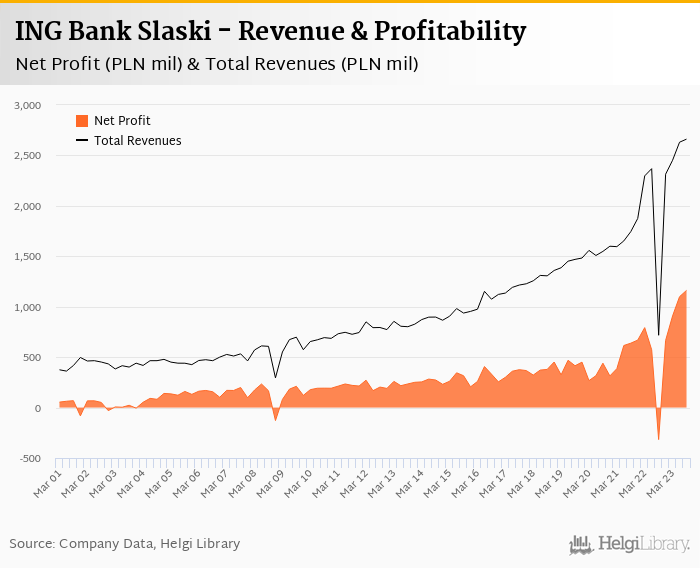

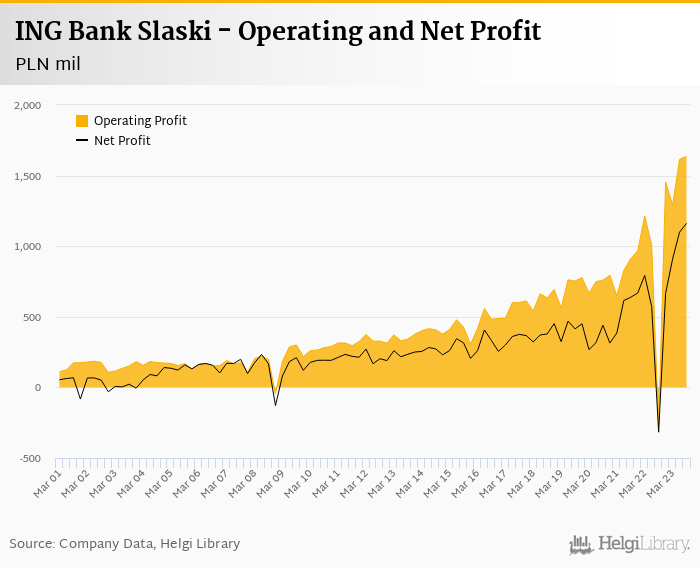

ING Bank Slaski rose its net profit 28.4% to PLN 1,162 mil in 3Q2023 when adjusted for last year's credit moratoria and generated ROE of 33.0%.

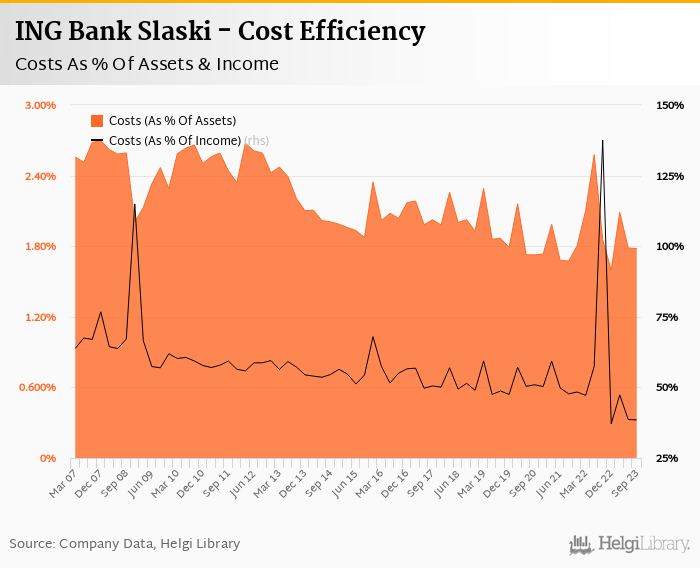

Revenues increased 13.3% yoy when adjusted and cost rose 3.86%, so cost to income decreased to 38.5%

Solid results with record quarterly operating and net profitability, though partly expected by the market. Trading at adj. PBV of 1.4x and PE of 9.0x expected in 2024, ING Slaski continues to trade with a premium for its quality.

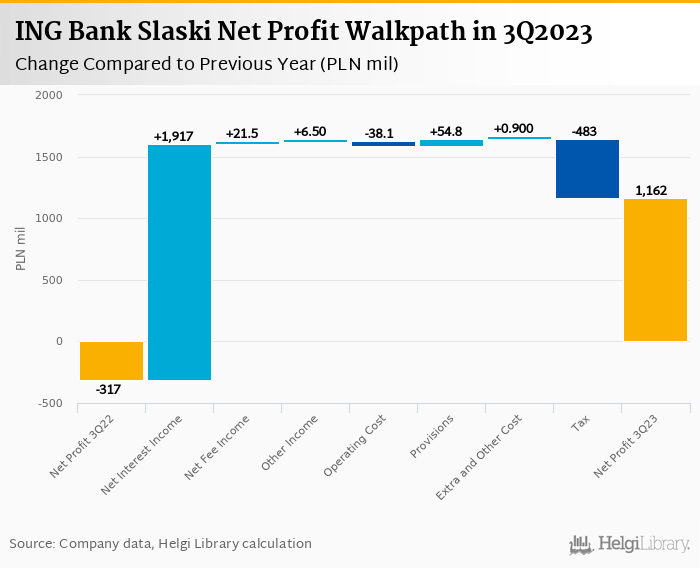

ING Bank Slaski made a net profit of PLN 1.16 bil in the third quarter of 2023, up 466% yoy (or app. 28% when adjusted for last year's credit moratoria). Some 85% of the adjusted profit improvement came from the higher net interest income, though both fee as well as trading income added their bits. Also, good cost control and lower provisioning helped the bottom line in the third quarter when compared to last year:

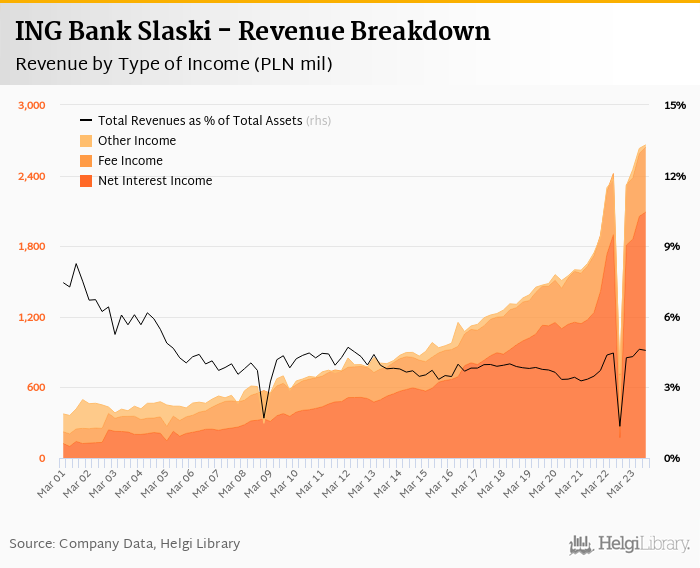

Revenues increased 13.3% yoy when adjusted to PLN 2.67 bil in the third quarter of 2023. Net interest income generated over 90% of the revenue growth supported by higher margins. But fee income (up 4.1% yoy) and other income (up PLN 7 mil yoy) delivered their part too. When compared to three years ago, revenues were up by 72%:

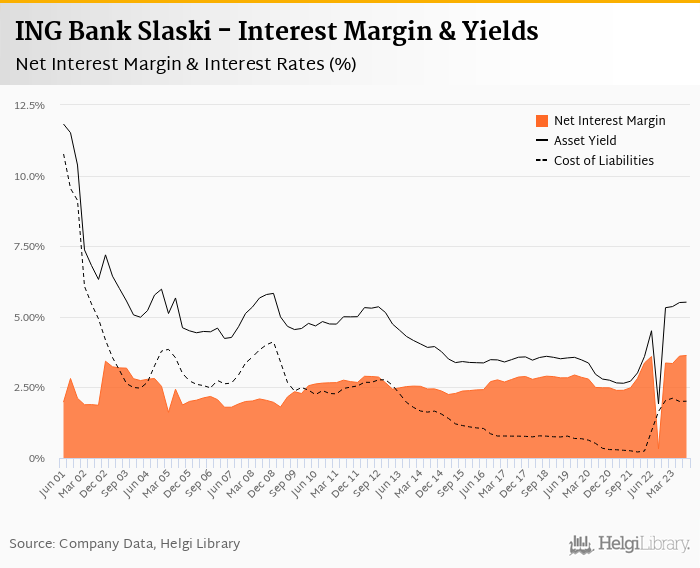

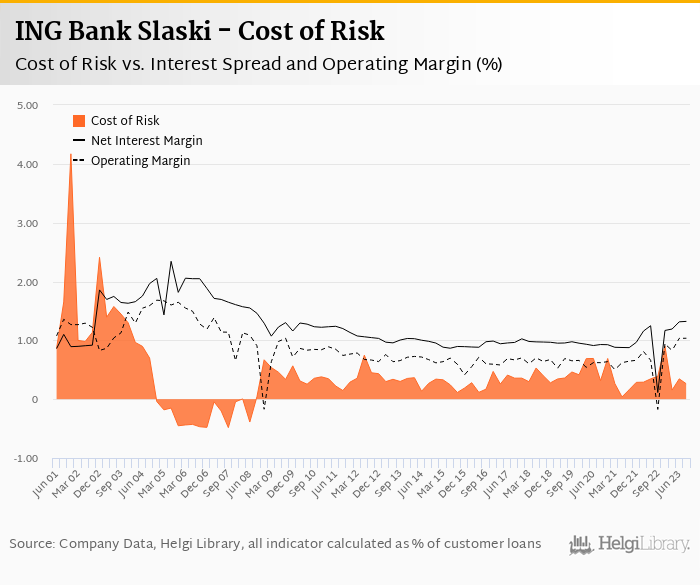

Net interest margin increased 24 pp to 3.63% of total assets (and 2 pp qoq). Average asset yield was 5.52% in the third quarter of 2023 (up from adjusted 5.32% a year ago) while cost of funding amounted to 2.01% in 3Q2023 (up from 1.65%). Both interest margin and spread stabilised at a level seen in the previous quarter suggesting the margin has been already peaking, so watch closely for the development in the coming quarters:

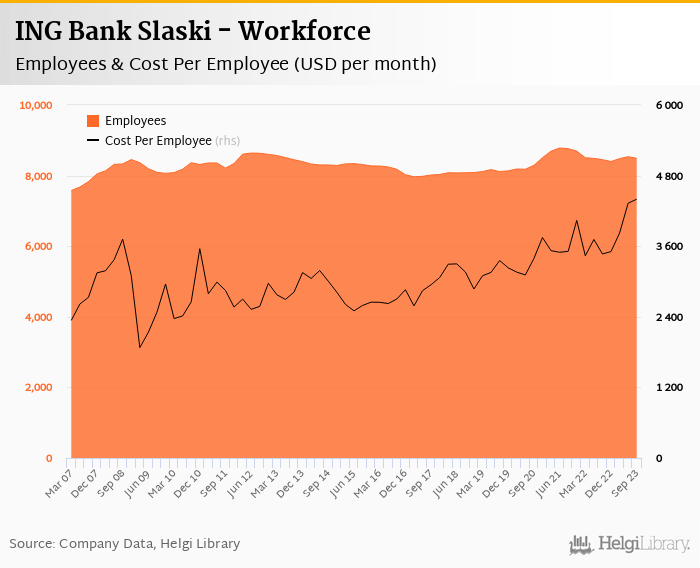

Costs increased by 3.9% yoy (and by 6.6% when adjusted for contribution to the Bank Guarantee Fund) and the bank operated with cost to income of 38.5% in the last quarter. Staff cost rose 14.4% as the bank added 38 people, or 0.5% yoy increase (total of 8,490 persons. Further 4 branches have been closed in the third quarter, which means Bank's branch network is almost a tenth lower when compared to last year (214 branches) :

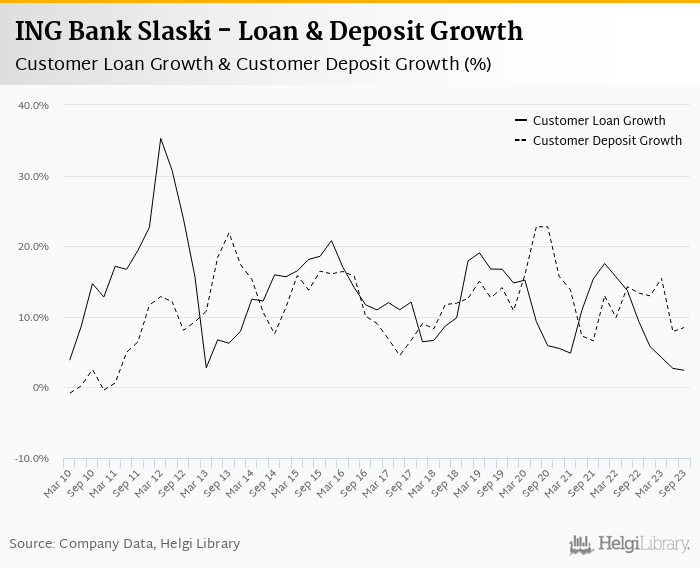

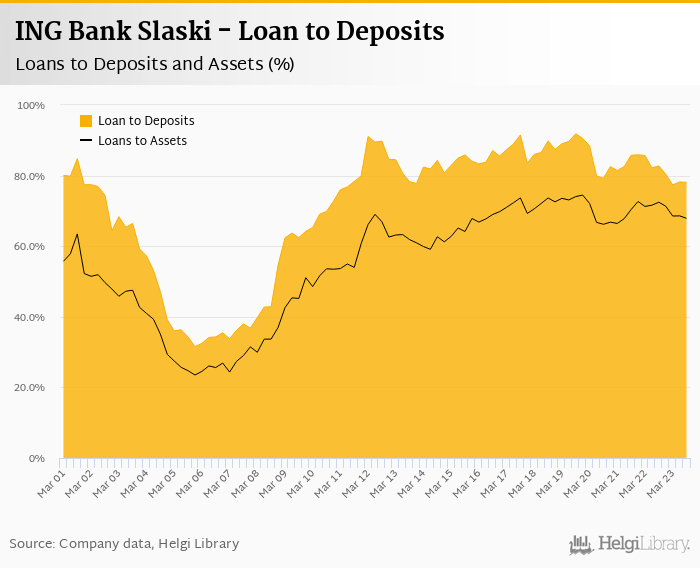

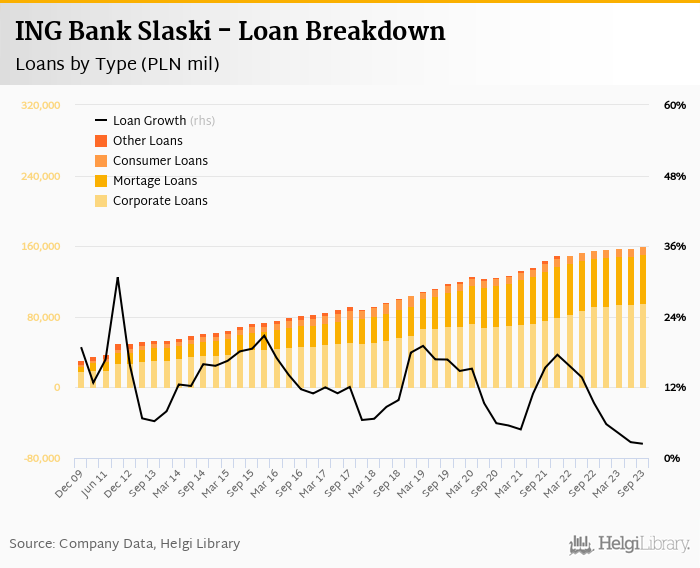

A small growth in loans has been seen in the third quarter with 1.2% qoq and 2.4% yoy while customer deposits grew stronger at 1.34% qoq and 8.5% yoy. That’s compared to average of 9.0% and 11.6% average annual growth seen in the last three years.

At the end of third quarter of 2023, ING Bank Slaski's loans accounted for 78.1% of total deposits and 67.9% of total assets.

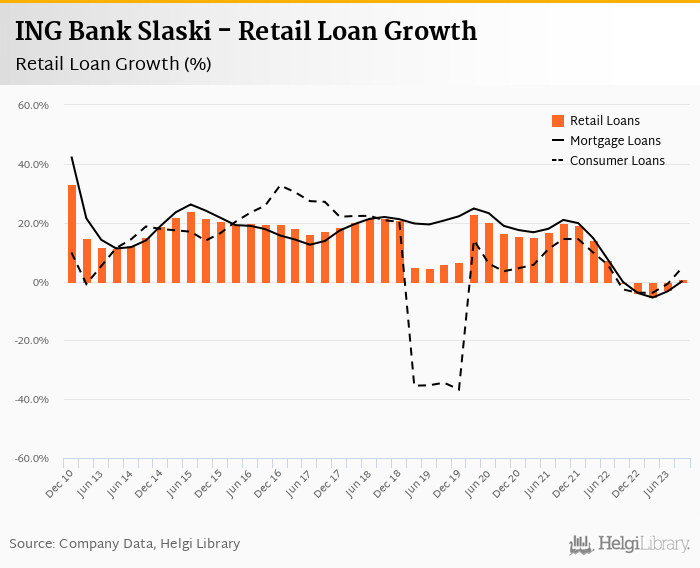

Retail loans grew 1.2% qoq and were 0.81% up yoy while corporate loans increased 1.5% qoq and 4.2% yoy, respectively. Mortgages represented 35.2% of the ING Bank Slaski's loan book, consumer loans added a further 5.8% and corporate loans formed 60.4% of total loans:

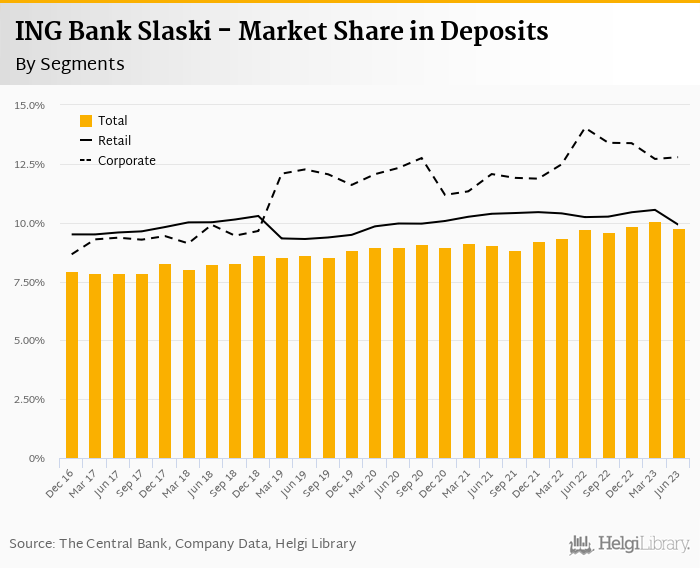

Based on the preliminary data, we estimate that ING Bank Slaski has grown faster in retail loans and deposits in the third quarter when compared to the sector while losing some of the share in the corporate segment:

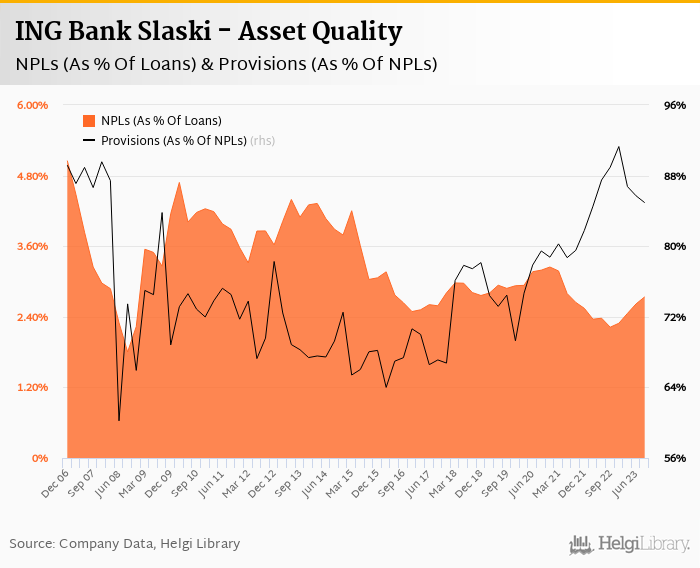

ING Bank Slaski's non-performing loans increased by further PLN 248 mil in the third quarter and reached 2.74% of total loans, up from 2.22% when compared to the previous year. Provisions covered some 84.9% of NPLs at the end of the third quarter of 2023.

No provisions have been created for the FX mortgage saga in 2023 since the Bank's coverage is already high at 90% and risk exposure is relatively small at below PLN 600 mil.

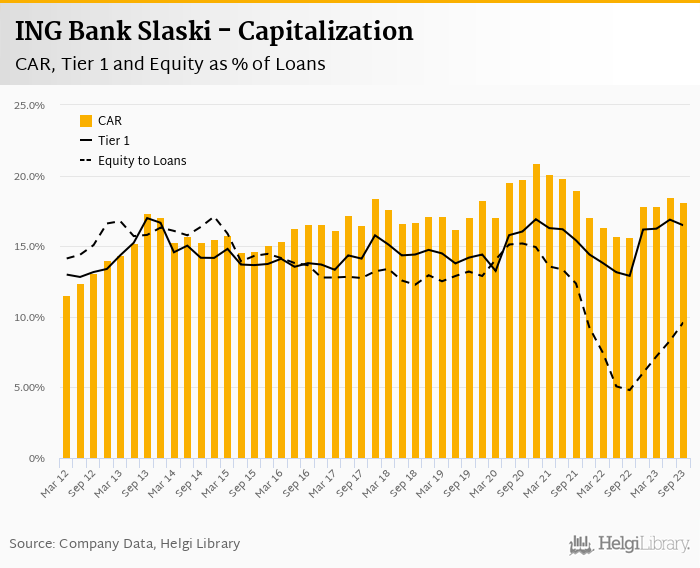

Capital adequacy ratio reached 18.1% in the third quarter of 2023, up from 15.7% for the previous year. The Tier 1 ratio amounted to 16.5% at the end of the third quarter of 2023 while bank equity accounted for 9.60% of loans:

Overall, ING Bank Slaski made a net profit of PLN 1.16 bil in the third quarter of 2023, up 28.4% yoy when adjusted for the credit moratoria in the third quarter of 2022. This means impressive annualized return on equity of 33.0% in the last quarter or 31.5% when the last four quarters are taken into account:

Strong results though already expected by the market. The Bank trades at relatively high PBV of 1.9x (or rather 1.4-1.5x thanks to revaluation gains on bond portfolio sitting in Bank's equity) and PE of around 9.0x expected in 2024.

With ROE of over 30%, cost to income at below 40%, strong retail base and growing market share, that's what you pay for quality.