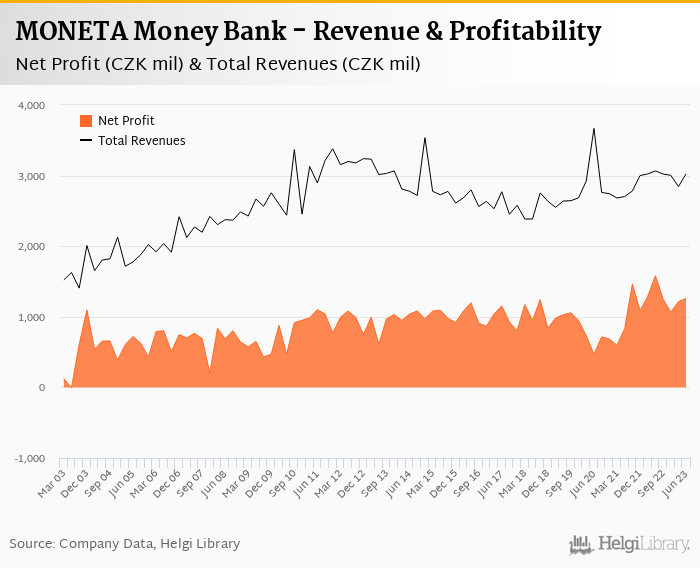

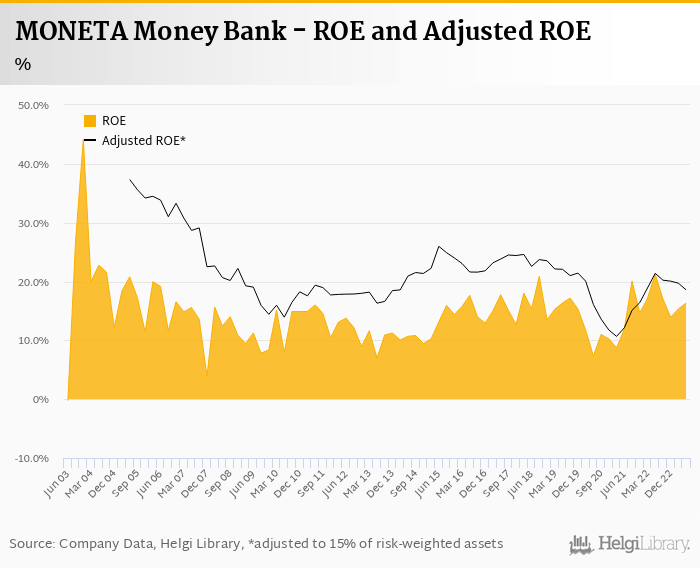

MONETA Money Bank decreased its net profit 20.2% to CZK 1,263 mil in 2Q2023 and generated ROE of 16.4%.

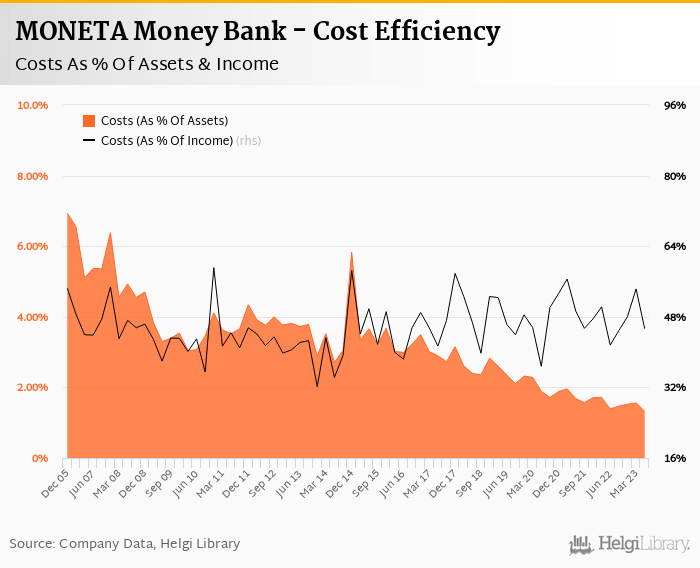

Revenues decreased 1.24% yoy and cost rose 7.61%, so cost to income increased to 45.3%

Bad loans fell to 1.31% of total loans and cost of risk amounted 0.219%.

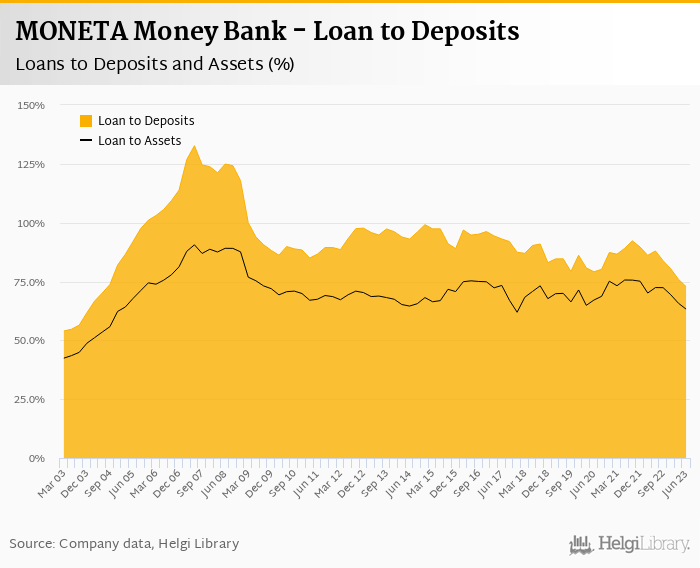

Loan to deposit ratio decreased to 72.8% and capital adequacy increased to 19.7%

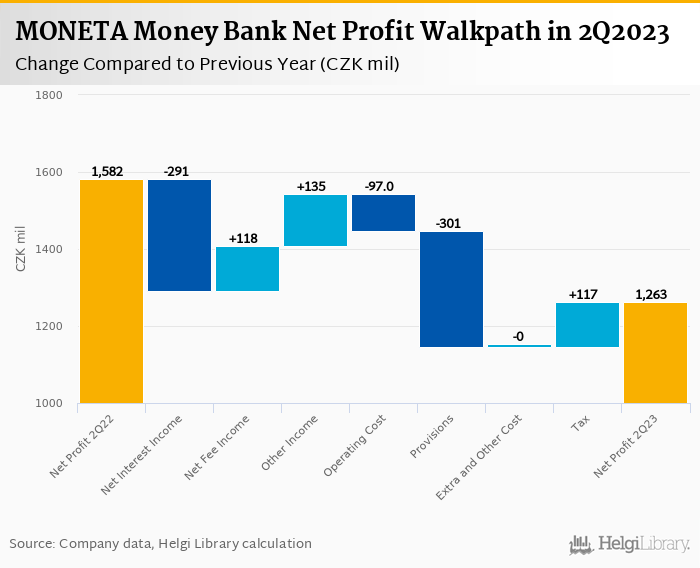

MONETA Money Bank made a net profit of CZK 1,263 mil in the second quarter of 2023, down 20.2% yoy, or decrease of CZK 319 mil in absolute terms. A third of the profit fall has been caused by lower operating profitability while two thirds of the worsening came from higher cost of provisions when compared to last year. On the operating profit level, revenues lost CZK 38.0 mil while cost increased CZK 97.0 mil compared to last year’s quarter:

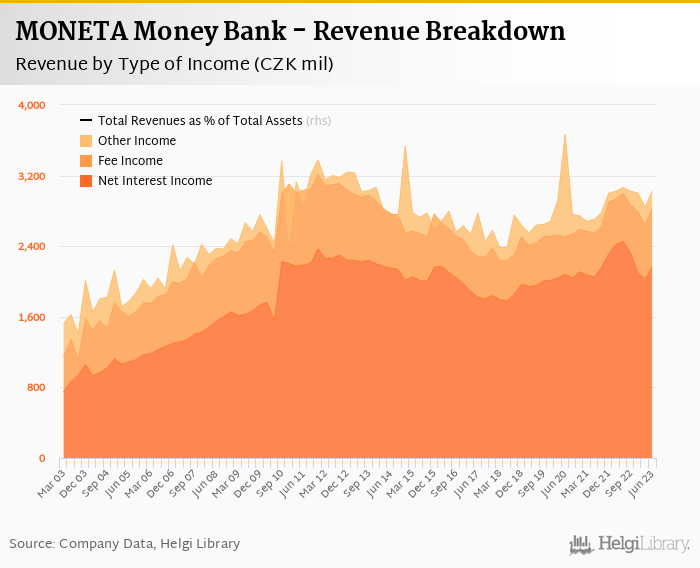

Revenues decreased 1.2% yoy to CZK 3,028 mil in the second quarter of 2023. Net interest income fell 11.8% yoy as loan growth disappeared and cost of deposits continued to eat into interest margin. Fee income grew solid 22% yoy driven by a sale of third parties' products and added a further fifth to the top line. When compared to three years ago, revenues were down 17.5%:

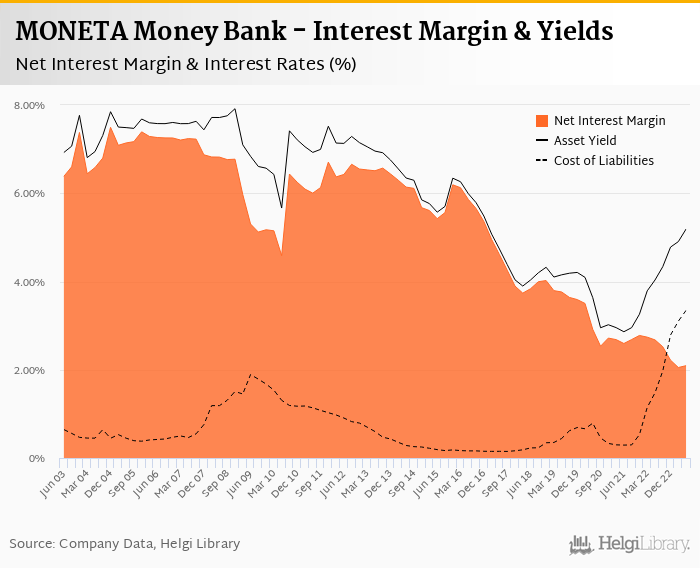

Average asset yield was 5.19% in the second quarter of 2023 (up from 4.03% a year ago) while cost of funding amounted to 3.35% in 2Q2023 (up from 1.48%). In spite of the margin pressure, the 2Q23 results suggest stabilisation of the interest spread.

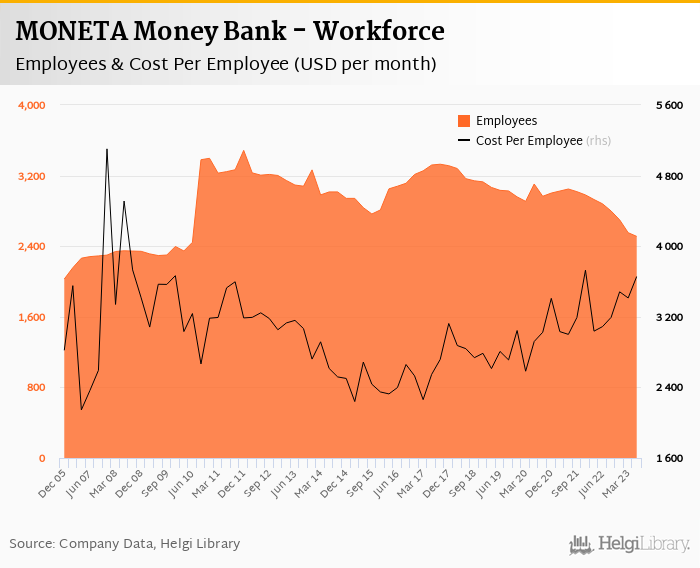

Costs increased by only 7.6% yoy and the bank operated with average cost to income of 45.3% in the last quarter. Staff cost fell 2.62% as the bank continued reducing its personnel (down 12.8% yoy to 2,511 persons) and kept its paychecks relatively low (CZK 78,986 per person per month including social and health care insurance cost):

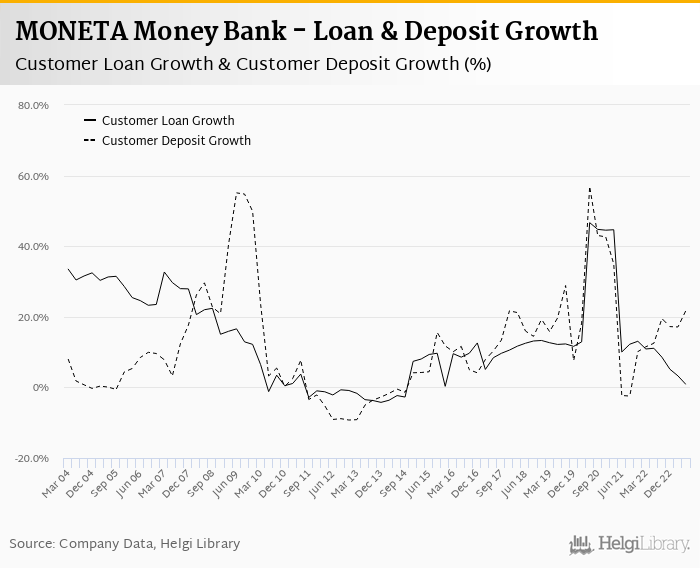

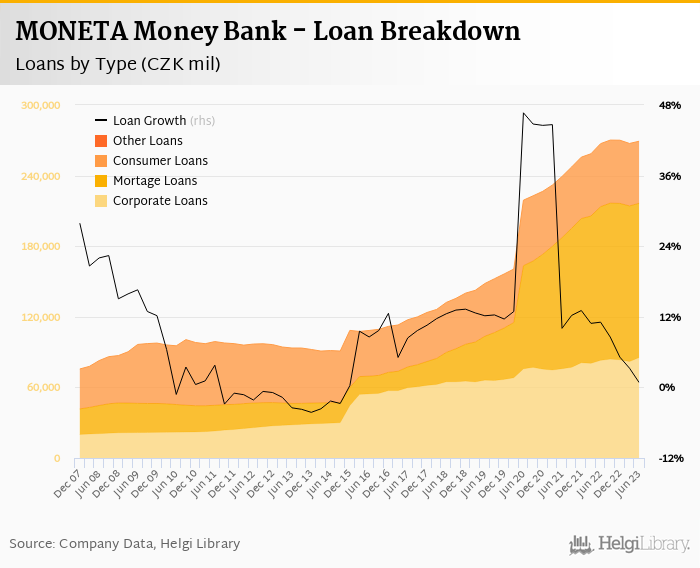

MONETA Money Bank's customer loans grew only 0.757% qoq and 0.815% yoy in the second quarter of 2023 as demand for most types of lending remains weak while customer deposit growth amounted to strong 5.1% qoq and 21.8% yoy. The development on the deposit side is quite interesting as average deposit balance of Bank's clients has increased by approximately 20% when compared to last year. Is it just an aggressive pricing, or strengthening relationship with its customer base?

At the end of second quarter of 2023, MONETA Money Bank's loans accounted for 72.8% of total deposits and 63.2% of total assets.

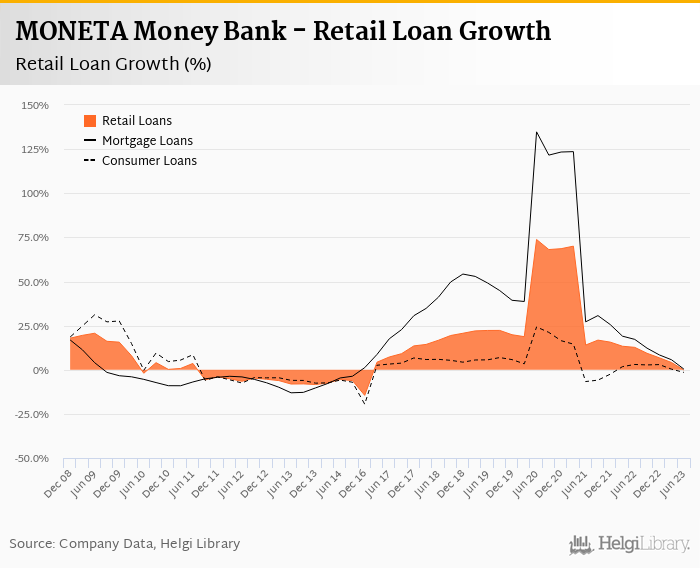

Retail loans fell 0.796% qoq and were only 0.167% up yoy. They accounted for 68.6% of the loan book at the end of the second quarter of 2023 while corporate loans increased 4.13% qoq and 2.87% yoy, respectively. Mortgages represented 48.9% of the MONETA Money Bank's loan book, consumer loans added a further 19.7% and corporate loans formed 31.8% of total loans:

MONETA Money Bank's asset quality continues to look good. Non-performing loans fell slightly to CZK 3.57 bil and reached 1.31% of total loans, down from 1.40% when compared to the previous year. Provisions covered some 133% of NPLs at the end of the second quarter of 2023, down from 134% for the previous year.

Provisions have "eaten" some 8.82% of operating profit in the second quarter of 2023 as cost of risk reached 0.219% of average loans:

MONETA Money Bank's capital adequacy ratio reached 19.7% in the second quarter of 2023, up from 16.8% for the previous year. The Tier 1 ratio amounted to 15.4% at the end of the second quarter of 2023 while bank equity accounted for of loans. Although lower when compared to most Czech peers, the overall capital figures are solid and offer enough room for continued dividend payments:

Overall, MONETA Money Bank made a net profit of CZK 1,263 mil in the second quarter of 2023, down 20.2% yoy. This means an annualized return on equity of 16.4%, or 18.6% when equity "adjusted" to 15% of risk-weighted assets:

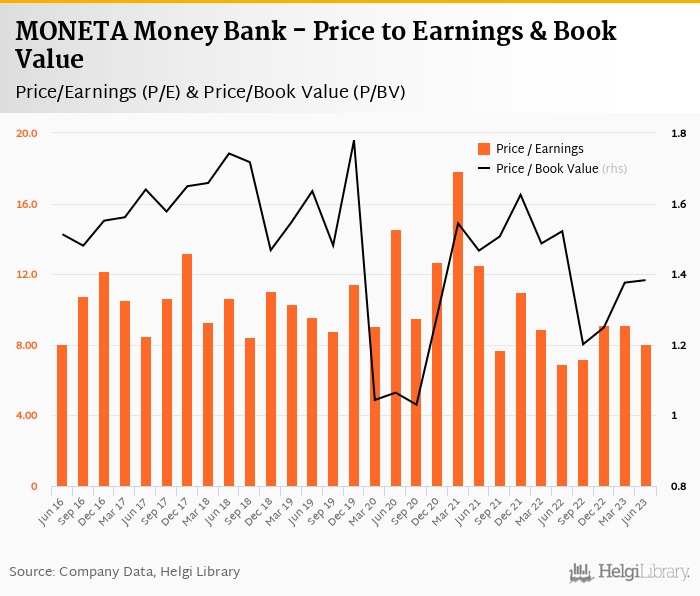

MONETA Money Bank stock trades at around 1.4x in terms of price to book and at around 9x based on price to earnings expected in 2023. With ROE at more than 15%, this is clearly not demanding. The problem continues to be a limited room for growth (from low loan demand to saturated client base) and already high level of cost efficiency/control and asset quality, so further room for improvement seems to be rather limited.

The bank reported solid set of results, mostly in line with what market had expected. The Bank upgraded its mid-term profit outlook, but this is heavily driven by lower effective tax rate on the back of lower expected windfall tax.

Interest income remains a key driver of bank's profitability in the coming months. Weak demand on the lending side and continued pressure from funding cost are the main negatives. On the other hand, 70% of loans are to be re-paid or re-priced within the next 36 months and funding pressure seems to have stabilised.

Cost control and asset quality remain impressive, though do not offer much upside going forward in our view given the good progress the management has already done on these fronts.

Moneta stocks seems attractively priced trading at PBV of 1.4x and PE of around 9x expected in 2023. Lack of growth and catalysts and cheap banking stocks elsewhere seem to limit upside price potential for now, however.