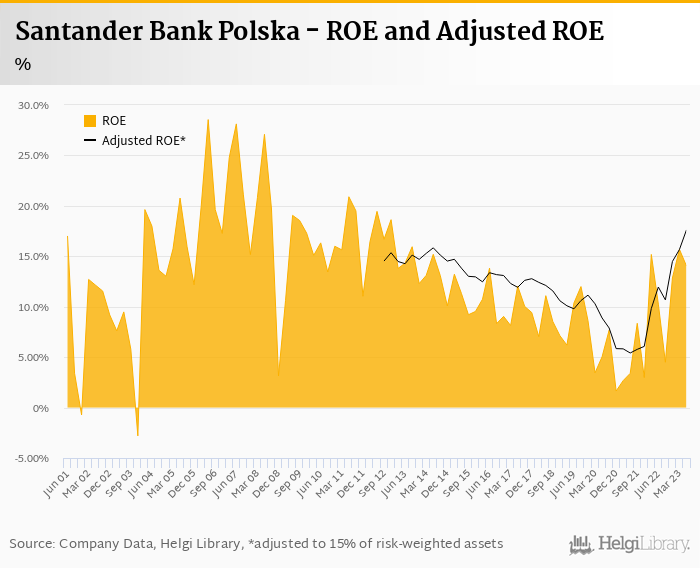

Santander Bank Polska rose its net profit 72% to PLN 1,130 mil in 2Q2023 and generated ROE of 14.0%.

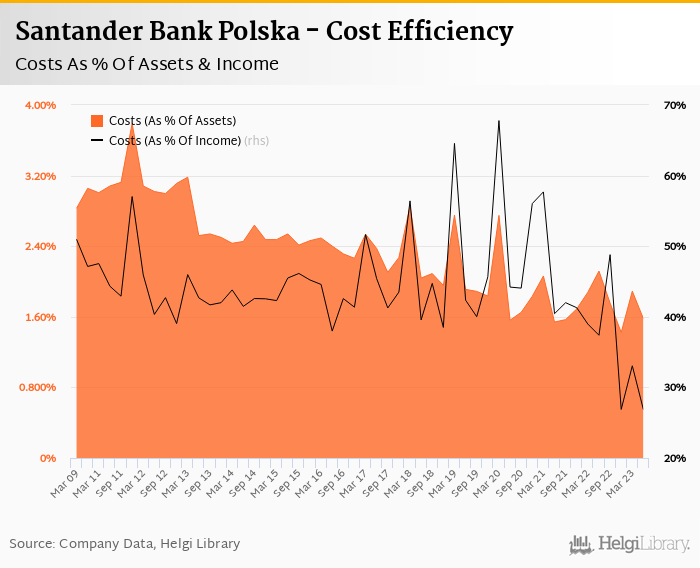

Revenues increased 10.1% yoy and cost fell 21.0%, so cost to income decreased to 26.8%

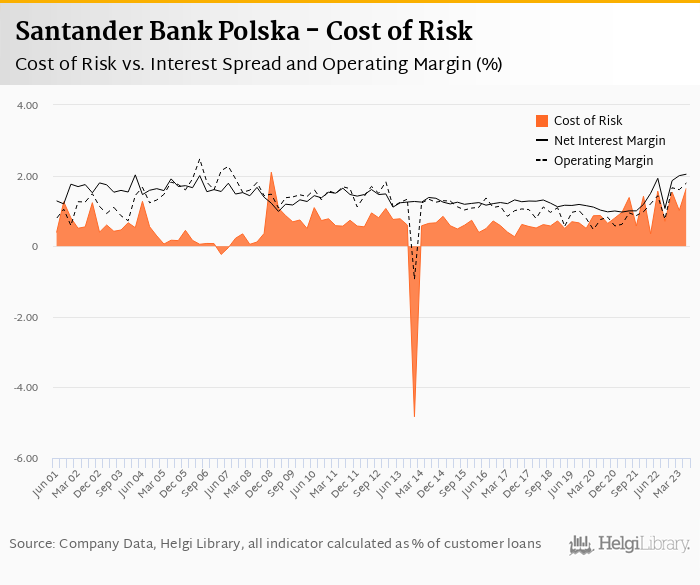

Cost of risk amounted 2.8% as bad loans rose to 4.28% of total loans

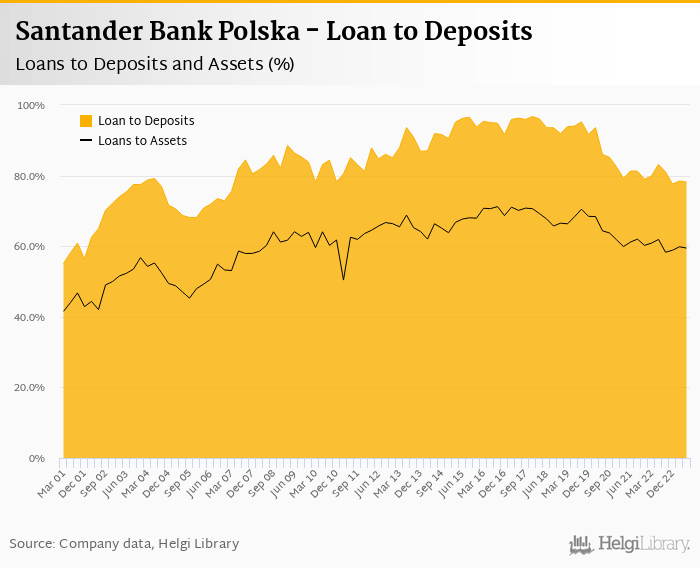

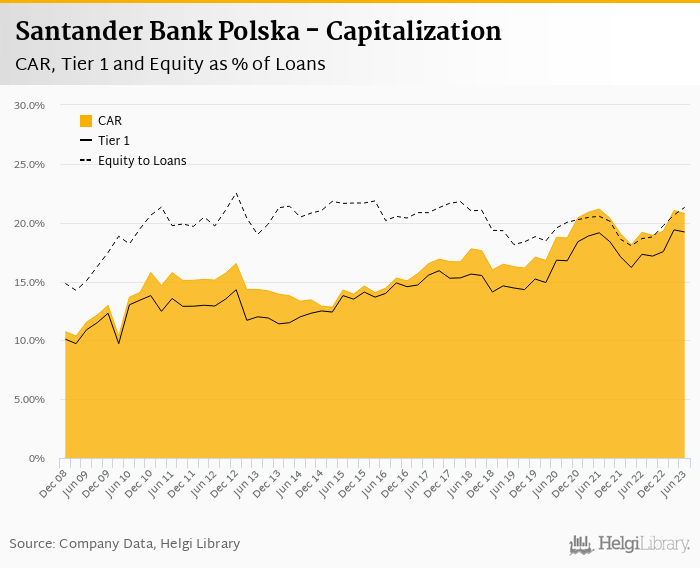

Loan to deposit ratio decreased to 78.2% and capital adequacy increased to 20.8%

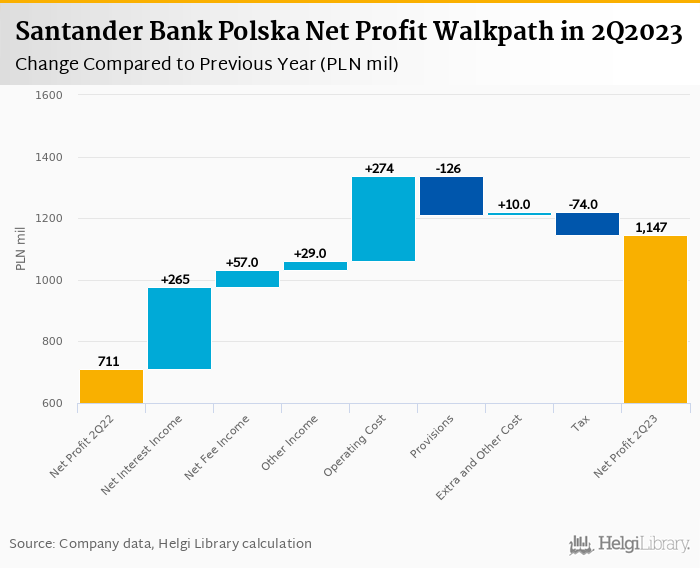

Santander Bank Polska increased its net profit by PLN 473 mil in 2Q23 in absolute terms. Strong operating profitability was the main driver as all revenues increased compared to las year and non-personnel costs fell significantly. The highest provisions ever created on the quarterly basis spoilt the day a little:

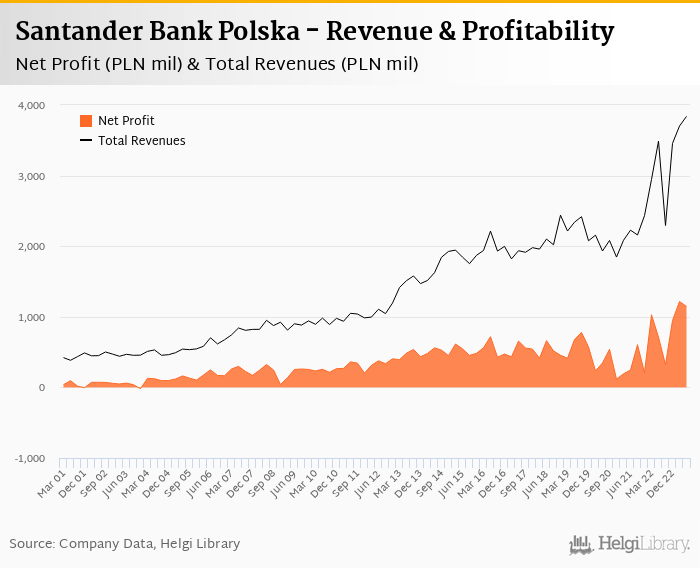

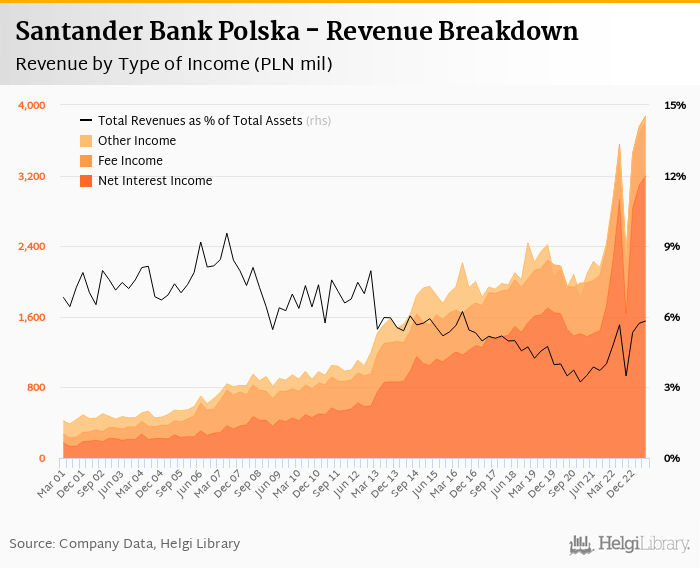

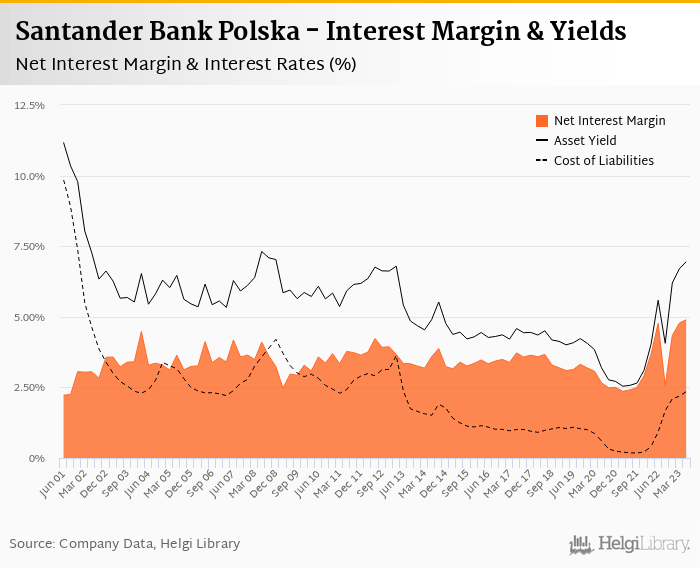

Revenues increased 10.1% yoy to PLN 3,839 mil in the second quarter of 2023. Net interest income rose 9.0% yoy as net interest margin increased to 4.90% of total assets. Fee income grew 9.2% yoy and losses in other income were PLN 29 mil lower yoy. When compared to three years ago, revenues have almost doubled:

Average asset yield was 6.96% in the second quarter of 2023 (while average yield on loans reached a record 8.47%) while cost of funding amounted to 2.36% in 2Q2023 (up from 0.923%). These are the highest figures seen over the last two decades:

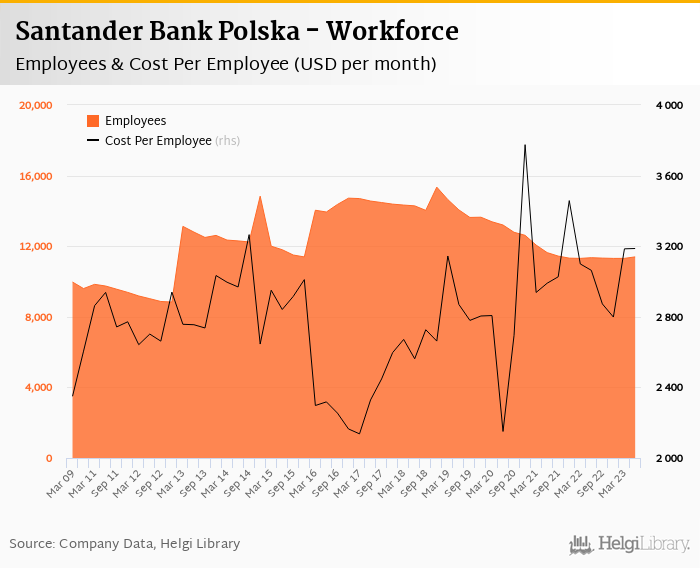

Costs decreased by 21.0% yoy and the bank operated with a very impressive cost to income of 26.8% in the last quarter. Staff cost rose 19.5% as inflationary and wage pressures kicked in, though other operating costs fell significantly when compared to last year. When adjusted, costs have grown by 16% in the first half of the year:

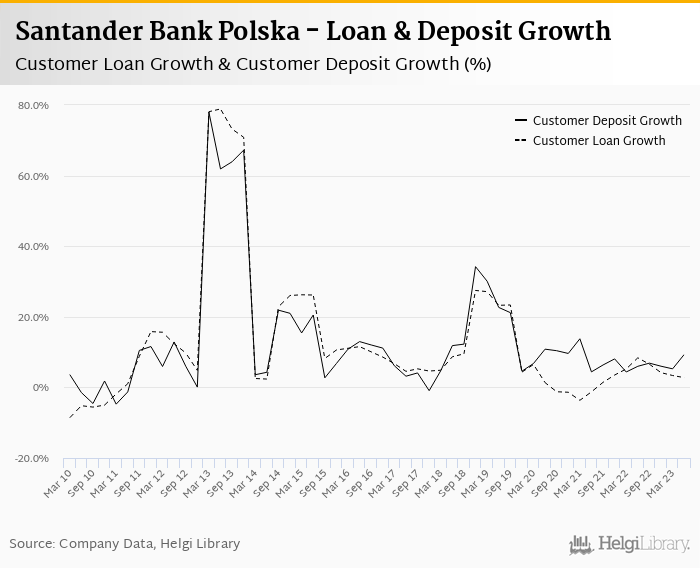

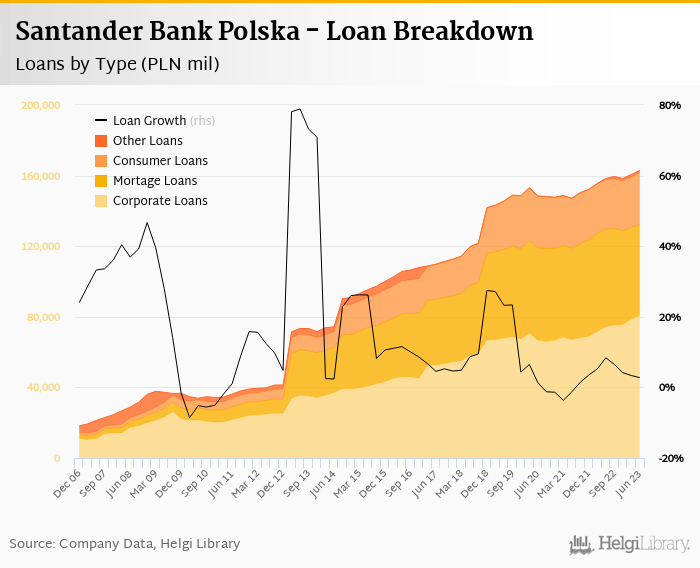

Loan and deposit growth remains subdued, similar to other banks. Santander Bank Polska's customer loans grew 1.4% qoq and 2.8% yoy in the second quarter of 2023 while customer deposit growth amounted to 1.8% qoq and 9.3% yoy. That’s compared to average of 2.3% and 7.5% average annual growth seen in the last three years.

At the end of second quarter of 2023, Santander Bank Polska's loans accounted for 78.2% of total deposits and 59.5% of total assets.

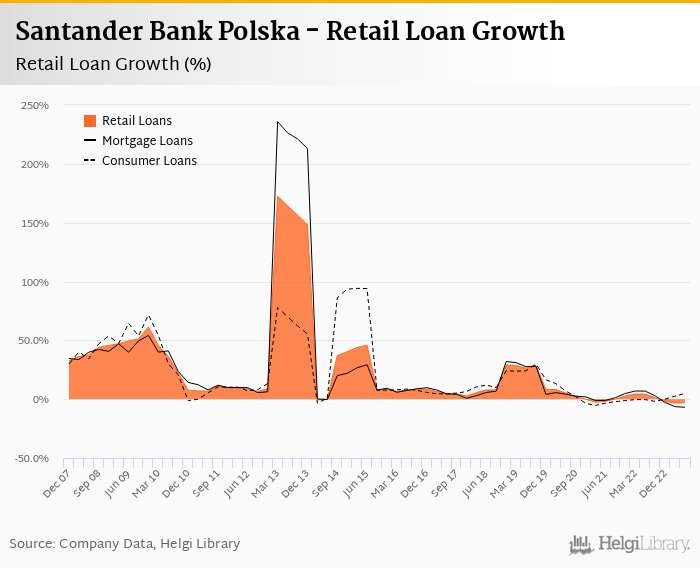

Retail loans grew 0.27% qoq and were 2.9% down yoy. They accounted for 52% of the loan book at the end of the second quarter of 2023 while corporate loans increased 2.7% qoq and 8.6% yoy, respectively. Mortgages represented a third of the Santander Bank Polska's loan book, consumer loans added a further 18.7% and corporate loans formed 51.5% of total loans:

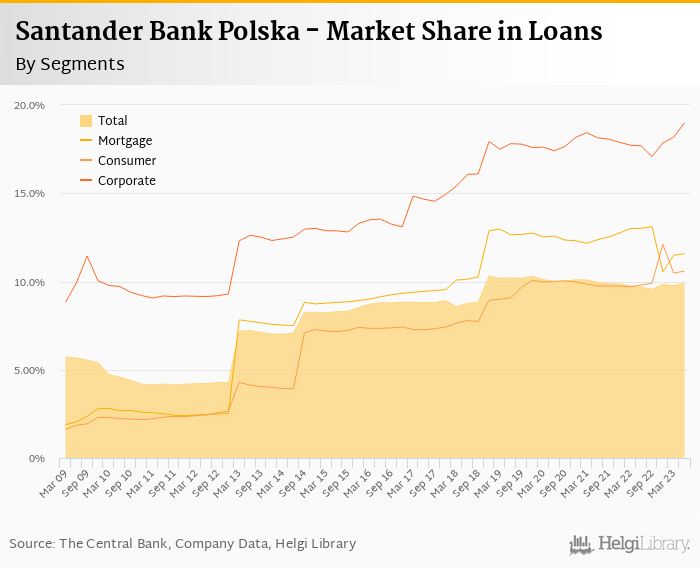

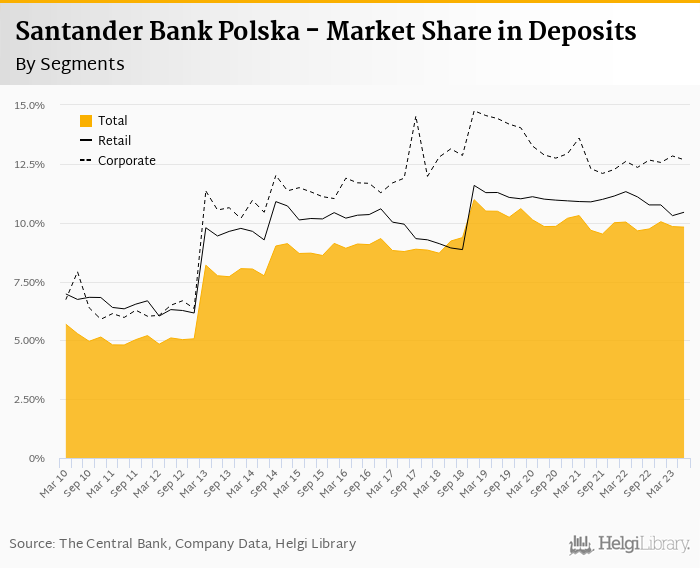

We estimate that Santander Bank Polska has gained 0.22 pp market share in the last twelve months in terms of loans (holding 9.90% of the market at the end of 2Q2023). On the funding side, the bank seems to have gained 0.16 pp and held 9.81% of the deposit market:

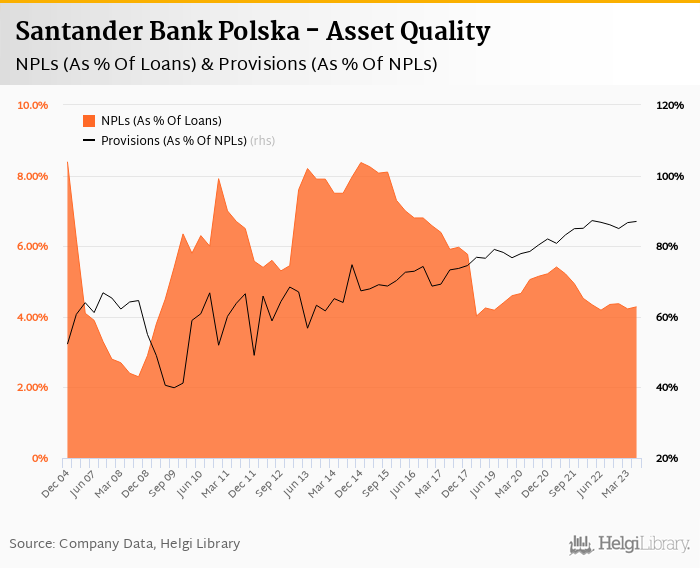

Santander Bank Polska's non-performing loans reached 4.3% of total loans, up from 4.2% when compared to the previous year. Provisions cover almost 90% of NPLs, so "non-provisioned" part of the NPLs accounts for around PLN 900 mil, or less than 3% of Bank's equity.

While NPL ratio has been stable for a few years, the need for additional provisioning to cover "new" NPLs costs the Bank dearly. Provisions have been "eating" some 30-40% of operating profit the Bank created (additional 38.7% in the second quarter of 2023) as cost of risk approaches 2% of loans (2.79% in 2Q23). With a provision coverage of less than 60% of FX mortgages, the cost of risk will likely remain high:

Santander Bank Polska's capital adequacy ratio reached 20.8% in the second quarter of 2023 and Tier 1 ratio amounted to 19.2%, some of the highest among Polish banks:

Overall, Santander Bank Polska made a net profit of PLN 1,130 mil in the second quarter of 2023, up 72.0% yoy. This means an annualized return on equity of 14.0%, or 17.6% when equity "adjusted" to 15% of risk-weighted assets:

Strong operating performance on both, revenue as well as cost side offset partly by the need to create additional provisions. Santander Polska remains one of our favourite banks in Poland and its valuation of less than 1.4x in terms of PBV and 9.5x on PE expected in 2024 shows the premium investors offer fot its stock. Asset quality and need of further provisions for CHF-denominated mortgage portfolio seems to be the main factors to watch for in the coming quarters.