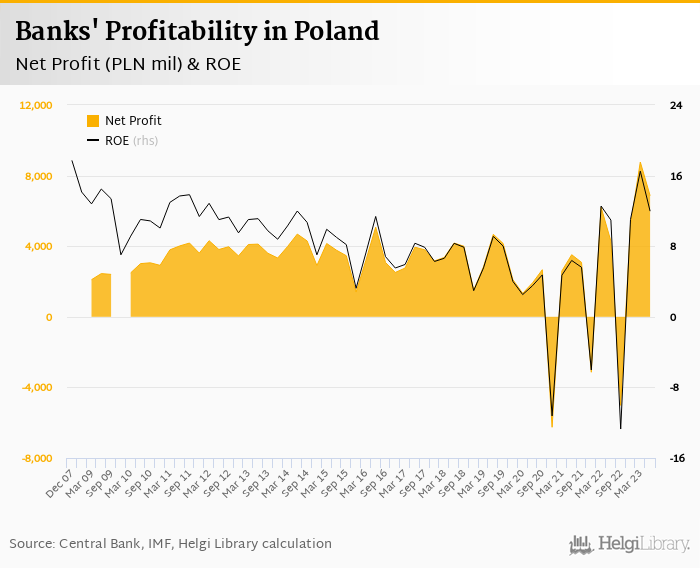

Polish banks increased net profit 60.1% yoy to PLN 6,862 mil in the second quarter of 2023 and generated ROE of 12.0%.

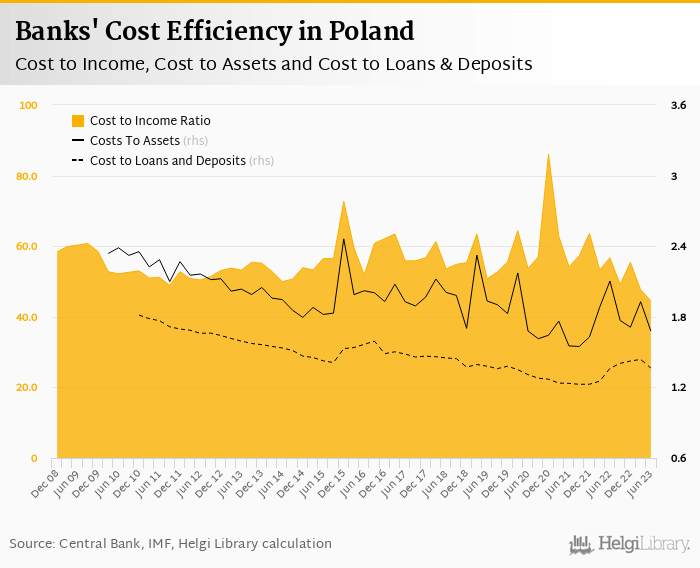

Operating income rose 8.65%, cost to income dropped to 44.5% and banks' share of bad loans fell to 4.09%.

Pekao generated the biggest profit while mBank produced the biggest loss.

Polish banks reported a net profit of PLN 6,862 mil in the second quarter of 2023, up 60.1% when compared to previous year. This implies ROE of 12.0% in 2Q2023. In the last twelve months, profits rose 51.8% yoy to PLN 15,834 mil and ROE reached 7.45%.

Pekao generated the largest net profit in the last quarter (PLN 1,694 mil) followed by Santander Bank Polska and ING Bank Slaski. At the other end of the scale was mBank with a reported loss of PLN 15.4 mil:

Revenues increased 8.65% yoy to PLN 26,662 mil in the second quarter of 2023:

| 2Q2022 | 2Q2023 | Change | 1-6/2022 | 1-6/2023 | Change | |

| Revenues | 24,540 | 26,662 | 8.65% | 47,347 | 54,553 | 15.2% |

| Net Interest Income | 20,269 | 23,750 | 17.2% | 37,048 | 47,003 | 26.9% |

| Net Fee Income | 4,667 | 4,637 | -0.643% | 9,378 | 9,258 | -1.28% |

| Other Income | -396 | -1,725 | -336% | 921 | -1,708 | -285% |

| Costs | 13,917 | 11,873 | -14.7% | 26,075 | 25,169 | -3.47% |

| Staff Cost | 5,060 | 6,083 | 20.2% | 9,929 | 11,880 | 19.6% |

| Operating Profit | 10,623 | 13,584 | 27.9% | 21,272 | 26,960 | 26.7% |

| Cost of Risk | 0.759% | 1.31% | 0.556 pp | 4,963% | 7,972% | 3,009 pp |

| Pre-Tax Profit | 6,933 | 9,892 | 42.7% | 15,516 | 22,051 | 42.1% |

| Net Profit Bank | 4,285 | 6,862 | 60.1% | 10,489 | 15,630 | 49.0% |

| ROE | 11.0% | 12.0% | 1.01 pp | 10.8% | 13.6% | 2.81 pp |

| NIM | 3.06% | 3.36% | 0.294 pp | 2.80% | 3.32% | 0.522 pp |

| Cost To Income | 56.7% | 44.5% | -12.2 pp | 55.1% | 46.1% | -8.94 pp |

Net interest margin increased 0.294 pp to 3.36% as asset yield grew by 1.52 bp to 5.90% and cost of funding increased by 1.34 bp to 2.76%. Fees added 17.4% to total revenues and decreased by 0.643% when compared to last year:

Banks operated with average cost to income of 44.5% in the last quarter as operating costs fell 14.7% yoy. Staff accounted for 51.2% of operating expenditure with a total of 143,887 employees in the sector. Banks paid their staff 19.2% more than last year with the average monthly cost of PLN 14,092 per person:

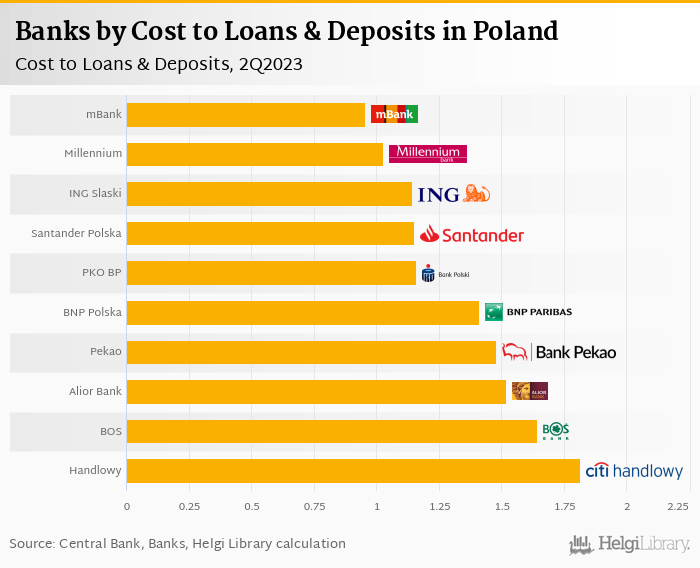

mBank was the most cost efficient based on the cost to income ratio in the second quarter of 2023 (with 26.1%) and it also operated with the lowest operating costs when compared to a sum of loans and deposits, i.e. when utilization of both assets as well as liabilities is taken into account (0.955%):

Commercial banks generated operating profit before provisioning of PLN 13,584 mil in the second quarter of 2023, up 27.9% when compared to last year. PKO BP generated the largest operating profit in the second quarter of 2023 (PLN 4,032 mil), whilst Bank Handlowy was operating with the highest operating margin when compared with risk weighted assets (10.2%):

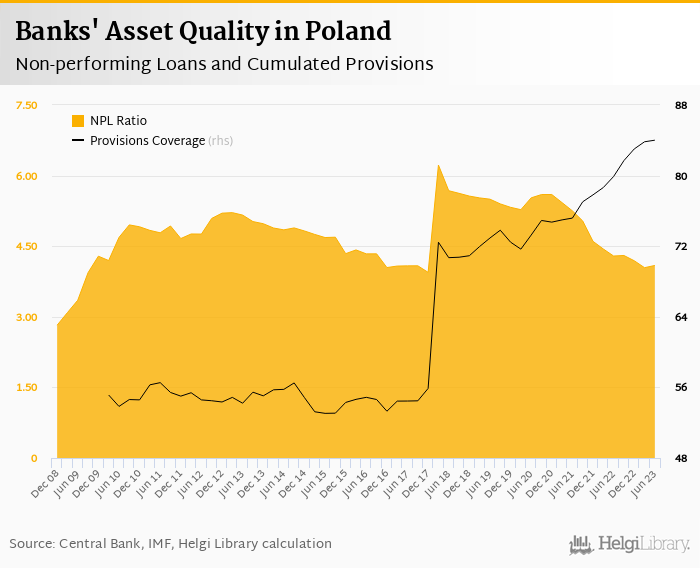

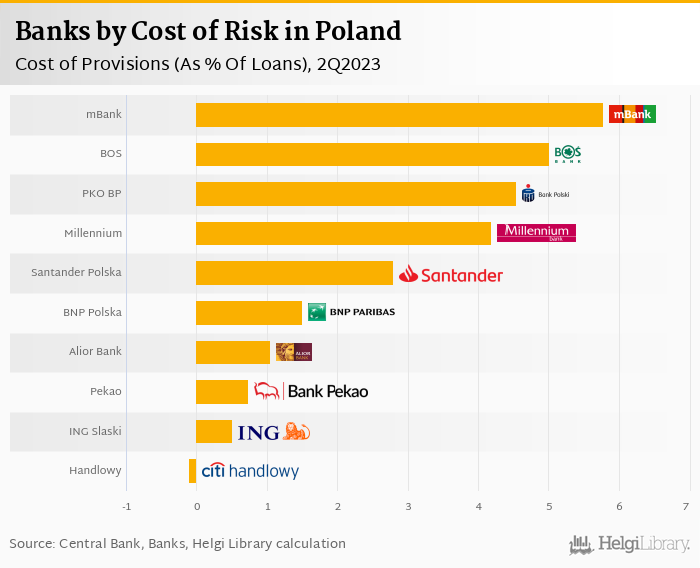

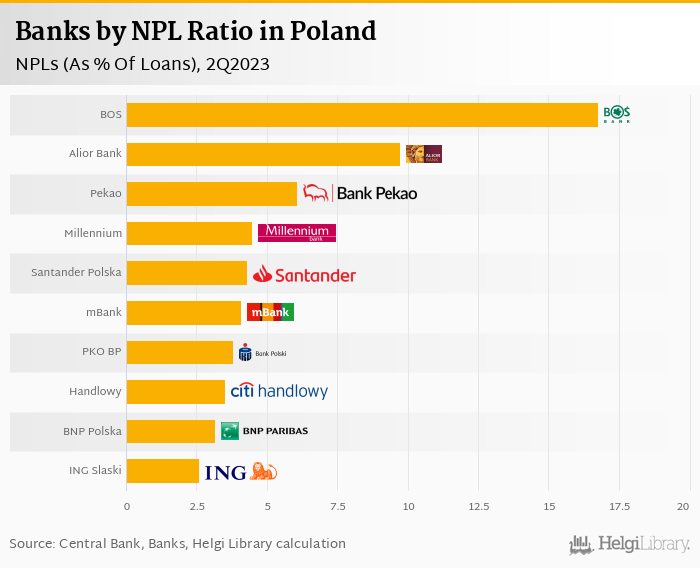

Provisions have "eaten" some 38.3% of operating profit in the second quarter of 2023 as cost of risk reached 1.31% of average loans. The volume of non-performing loans decreased by 4.76% qoq to PLN 64.8 bil and represented 4.09% of total loans at the end of June. Provisions covered 84.0% of NPLs, up from 79.9% a year ago:

Within the sector, mBank had to create the most provisions in the second quarter of 2023 relative to its loans (5.78%) and Bank Handlowy the least (-0.101%). In terms of overall asset quality, we estimate that Bank Ochrony Srodowiska was operating with the highest share of non-performing loans, some 16.8% of customer loans at the end of June:

The three largest banks created 57.4% of sector's total profit in the second quarter of 2023, up when compared to 53.2% seen three years ago. In terms of revenue and operating profit, the trio generated 50.5% and 68.3% of the total:

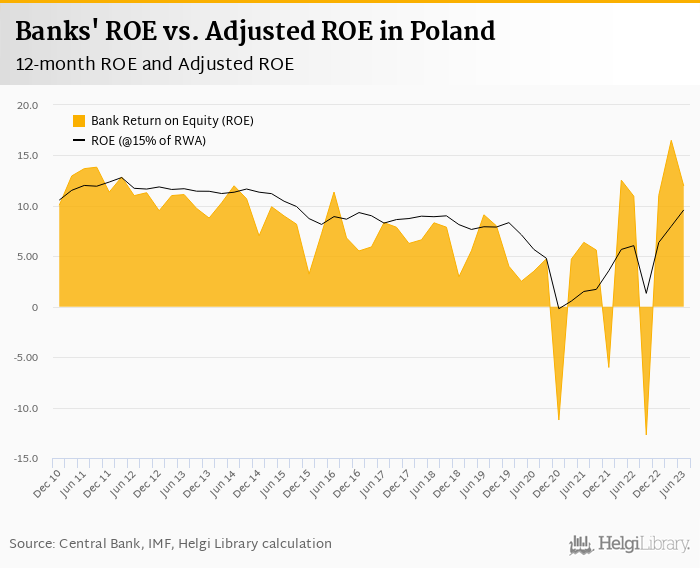

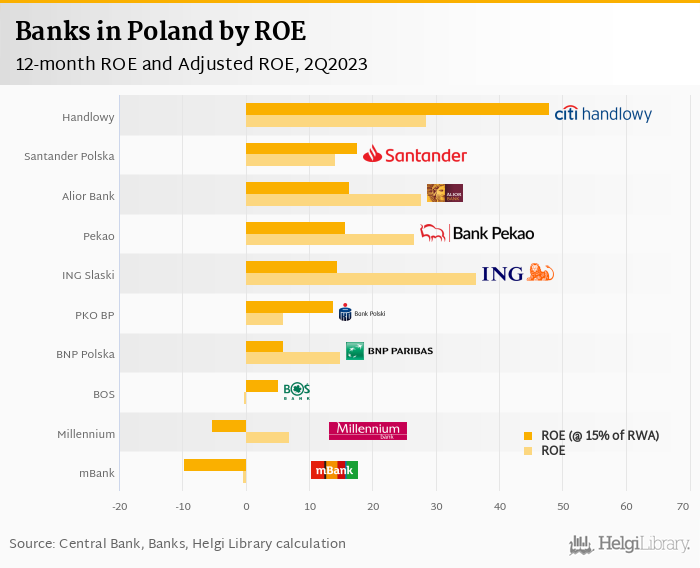

Overall, Polish banks generated its shareholders an annualized return on equity of 12.0% in the second quarter of 2023 and 7.45% return in the last four quarters. When equity "adjusted" to 15% of risk-weighted assets, the return on equity would have reached 16.6% in 2Q2023 and 9.38% in the last twelve months.

ING Bank Slaski generated its shareholders the highest return in the last quarter (ROE of 36.3%) followed by Bank Handlowy (28.5%) and Alior Bank (27.7%). When adjusted for the same level of equity (i.e. 15% of RWA), Bank Handlowy, Santander Bank Polska and Alior Bank would have made it to the top of the list:

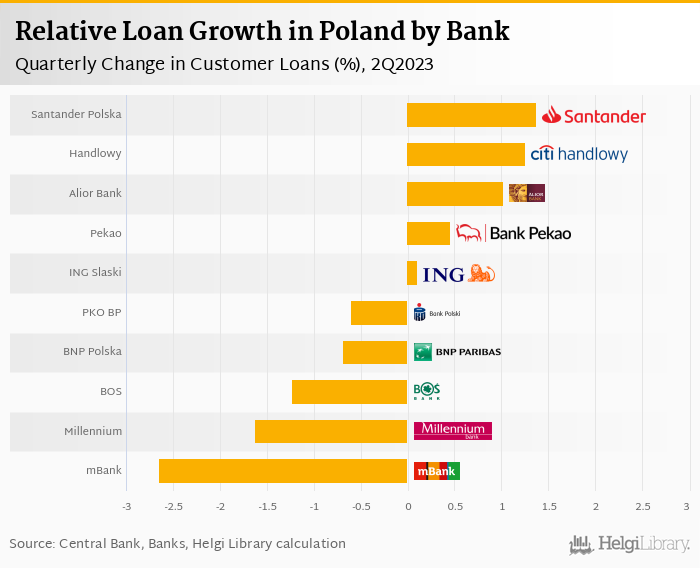

Loans decreased by 0.064% qoq to PLN 1,584 bil during the second quarter of 2023. This implies an annual growth rate of 0.522% in the last 12 months:

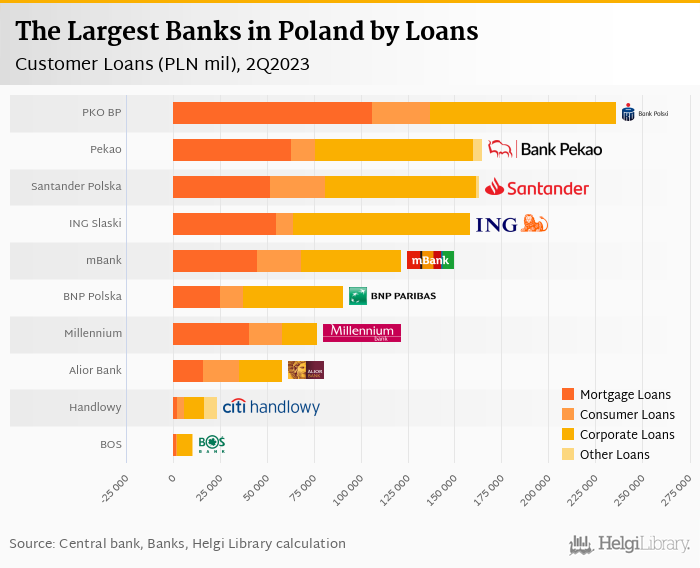

Mortgage loans grew 4.69% yoy in the last 12 months and were down 1.64% qoq in the last quarter. At the end of June, mortgages formed 28.1% of total loans. Consumer loans increased 1.20% qoq (down 3.02% yoy) and represented 17.5% of total bank loans while corporate loans fell 1.75% qoq and were up 1.05% yoy to PLN 425 bil (or 26.8% of loans).

Santander Bank Polska has grown the fastest in relative terms within the last quarter (1.37%% qoq), followed by Bank Handlowy and Alior Bank. In absolute terms, however, Santander Bank Polska the largest piece of the pie when compared to the previous quarter (PLN 2,123 mil or -209% of the market net increase) followed by Pekao and Alior Bank:

Overall, PKO BP remains the largest lender with 14.9% of the market followed by Pekao with a 10.1% market share and Santander Bank Polska (9.90%). At the end of June 2023, most of PKO BP's loans came from residential mortgages (44.9% of total). Corporate loans formed 41.9% and consumer loans represented a further 13.2% of the total loan book:

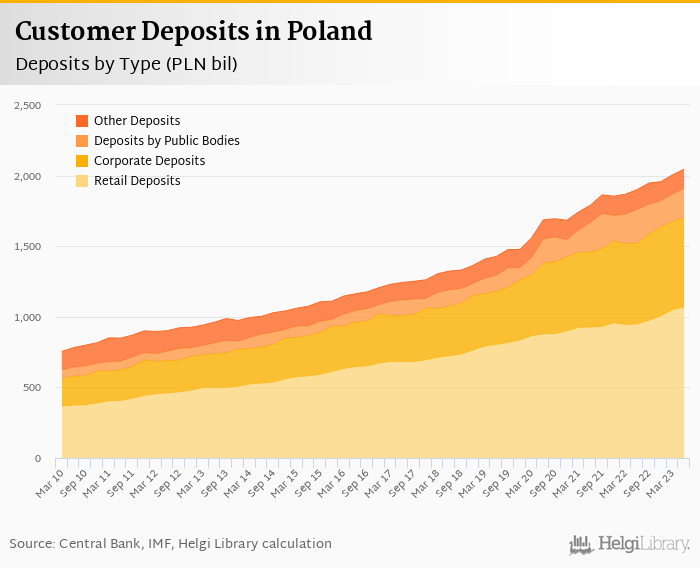

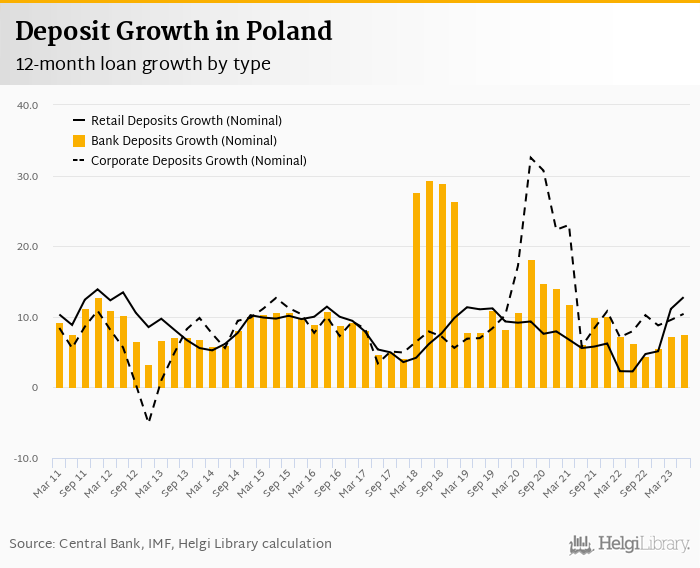

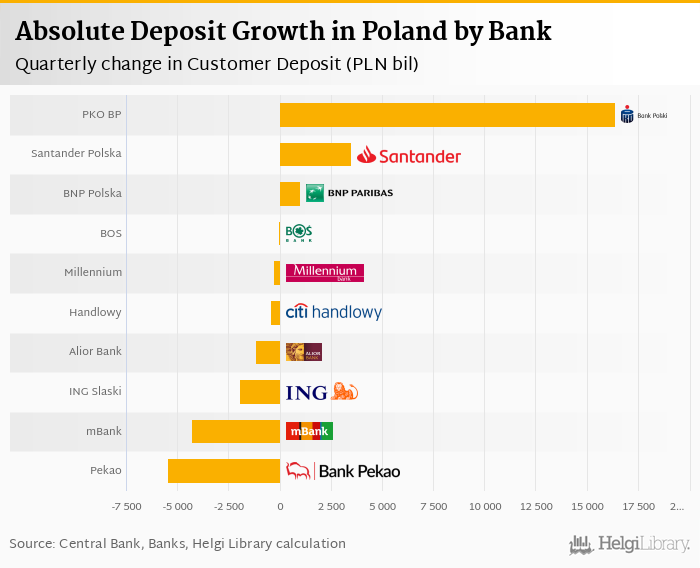

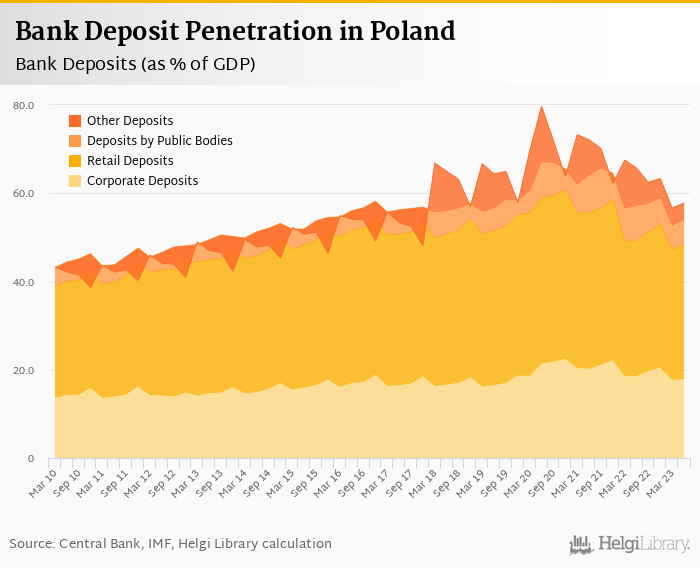

Customer deposits increased 2.00% qoq to PLN 2,045 bil during the second quarter of 2023. This means an annual growth rate of 7.57%, which is below the average growth of 7.84% we have seen in deposits in the last decade:

As partly seen above, households deposits grew 1.91% qoq and 12.8% yoy in the last 12 months and represented 52.2% of total customer deposits at the end of June 2023. Corporate deposits increased by 0.855% qoq (or 10.4% yoy) and made up 31.0% of total.

Bank Handlowy appears to have grown the fastest in deposits in relative terms last quarter compared to the next bunch of Polish banks (13.2% qoq), followed by PKO BP and mBank. In absolute terms, when compared to the previous quarter, however, most new deposits went to PKO BP (PLN 16,380 mil) followed by Santander Bank Polska and BNP Paribas Bank Polska:

Overall, PKO BP remains the largest deposit collector with a 17.9% market share followed by Pekao (10.8%) and Santander Bank Polska (9.81%):

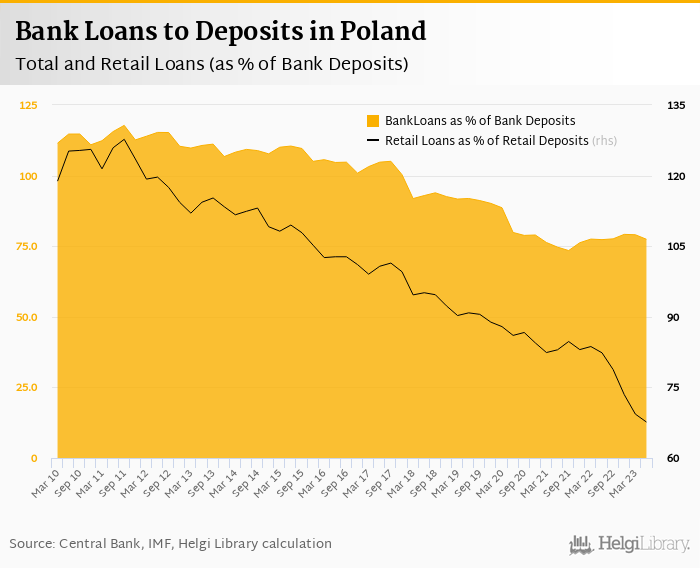

At the end of June 2023, customer deposits in Poland reached 57.8% of GDP, up from 47.0% seen a decade ago. Loan to deposit ratio accounted for 77.5% in Poland at the end of second quarter of 2023, up from 77.3% a year ago and 111% in 2013. When comparing only household loans and deposits, the ratio was 67.6% at the end of June 2023:

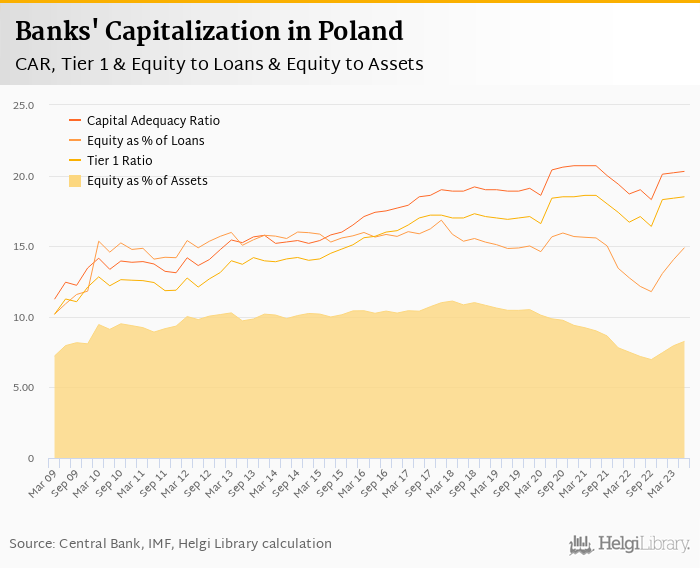

Polish banks operated with capital adequacy ratio of 20.3% at the end of the second quarter of 2023, up 1.30 bp when compared to the same period of last year. Sector's Tier 1 ratio reached 18.5% and equity accounted for 14.9% of loans. This is up 1.50 bp and down 0.454 bp when compared to five years ago.

Santander Bank Polska reported the highest capital adequacy ratio (20.8%) followed by Bank Handlowy (20.3%) and PKO BP. Bank Millennium and Alior Bank managed to operate with relatively low capital ratios of 14.8% and 15.1%, respectively:

ING Bank Slaski achieved the highest ROE in the last three years (17.3%) followed by Bank Handlowy (15.3%) and Alior Bank (11.7%). When adjusted to the same level of capital (15% of risk-weighted assets), Bank Handlowy would be the most profitable with a ROE of 47.9% in the last twelve months:

For more details, please, see our report for free at https://www.helgilibrary.com/reports/polish-banking-quarterly-2q2023

or get actual datasets for Polish banks and/or for the whole Polish banking sector with all key indicators at:

https://www.helgilibrary.com/reports/comparison-of-11-companies-within-polish-banks

https://www.helgilibrary.com/reports/banking-in-poland-1