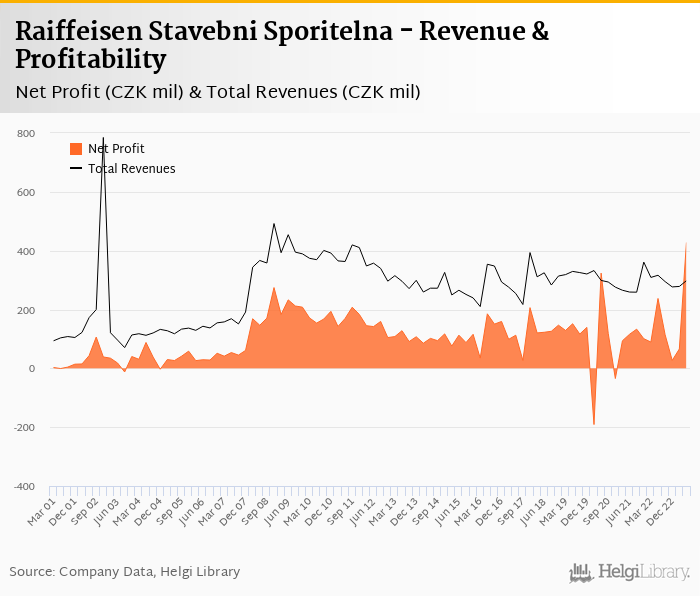

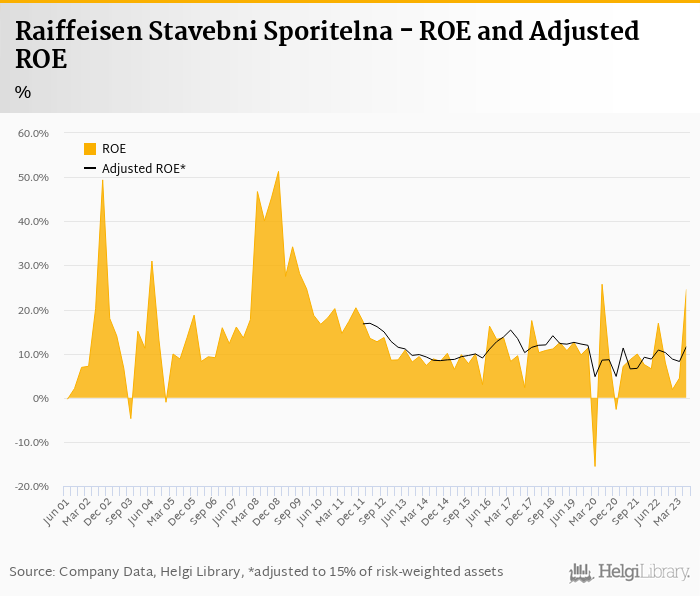

Raiffeisen Stavebni Sporitelna rose its net profit 80% to CZK 428 mil in 2Q2023 and generated ROE of 24.6%.

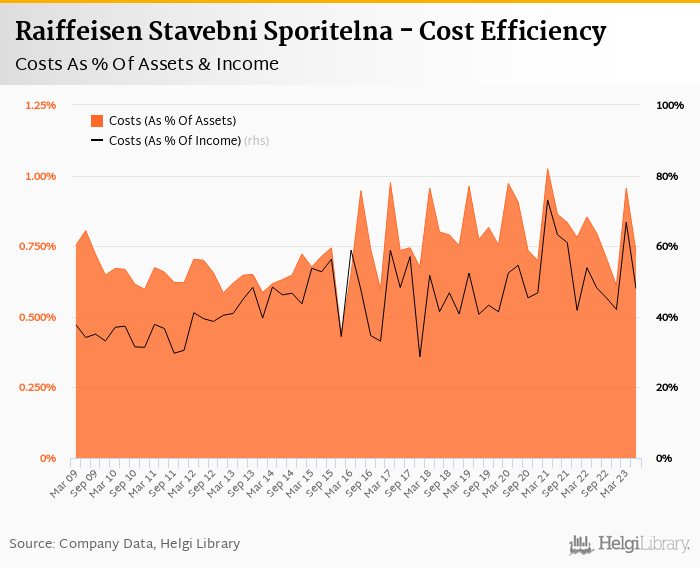

Revenues decreased 5.8% yoy due to absence of last year's trading gains but cost fell 6.14%, so cost to income decreased to 48.0%

CZK 374 mil provision write-back boosted profitability and generated 70% of the Bank's profit.

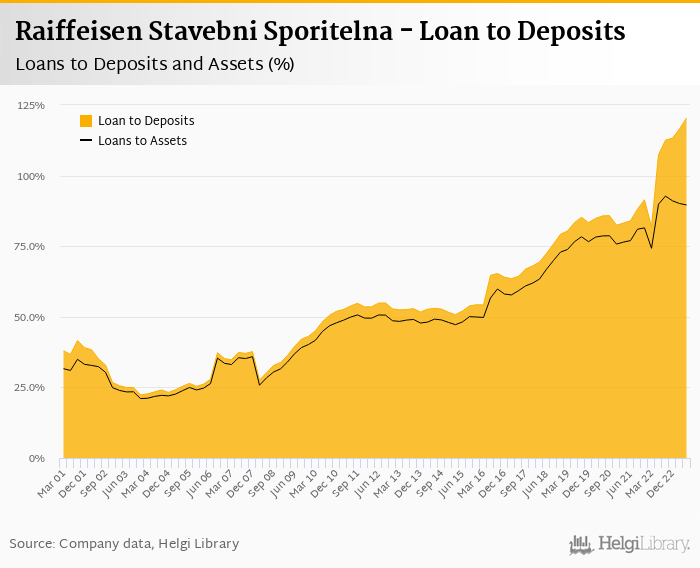

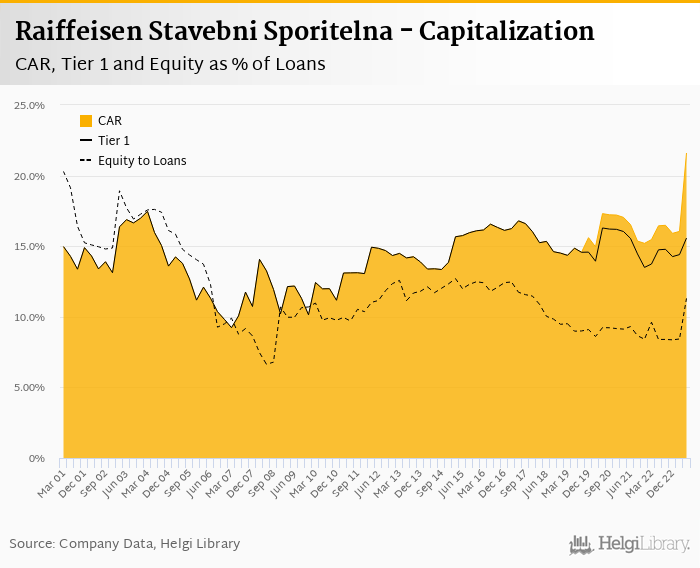

Loan to deposit ratio increased to 120% and capital adequacy increased to around 21.5%

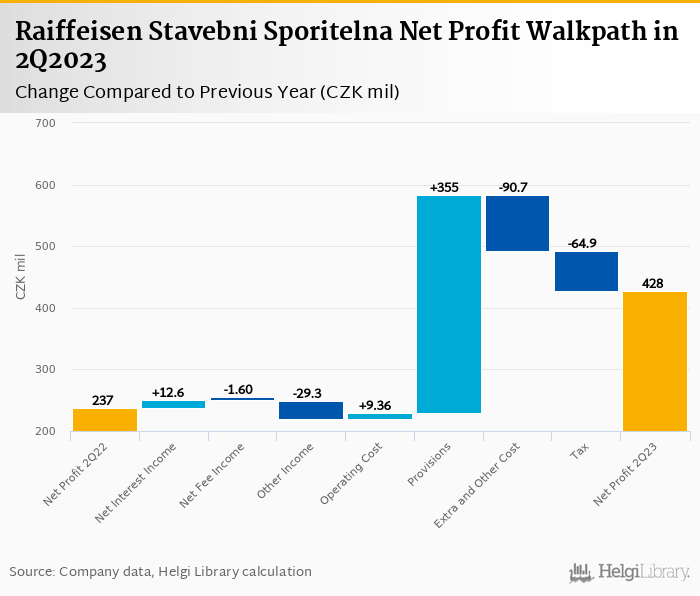

Raiffeisen Stavebni Sporitelna made a net profit of CZK 428 mil in the second quarter of 2023, up CZK 191 mil in absolute terms. Some 70% of the pre-tax profit has been generated by a hefty provision write-back due likely to a disposal of provisioned financial assets. Operating profit fell 5.4% as absence of last year's trading gain (CZK 29.5 mil) was bigger than impressive savings made on the cost side (CZK 9.4 mil):

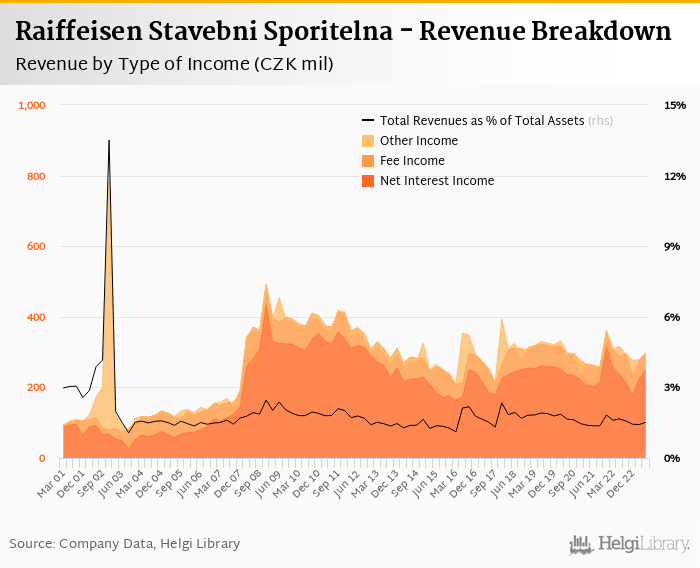

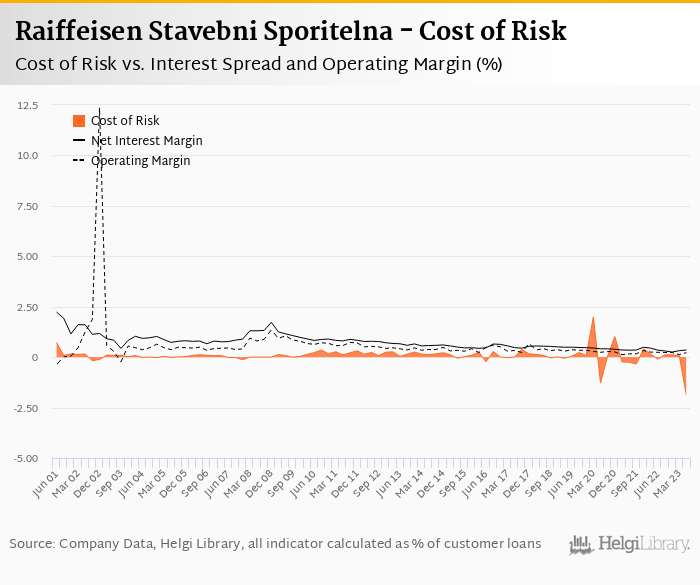

Revenues decreased 5.8% yoy to CZK 298 mil in the second quarter of 2023. Net interest income rose 5.3% yoy as net interest margin continued to recover (up 0.034 pp to 1.28% of total assets). Fee income fell 3.3% yoy and last year's trading gains of CZK 29.5 mil was not repeated. When compared to three years ago, revenues were down 0.255%:

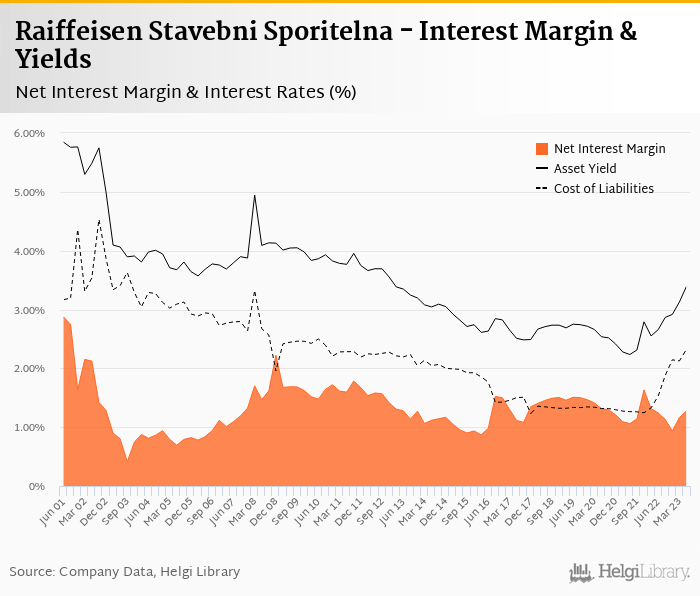

Average asset yield was 3.39% in the second quarter of 2023 (up from 2.66% a year ago) while cost of funding amounted to 2.32% in 2Q2023 (up from 1.53%). The margin recovered somewhat from poor 4Q2022 though 2Q2023 net interest income remains at the levels seen in 2018-2020, at best:

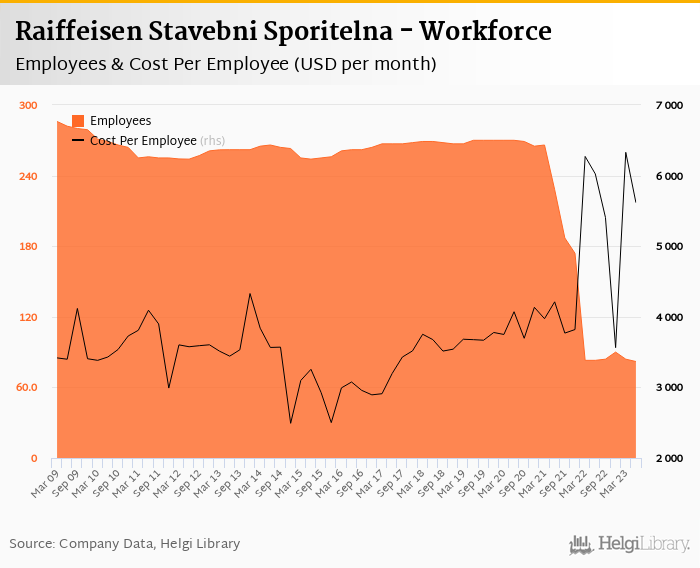

Costs fell across the board and decreased by 6.14% yoy and the bank operated with average cost to income of 48.0% in the last quarter. Similar to other building savings banks, cost cutting is a must when the business model is under pressure. And under pressure it is as revenues have been falling since 2008:

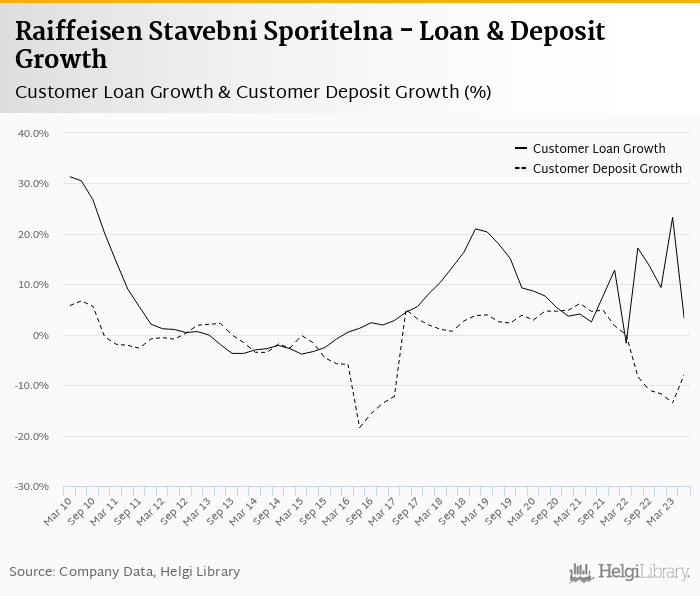

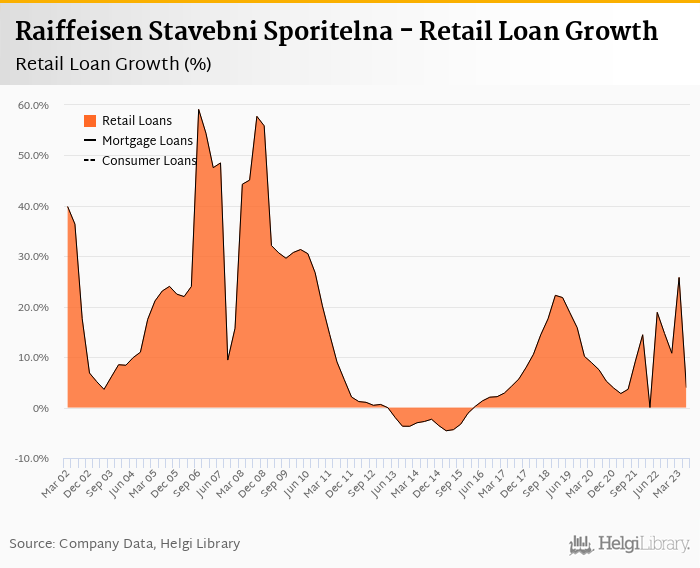

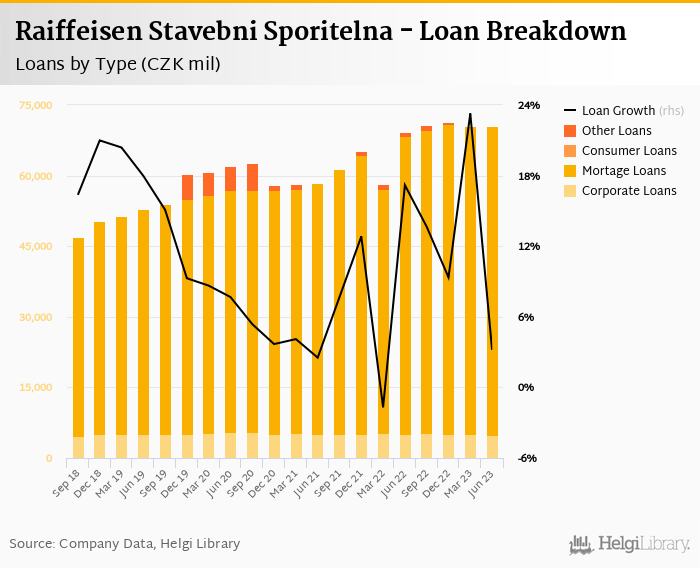

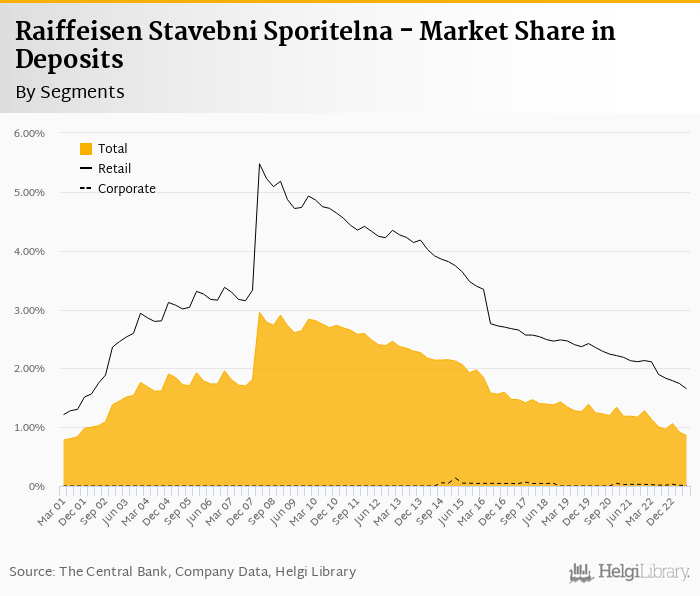

Demand for loans remains weak while depositors have been increasingly looking elsewhere since interest rates increased. Raiffeisen Stavebni Sporitelna's customer loans grew 0.01% qoq and 3.2% yoy in the second quarter of 2023 while customer deposit fell further 3.2% qoq and almost 8.0% when compared to last year. That’s compared to average of 8.4% annual growth and 2.1% decline seen in the last three years.

At the end of second quarter of 2023, Raiffeisen Stavebni Sporitelna's loans accounted for 120% of total deposits and 89.6% of total assets.

Retail loans grew 0.50% qoq and were 3.9% up yoy. They accounted for 93.2% of the loan book at the end of the second quarter of 2023 while corporate loans decreased 6.1% qoq and 6.0% yoy, respectively. Mortgages represented 93.2% of the Raiffeisen Stavebni Sporitelna's loan book and corporate loans formed 6.82% of total loans:

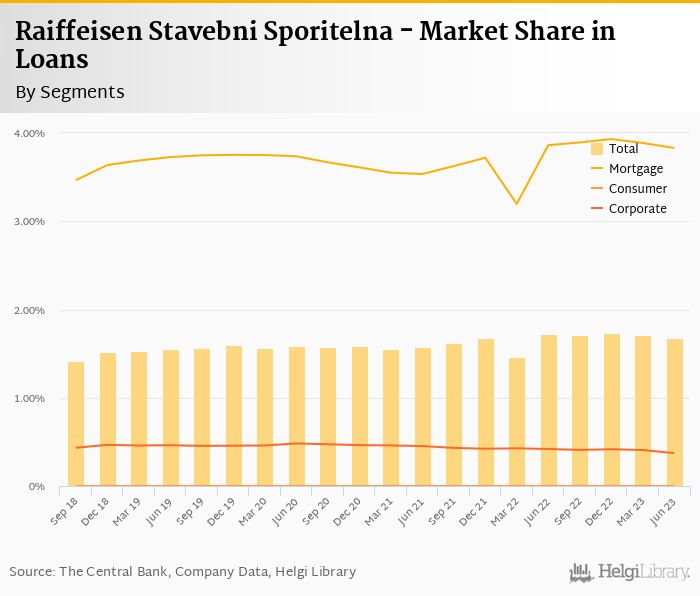

We estimate that Raiffeisen Stavebni Sporitelna has lost 0.05 pp market share in the last twelve months in terms of loans (holding 1.68% of the market at the end of 2Q2023). On the funding side, the bank seems to have lost 0.146 pp and held 0.858% of the deposit market. In terms of mortgage lending, we estimate the Bank held 3.8% of the market in the middle of 2023:

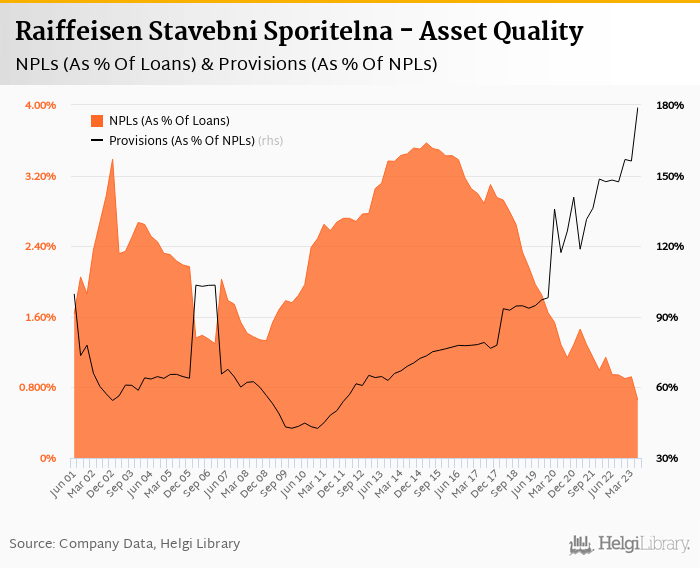

The Bank wrote-back CZK 374 mil of provisions in the second quarter of 2023, the biggest in Bank's history. Since financial assets held by the Bank fell CZK 355 mil qoq, we assume the Bank disposed some of its debt securities it created provisions for in the past.

Reporting no details on its loan portfolio quality, we assume Raiffeisen Stavebni Sporitelna's non-performing loans reached 0.6-0.7% of total loans, down from 0.94% when compared to the previous year. Provisions should be covering more than 100% of NPLs, on our estimates:

We believe Raiffeisen Stavebni Sporitelna's capital adequacy ratio reached 21-22%% in the second quarter of 2023, up from 16.4% for the previous year:

Overall, Raiffeisen Stavebni Sporitelna made a net profit of CZK 428 mil in the second quarter of 2023, up 80.3% yoy. This means an annualized return on equity of 24.6% in the last quarter or 9.89% when the last four quarters are taken into account:

Strong headline profitability masking relatively weak operating profitability and low demand for loans and deposits. The ongoing reduction in operating costs suggests the management has been doing its job (costs are down 14% when compared to 2021), though bank's business model remains under pressure. When adjusted for the hefty provision write-back, we assume Bank's ROE would have reached 6-7% only in 2Q2023.