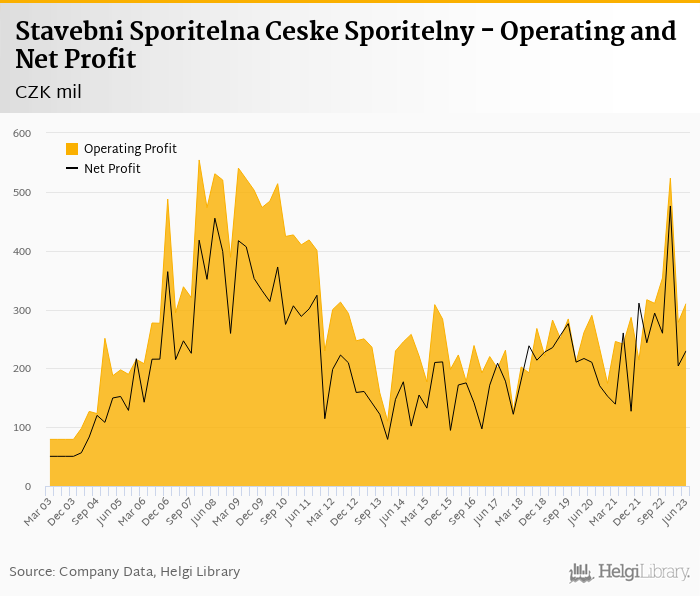

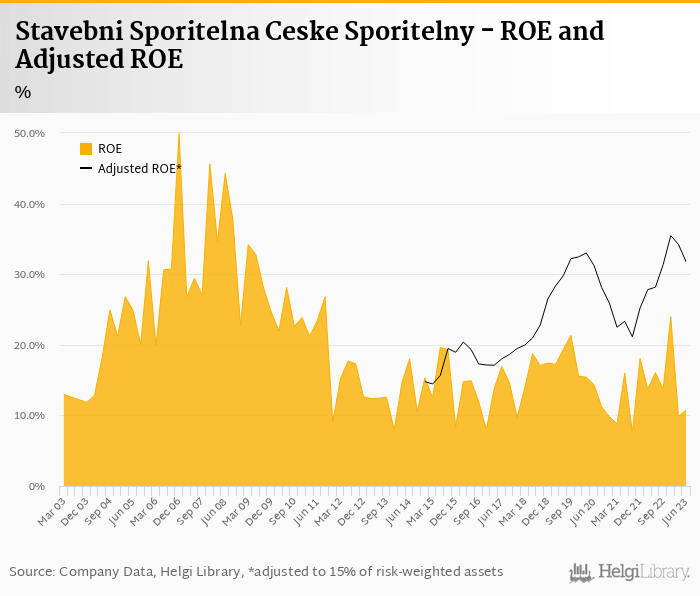

Stavebni Sporitelna Ceske Sporitelny's net profit fell 21.8% to CZK 230 mil in 2Q2023 with ROE at 10.8%.

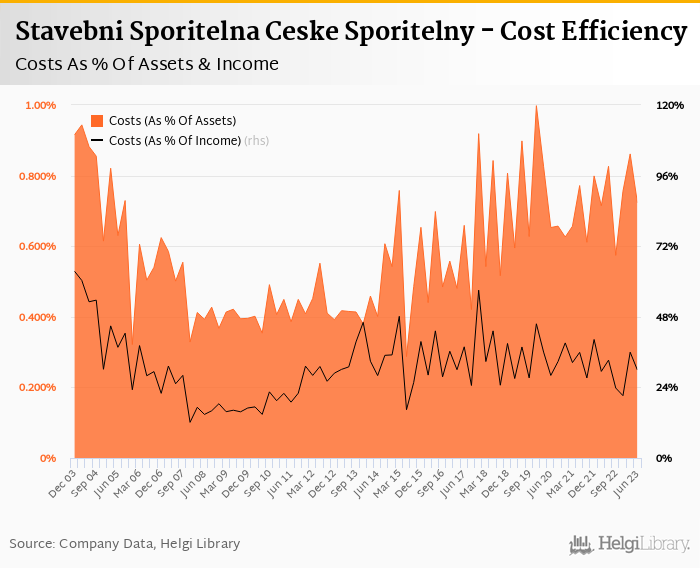

Operating profit was flattish as 4.9% decrease in revenues was offset by a 14.5% reduction on the cost side. Cost to income fell below 30%.

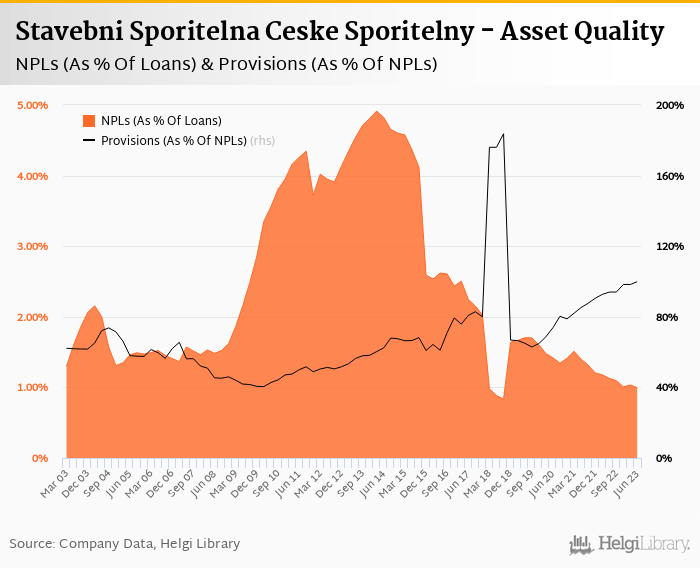

Asset quality seems to be good with NPL ratio staying around 1.0% on our estimates

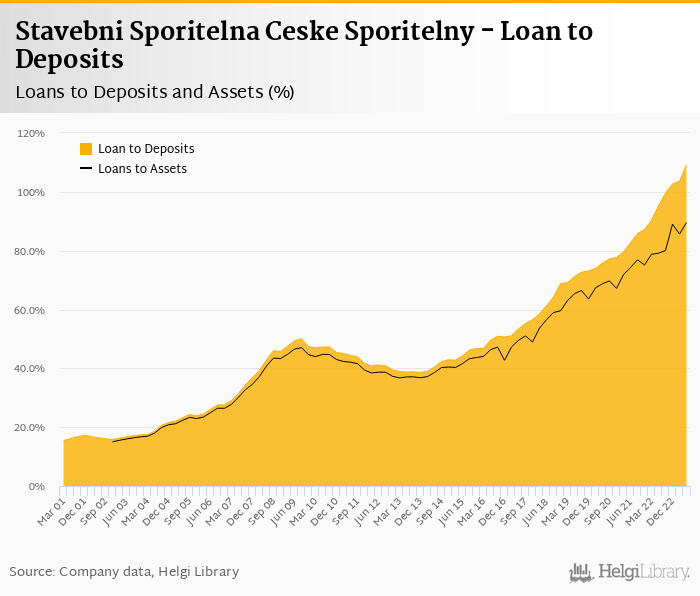

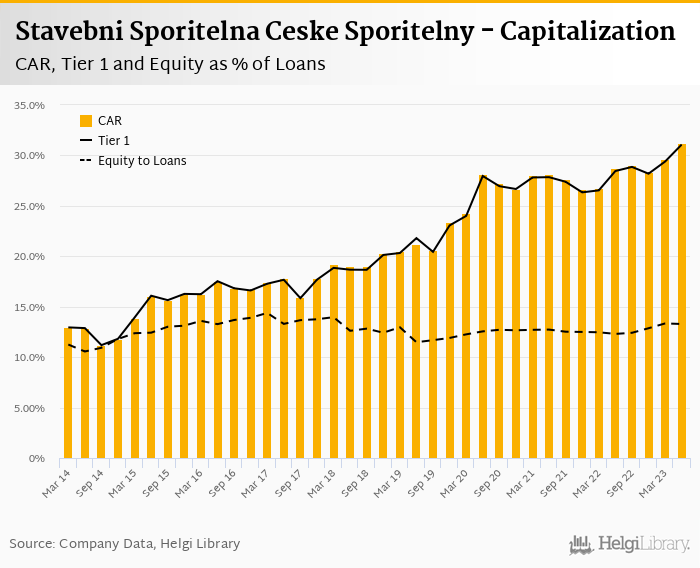

Loan to deposit ratio increased further to 109% and capital adequacy might be around 30%.

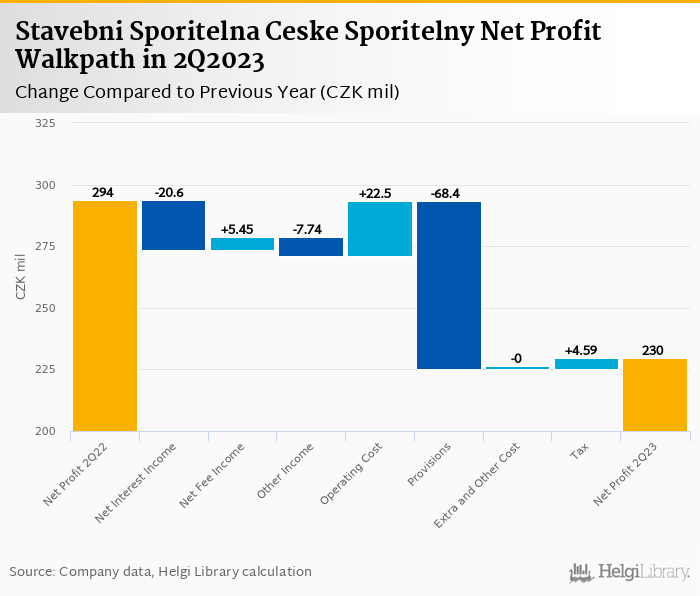

Stavebni Sporitelna Ceske Sporitelny made a net profit of CZK 230 mil in the second quarter of 2023, down 21.8% yoy, or decrease of CZK 64.1 mil in absolute terms. The annual reduction is a result of higher provisions on the back of last year's provision write-back. Operating profit stagnated as a fall in interest income was offset by cost cuts:

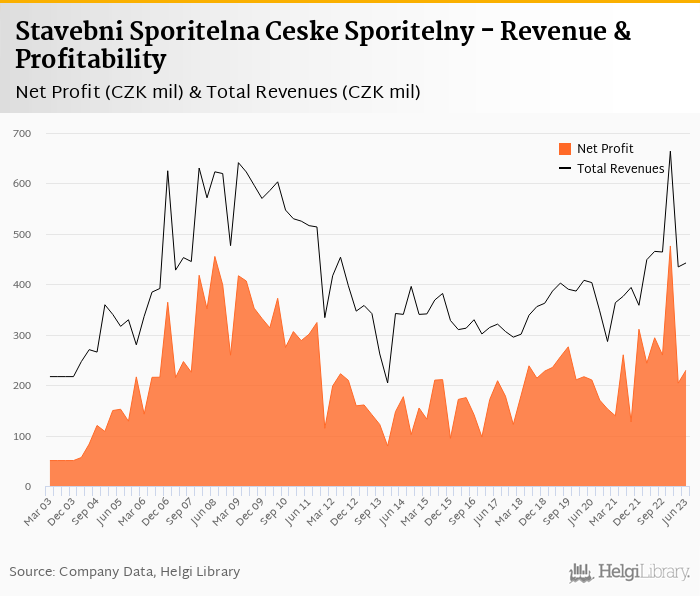

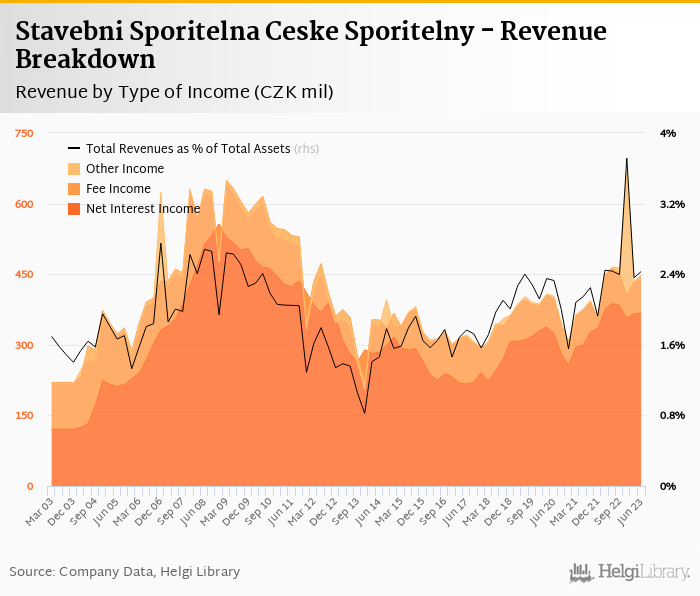

Revenues decreased 4.92% yoy to CZK 442 mil in the second quarter of 2023. Net interest income fell 5.3% yoy as net interest margin decreased 0.063 pp to 2.01% of total assets. Fee income grew 7.3% yoy but losses on other and trading income pushed the revenues further down. When compared to three years ago, revenues were up 9.7%:

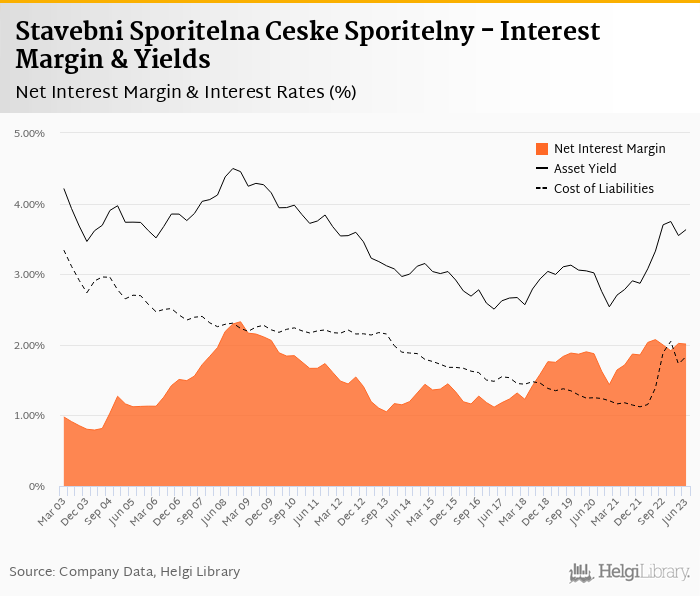

Average asset yield was 3.63% in the second quarter of 2023 (up from 3.33% a year ago) while cost of funding amounted to 1.84% in 2Q2023 (up from 1.39%). The pressure from higher cost of funding is still there, though the Bank seems to have managed it pretty well on the asset side and net margin has been relatively stable since 1Q2022:

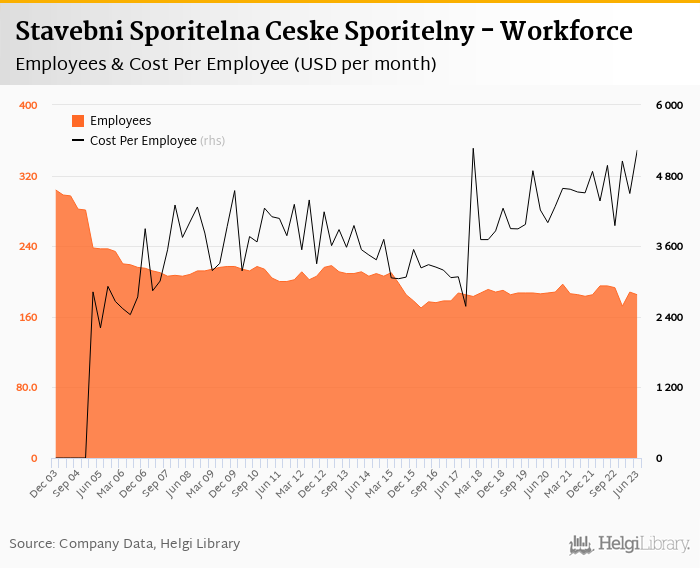

Costs decreased by 14.5% yoy and the bank operated with impressive cost to income of 29.9% in the last quarter. The cuts have been seen across the board from staff cost falling 5.8% (workforce down 5.1% yoy) to depreciation (down 28.5%) or non-personnel (minus 19.9%):

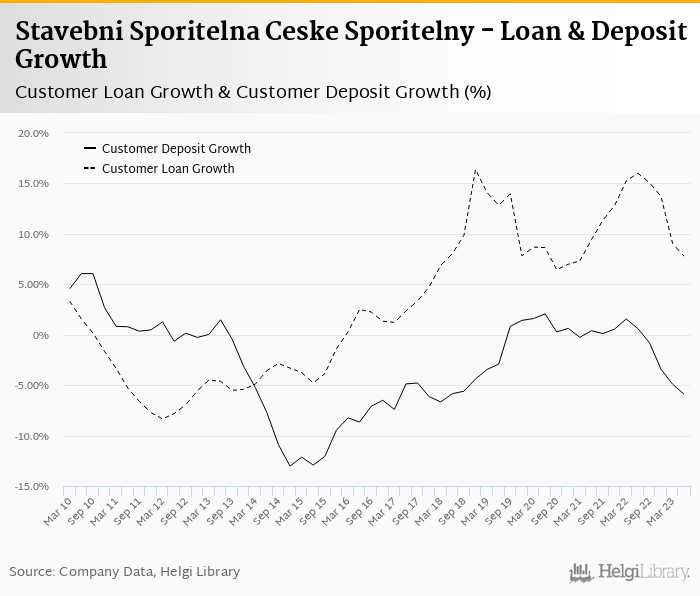

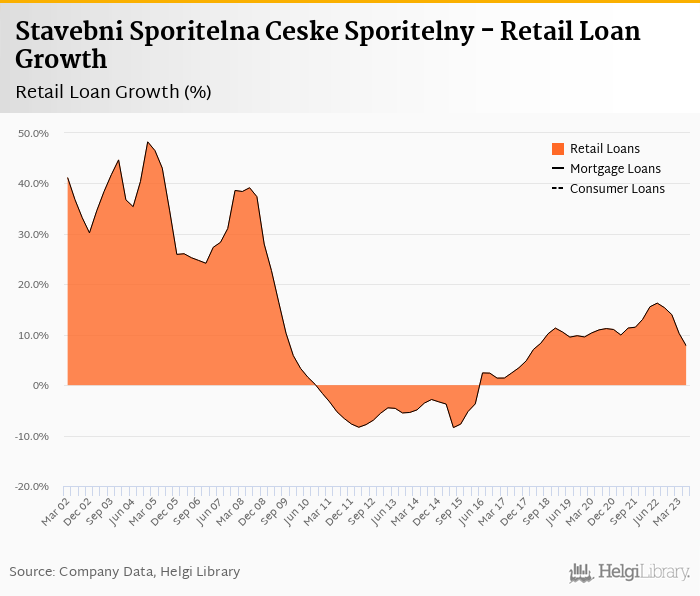

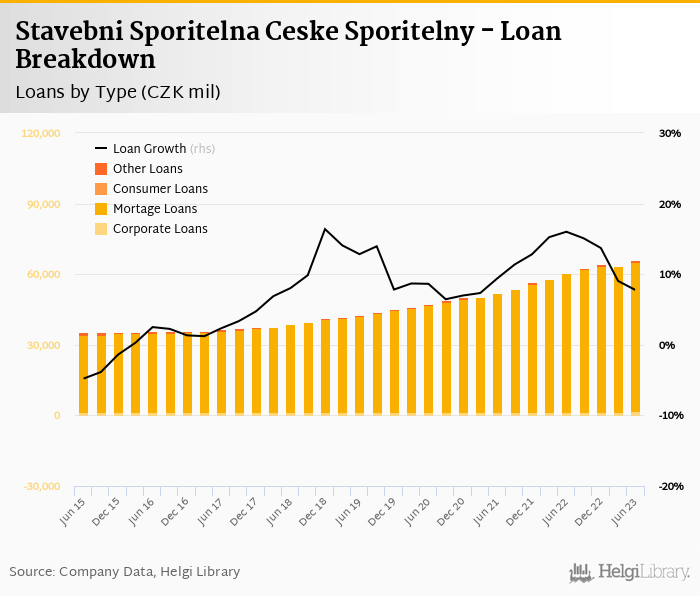

Loan portfolio grows while deposit outflow continues. Stavebni Sporitelna Ceske Sporitelny's customer loans grew 3.4% qoq and 7.78% yoy in the second quarter of 2023 while customer deposit fell further 1.89% qoq and 5.91% yoy. That’s compared to average annual growth of 10.9% in loans and decline in deposits of 0.93% seen in the last three years.

At the end of second quarter of 2023, Stavebni Sporitelna Ceske Sporitelny's loans accounted for 109% of total deposits and 89.6% of total assets.

Assuming residential mortgage loans formed 97.4% of the loan book, they grew 2.28% qoq and were 7.75% up yoy:

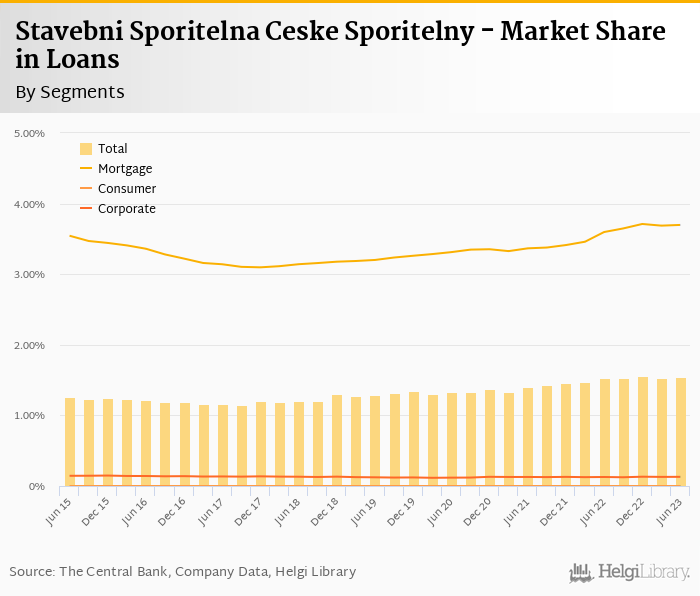

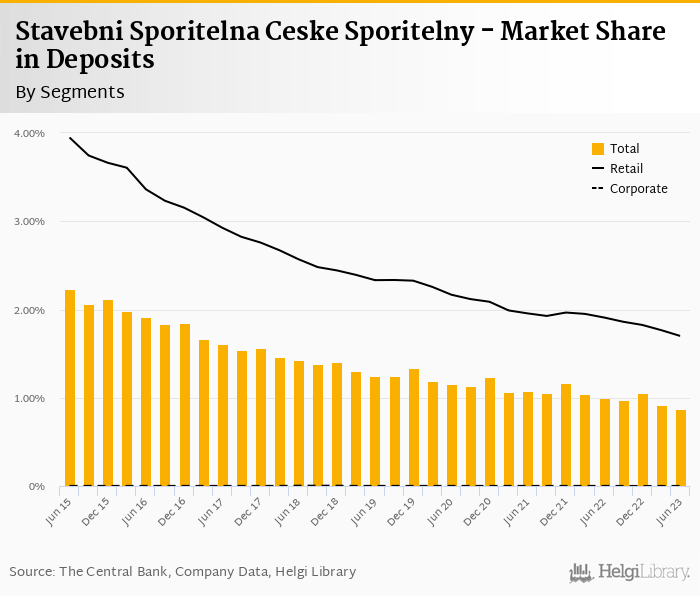

We estimate that Stavebni Sporitelna Ceske Sporitelny has gained 0.022 pp market share in the last twelve months in terms of loans (holding 1.55% of the market at the end of 2Q2023). On the funding side, the bank seems to have lost 0.127 pp and held 0.874% of the deposit market:

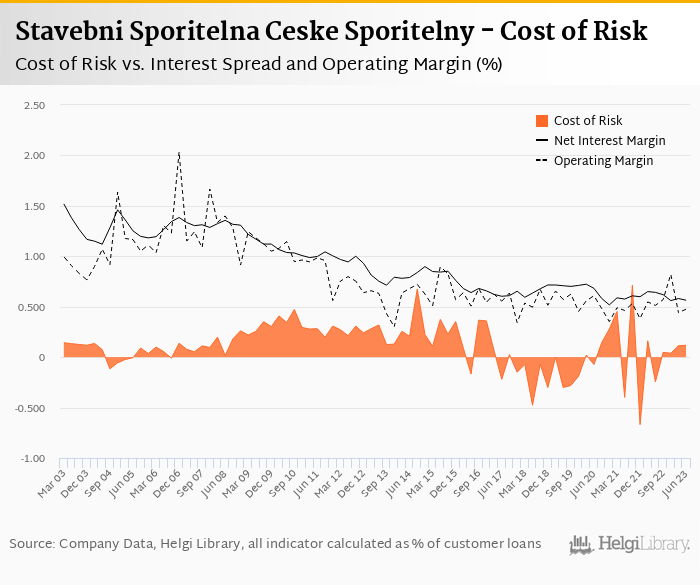

Provisions have "eaten" some 6.9% of operating profit in the second quarter of 2023 as cost of risk reached 0.134% of average loans, a similar figure when compared to the first quarter of 2023.

We therefore assume Stavebni Sporitelna Ceske Sporitelny's non-performing loans reached approximately 1.0% of total loans, down from 1.13% when compared to the previous year. Provisions might have covered the whole NPL, on our estimates:

With no official details, we assume Stavebni Sporitelna Ceske Sporitelny's capital adequacy ratio reached 30-31% in the second quarter of 2023, up from 28.7% for the previous year while bank equity accounted for 13.3% of loans:

Overall, Stavebni Sporitelna Ceske Sporitelny made a net profit of CZK 230 mil in the second quarter of 2023, down 21.8% yoy. This means an annualized return on equity of 10.8% in the last quarter or 14.2% when the last four quarters are taken into account:

Solid set of results given the circumstances. When adjusted for the provision write-back, Bank's operating profit stagnated when compared to last year. That's in spite of a decline in revenues, which the management offset by cost cuts.