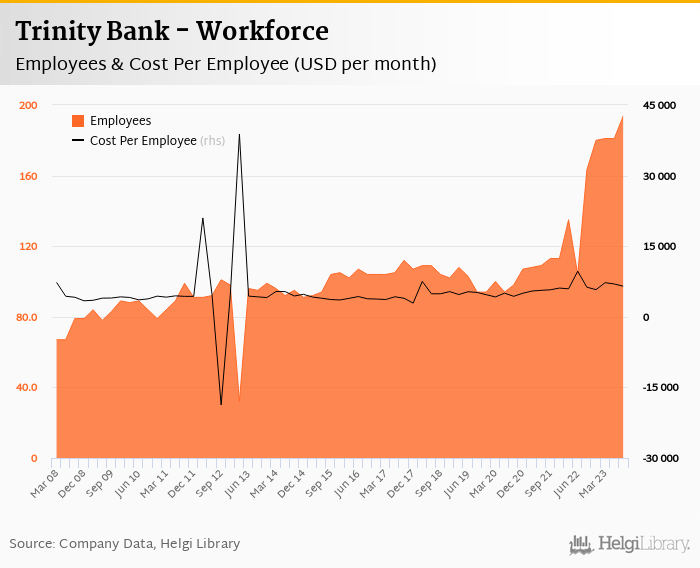

Staff cost rose 12.3% as the bank employed 194 persons (up 18.9% yoy), so the main pressure comes from non-personnel and depreciation (up 57% and 30% yoy, respectively). The 3Q2023 results show a moderation on all cost fronts when compared to previous quarters and total costs were flattish when compared to previous quarter:

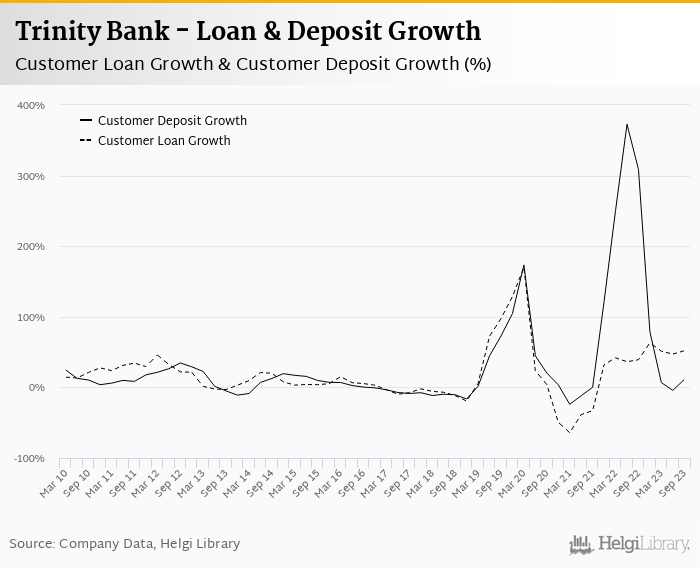

With few details on the loan portfolio and deposits, we think solid loan and deposit growth continued in 3Q2023. We expect Trinity Bank's customer loans grew 8-9.0% qoq and was 50% higher when compared to lat year while customer deposits might have grown around 6.0% qoq and were approximately 11% yoy higher.

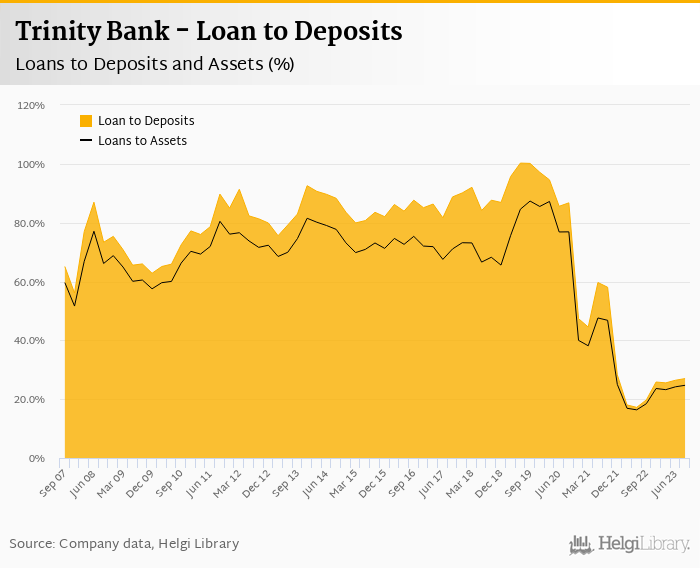

If so, Trinity's balance sheet would be still very liquid with loans accounting for about a quarter of total deposits:

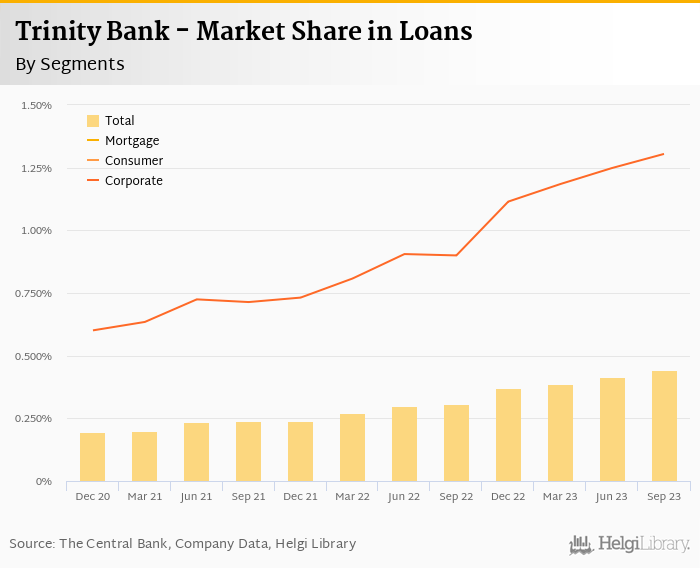

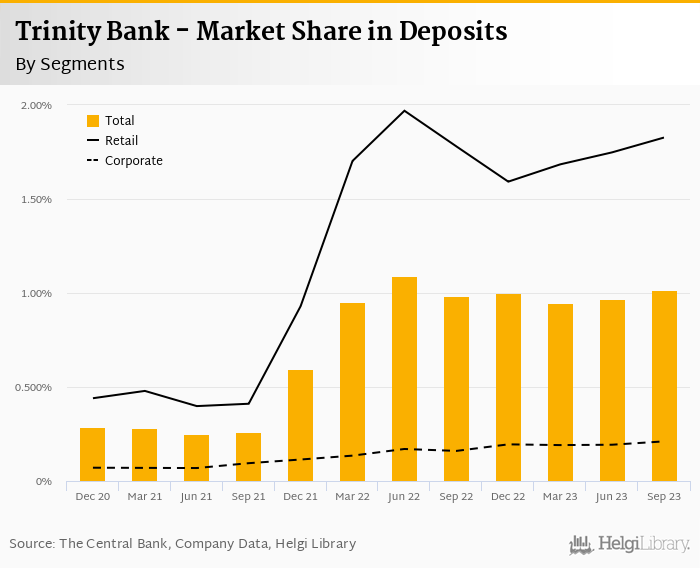

We estimate that Trinity Bank has gained 0.135 pp market share in the last twelve months in terms of loans (holding 0.44% of the market at the end of 3Q2023). On the funding side, the bank seems to have gained 0.028 pp and held 1.0% of the deposit market:

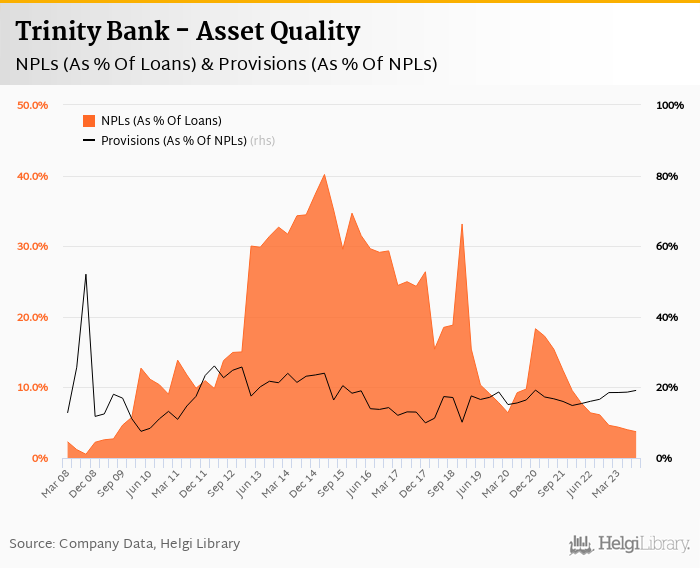

Net provisions reached CZK 8.8 mil last quarter, so we assume asset quality continued improving. We therefore estimate non-performing loans fell to around 4.0% of total loans (from around 6.o% last year) while provision coverage might have increased to around 20% of NPLs at the end of the third quarter of 2023.

Provisions have "eaten" some 4.4% of operating profit in the third quarter of 2023 as cost of risk reached 0.193% of average loans:

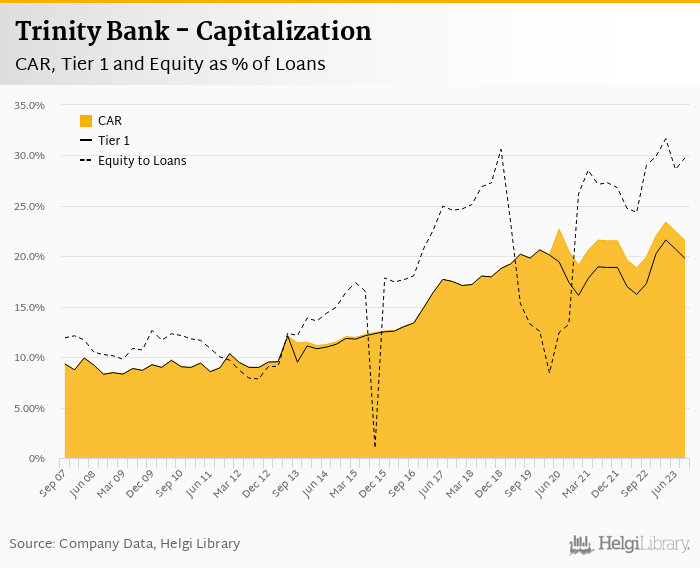

Based on the asset growth and profitability generated last quarter, we "guesstimate" that Trinity Bank's capital adequacy ratio reached over 21% in the third quarter of 2023 and bank equity accounted for 29.8% of loans:

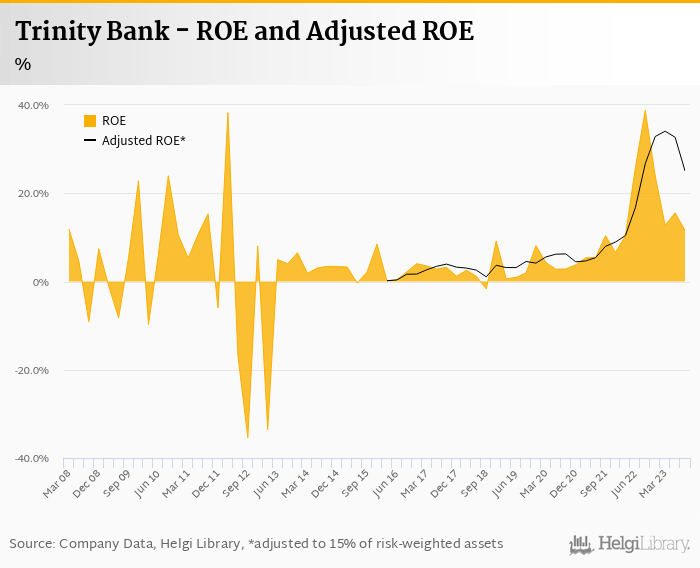

Overall, Trinity Bank made a net profit of CZK 155 mil in the third quarter of 2023, down 51.2% yoy. This means an annualized return on equity of 11.6% in the last quarter or 14.7% when the last four quarters are taken into account:

Trinity Bank announced a hefty fall in both, the revenues as well as profits last year and all the main operating lines have shown a deterioration when compared to last year. This is partly a result of the record profitability seen last year and there are some further silver linings when looking at 3Q2023 results:

- interest margin has stabilised and interest income has been growing last three quarters

- operating costs are flattish when compared to previous quarters

- asset quality seems to be good based on the low provisions created

- inflow of new clients continues based on the solid deposit growth

Interest margin and deposit inflow are the main areas to watch for in the short-term as the main profit drivers while fee generation in the longer-term is a key to confirm Bank's ability to keep and service its army of new clients attracted by high interest rates.