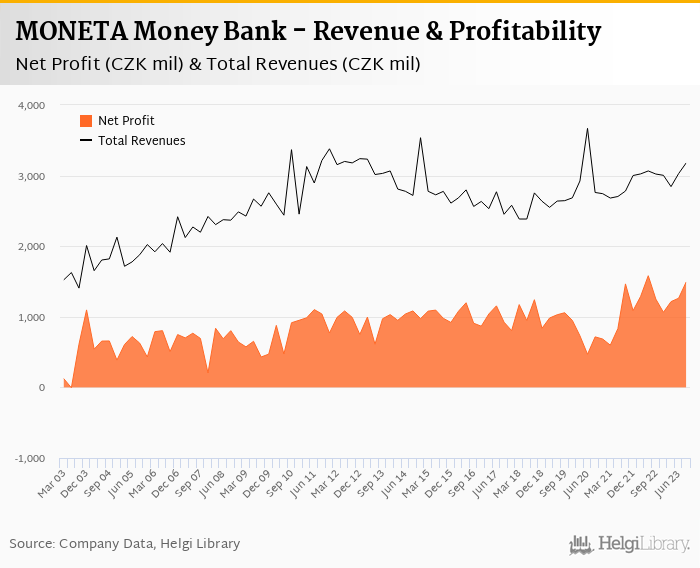

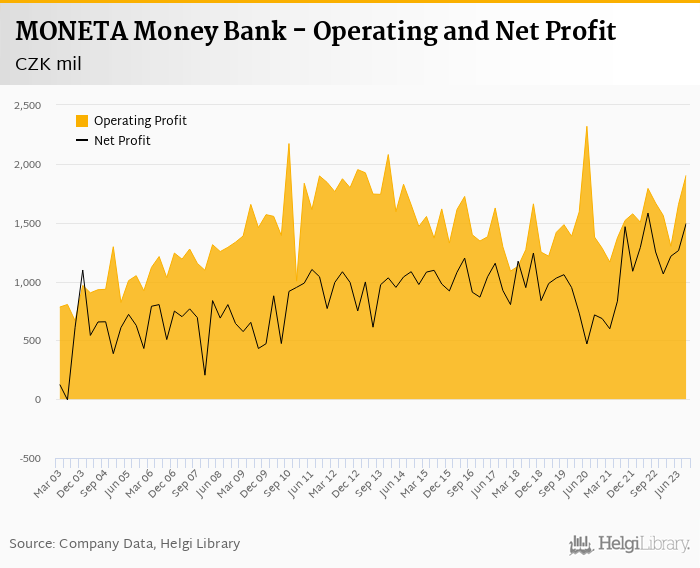

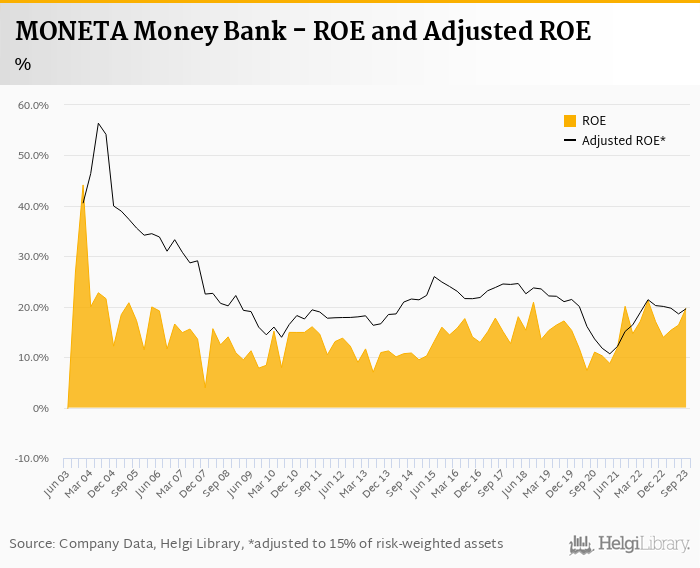

MONETA Money Bank rose its net profit 19.4% to CZK 1.49 bil in 3Q2023 and generated impressive ROE of 19.8%.

Strong revenue generation (up 5.2% yoy) and impressive cost control (down 5.9%) and lower effective tax rate are behind the better than expected profitability

Better than expected results and solid capitalization and release of further CZK 500 mil in 2024 from capital requirements paves room for interesting dividend in 2024

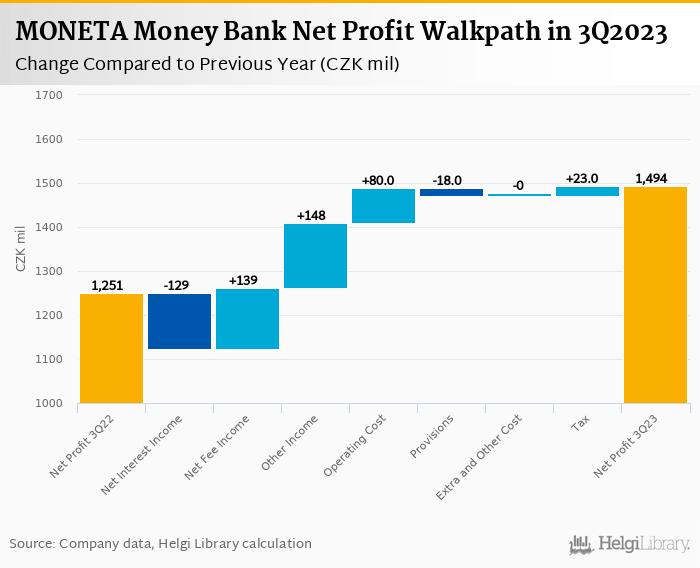

MONETA Money Bank made a net profit of CZK 1.49 bil in the third quarter of 2023, up 19.4% yoy, or increase of CZK 243 mil in absolute terms. This was some 10-15% better than the market expected fuelled by all fronts of the revenue side, strong cost control and lower effective tax rate. When compared to last year, roughly two thirds of the profit improvement came from the revenue side while a third from lower costs:

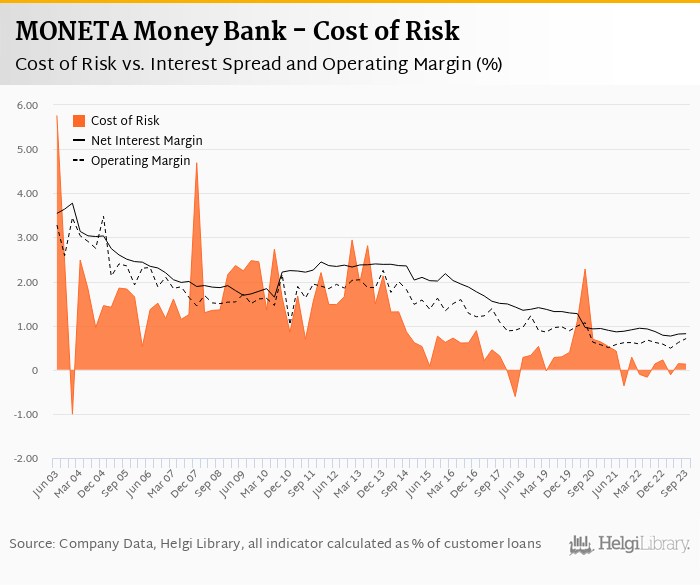

Revenues increased 5.2% yoy to CZK 3,180 mil in the third quarter of 2023. Despite the ongoing pressure from higher cost of funding (net interest income fell 5.54% yoy), the results confirmed stabilisation of the interest margin and spread. Strong fee income growing by a quarter on the back of a sale of third party products (mainly life and pension insurance) and very good trading income (FX conversions and absence of last year's losses on FX swaps) supported the revenue line in the third quarter. When compared to three years ago, revenues were up 15.2%:

Average asset yield was 5.29% in the third quarter of 2023 (up from 4.34% a year ago and 5.19% in 2Q) while cost of funding amounted to 3.52% in 3Q2023 (up from 1.97% and 3.35% in 2Q). The numbers show an ongoing pressure from the higher cost of funding and a stabilization of the margins at around 2.0% and spread at around 1.8%. With al most 70% of revenues coming from the net interest income, the develoment in margin will be crucial for the Bank's revenue and profit generation in the coming quarters:

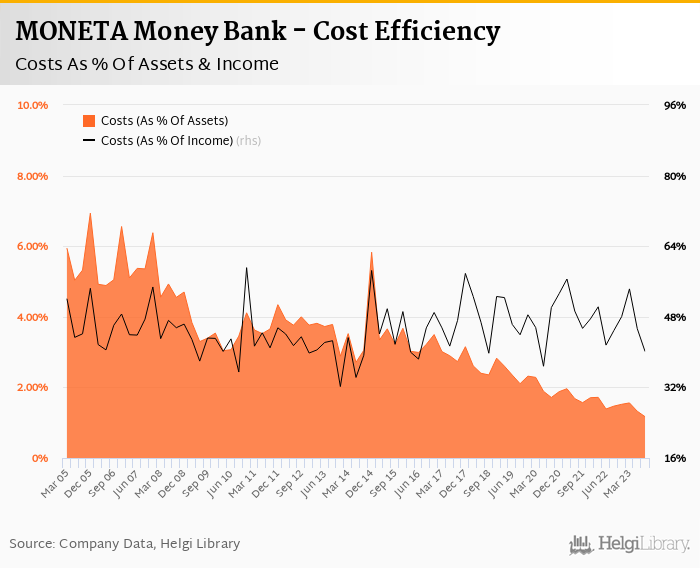

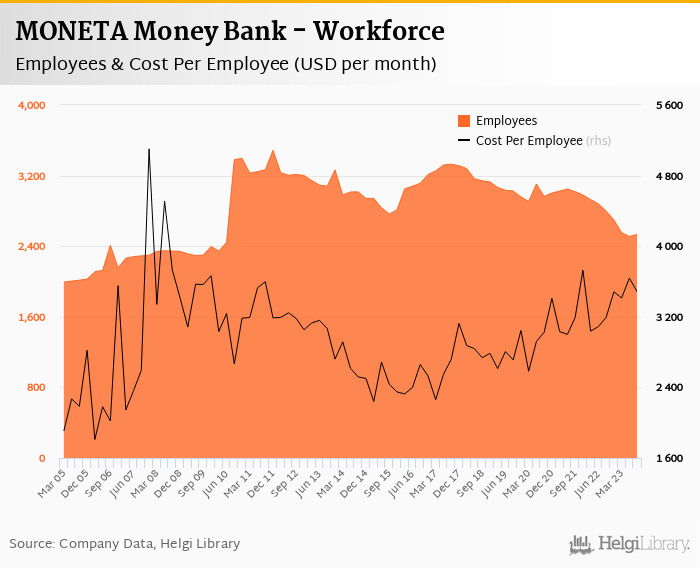

Costs decreased by 5.9% yoy and were at a similar level as in 2021, which is very impressive given the external environment. This is heavily a result of the cost cutting efforts the Bank made during 2022 when more than 9% of employees have been laid off and 14 branches have been closed. With numbers of both, employees as well as branches stagnating in 2023, one should not expect such impressive numbers to continue indefinitely.

As a result, the Bank operated with impressive cost to income of 40.1% in the last quarter:

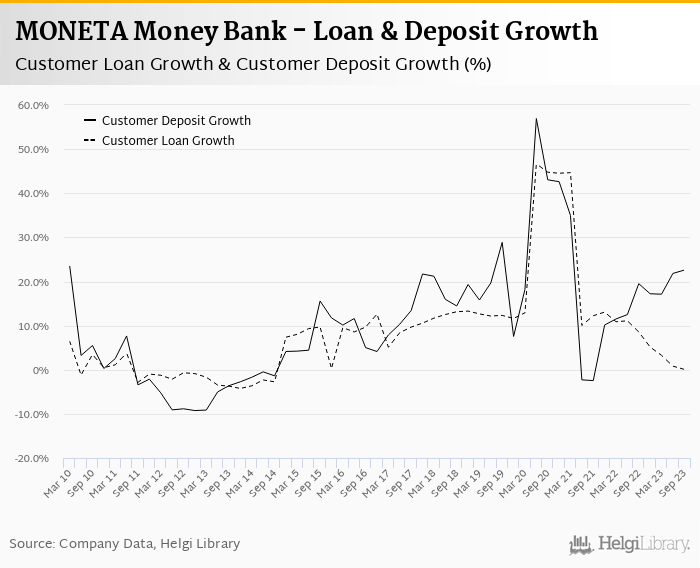

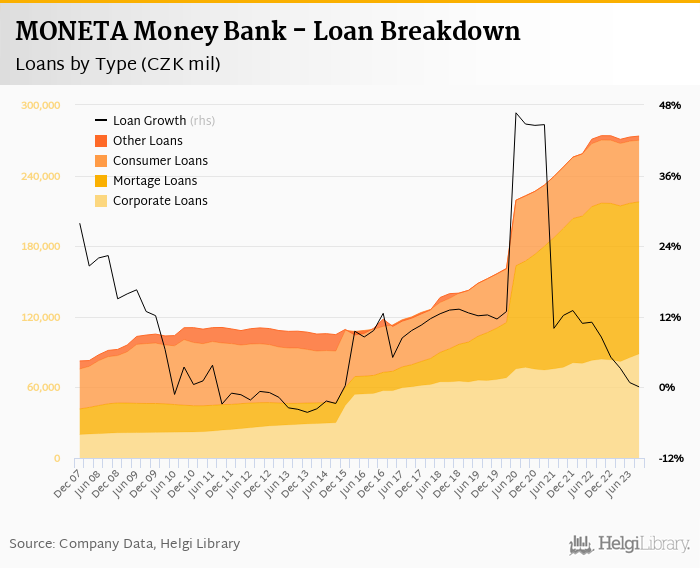

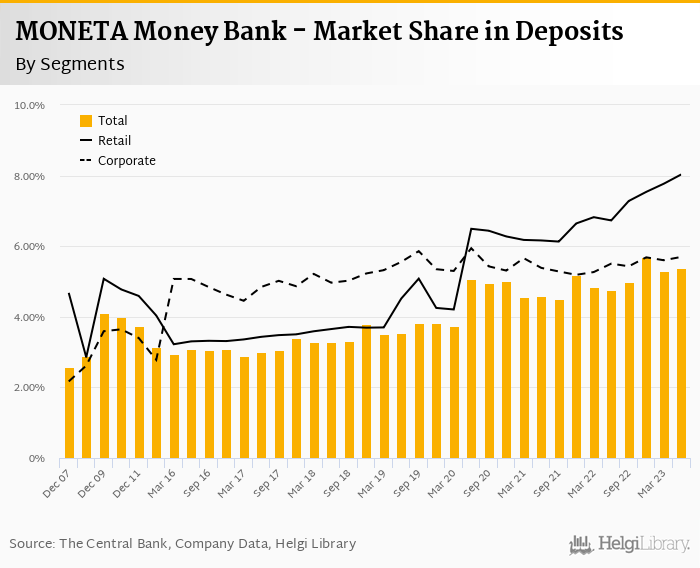

Demand for lending remains subdued, so MONETA Money Bank's customer loans were flattish when compared to both, last quarter as well as last year. On the other hand, deposits continued to grow strongly and added 6.8% qoq and 22.6% yoy.

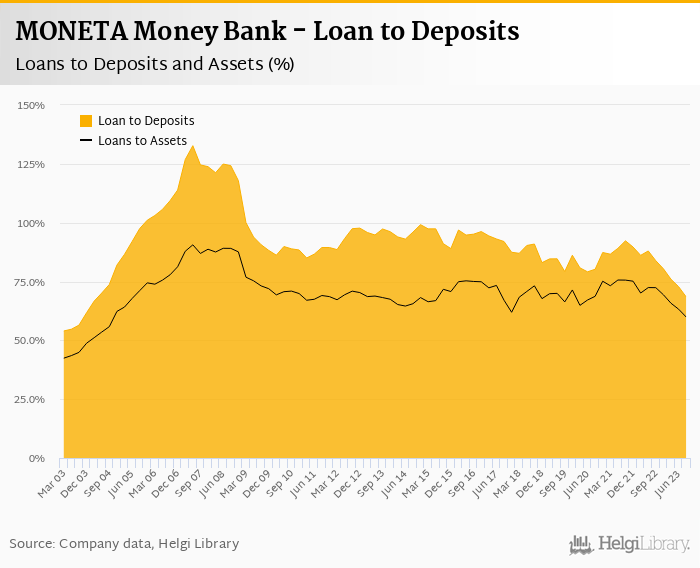

At the end of third quarter of 2023, MONETA Money Bank's loans accounted for 68.4% of total deposits and 59.9% of total assets. These are the lowest numbers seen at the Bank for the last two decades:

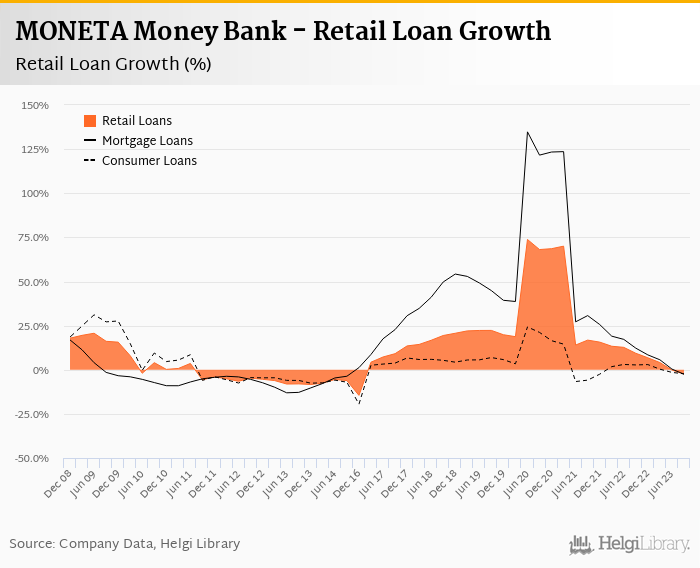

Retail loans fell 1.3% qoq and were 2.5% down yoy. They accounted for two thirds of the loan book at the end of the third quarter of 2023 while corporate loans increased 3.7% qoq and 5.4% yoy, respectively. Mortgages represented 48.0% of the MONETA Money Bank's loan book, consumer loans added a further 19.5% and corporate loans formed 32.9% of total loans:

Moneta Money Bank seems to have been losing market share on lending for some time while strenghtening its market position on the deposit side. This could be a part of the Bank's strategy to protect its margin on the asset side and to gain new clients through deposit collection:

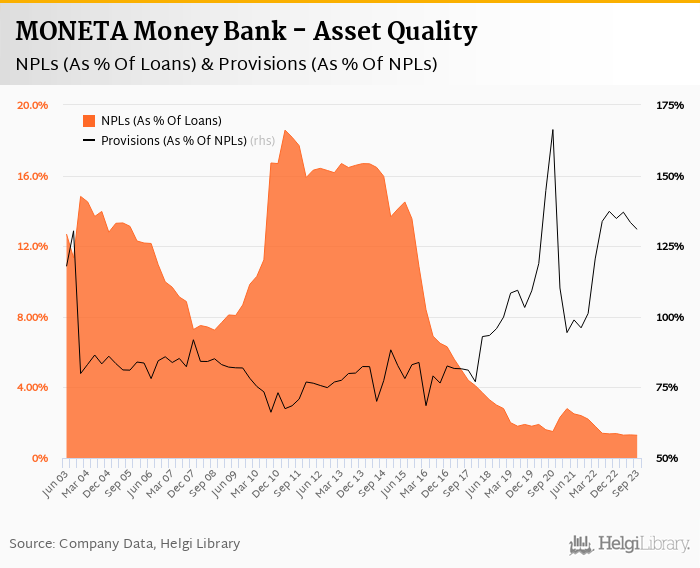

Asset quality remains very good. MONETA Money Bank's non-performing loans reached 1.29% of total loans, down from 1.37% when compared to the previous year. Provisions covered some 131% of NPLs at the end of the third quarter of 2023.

More importantly, new formation of NPLs does not exceed the amount of "cured" loans and write-offs, so amount of NPLs has been declining since the middle of 2021 in absolute terms. Relatively speaking, loans overdue for more than 30, 60 as well as 90 days have been close to the all time lows suggesting limited pressure overall.

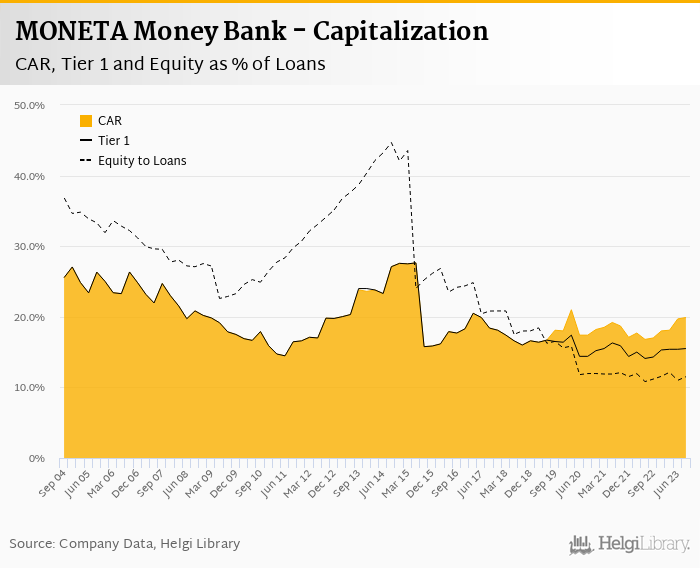

MONETA Money Bank's capital adequacy ratio reached 19.9% in the third quarter of 2023, up from 17.0% for the previous year. The Tier 1 ratio amounted to 15.5% at the end of the third quarter of 2023 while bank equity accounted for 11.5% of loans.

Apart from the better than expected profitability and capital position in 2023, the Bank might free up further CZK 500 million of capital in 2024 thanks to 30 bp lower requirements for SREP Pillar II.

Just a reminder, the management plans to pay dividends equal to 80% of annual consolidated net profit. However, that's apart from further CZK 4 bil of excess capital the Bank is sitting on, so a room for interesting dividend is clearly there:

Overall, MONETA Money Bank made a net profit of CZK 1.49 mil in the third quarter of 2023, up 19.4% yoy. This means an impressive annualized return on equity of 19.8% in the last quarter or 16.3% when the last four quarters are taken into account:

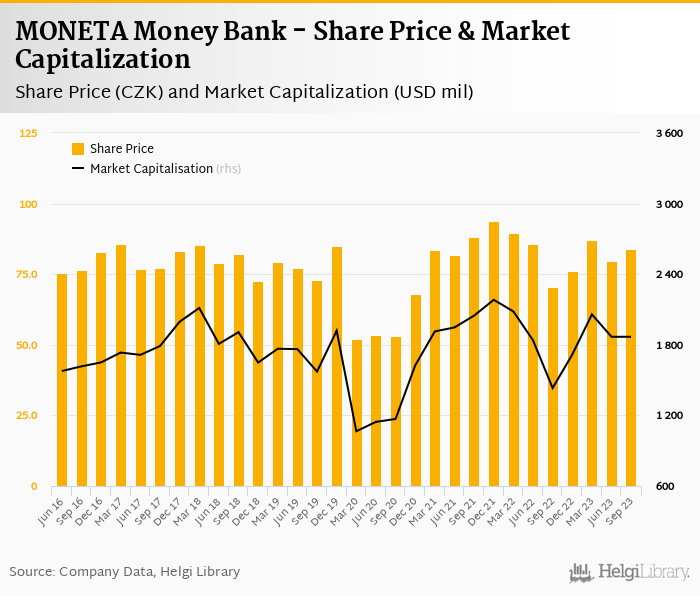

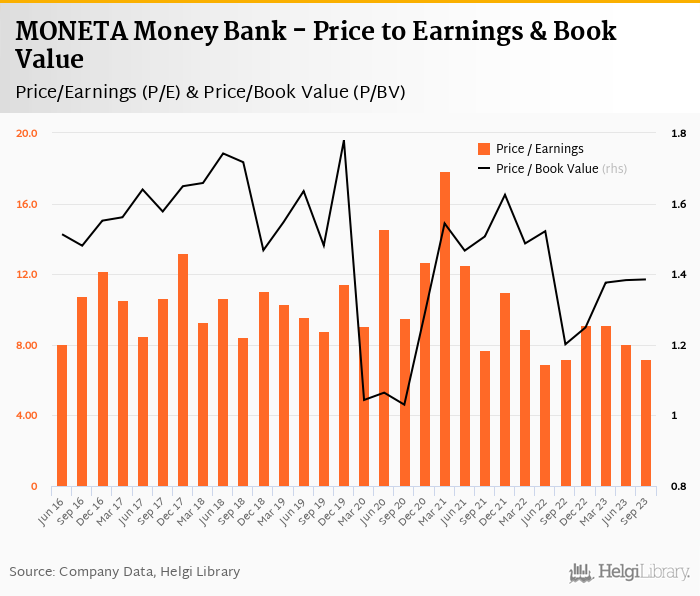

MONETA Money Bank stock traded at CZK 83.8 per share at the end of 3Q2023 resulting in a market capitalization of USD 1,868 mil. The stock appreciated by 5.0% in the third quarter and is 57.5% up when compared to three three years ago. This put stock at a 12-month trailing price to earnings of 7.18x and price to book value of 1.39x as of the end of 3Q2023 and around 9.0x and 1.3x expected in 2024.

Strong set of 3Q2023 results of Moneta Money Bank supported by all fronts, from better expected interest as well as fee income, very good cost control and asset quality, solid growth in deposits and lower than expected effective tax rate.

The management further upgraded its profit guidance for 2023 to over CZK 5 bil (from original CZK 4.3 bil and updated CZK 4.7 bil). With already impressive cost control, very good asset quality and aggressive pricing on the deposit side, the Bank has been running at full steam.

Interest rate and margin development will be a key to watch for in the coming quarters, for both the interest margin development as well as so much needed recovery of lending. The management expects each 100 bp rate cut to eat roughly CZK 435 mil of revenues, or approximately 7.5% of pre-tax profit, so the speed and size of rate cuts will matter .

Despite the impressive performance and upgraded profit outlook, we believe the share price upside remains limited. Trading at PBV of 1.3x and PE of around 9x expected in 2024, Moneta stock continues to be more expensive than most CEE peers, well above Polish banks, Komercni Banka, or Erste Bank, for example.