Pekao's profits more than trippled to PLN 1,693 mil in 2Q2023 and the Bank generated ROE of 26.5%.

Revenues increased 24.5% yoy fuelled by rising margins and trading income while cost fell 22%, due to a fall in regulatory costs.

Cost of risk increased, but was only a half compared to last year on lower provisioning on CHF-mortgages.

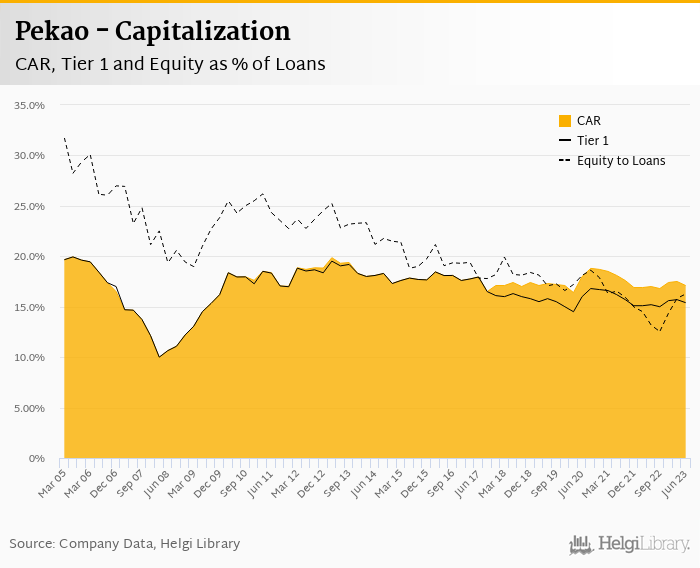

Capital adequacy increased to 17.1% and Pekao came out as the most stress-resistant bank out of 70 banks participating in the EBA stress test.

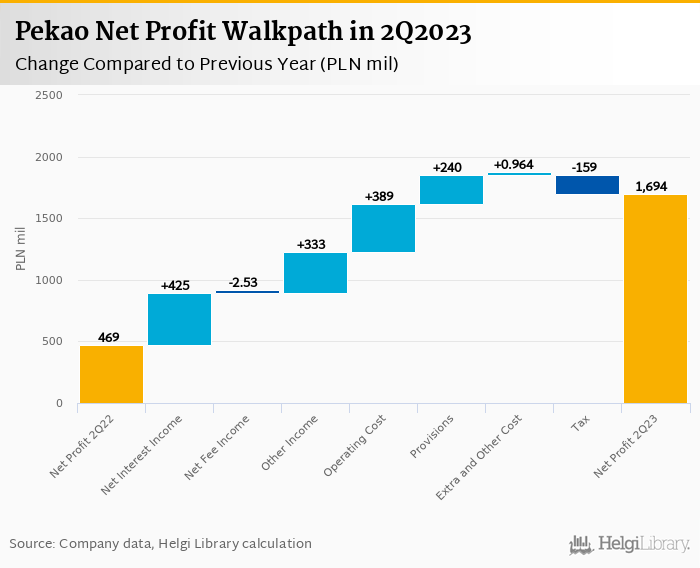

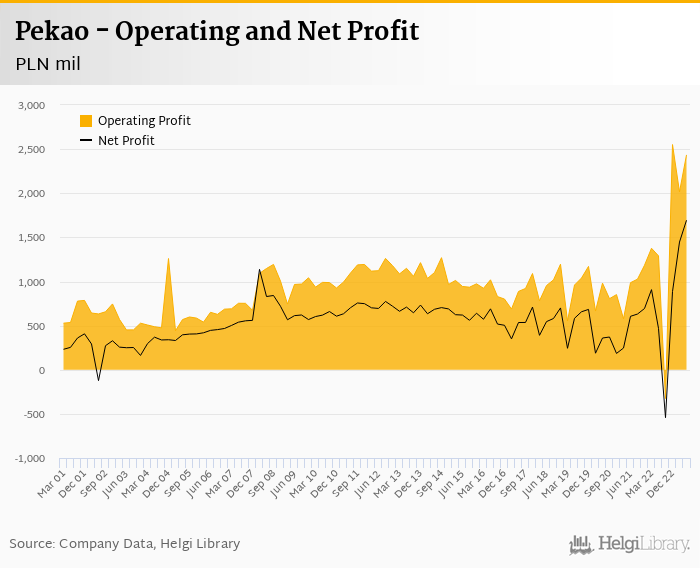

Pekao made a net profit of PLN 1,693 mil in the second quarter of 2023, up 262% yoy, or increase of PLN 1,225 mil in absolute terms. Half of the profit improvement came from higher revenues (interest and trading income), almost 30% from lower cost on the back of PLN 500 mil fall in regulatory cost and a fifth of the improvement from lower provisioning due mainly to lower charges on CHF-mortgages:

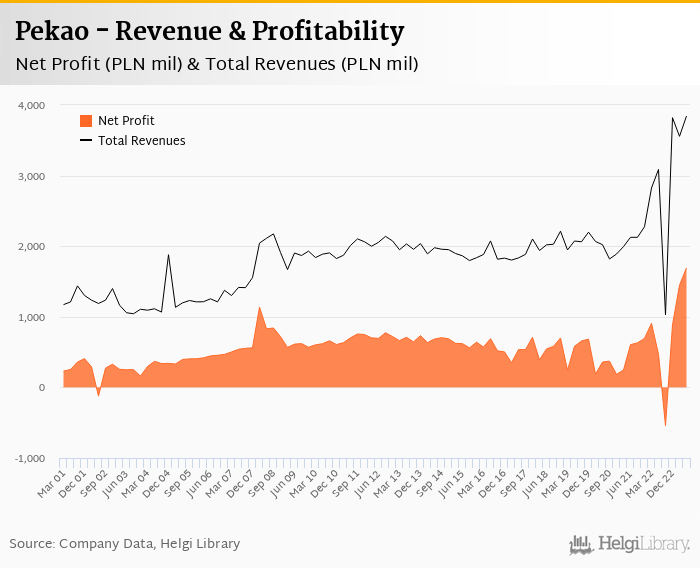

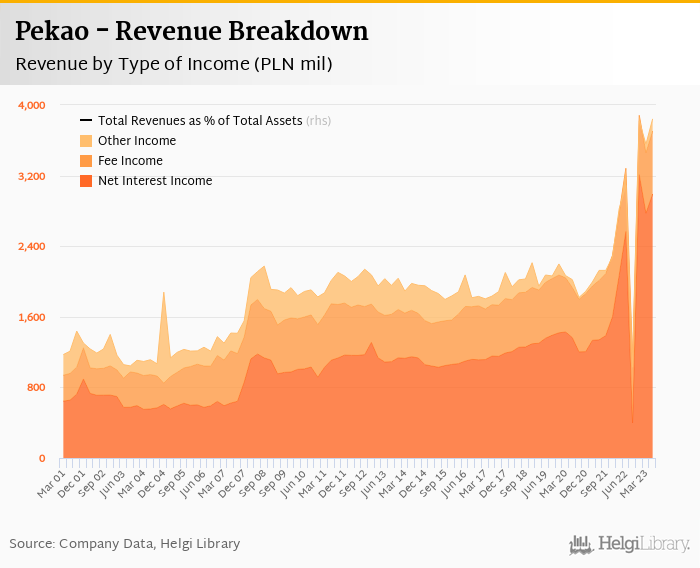

Revenues increased 24.5% yoy to PLN 3,843 mil in the second quarter of 2023. Net interest income rose 16.6% yoy as rising interest rates support Bank's net interest margin (up 0.386 pp to 4.12% of total assets). Trading and other income added further PLN 333 mil yoy improvement due mainly to absence of losses when compared to last year. When compared to three years ago, revenues were up 90%:

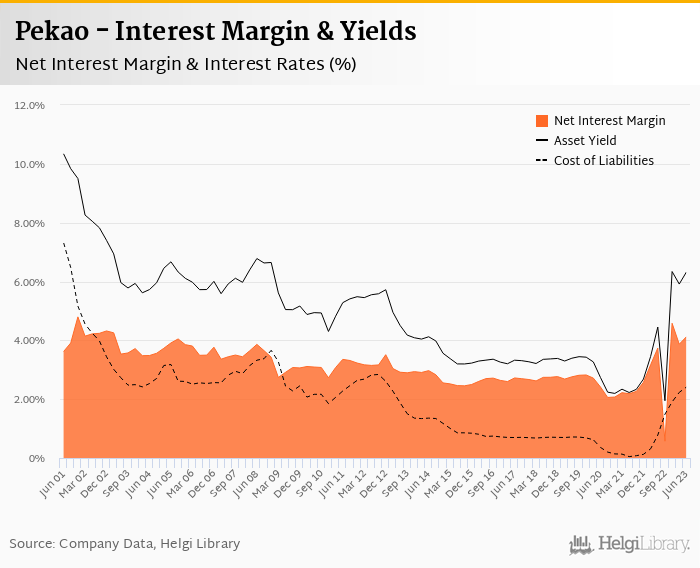

Average asset yield was 6.32% in the second quarter of 2023 (up from 4.45% a year ago) while cost of funding amounted to 2.41% in 2Q2023 (up from 0.779%). Poland seems to be still a few quarters behind Czech banks, where increase in interest rates started biting into interest margin through cost of funds.

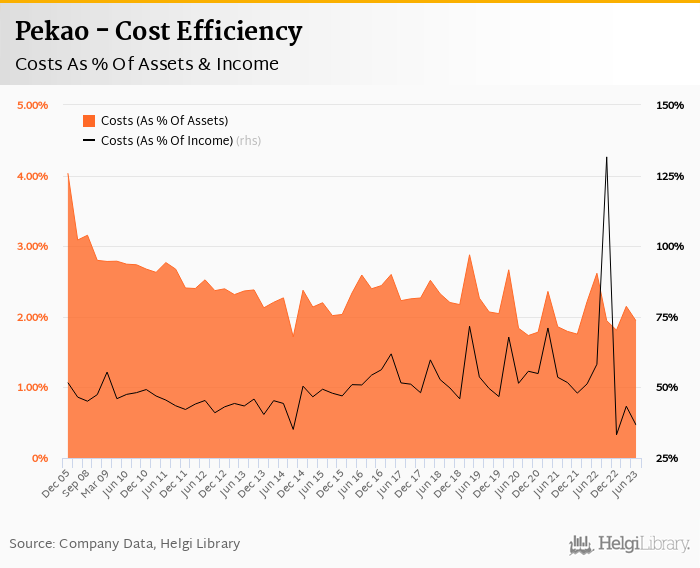

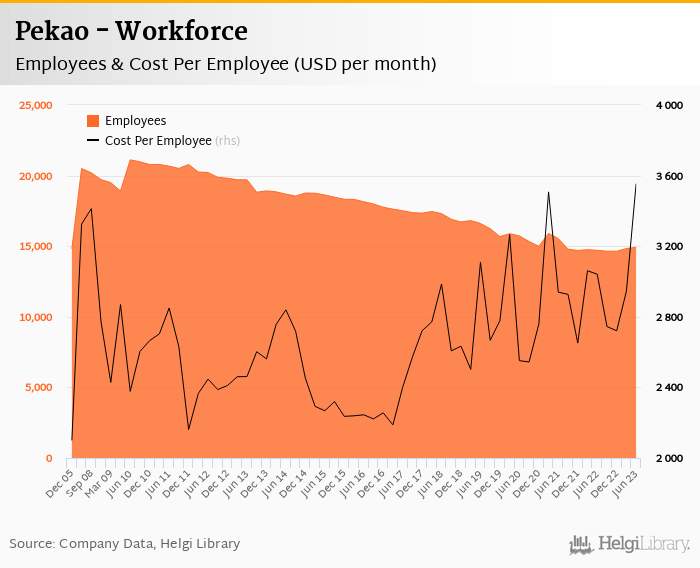

Costs decreased by 22% yoy due mainly to a PLN 500 mil lower regulatory charge, so the bank operated with impressive cost to income of 36.7% in the last quarter. Staff cost rose 24.7% as the bank employed 14,918 persons (up 1.43% yoy) and paid PLN 16,200 per person per month including social and health care insurance cost:

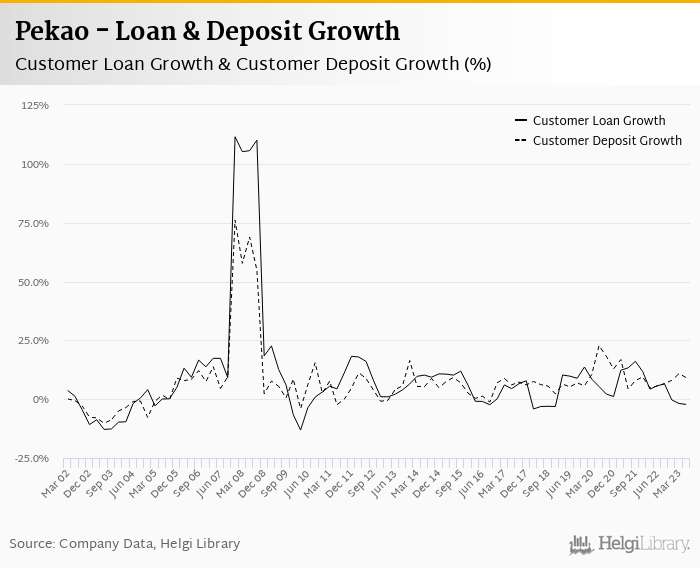

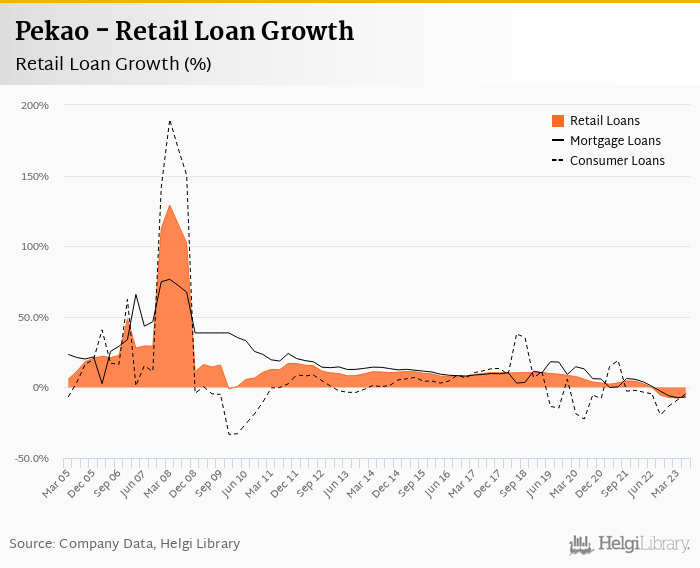

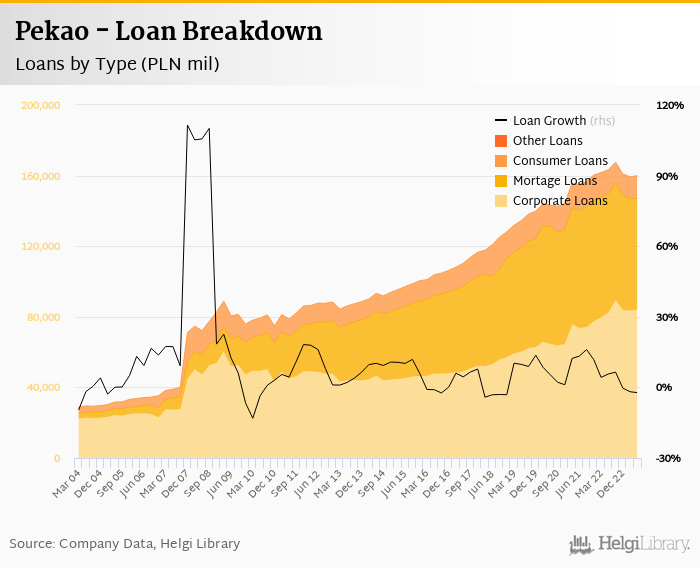

Asset growth remains weak, especially in retail lending. Pekao's customer loans grew 0.456% qoq and decreased 2.23% yoy in the second quarter of 2023 while customer deposit growth amounted to -2.40% qoq and 9.13% yoy. That’s compared to average of 5.73% and 9.55% average annual growth seen in the last three years.

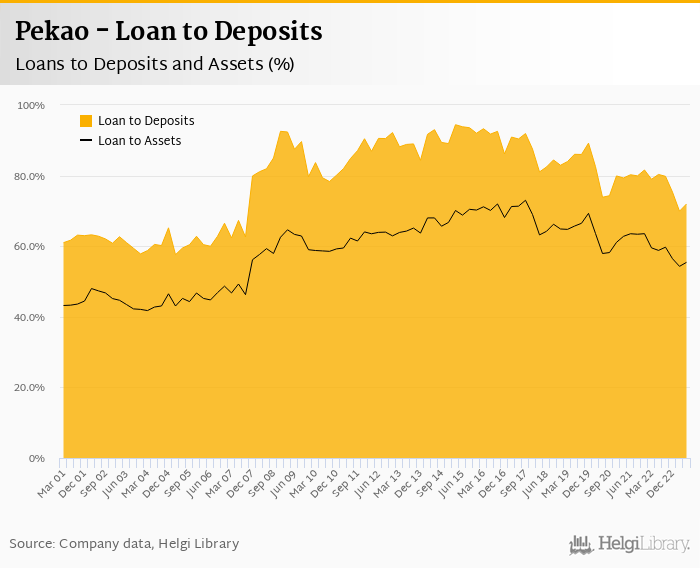

At the end of second quarter of 2023, Pekao's loans accounted for 72.0% of total deposits and 55.4% of total assets.

Retail loans fell 0.124% qoq, though sales of both, new mortgage as well as consumer loans picked up significantly last quarter (up 91% and 21% qoq). Corporate loans increased 0.858% qoq and 2.23% yoy, respectively. Mortgages represented 39.3% of the Pekao's loan book, consumer loans added a further 8.11% and corporate loans formed 52.9% of total loans:

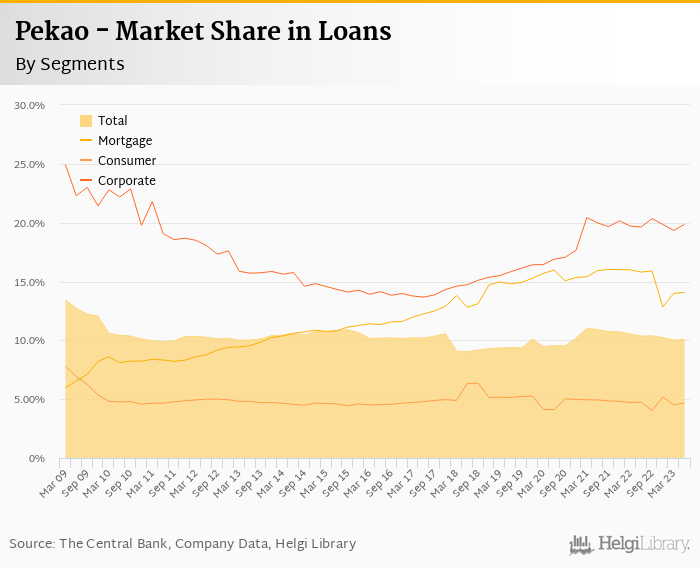

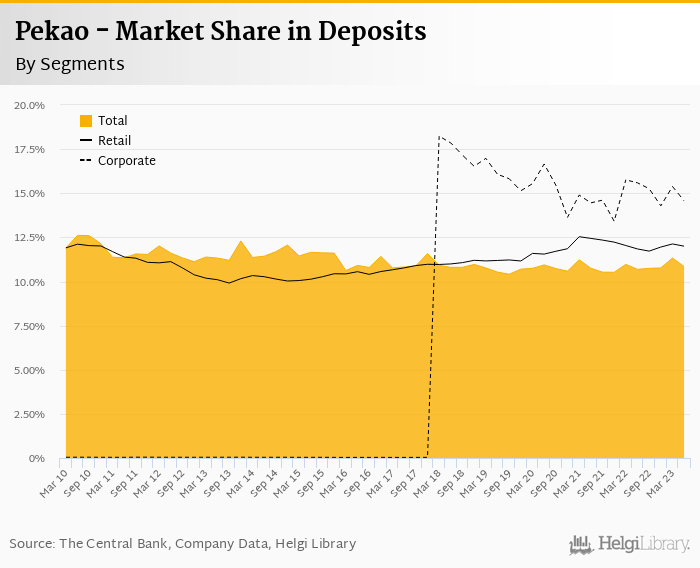

We estimate that Pekao has lost 30 pp market share in the last twelve months in terms of loans (holding 10.4% of the market at the end of 2Q2023). On the funding side, the bank seems to have gained 10 pp and held 10.8% of the deposit market:

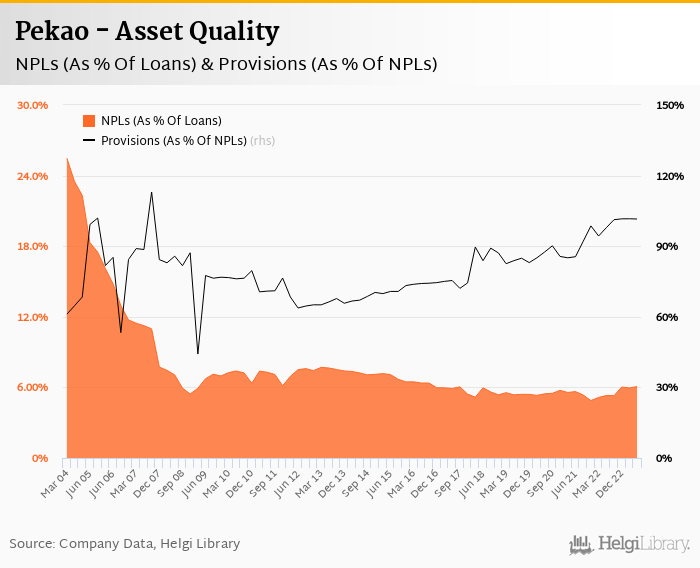

Pekao's non-performing loans reached 6.1% of total loans, up from 5.31% when compared to the previous year. Provisions covered some 102% of NPLs at the end of the second quarter of 2023, up from 97.9% for the previous year.

Provisions have "eaten" some 12.0% of operating profit in the second quarter of 2023 as cost of risk reached 0.731% of average loans. This was positively affected by lower provisioning to CHF mortgage exposure (PLN 223 mil lower yoy), on the other hand, significant write-offs have been made for exposures to one capital group reclassified to NPL. Moderate increase in cost of risk is expected in the coming months.

Pekao's capital adequacy ratio reached 17.1% in the second quarter of 2023, up from 17.0% for the previous year. The Tier 1 ratio amounted to 15.4% at the end of the second quarter of 2023 while bank equity accounted for 16.3% of loans. Subdued volume growth and strong capital position allow the Bank to follow a strategy of 50-75% dividend payout.

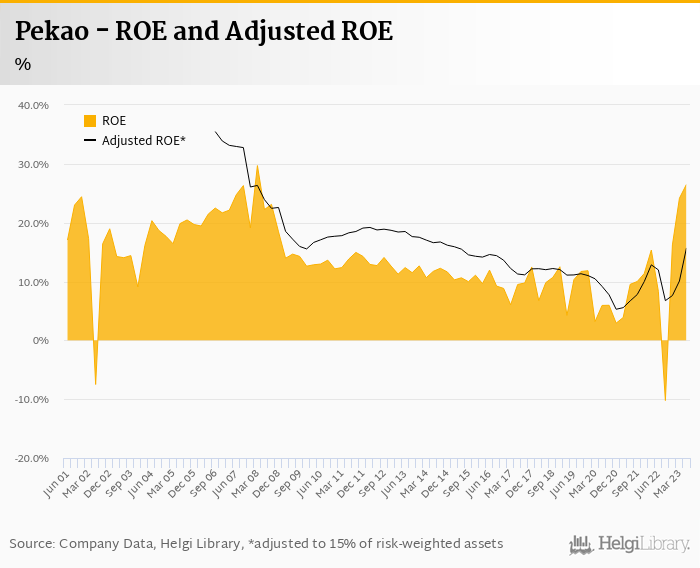

Overall, Pekao made a net profit of PLN 1,693 mil in the second quarter of 2023, up 262% yoy. This means an annualized return on equity of 26.5%, or 15.7% when equity "adjusted" to 15% of risk-weighted assets:

Bank Pekao announced strong results in the second quarter of 2023, slightly better than market had expected. Apart from solid operating performance, the Bank clearly benefited from absence of last year's negative one-offs such as trading losses, regulatory charges and provisioning for CHF-mortgage loans.

Low demand for loans, especially, on the retail side remains a negative, though second quarter brought signs of recovery for both, mortgage as well as consumer loans. With 8% increase in new clients, mid-term growth potential remains solid.

Trading at price to earnings of 7-8x and price to book value of 1.1-1.2x expected in 2023/2024, Pekao currently seems to offer better story than Komercni Banka or Moneta Money Bank, in our view.