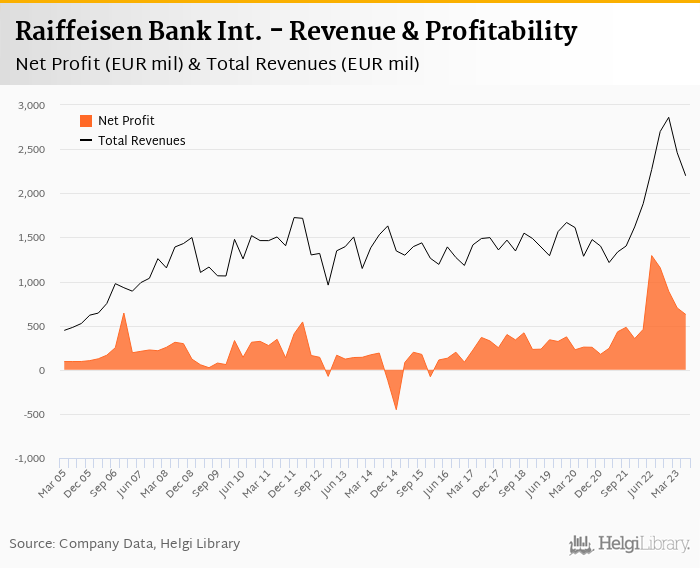

Raiffeisen Bank Int. decreased its net profit 54.5% to EUR 578 mil in 2Q2023 and generated ROE of 13.0%. When excluding for a sale of Bulgarian unit last year, the fall would have been around 22%.

The results were somewhat disappointing on the operating level due to weak fee income generation, though provision write-backs saved the day and bottom line this quarter.

The management slightly upgraded its profit guidance the Bank to generate core ROE of 10% and to operate with cost to income ratio of 51-53% in 2023.

Raiffeisen Int. remains "dirt-cheap" stock trading at adj. PE of 6-7x and at less than half of its book value in 2023/2024. Waiting for a disposal of Russian assets remains a key catalyst.

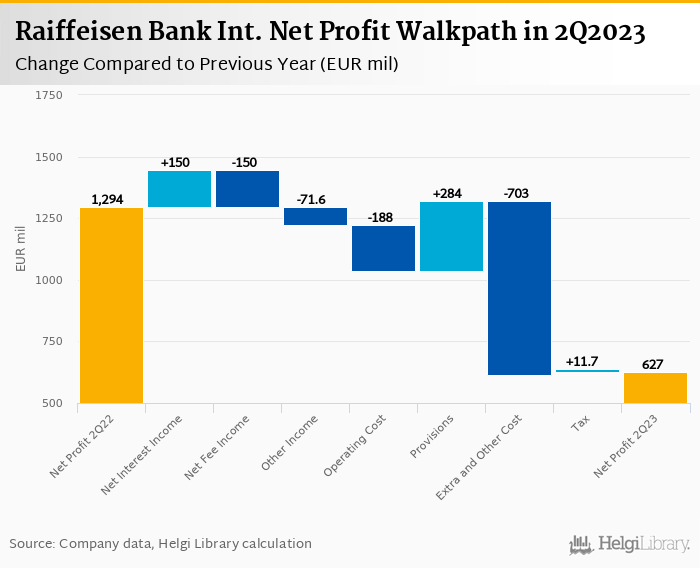

Raiffeisen Bank Int. made a net profit of EUR 578 mil in the second quarter of 2023, down 54.5% yoy, or decrease of EUR 692 mil in absolute terms. A net profit adjusted for Russia/Belarus and Bulgaria accounted for EUR 497 mil, ROE only 7.6% and CET1 Ratio 13.9% (vs. 14.9% and 15.9% for the latter two). Apart from the absence of last-year's one-off gain, provision write-backs were the main difference when compared to last year:

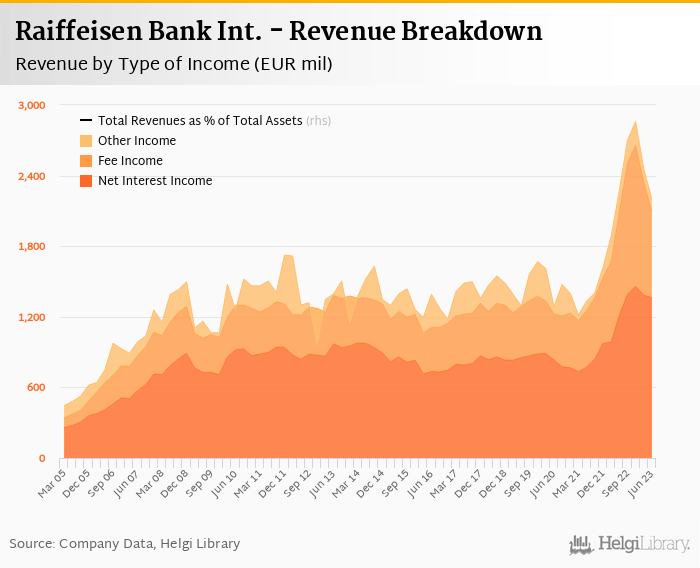

Revenues decreased 3.2% yoy to EUR 2,197 mil in the second quarter of 2023 as higher net interest income rose (up 12.4% yoy) supported by higher net interest margin (up 0.229 pp to 2.62%) were not enough to compensate for 17% fall in fee income:

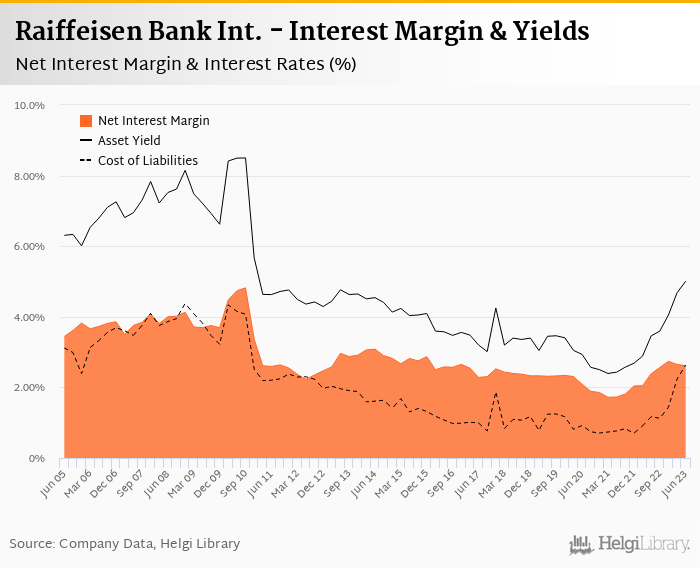

Average asset yield was 5.01% in the second quarter of 2023 (up from 3.46% a year ago) while cost of funding amounted to 2.63% in 2Q2023 (up from 1.17%). Austrian operations contributed the most to the increase.

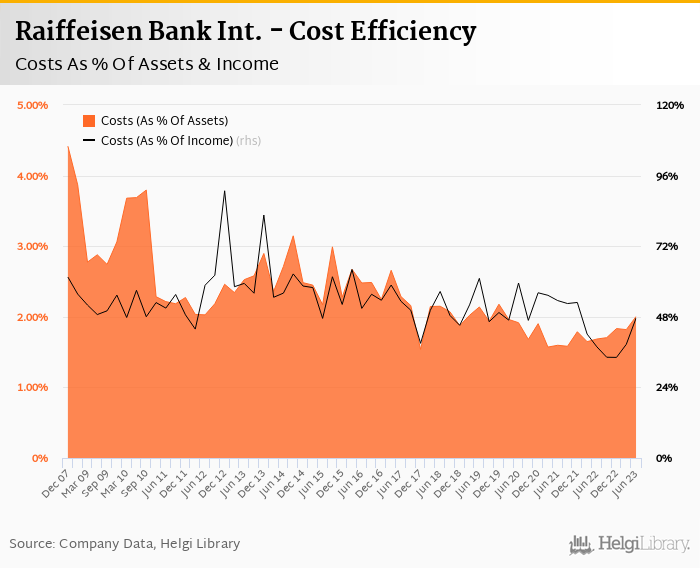

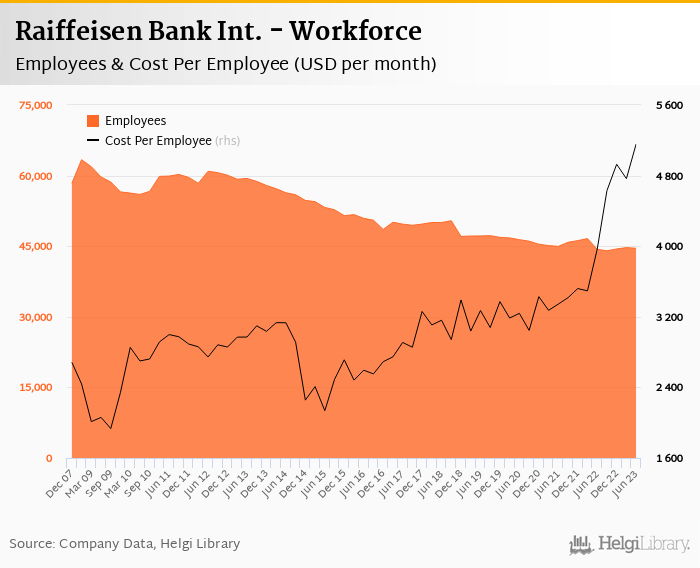

Costs increased by 22.0% yoy as pressure has been felt across the board and countries due mainly to the higher inflation. Staff cost rose 30.7% yoy under stable workforce, for instance. The bank operated with average cost to income of 47.6% in the last quarter, though the number would have exceeded 50% when adjusted for operations in Russia/Belarus.

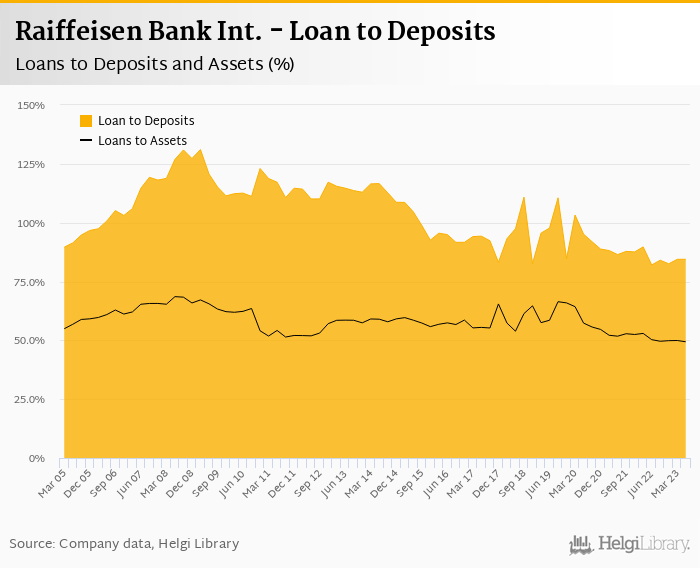

Loan and deposit growth remains weak, both fell 3.0% qoq. When compared to last year, loans were 5.5% and deposits 8.2% lower, respectively.

At the end of second quarter of 2023, Raiffeisen Bank Int.'s loans accounted for 84.4% of total deposits and 49.4% of total assets.

Retail loans fell 1.53% qoq and were 2.13% up yoy. They accounted for 48.5% of the loan book at the end of the second quarter of 2023 while corporate loans decreased 0.394% qoq and -8.75% yoy, respectively.

Non-performing loans reached 2.82% of total loans and provisions covered some 57.6% of NPLs at the end of the second quarter of 2023 (down from 60.7% for the previous year).

Lower provisions were one of the positive surprises in the result set this quarter (with other banks in the CEE too). That includes additional EUR 329 mil of extra provisions created to cover risk of litigation of Poland's CHF-denominated mortgage loan exposure. Having said that, the Bank created so far total of EUR 1,199 mil for the risk covering 63.4% of the potential risk exposure.

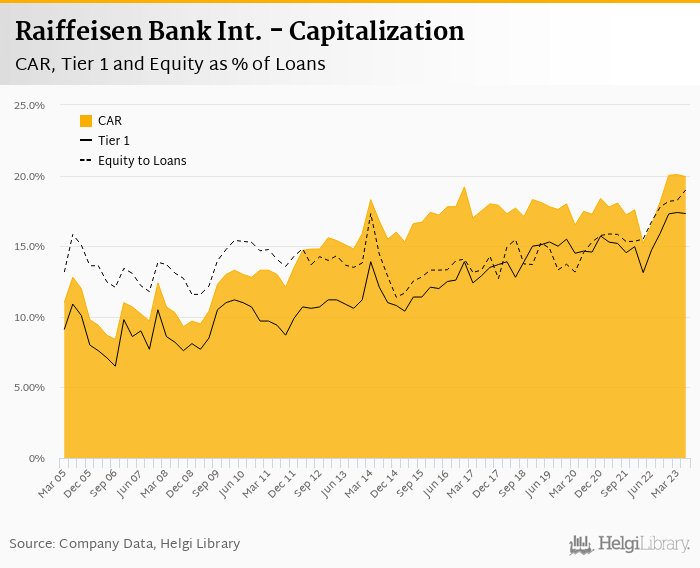

Raiffeisen Bank Int.'s capital adequacy ratio reached 19.9% in the second quarter of 2023, up from 16.6% for the previous year. The Tier 1 ratio amounted to 17.3% at the end of the second quarter of 2023 while bank equity accounted for of loans.

Assuming P/B zero deconsolidation” of Russia, the group CET1 ratio would be above 13.5%. The capital adequacy would have reach 18.7% assuming AT1 and A2 capital buckets to be supplied, according to the management.

Overall, Raiffeisen Bank Int. made a net profit of EUR 578 mil in the second quarter of 2023, down 54.5% yoy. This means an annualized return on equity of 13.0%, or 22.3% when equity "adjusted" to 15% of risk-weighted assets:

Similar to Erste Bank, the management updated its guidance for 2023 following the first half results. The plan is slightly better when compared to a quarter ago and the main assumptions excluding operations in Russia/Belarus are following:

- interest income at EUR 3.8-4.0 bil (vs. EUR 5.3-5.4 bil incl. Russia/Belarus)

- cost to income at 51-53% (43-45% incl. Russia/Belarus)

- cost of risk at around 45 bp (up to 60 bp incl. Russia/Belarus)

- ROE of around 10% (around 17.0% incl. Russia/Belarus)

- CET1 at above 13.5% (>16.0%) assuming PBV zero deconsolidation of Russia

Slightly disappointing results on the operational level compensated for lower risk cost. Upgraded management guidance might add some optimism, though core ROE of 10% and cost to income of 51-53% expected in 2023 remain well below the best peers in the CEE or Erste Bank.

Raiffeisen Int. remains "dirt-cheap" stock trading at adj. PE of 6-7x and at less than half of its book value in 2023/2024. Waiting for a disposal of Russian assets remains a key catalyst.