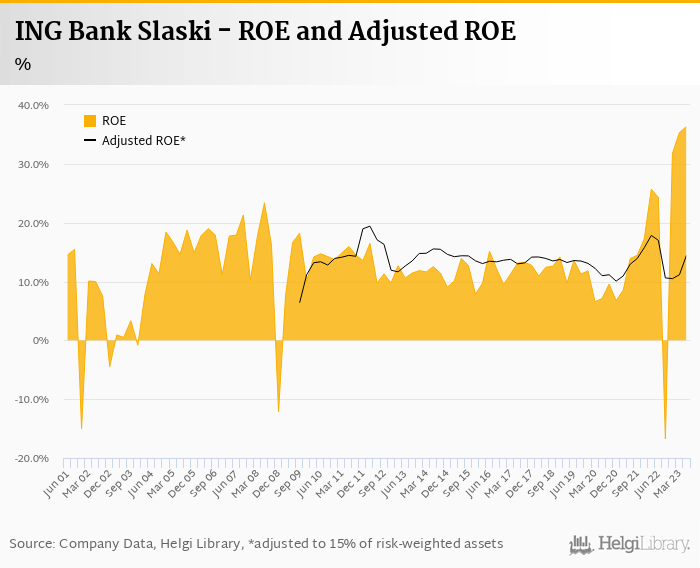

ING Bank Slaski almost doubled its net profit to PLN 1.1 bil in 2Q2023 and generated ROE of 36.3%.

Strong operating profitability with cost to income at to 39% as revenues rose 11% yoy and cost increased 9% when adjusted

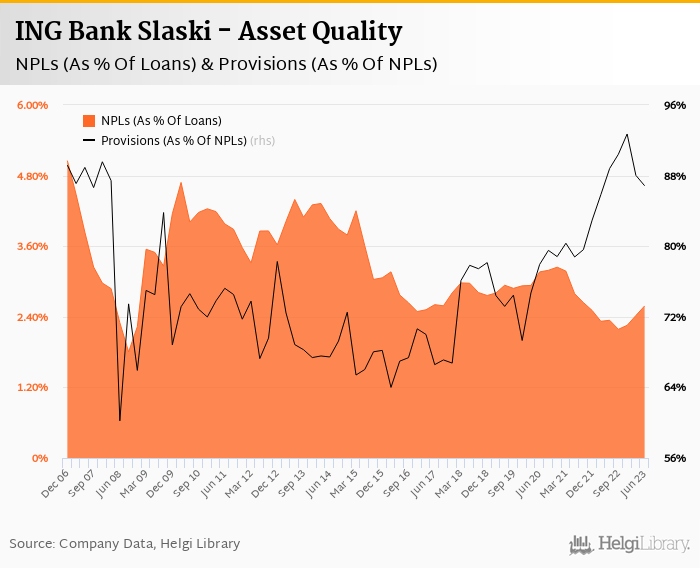

Bad loans rose to 2.59% of total loans and cost of risk amounted 0.50%, but provision coverage remains solid

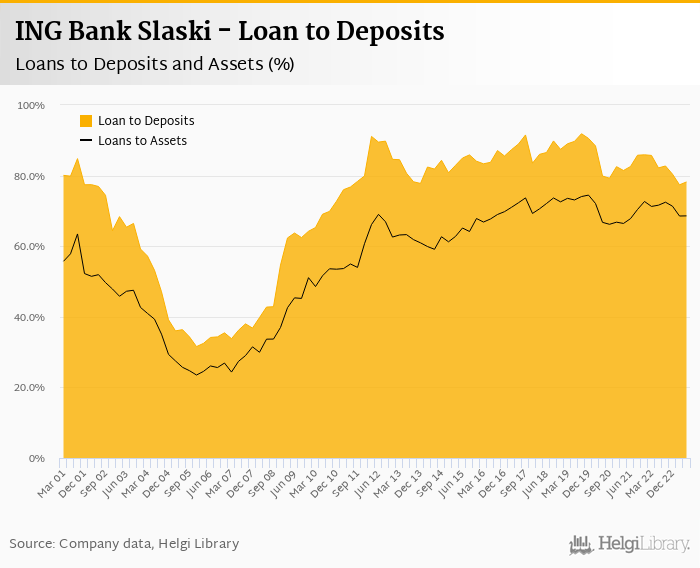

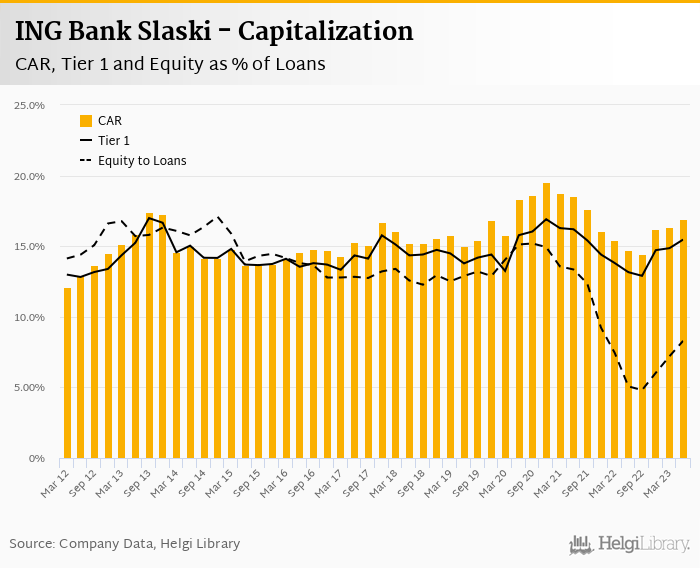

With loan to deposit at 78% and capital adequacy at 17.0%, the Bank has a plenty of room to continue strenghtening its market position

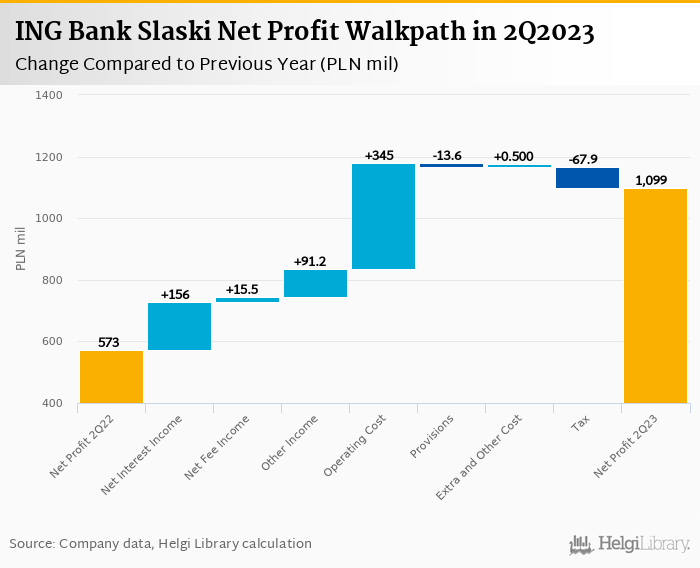

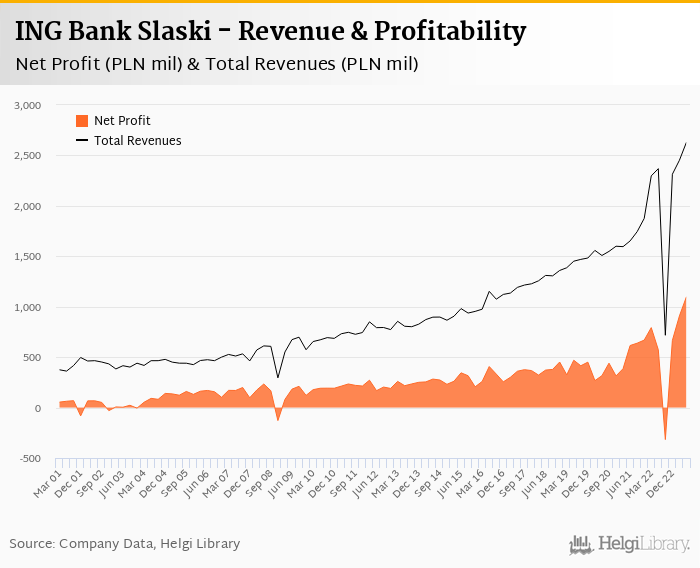

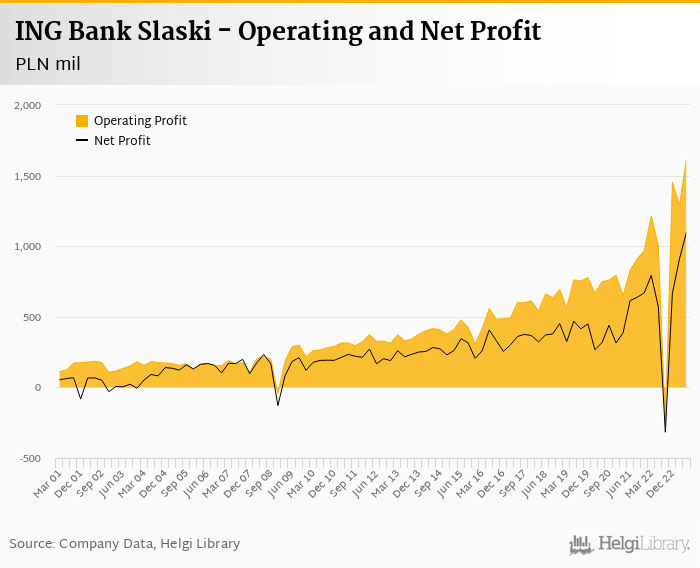

ING Bank Slaski made a net profit of PLN 1,099 mil in the second quarter of 2023, up 92% yoy, or increase of PLN 526 mil in absolute terms. Most of the improvement came from an absence of contribution to the Commercial Banks Protection System (PLN 429.8 mil in 2Q22), though operating profit and pre-tax profit would still grow 12-13% yoy when adjusted. Strong interest and other income and relatively good cost control are behind the improvement when compared to last year::

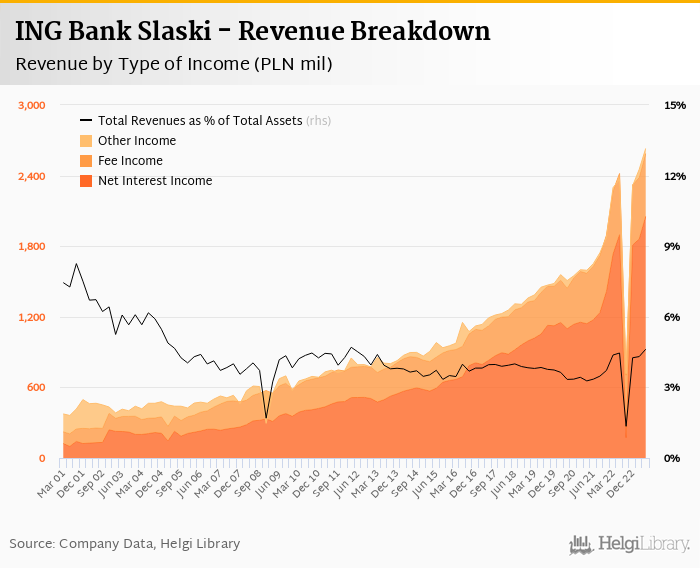

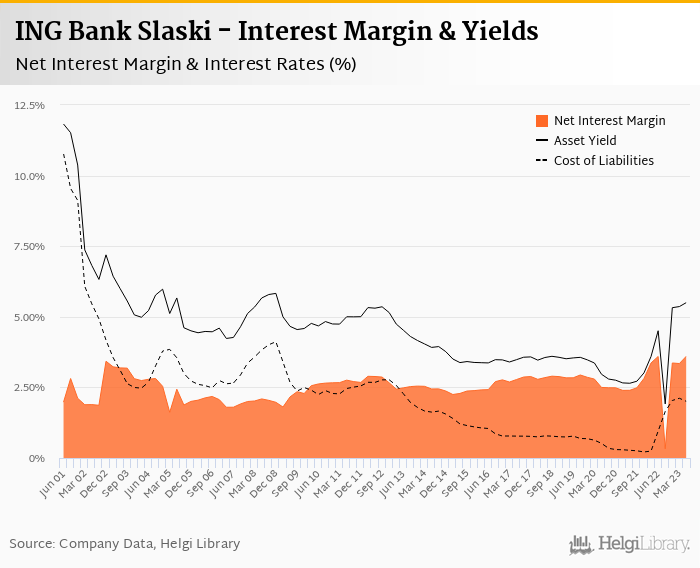

Revenues increased 11.1% yoy to PLN 2,631 mil in the second quarter of 2023. Net interest income rose 8.2% yoy as net interest margin improved 0.013 pp to 3.61% of total assets. Fee income grew 3.0% yoy on higher volumes while other income improved due to a lack of last year's revaluation of currency derivatives mostly . When compared to three years ago, revenues were up 74.5%:

Average asset yield was 5.5% in the second quarter of 2023 (up from 4.5% a year ago) while cost of funding amounted to 2.0% in 2Q2023 (up from 0.953%). The net interest margin improved 0.026 pp when compared to previous quarter when both, spreads on loans as well as deposits improved.

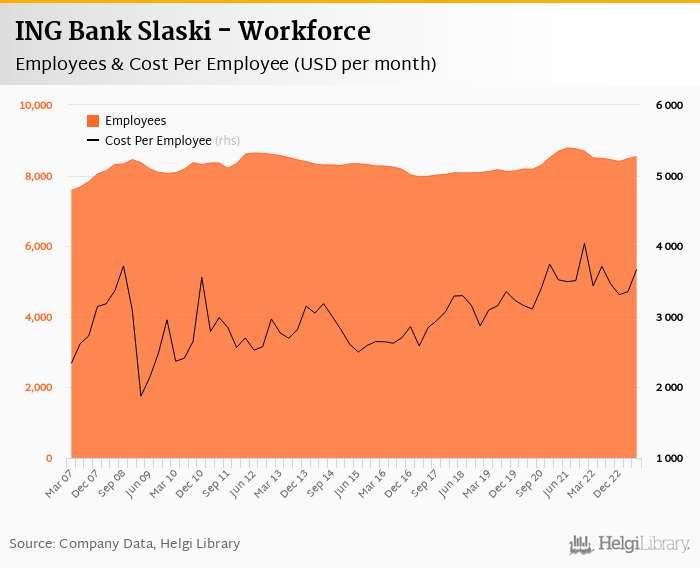

Costs decreased by 25.4% yoy and the bank operated with average cost to income of 38.6% in the last quarter. When adjusted for the contribution to the Commercial Bank Protection System (or an absence of it when compared to PLN 429.8 mil booked in 2Q22), costs have rose 9.1% yoy. Staff cost rose 13.7% as the bank employed 8,536 persons (unchanged yoy) and the Bank increased wages in April, but most other costs rose below inflation:

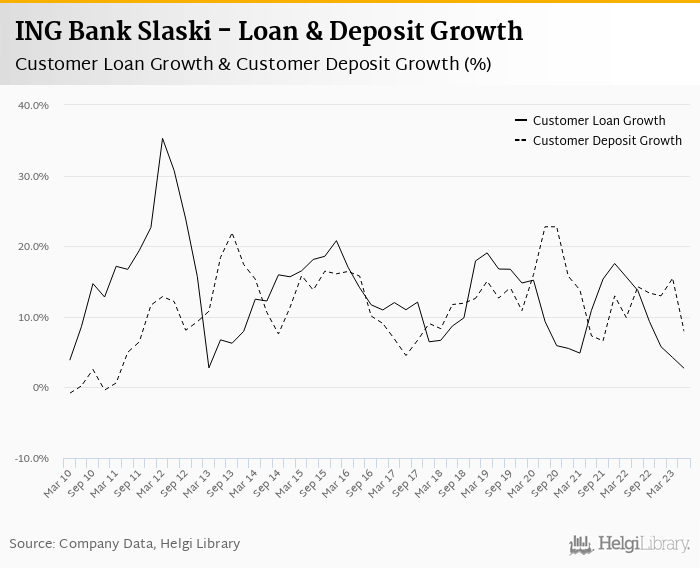

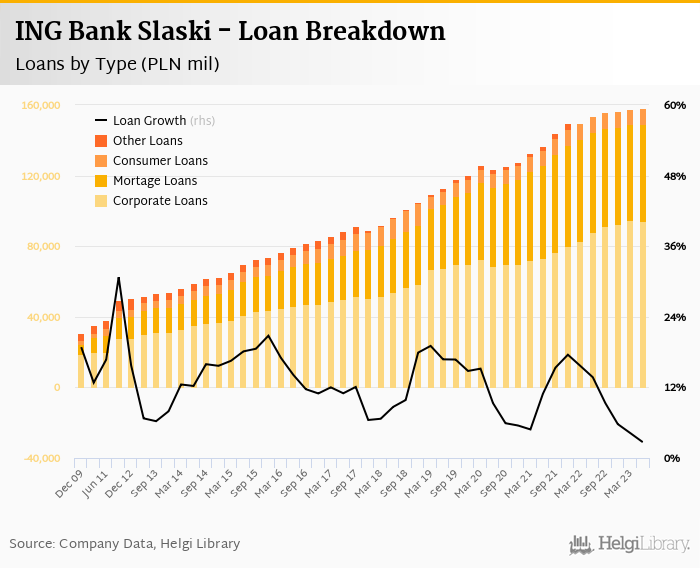

Loans and deposits changed little in 2Q23. Customer loans grew 0.1% qoq and 2.7% yoy in the second quarter of 2023 while customer deposit fell 0.95% qoq and increased 7.9% yoy when compared to last year. That’s compared to average of 9.3% and 12.8% average annual growth seen in the last three years.

At the end of second quarter of 2023, ING Bank Slaski's loans accounted for 78.2% of total deposits and 68.6% of total assets..

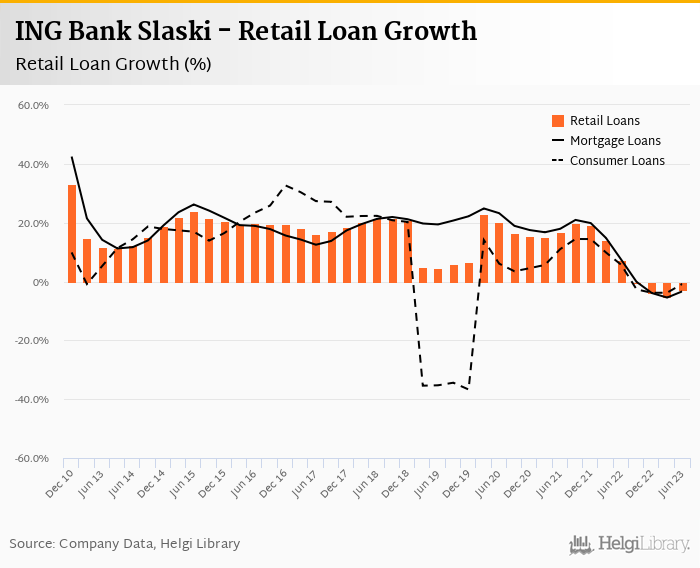

Retail loans grew 0.89% qoq and were 3.0% up yoy. They accounted for 40.9% of the loan book at the end of the second quarter of 2023 while corporate loans decreased 0.470% qoq and 7.19% yoy, respectively. Mortgages represented 35.2% of the ING Bank Slaski's loan book, consumer loans added a further 5.72% and corporate loans formed 60.3% of total loans:

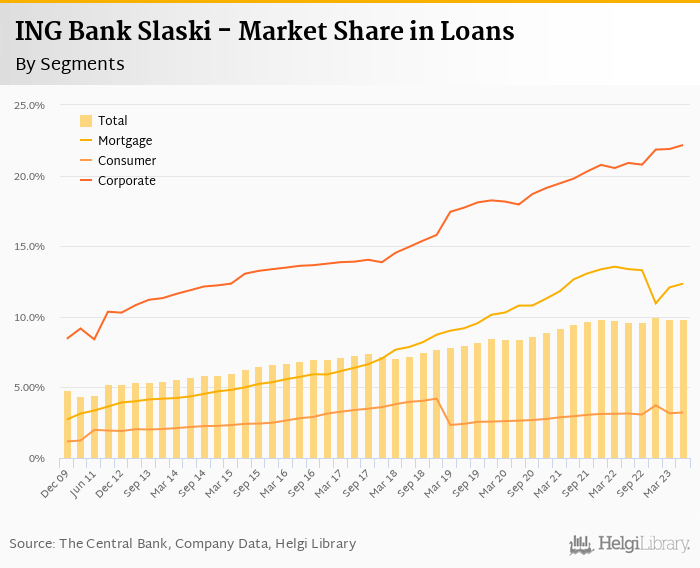

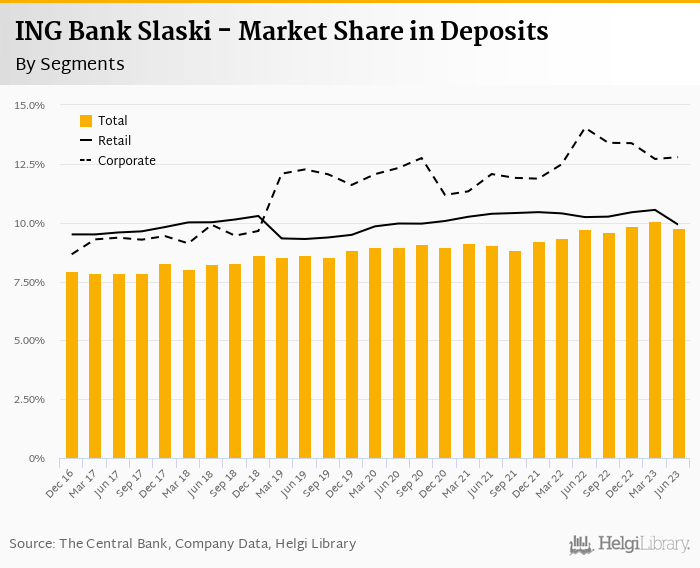

We estimate that ING Bank Slaski has gained 0.208 pp market share in the last twelve months in terms of loans (holding 9.9% of the market at the end of 2Q2023). On the funding side, the bank seems to have gained 0.031 pp and held 9.8% of the deposit market:

NPLs increased further PLN 261 mil in 2Q23 and non-performing loans reached 2.59% of total loans, up from 2.34% when compared to the previous year. Provisions covered some 86.9% of NPLs at the end of the second quarter of 2023, down from 88.8% for the previous year. The Bank hasn’t added any provisions for its CHF-mortgage loans in 2023. The provisions created cover relatively high 89% since the end of 2022.

Provisions have therefore "eaten" some 12.2% of operating profit in the second quarter of 2023 as cost of risk reached 0.50% of average loans:

ING Bank Slaski's capital adequacy ratio reached 17.0% in the second quarter of 2023, up from 14.7% for the previous year. The Tier 1 ratio amounted to 15.5% at the end of the second quarter of 2023 while bank equity accounted for 8.3% of loans:

Overall, ING Bank Slaski made a net profit of PLN 1,099 mil in the second quarter of 2023, up 91.9% yoy. This means an annualized return on equity of 36.3%, or 14.4% when equity "adjusted" to 15% of risk-weighted assets:

Solid set of results beating slightly market expectations. Better than expected net interest income from both, loans as well as deposit margins alongside good cost control, when adjusted for contribution to Guarantee Fund last year. Ongoing pressure on the asset quality and a lack of volume growth seems to be issued to watch for.

With PE of around 8.0x and PBV of around 2.0x, Bank Slaski remains one of the most expensive Polish banks. With ROE of over 30%, cost to income at below 40%, strong retail base and growing market share, that's what you pay for quality.