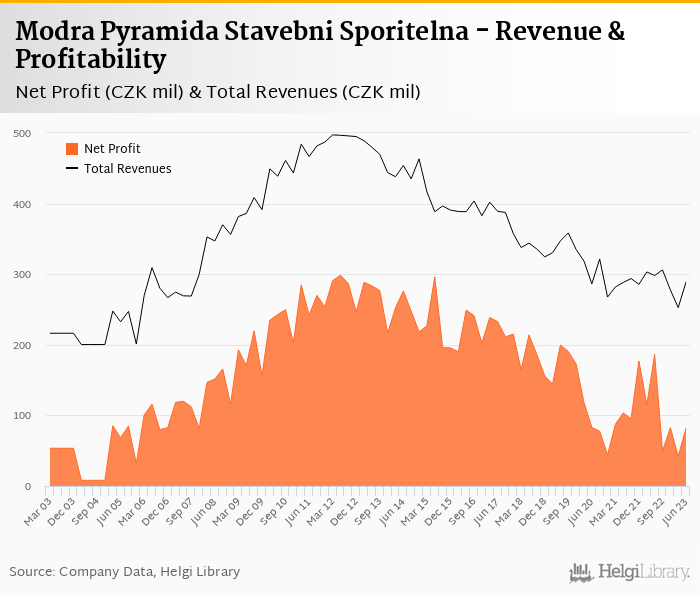

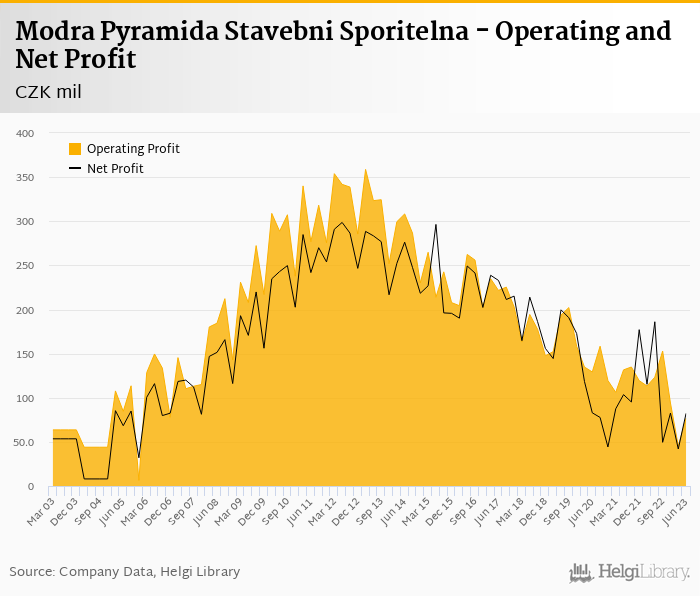

Modra Pyramida Stavebni Sporitelna's net profit fell 59% to CZK 82.3 mil in 2Q2023 due mainly to an absence of CZK 121 mil extra gain made last year.

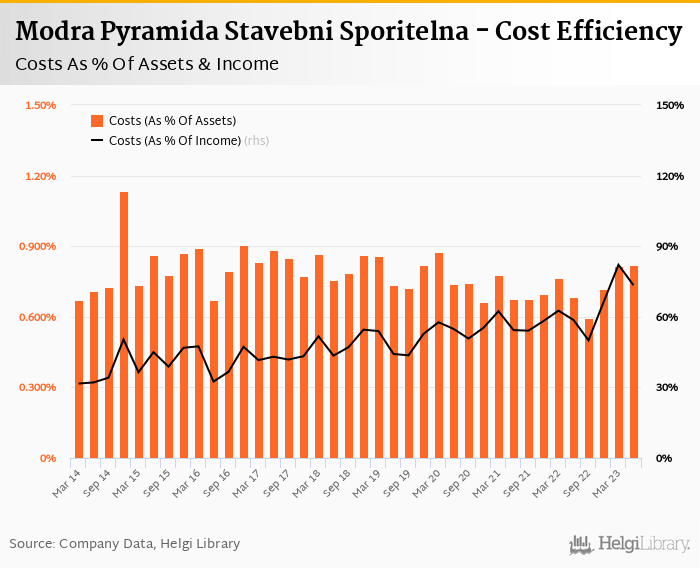

Operating profit fell by a third as revenues decreased 3.04% due to weak interest income and cost rose hefty 21.3% thanks to staff cost. Cost to income therefore increased to 73.4%

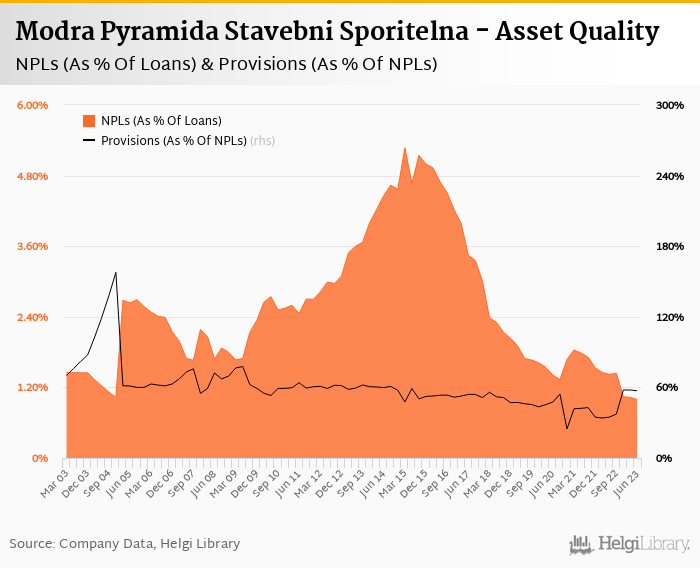

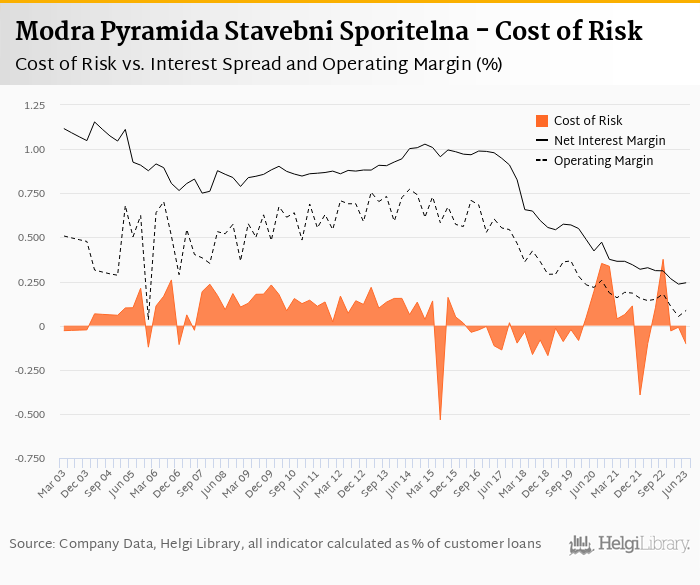

The Bank wrote back another CZK 27.6 mil in provisions, so we expect the NPL ratio fell below 1.0%.

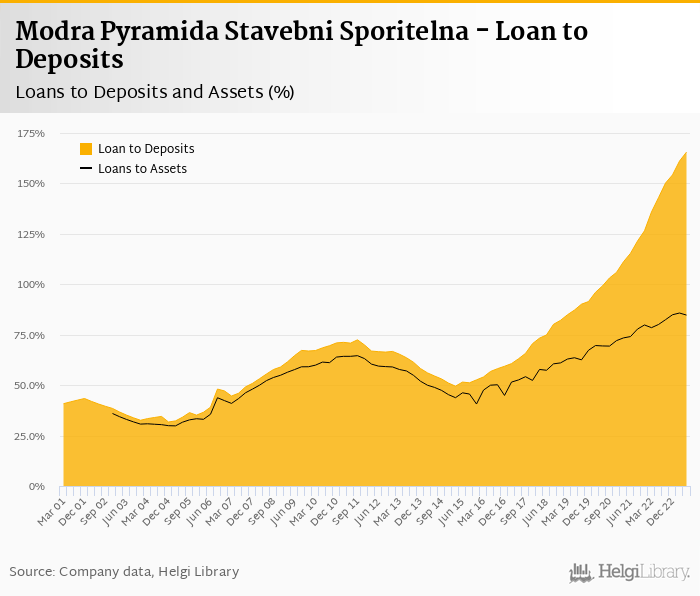

Loan momentum remains good rising 2.3% qoq, though loan to deposit ratio rising to 166% is something to watch for

Modra Pyramida Stavebni Sporitelna made a net profit of CZK 82.3 mil in the second quarter of 2023, down 55.8% yoy, or decrease of CZK 104 mil in absolute terms. Excluding CZK 121 mil extra gain from a sale of assets in 2Q2023, pre-tax profit would have increased by 7.4% yoy. Having said that, operating profitability was weak due mainly to lower interest income and cost growth, another provision write-back was the main positive message of the quarter:

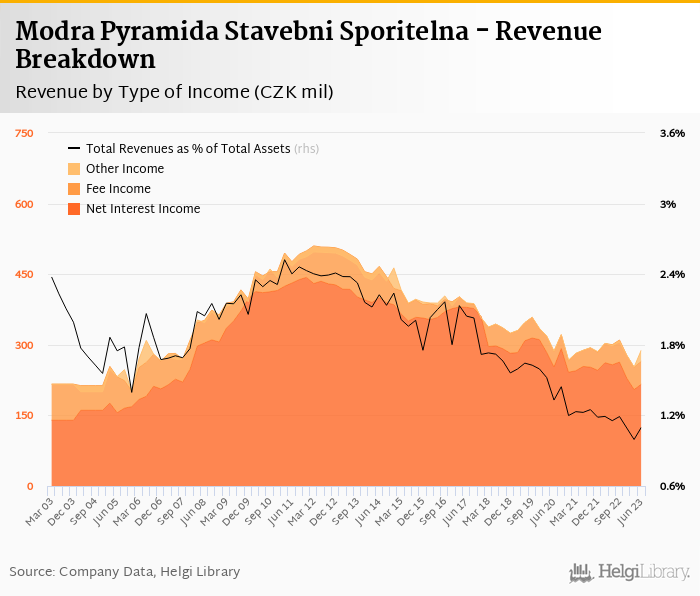

Revenues decreased 3.0% yoy to CZK 289 mil in the second quarter of 2023 due mainly to weaker net interest income (down 16.0% yoy). Despite a solid loan growth, the pressure from higher cost of funding stays, so net interest margin decreased 0.168 pp to 0.837% of total assets compared to last year. On the positive note, fee income grew 14.7% yoy and trading/other income was relatively strong. When compared to three years ago, revenues are up less than 1.0% showing the sub-sector remains under pressure:

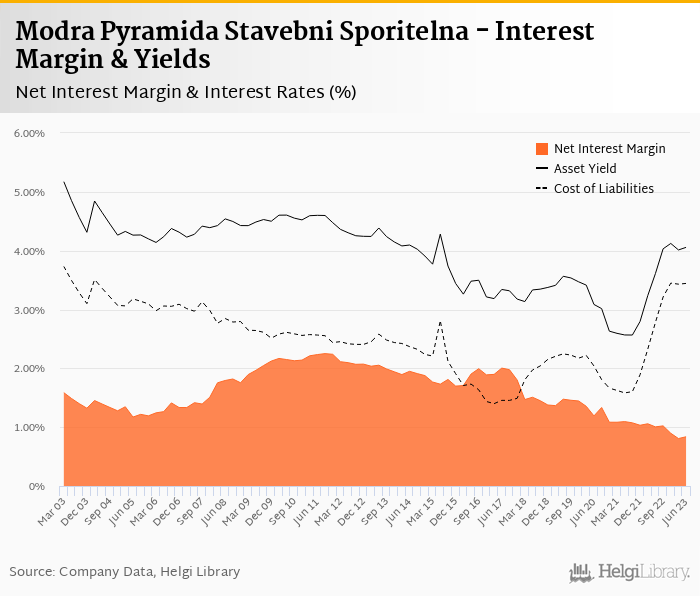

Average asset yield was 4.06% in the second quarter of 2023 (up from 3.61% a year ago) while cost of funding amounted to 3.44% in 2Q2023 (up from 2.78%). Asset yield increased 3 bp and cost of funds was flattish last quarter, so pressure seems to be easing:

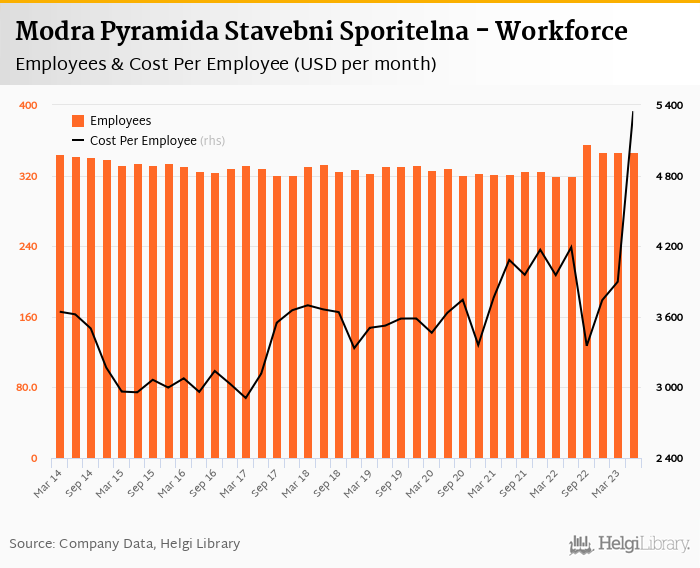

Costs increased by 21.3% yoy and the bank operated with average cost to income of 73.4% in the last quarter. Staff cost rose hefty 31% as the bank added 8.5% more people on its paycheck (total of 347 persons) while non-personnel expenses rose 7.0% when adjusted for the contribution to the Bank Guarantee Fund:

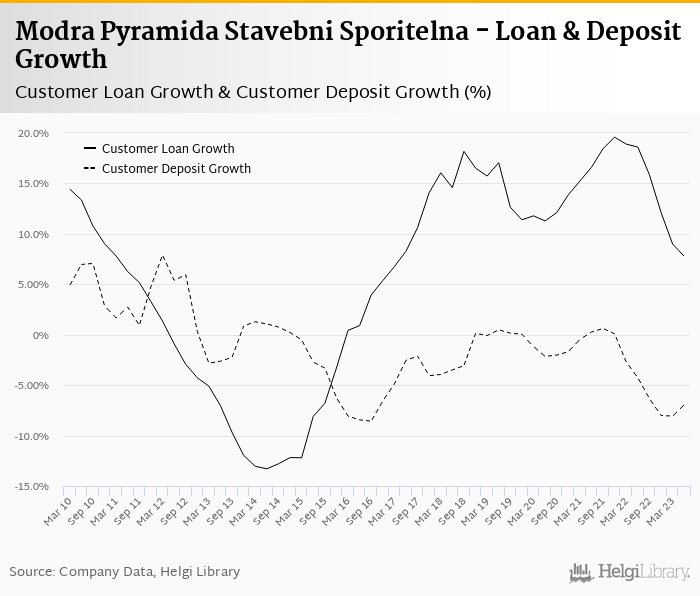

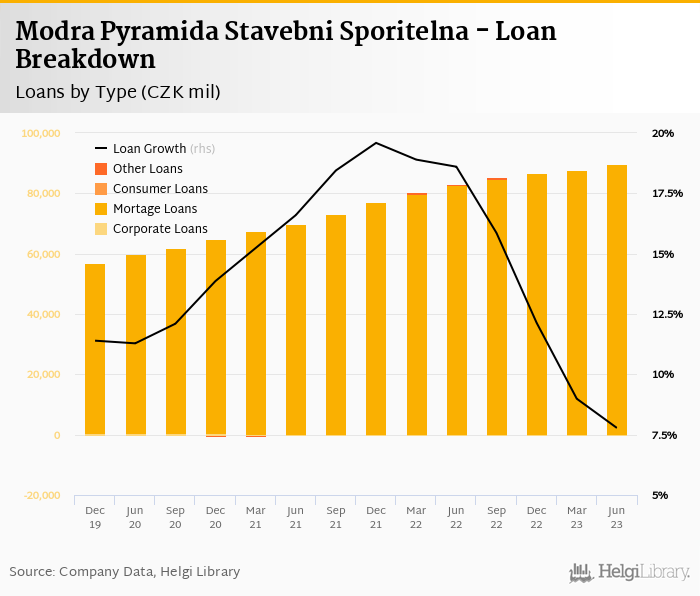

Loan growth remains solid while deposits continue decreasing since the end of 2021. Modra Pyramida Stavebni Sporitelna's customer loans grew 2.3% qoq and 7.78% yoy in the second quarter of 2023 while customer deposits fell further 0.45% qoq and 6.95% yoy. That’s compared to average annual growth of 14.8% in loans and 3.29% decline in deposits seen in the last three years.

At the end of second quarter of 2023, Modra Pyramida Stavebni Sporitelna's loans increased 166% of total deposits and 84.7% of total assets. That's compared to 106% and 72%, respectively, at the end of 2020:

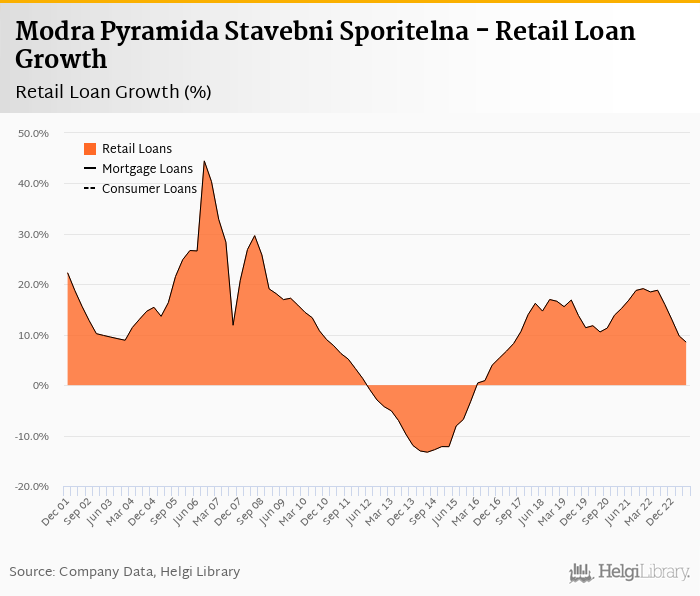

Retail, mostly residential mortgage loans grew 2.30% qoq and were 8.48% up yoy accounting for almost 100% of the loan book at the end of the second quarter of 2023:

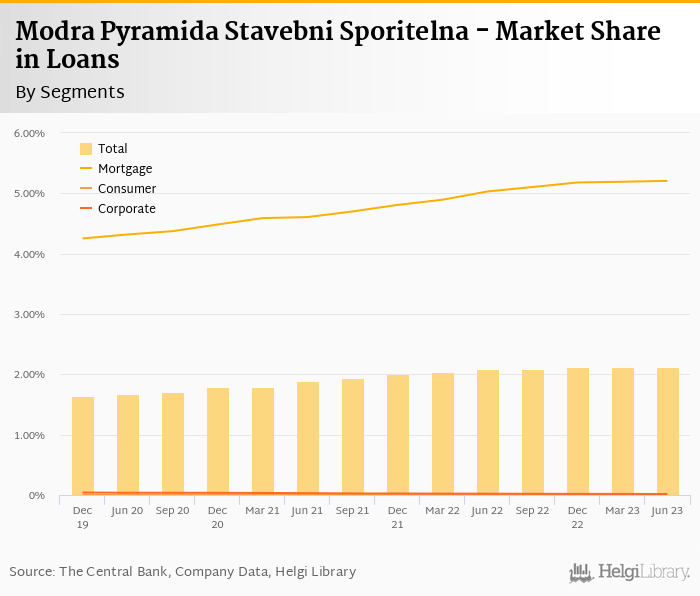

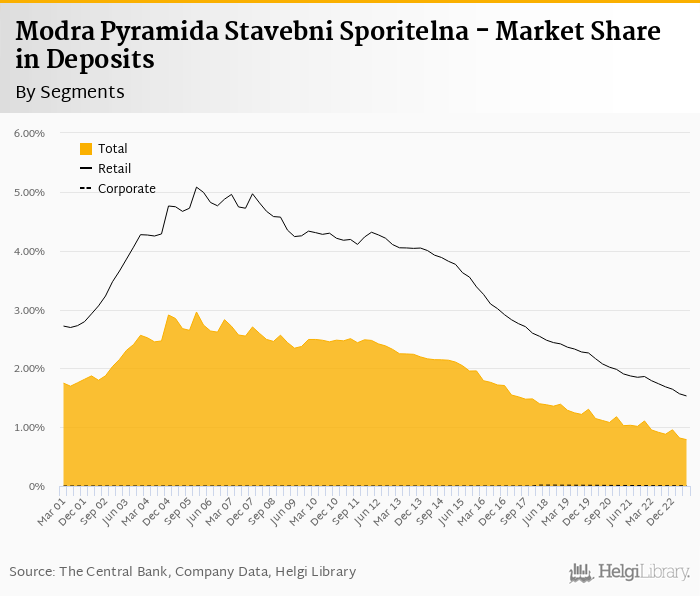

We estimate that Modra Pyramida Stavebni Sporitelna has gained 0.03 pp market share in the last twelve months in terms of loans (holding 2.12% of the market at the end of 2Q2023). On the funding side, the bank seems to have lost 0.124 pp and held 0.788% of the deposit market. In terms of mortgage lending, the Bank seems to be gaining market share to over 5.0%:

The Bank made a third consequtive quarterly provision write-back amounting to CZK 27.6 mil in the second quarter of 2023.

We therefore assume asset quality remains good and share of non-performing loans might have fallen below 1.0% of total loans in June 2023, while provisions might be covering around 50% of bad loans, on our estimates:

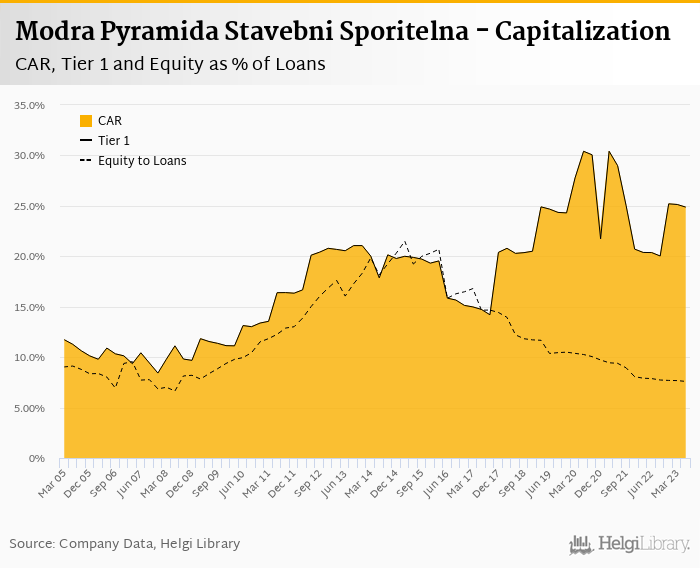

We assume Modra Pyramida Stavebni Sporitelna's capital adequacy ratio reached 24-25.0% in the second quarter of 2023, up from 20.4% for the previous year while bank's equity continues falling as a share of loans, as loan books expands:

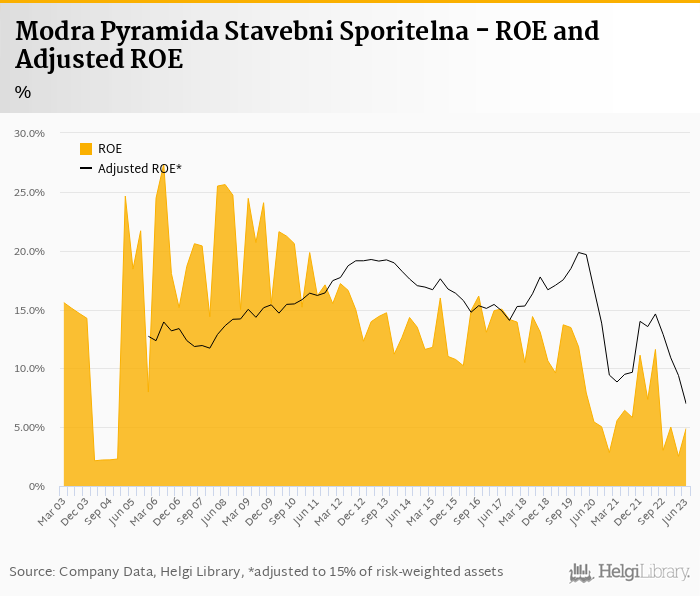

Overall, Modra Pyramida Stavebni Sporitelna made a net profit of CZK 82.3 mil in the second quarter of 2023, down 55.8% yoy. This means an annualized return on equity of 4.90% in the last quarter or 3.85% when the last four quarters are taken into account:

Even when excluding the one-off gain made last year, Modra Pyramida announced relatively weak set of results in 2Q2023 with operating profit falling by a third. This is due mainly to an ongoing pressure on the interest margin and a hefty increase in personnel cost. Increasing imbalance between loans and deposits (loans to deposits at 166%) funded by Komercni Banka is also something to watch for.