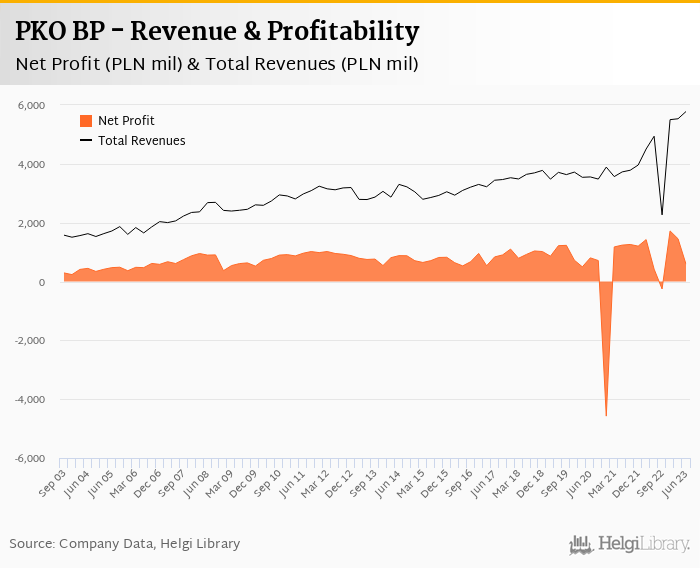

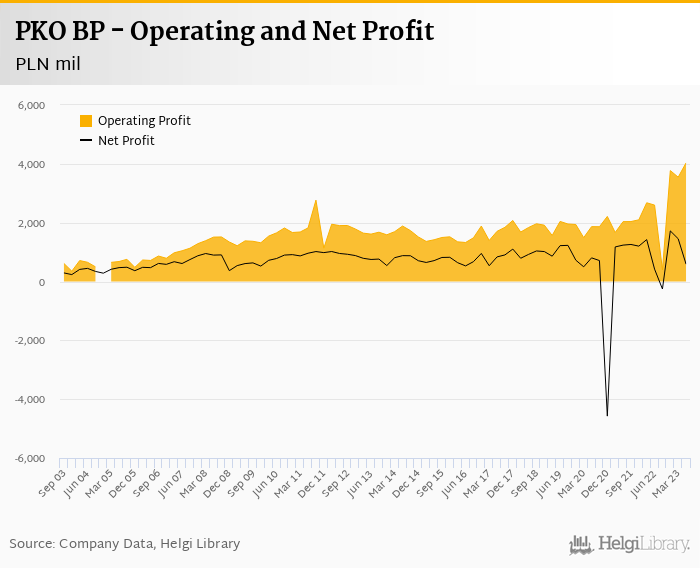

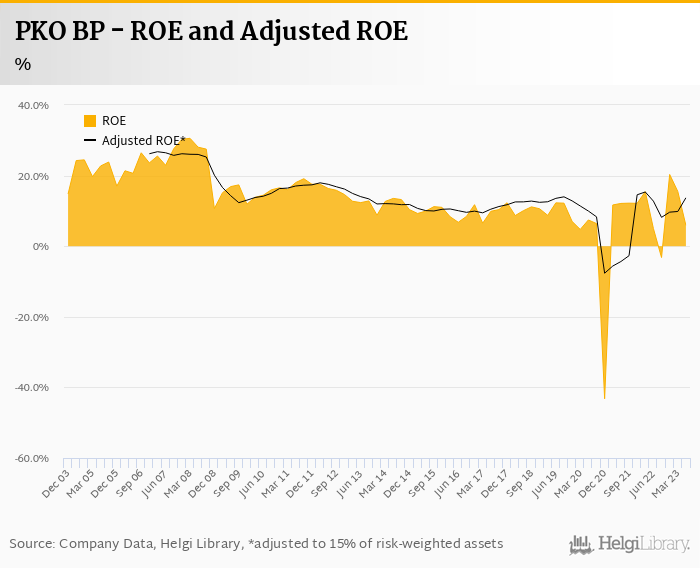

PKO BP rose its net profit 39.4% to PLN 587 mil in 2Q2023 and generated ROE of 5.86%.

Revenues increased 17.0% yoy driven by higher margins and cost rose 17.6% when adjusted, so cost to income decreased to impressive 30.2%

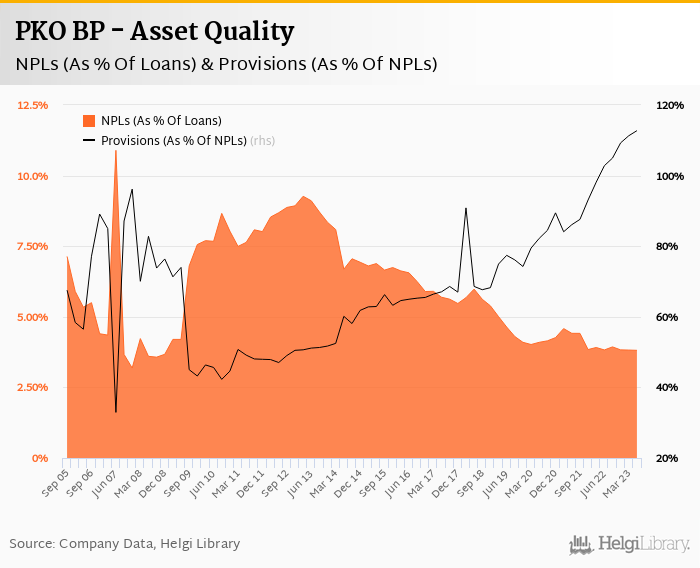

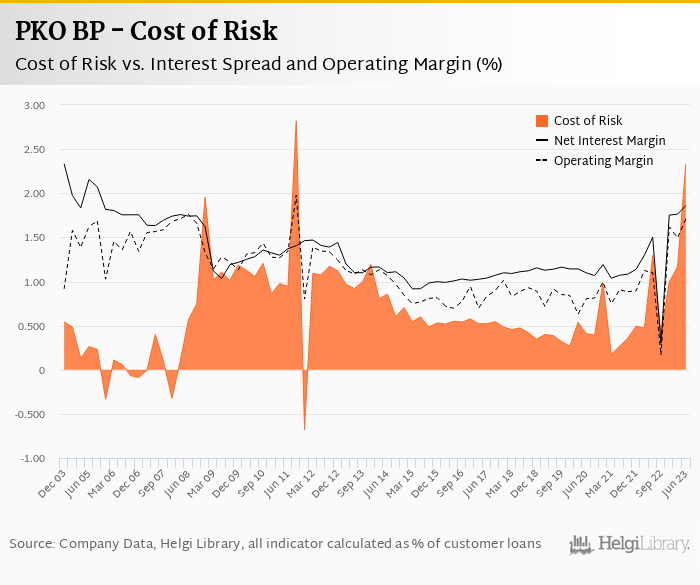

Cost of risk amounted to hefty 4.5% as PLN 2.74 bil of further provisions for CHF-mortgages were created, though underlying asset quality remains good.

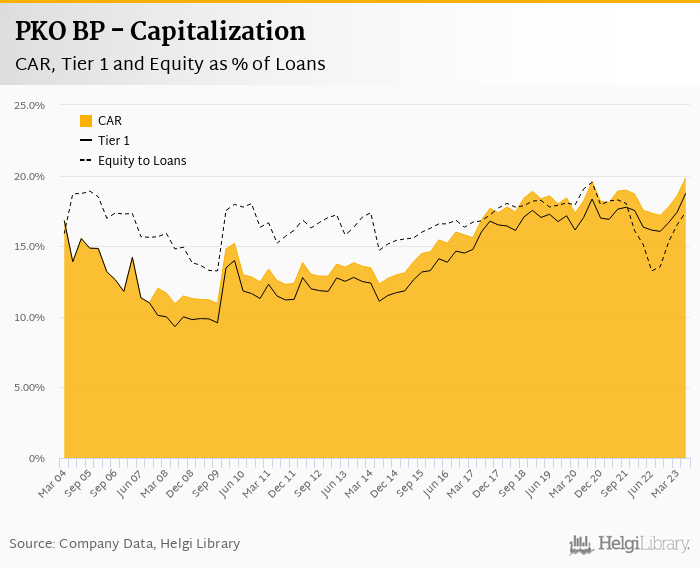

Loan to deposit ratio decreased to 64.5% and capital adequacy increased to strong 19.8%

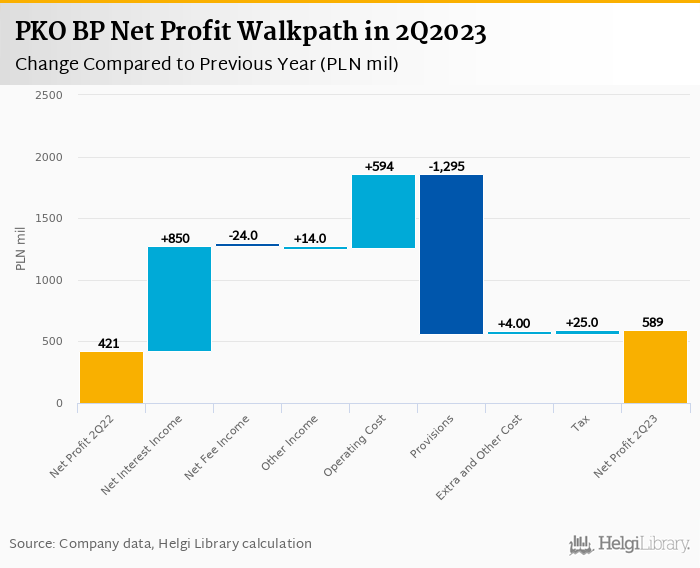

PKO BP made a net profit of PLN 587 mil in the second quarter of 2023, up 39.4% yoy, or increase of PLN 166 mil in absolute terms. Operating profit jumped 55% on the back of higher interest rates and reduction in costs due mainly to lower taxes (PLN 855 mil difference yoy). When adjusted, operating profit would still be 17% yoy higher and costs would have grown 17.6% yoy. Still, PLN 2.74 bil of additional provisions for CHF-mortgages stole the show and somewhat worsened the bottom line improvement:

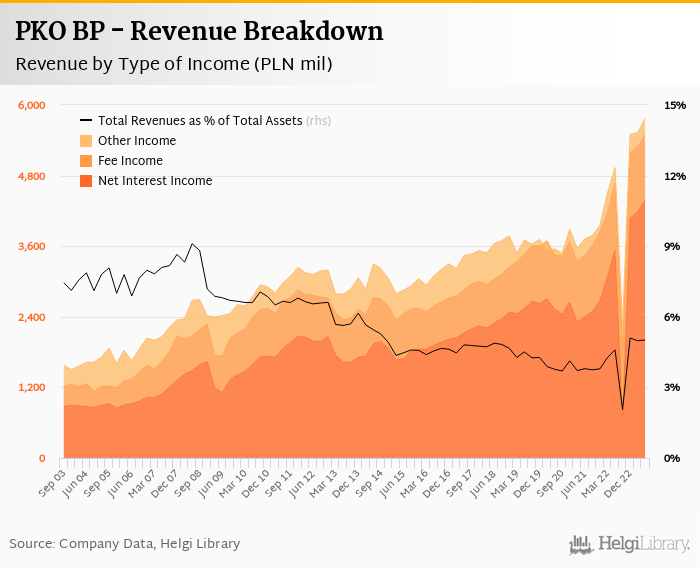

Revenues increased 17.0% yoy to PLN 5,778 mil in the second quarter of 2023. Net interest income rose 24.0% yoy was the main driver of the revenue growth. As loan volume stagnated yoy, 56 bp improvement in net interest margin to 3.88% of total assets was the driving force here. Fee income fell 2.1% yoy and other income increased PLN 14 mil yoy only. When compared to three years ago, revenues were up 62.5%:

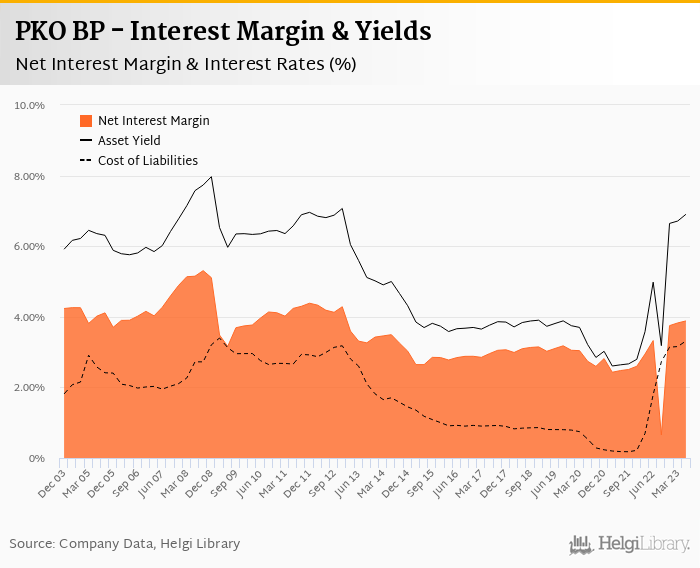

Average asset yield was 6.90% in the second quarter of 2023 (up from 4.98% a year ago) and average loan yield increased to 9.55% (from 7.10% last year). Cost of funding amounted to 3.31% in 2Q2023 (up from 1.80%) and the Bank paid 2.31% to deposit holders on average in 2Q2023 (vs. 0.83% in 2Q2022). Given the 18% increase in retail deposits in the last three quarters, it will be interesting to watch the development in cost of deposits in the coming quarters:

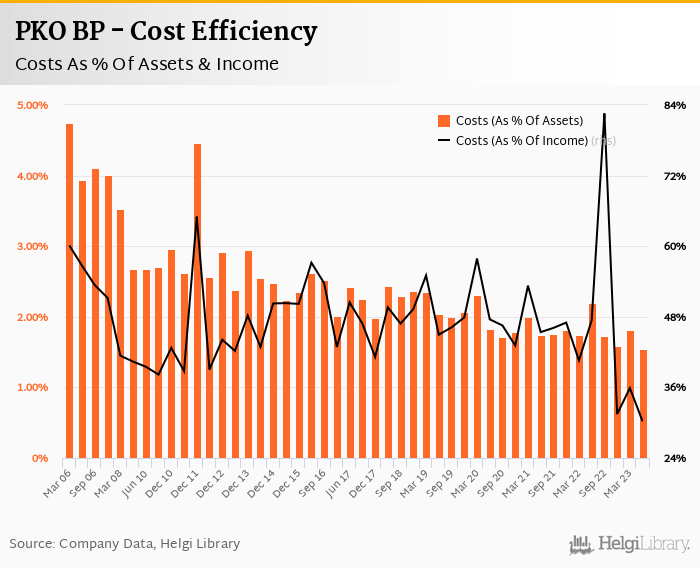

Costs decreased by 25.4% yoy and the bank operated with average cost to income of 30.2% in the last quarter. When adjusted for taxes and charges paid in 2Q2o22 (PLN 906 mil vs. PLN 51 mil this year), operating costs would have grown 17.6% yoy.

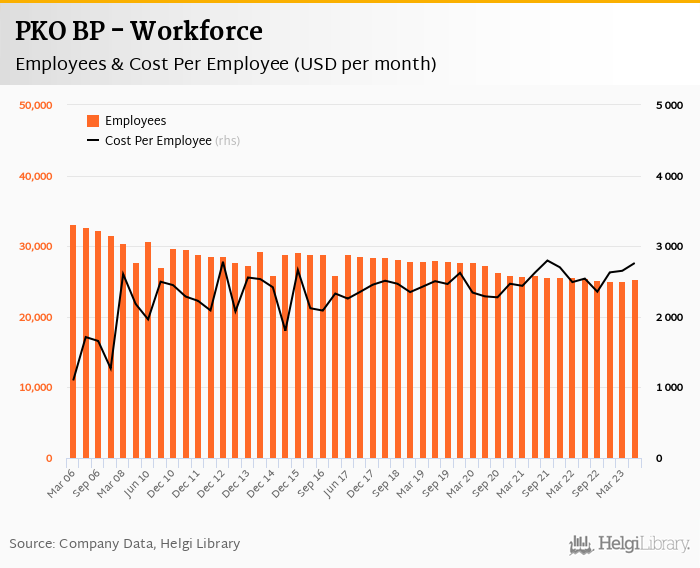

Staff cost rose 17.5% (and 5.0% qoq) as the bank employed 25,300 persons (down 202 persons compared to last year), so wage and inflation pressures have been clearly not abating yet:

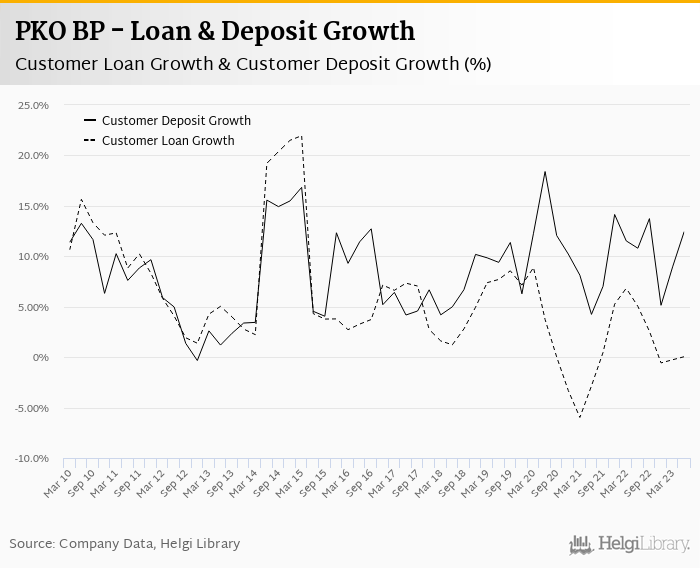

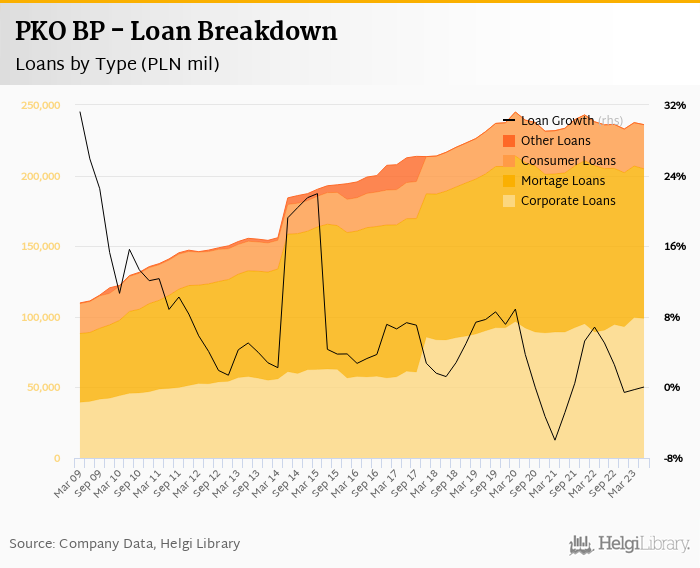

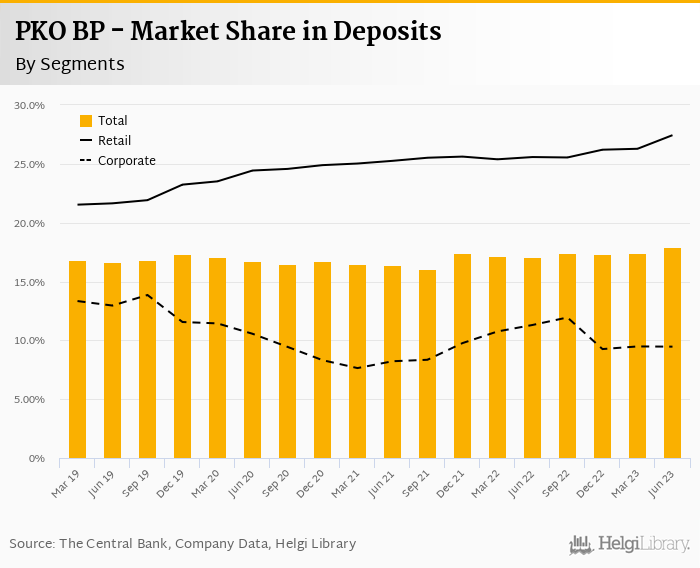

Customer loans decreased 0.61% qoq and grew 0.05% yoy in the second quarter of 2023 while customer deposit growth amounted to 4.68% qoq and 12.5% yoy. That’s compared to average of 0.61% and 9.9% average annual growth seen in the last three years.

At the end of second quarter of 2023, PKO BP's loans accounted for 64.5% of total deposits and 51.2% of total assets.

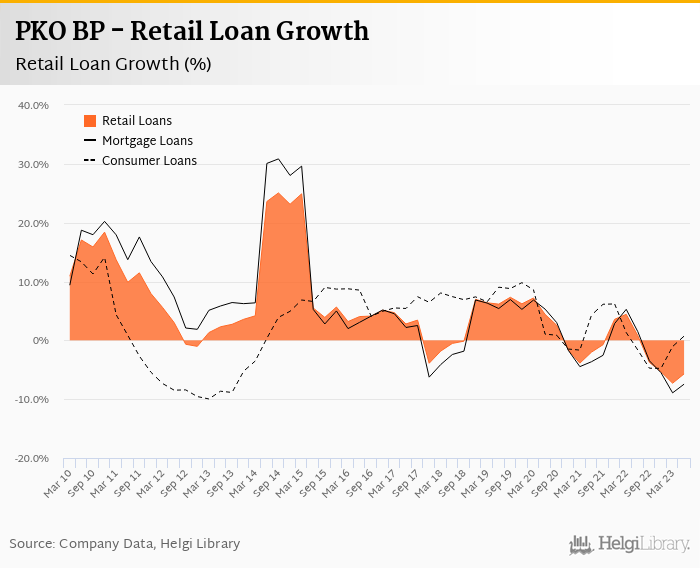

Consumer and corporate loans have been trying to offset the reduction in mortgage loans (down 7.4% qoq and 1.4% yoy). Retail loans fell 0.65% qoq and were 5.7% down yoy. They accounted for 58.1% of the loan book at the end of the second quarter of 2023 while corporate loans decreased 0.54% qoq but were up 9.3% yoy, respectively. Mortgages represented 45% of the PKO BP's loan book, consumer loans added a further 13.2% and corporate loans formed 41.9% of total loans:

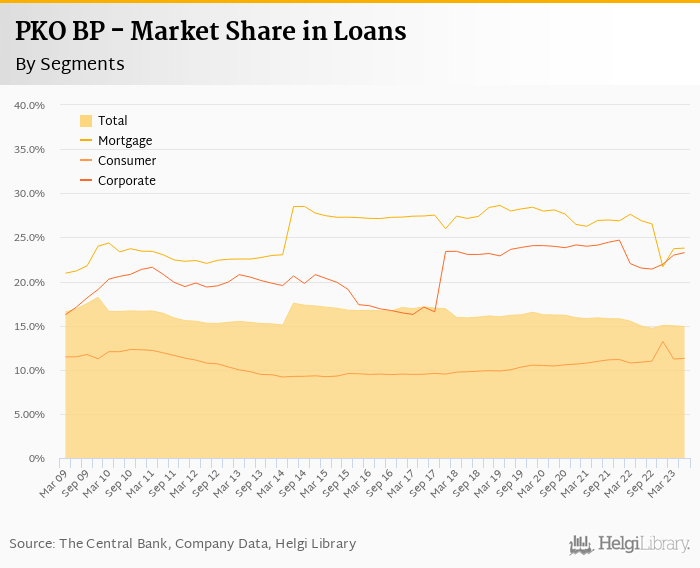

We estimate that PKO BP has lost 0.071 pp market share in the last twelve months in terms of loans (holding 14.9% of the market at the end of 2Q2023). On the funding side, the bank seems to have gained 0.78 pp and held 17.9% of the deposit market. The pick up in retail deposit market share is interesting to watch here, if and how will be reflected in Bank's cost of funding:

Cost of risk reached 4.54% of average loans as PLN 2.47 bil of further provisions for CHF-denominated mortgage portfolio was created. In the middle of 2023, some 70% of the CHF-mortgages were covered by legal risk provisions while open uncovered exposure reduced to PLN 5.8 bil, or 14.1% of Bank's equity.

Overall, PKO BP's non-performing loans fell to 3.81% of total loans and provisions covered some 113% of NPLs at the end of the second quarter of 2023. Excluding FX mortgages, new provisions accounted for PLN 11 mil only in 2Q2023 (following PLN 11 mil in 1Q2023) suggesting the management's confidence in overall asset quality.

Still, provisions have "eaten" two thirds of the operating profit in the second quarter of 2023, so the Bank remains vulnerable until the FX mortgage saga is closed:

PKO BP's capital adequacy ratio reached solid 19.8% in the second quarter of 2023, up from 17.3% for the previous year. The Tier 1 ratio amounted to 18.8% at the end of the second quarter of 2023 while bank equity accounted for 17.4% of loans:

Overall, PKO BP made a net profit of PLN 587 mil in the second quarter of 2023, up 39.4% yoy. This means an annualized return on equity of 5.86% in the last quarter or 9.48% when the last four quarters are taken into account:

Strong results on the revenue side partly offset by wage and inflationary pressures on the cost side and the need for additional provisioningfor the CHF-mortgage portfolio. With PLN 5.8 bil of open exposure, the need for further provisions might keep the pressure on the bottom line for quarters to come, as seen on 2Q2023 results, when provisions have "eaten" two thirds of the operating profit created.

Trading at PE of around 7.0x and PBV of around 1.0x expected in 2024, PKO BP stock seem to be attractively valued and trading with a discount to other Polish banks. Some of that might be related to a political risk, which will hardly disappear before upcoming parliamentary elections.

For more details, download the data in excel format at https://www.helgilibrary.com/reports/