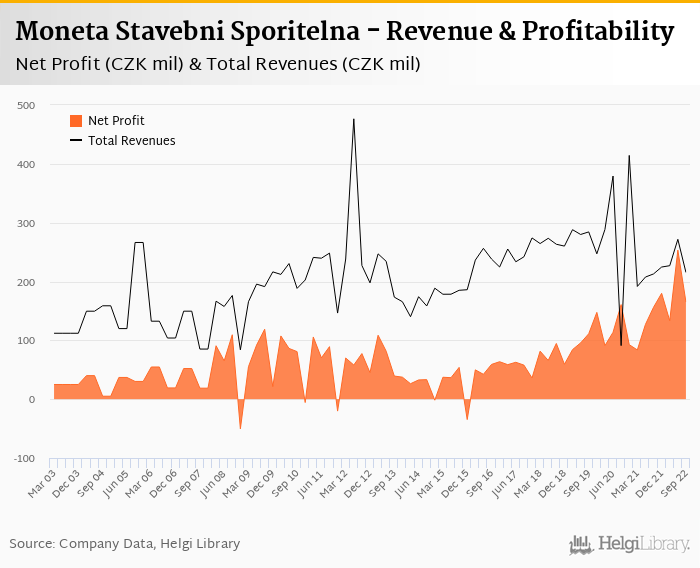

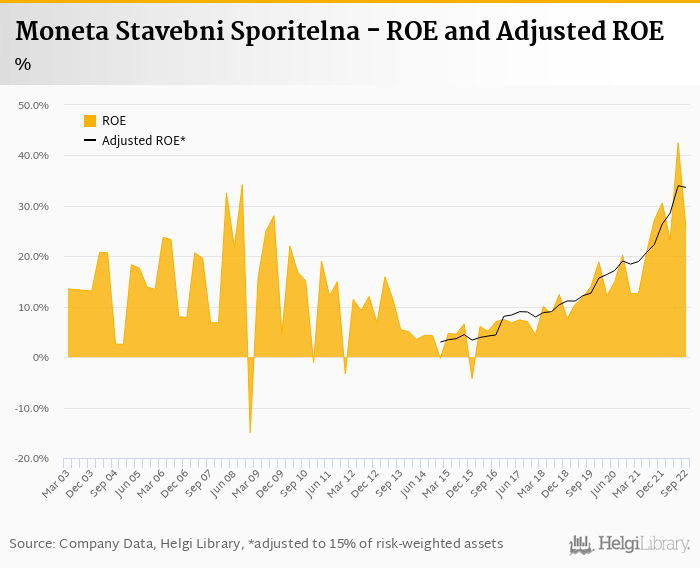

Moneta Stavebni Sporitelna rose its net profit 5.7% to CZK 165 mil in 3Q2022 and generated ROE of 25.4%.

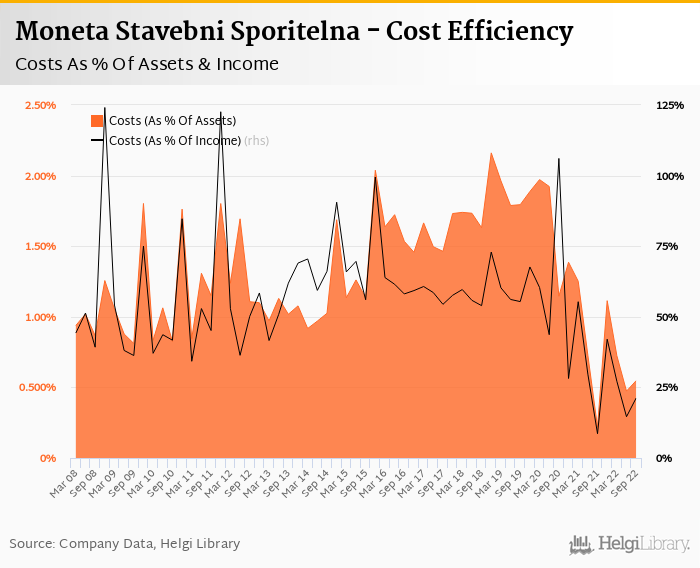

Revenues increased 1.19% yoy and cost rose 150%, so cost to income increased to 21.2%

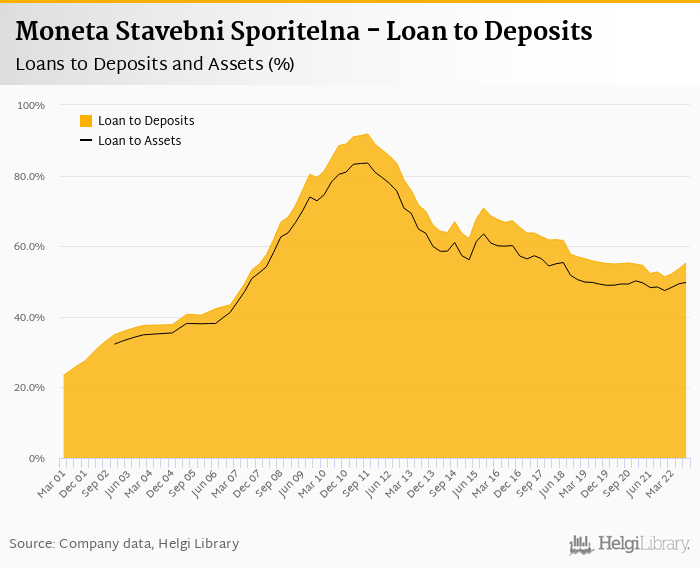

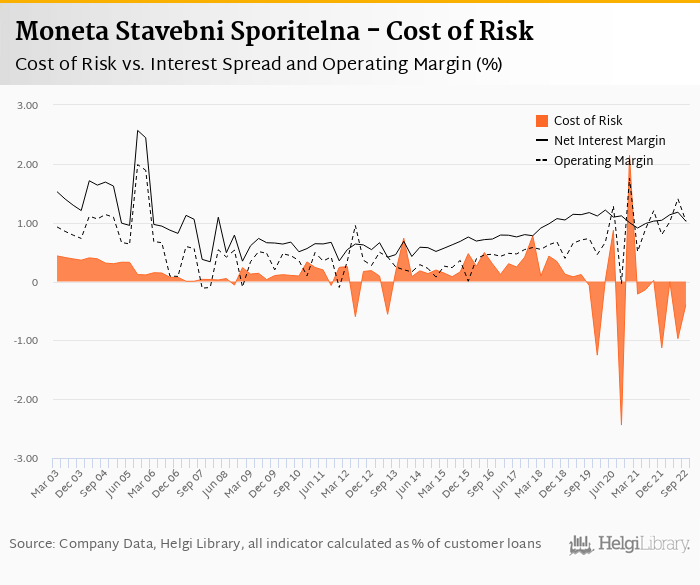

Cost of risk was again negative at -0.783% of loans and loan to deposit ratio increased to 55.3%

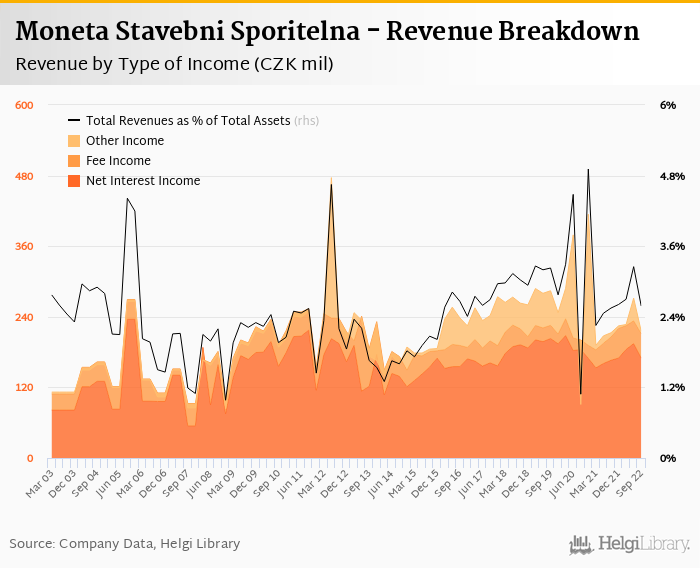

Revenues increased only 1.19% yoy to CZK 215 mil in the third quarter driven by net interest income (up 2.22% yoy) and fee growth (5.0% yoy). When compared to three years ago, revenues were down 24.2%:

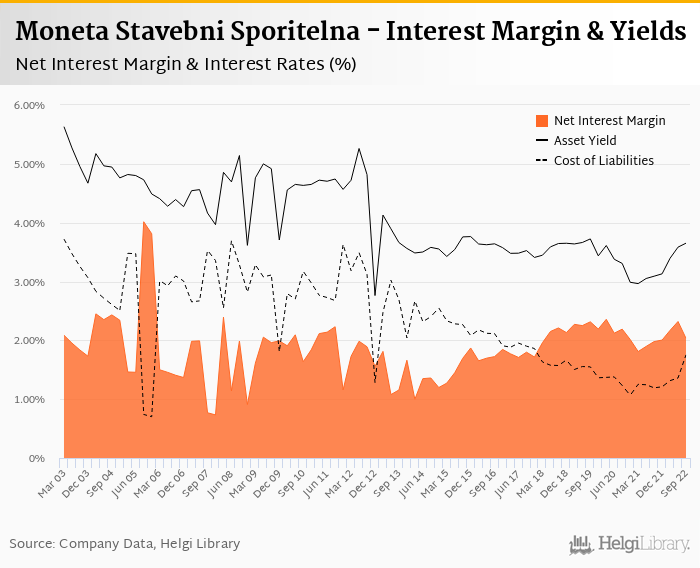

Net interest margin increased 0.055 pp to 2.03% of total assets. Average asset yield was 3.65% in the third quarter of 2022 (up from 3.09% a year ago) while cost of funding amounted to 1.75% in 3Q2022 (up from 1.19%).

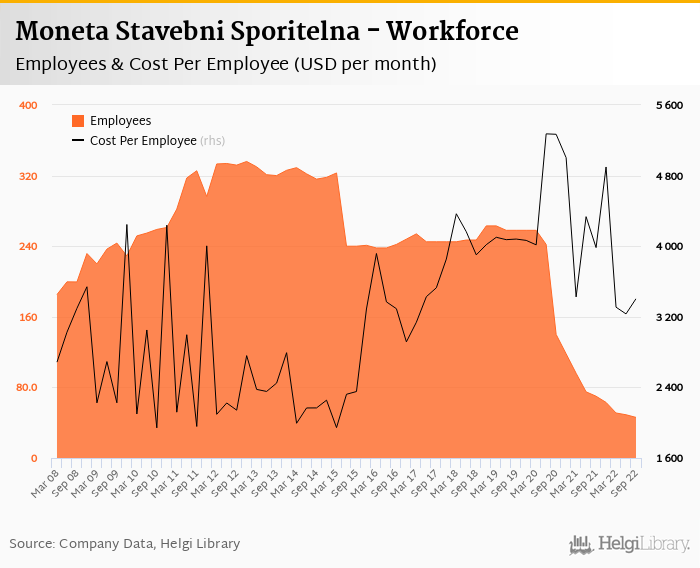

Costs increased by 150% yoy due only to a base effect (negative depreciation cost last year). Staff cost fell 37.2% as the bank reduced number of people by more than a third while other cost rose less than 2.0% yoy. As a result, cost to income reached impressive 21.2% in the last quarter:

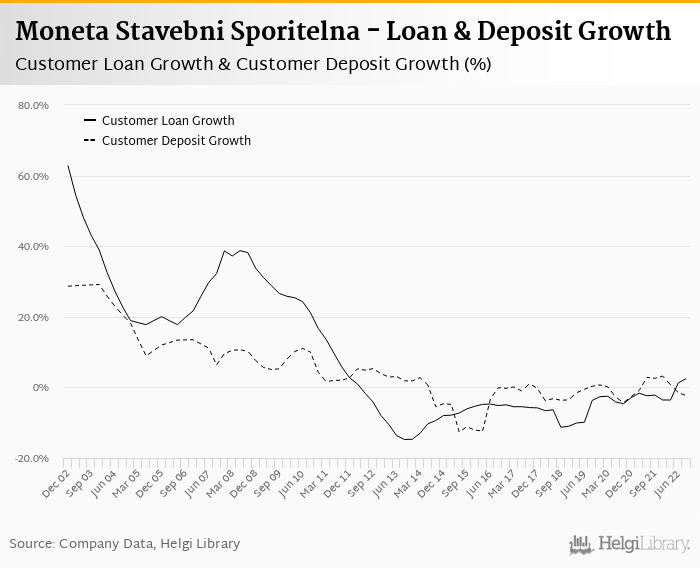

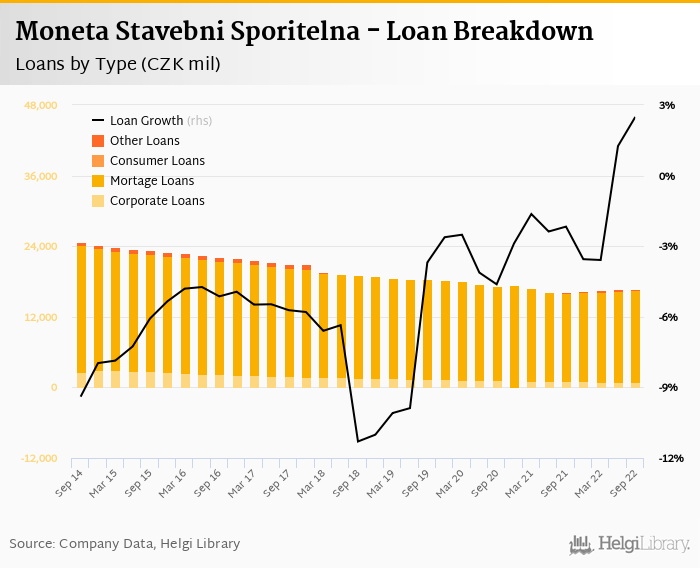

Moneta Stavebni Sporitelna's loans grew 0.54% qoq and 2.49% yoy while deposits fell 2.41% qoq and 2.34% yoy. That’s compared to average of -2.19% and -0.340% average annual growth seen in the last three years.

At the end of third quarter of 2022, Moneta Stavebni Sporitelna's loans accounted for 55.3% of total deposits and 49.7% of total assets.

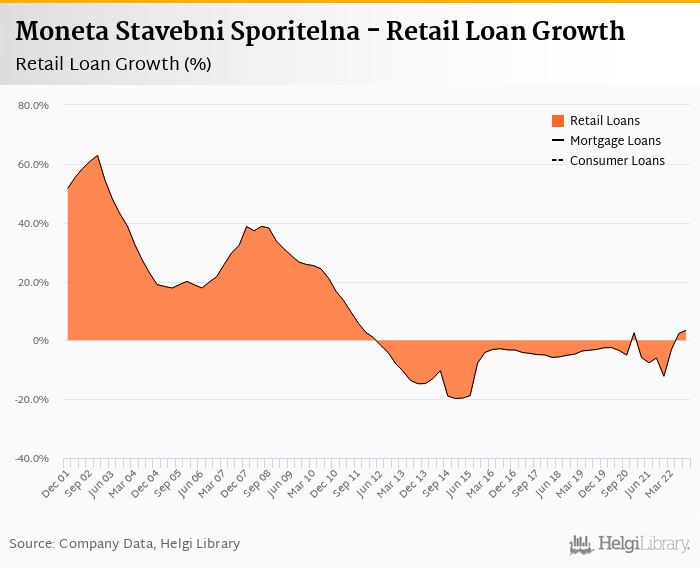

Retail loans grew 0.762% qoq and were 3.46% up yoy and accounted for 94.1% of the loan book at the end of the third quarter of 2022:

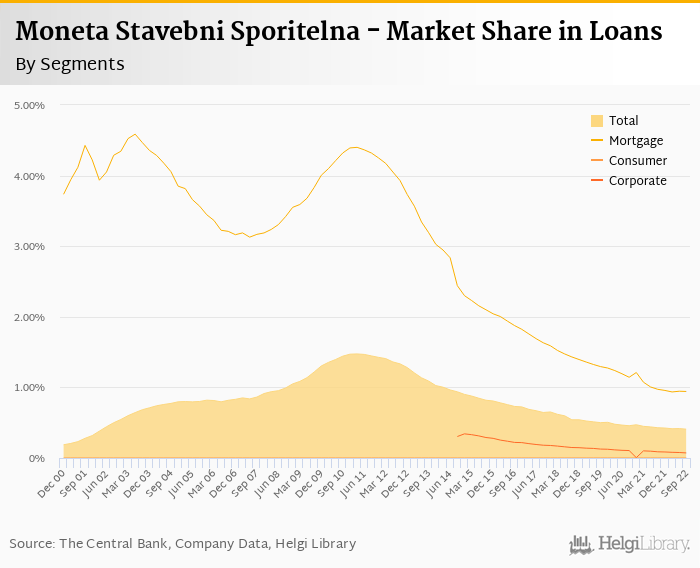

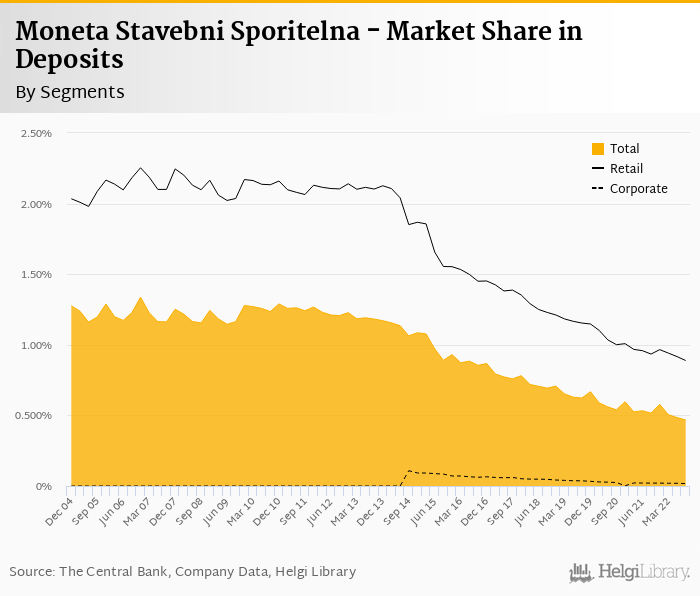

We estimate that Moneta Stavebni Sporitelna has lost 0.020 pp market share in the last twelve months in terms of loans (holding 0.408% of the market at the end of 3Q2022). On the funding side, the bank seems to have lost 0.049 pp and held 0.467% of the deposit market:

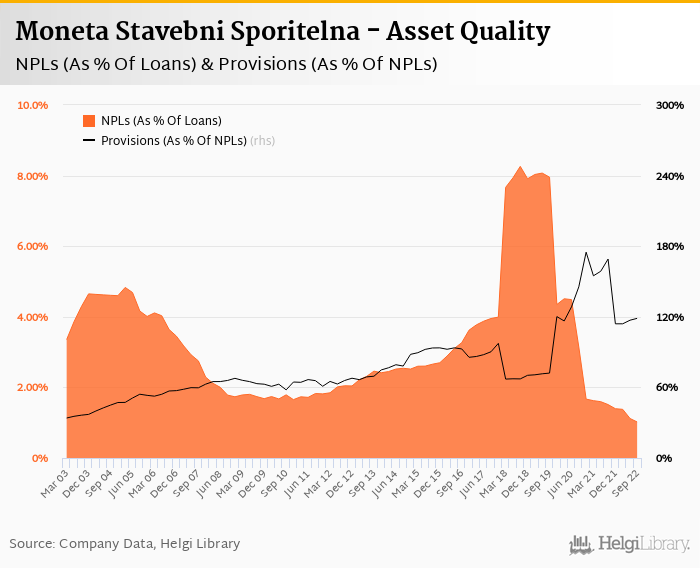

The Bank has written back further CZK 32 mil in the last quarter (fourth consecutive quarter of negative provisioning), so cost of risk reached -0.783% of average loans. High provision coverage (169% last year, some 120% now on our estimates) could be the reason. We also expect NPL ratio might have reached approximately 1.0% of total loans, down from 1.51% when compared to the previous year:

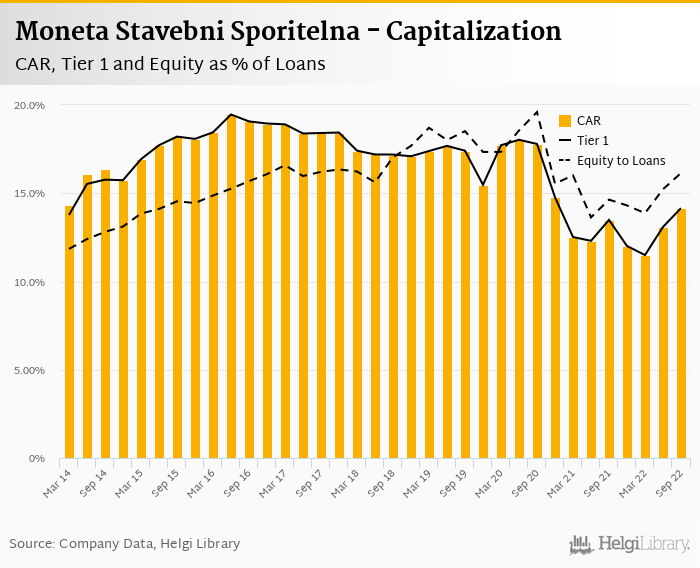

We estimate Moneta Stavebni Sporitelna's capital adequacy ratio reached 14.2% in the third quarter of 2022, up from 13.5% for the previous year. Bank equity accounted for 16.1% of loans:

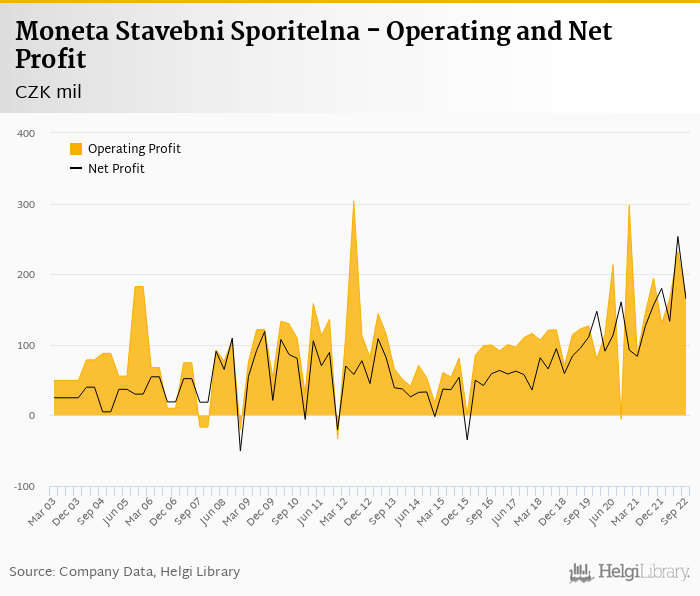

Overall, Moneta Stavebni Sporitelna made a net profit of CZK 165 mil in the third quarter of 2022, up 5.70% yoy. Operating profit fell 12.8% yoy, but when adjusted for the negative depreciation charge last year, the underlying growth would have reached approximately 10% yoy. This means an annualized return on equity of 25.4%, or 33.7% when equity "adjusted" to 15% of risk-weighted assets:

Very good cost control and support from ongoing provision write-backs. The Bank seems to remain over-provisioned while asset quality remains good. Lack of top-line and volume growth remain the main things to watch.