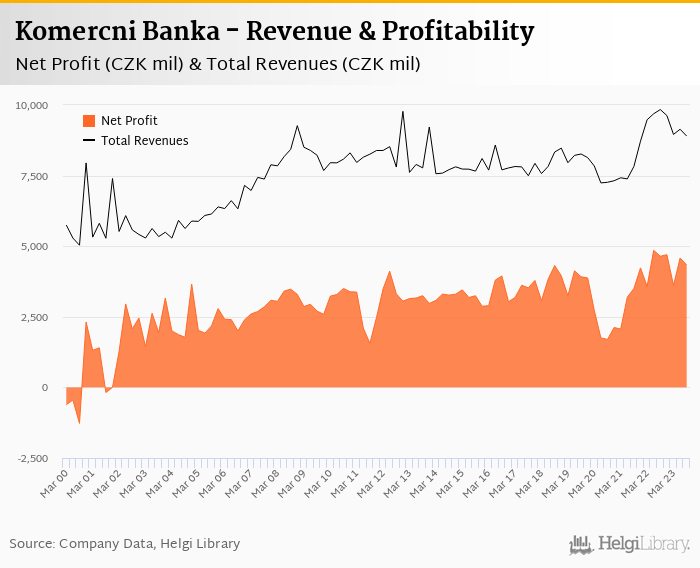

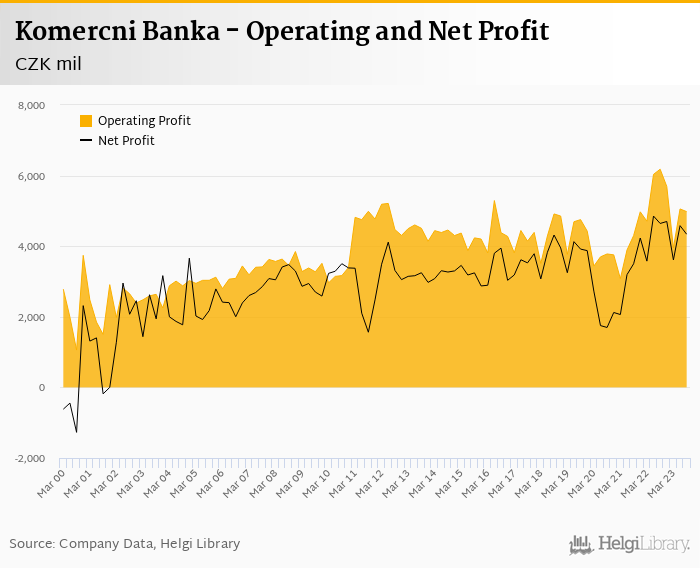

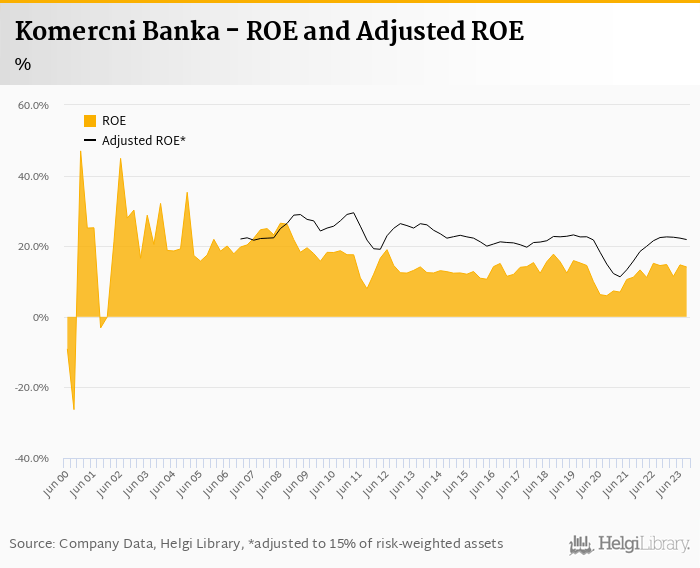

Komercni Banka decreased its net profit 7.3% to CZK 4.27 bil in 3Q2023 and generated ROE of 14.1%

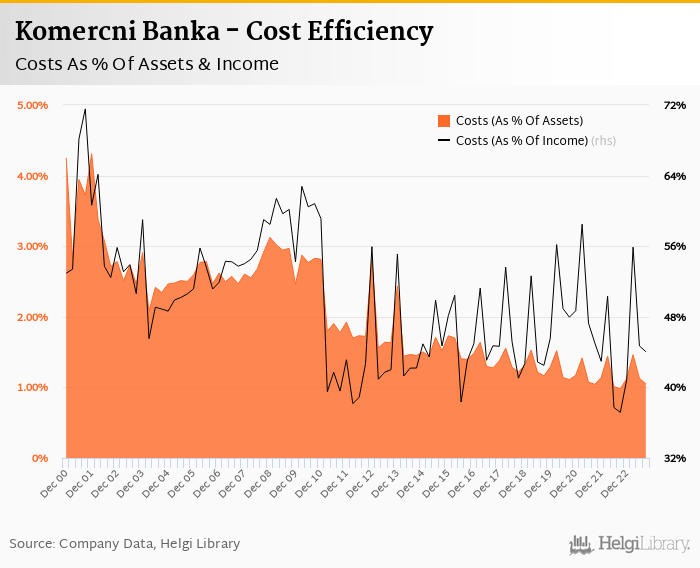

Operating performance disappointed slightly as revenues decreased 9.5% yoy and cost rose 7.19%, so cost to income increased to 44.0%

Provision write-backs and lower effective tax rate were the main positive surprises this quarter, albeit rather lower quality ones

Trading at PE of 9.0x and PBV of 1.1x with a dividend yield at around 7.0%, Komercni Banka looks attractive, though with a risk of a "value trap". Erste Bank and Polish banks seem to be offering a better story now.

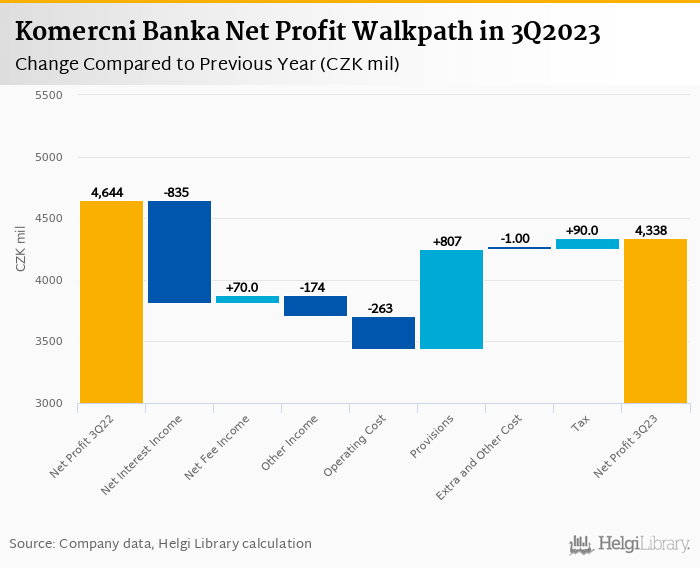

Komercni Banka made a net profit of CZK 4.27 bil in the third quarter of 2023, down 7.28% yoy, or decrease of CZK 335 mil in absolute terms. Operating profit fell by CZK 1.2 bil, or 19.4%, so further provision write-backs and lower effective tax rate saved the Bank from bigger profitability deterioration:

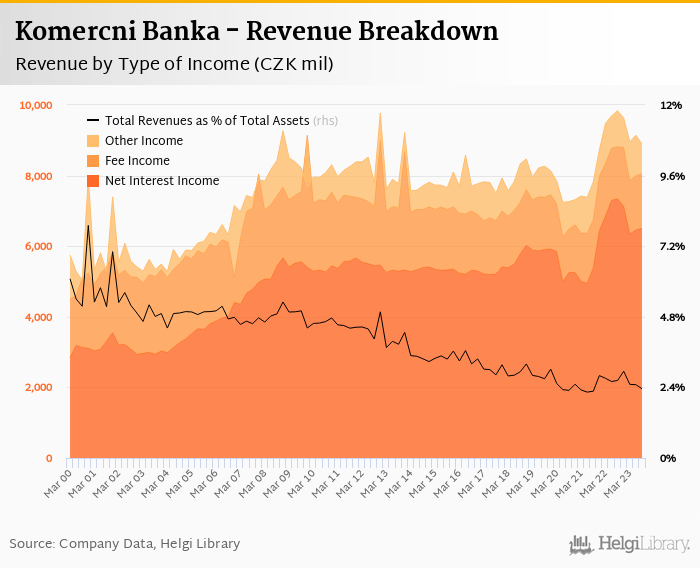

Revenues decreased 9.54% yoy to CZK 8.90 bil in the third quarter of 2023 due heavily to falling net interest income (89% of the reduction when compared to last year). Fee income grew 4.7% yoy thanks mainly to better product cross-selling though other and trading income were CZK 174 mil lower due to lower capital markets activity when compared to last year:

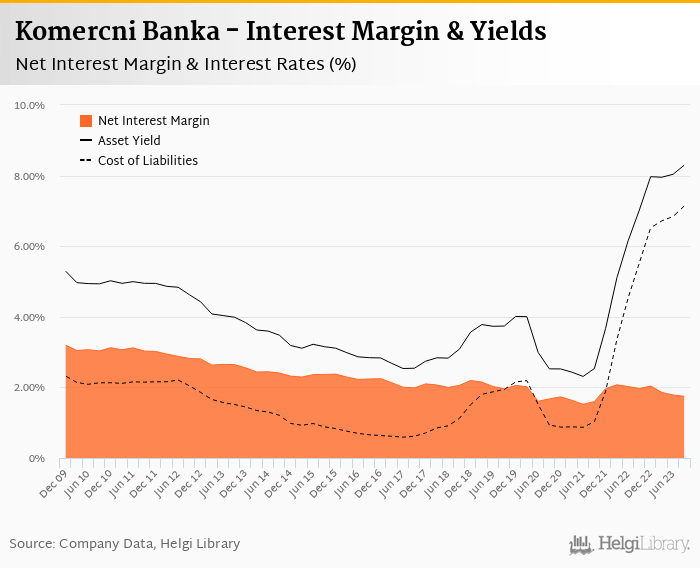

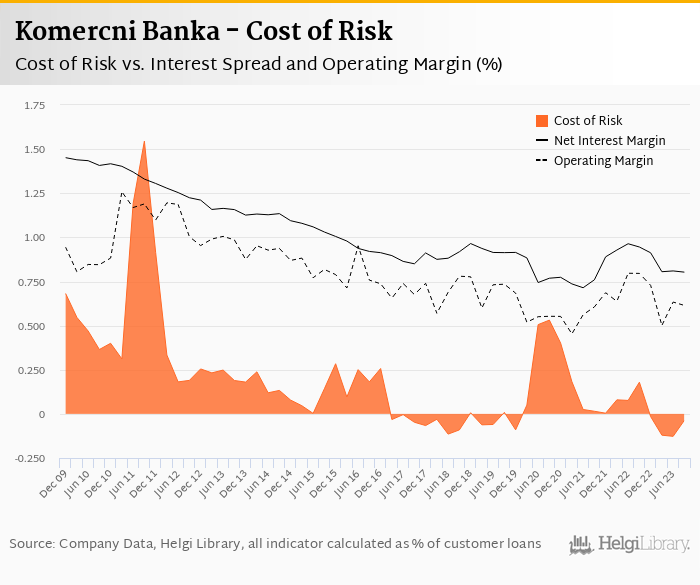

Net interest margin decreased further 4 bp to 1.75% of total assets (down from 1.49% last year). With asset yield rising further 26 bp to 8.30% in the third quarter of 2023 (up from 7.03% a year ago), the problem is clearly on the funding side where costs increased by 30 bp last quarter to 7.14% (up from 5.53% last year).

Share of sight deposits fell futher to 51% of total at the end of September (from 58% in Sep 2022 and 71% in Sep 2021), so pressure from customers looking for better yields clearly continues:

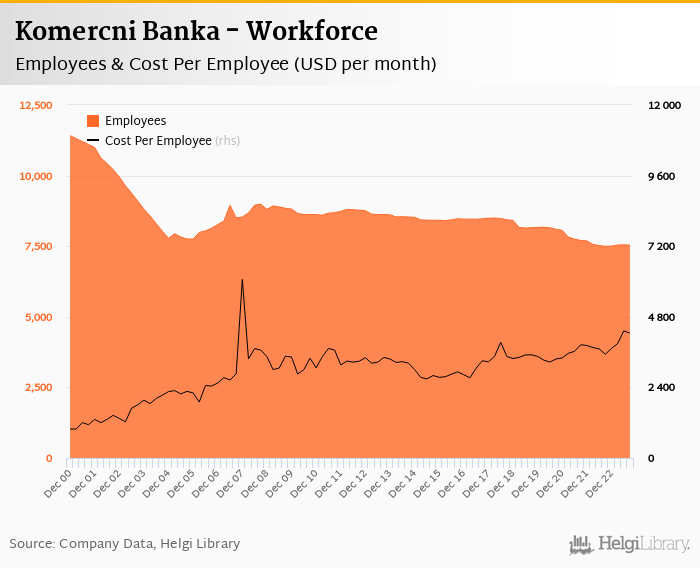

Costs increased by 7.2% yoy and the bank operated with cost to income of 44.0% in the last quarter. Staff cost rose 10.7% as the bank slightly increased number of employees and only 6 branches have been closed since the end of last year. That's a difference when compared to Moneta Money Bank, for example, with 9.5% workforce reduction and 14 branches being closed, or Ceska Sporitelna's performance:

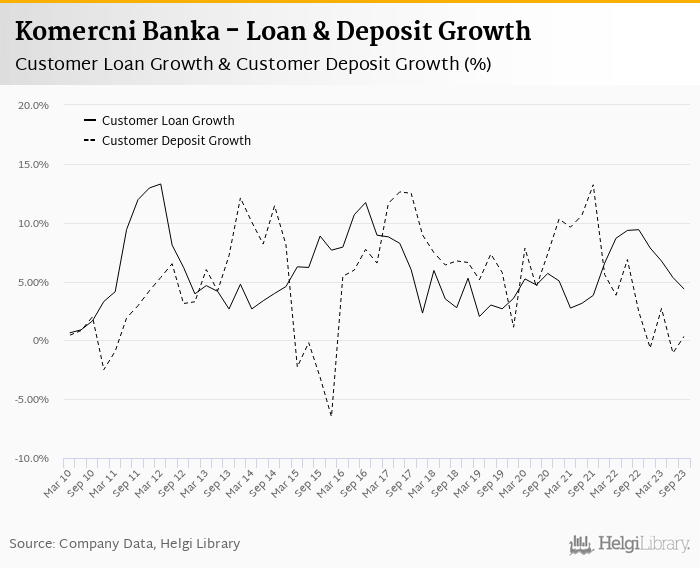

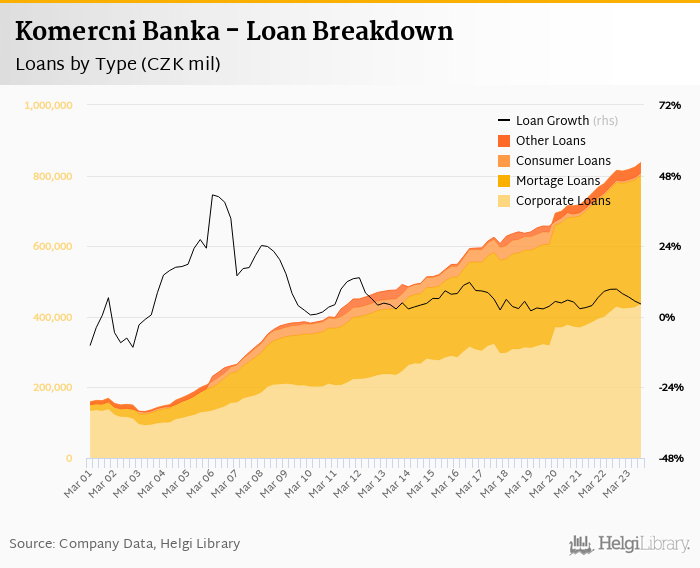

Demand for lending remains subdued in spite of a pick up in new sales of mortgage loans. Customer loans grew 1.55% qoq and 4.35% yoy in the third quarter of 2023 while customer deposit growth amounted to 3.01% qoq and 0.359% yoy. That’s compared to average of 6.1% and 5.3% average annual growth seen in the last three years.

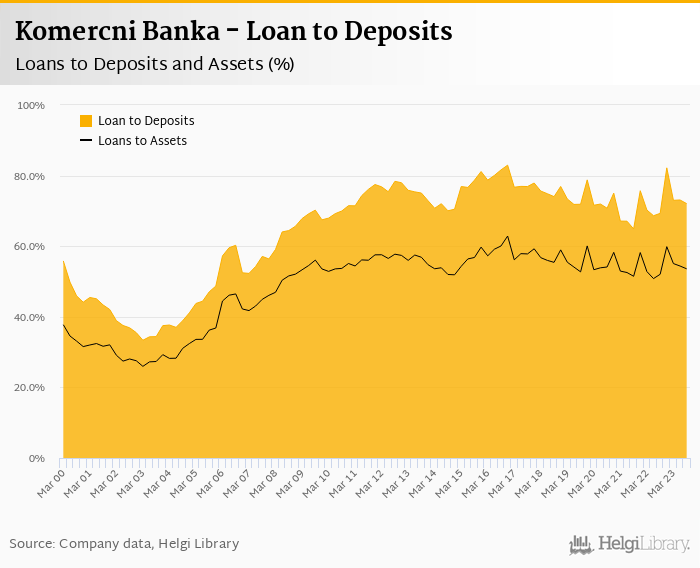

At the end of third quarter of 2023, Komercni Banka's loans accounted for 72.1% of total deposits and 53.6% of total assets.

Retail loans grew 1.13% qoq and were 4.02% up yoy while corporate loans increased 2.08% qoq and 1.63% yoy, respectively. Mortgages represented 45% of the Komercni Banka's loan book, consumer loans added a further 4.6% and corporate loans formed 54% of total loans:

We estimate that Komercni Banka has lost 0.216 pp market share in the last twelve months in terms of loans (holding 18.9% of the market at the end of 3Q2023). On the funding side, the bank seems to have lost 1.24 pp and held 16.2% of the deposit market.

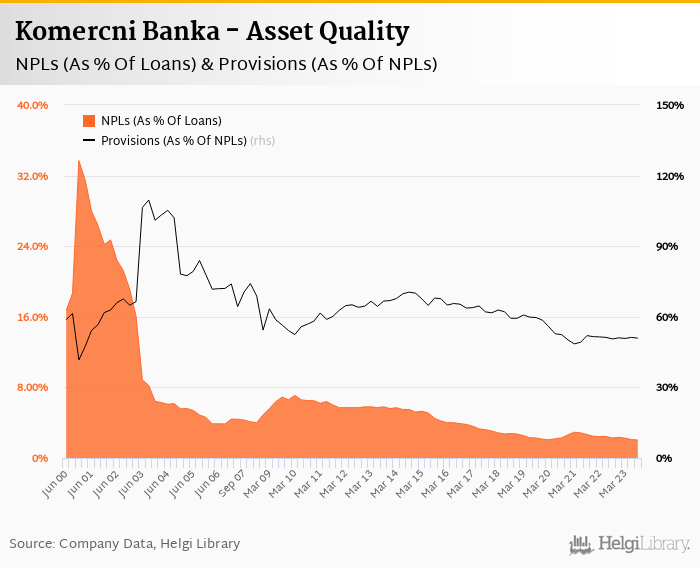

Asset quality remains good with non-performing loans at 2.04% of total loans (vs. 2.27% last year) and stable provision coverage at around 51%.

Low default ratio and a few corporate recoveries helped the Bank to write-backs some of the provisions back resulting in CZK 138 mil net release of provisions in 3Q2023, a fourth consequtive quarter now:

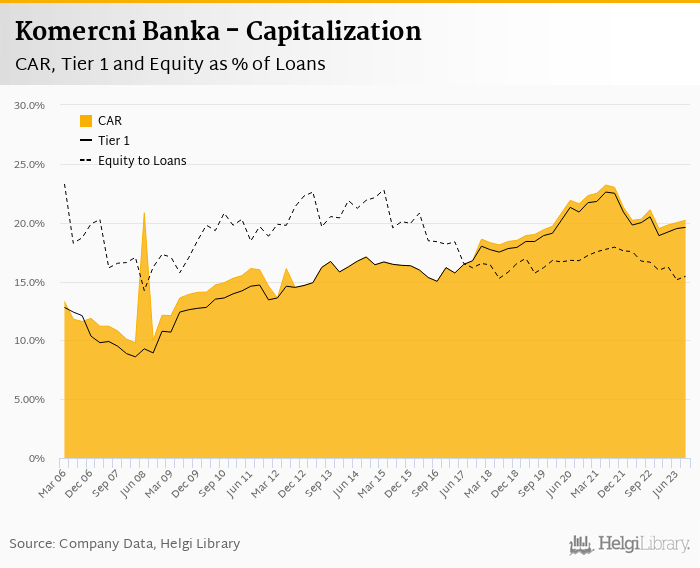

Komercni Banka's capital adequacy ratio reached solid 20.2% in the third quarter of 2023, down from 21.1% for the previous year. The Tier 1 ratio amounted to 19.6% at the end of the third quarter of 2023 while bank equity accounted for 15.4% of loans. With little pressure on asset quality and low demand for lending, the Bank is in a comfortable position to pay a fat dividend again next year:

Overall, Komercni Banka made a net profit of CZK 4.27 bil in the third quarter of 2023, down 7.28% yoy. This means an annualized return on equity of 14.1% in the last quarter or when the last four quarters are taken into account:

Weaker than expected operating performance offset by another provision write-backs and lower effective tax rate. On the operating side, revenues are getting under increased pressure from interest margin and lower business activity while costs are not cut as much as at Moneta Money Bank, or Ceska Sporitelna, it seems.

Trading at PE of 9.0x and PBV of 1.1x with a dividend yield at around 7.0%, Komercni Banka looks attractively priced. We still fear of a "value trap" risk as both, the bank and its stock lack a positive momentum.

We continue to prefer Erste Bank and Polish banks to Komercni banka at these levels as a better play on CEE banking.