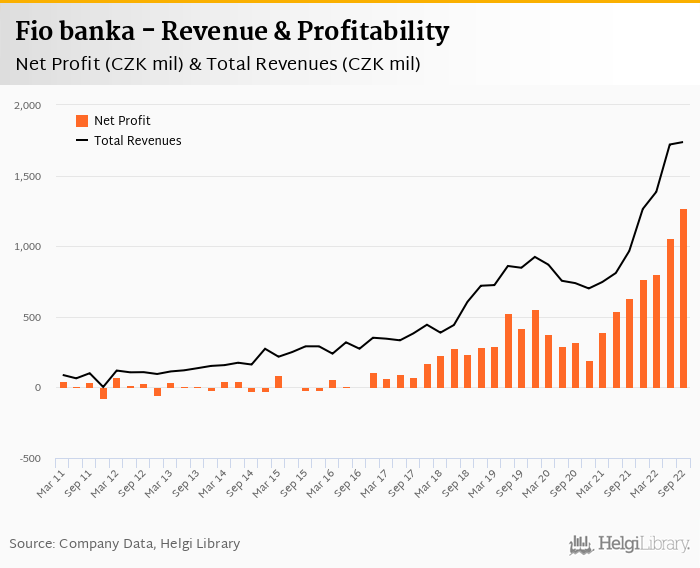

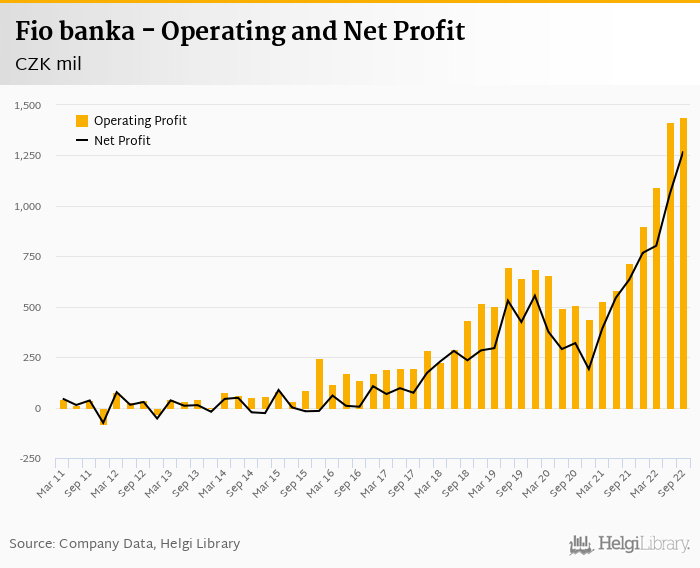

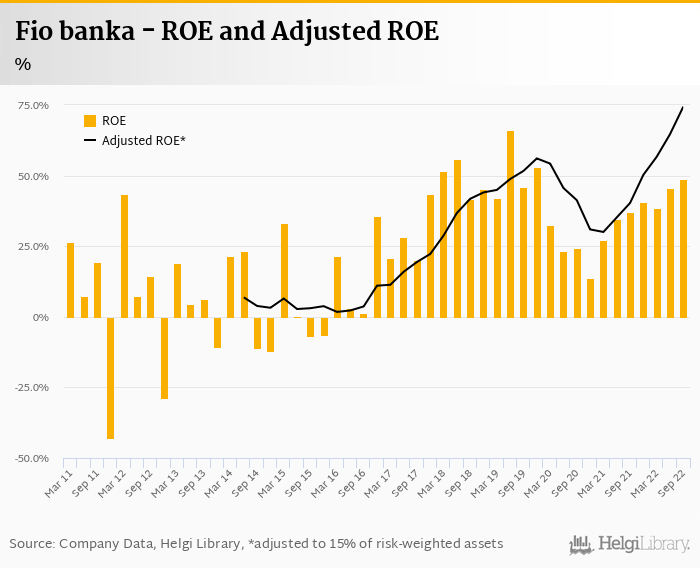

Fio banka has doubled its net profit to CZK 1.27 bil in 3Q22 generating ROE of 48.7%.

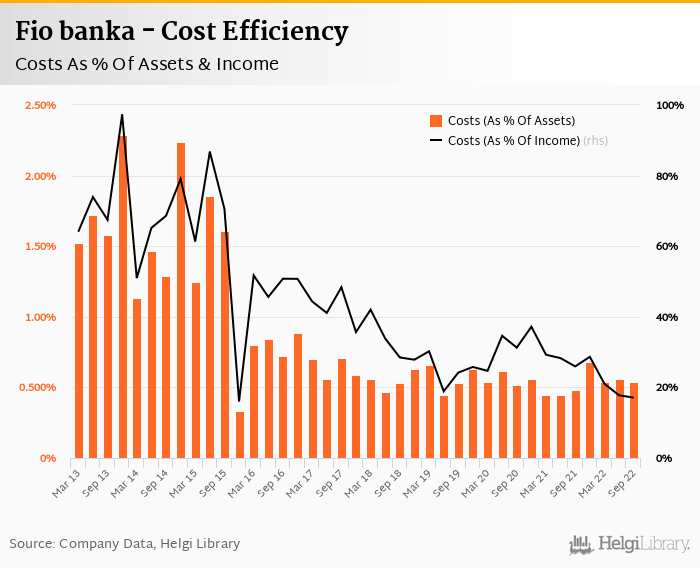

Revenues increased 79.8% yoy and cost rose 18.6%, so cost to income decreased to 17.1%

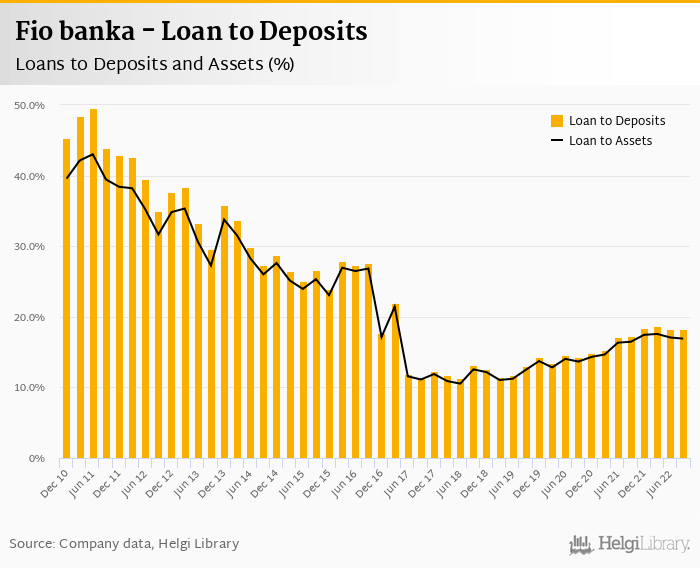

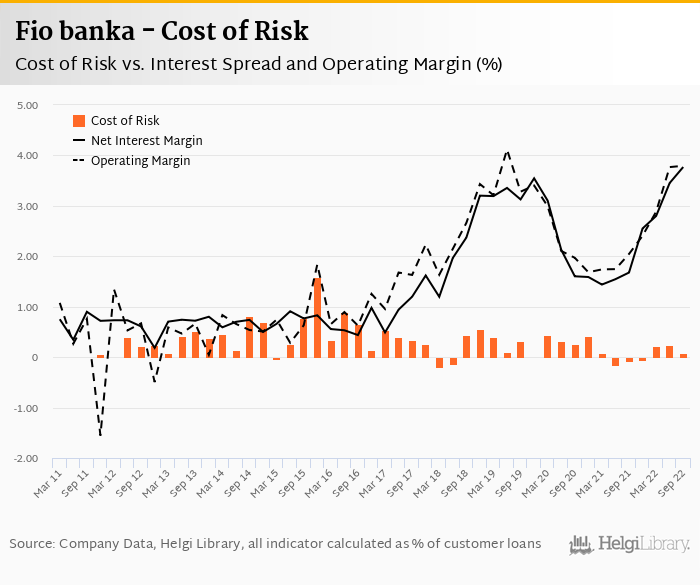

Cost of risk amounted 0.517% and loans to deposit ratio increased to 18.2%

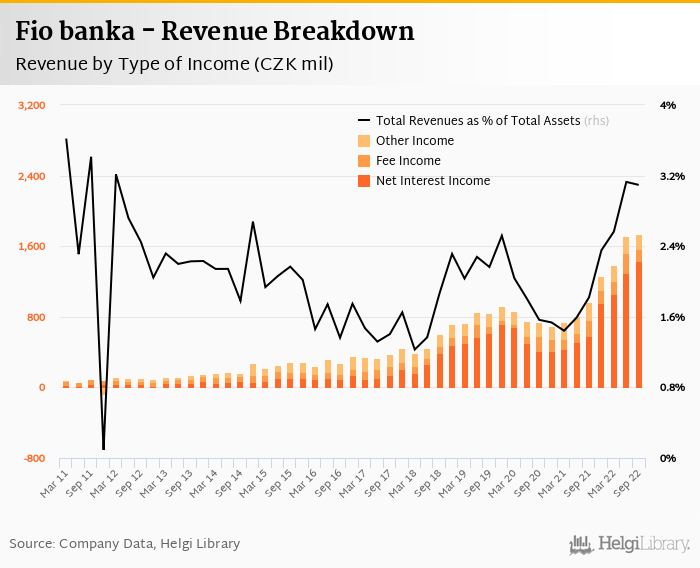

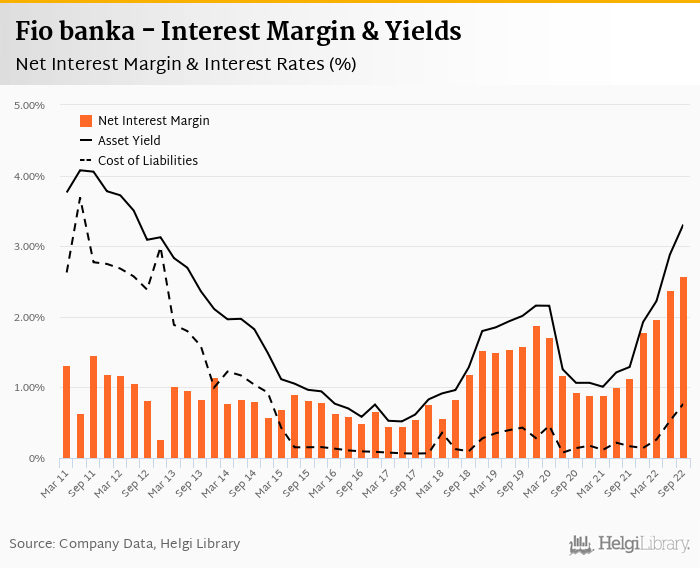

Revenues increased 79.8% yoy to CZK 1,738 mil in the third quarter of 2022 driven mainly by rising interest rates. Net interest income rose 144% yoy and formed 82.4% of total with net interest margin increasing 1.45 pp to 2.58% of total assets. Fee income fell 23.8% yoy and added a further 7.60% to total revenue while trading income fell CZK 32 mil compared to last year. When compared to three years ago, revenues were up 105%:

Average asset yield was 3.31% in the third quarter of 2022 (up from 1.29% a year ago) while cost of funding amounted to 0.767% in 3Q2022 (up from 0.167%).

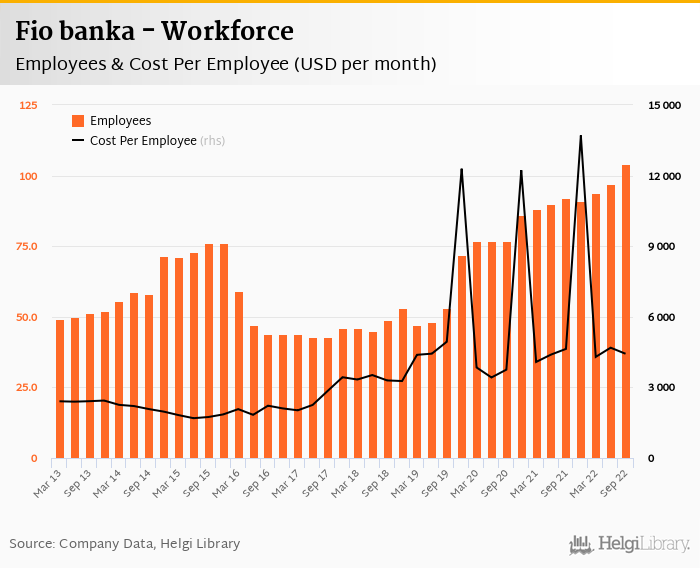

Although costs increased by 18.6% yoy, the bank operated with hard-to-believe cost to income of 17.1% in the last quarter. Staff cost rose 20.7% as the bank employed 104 persons (up 13.0% yoy) and the Bank paid CZK 107,548 per person per month including social and health care insurance cost:

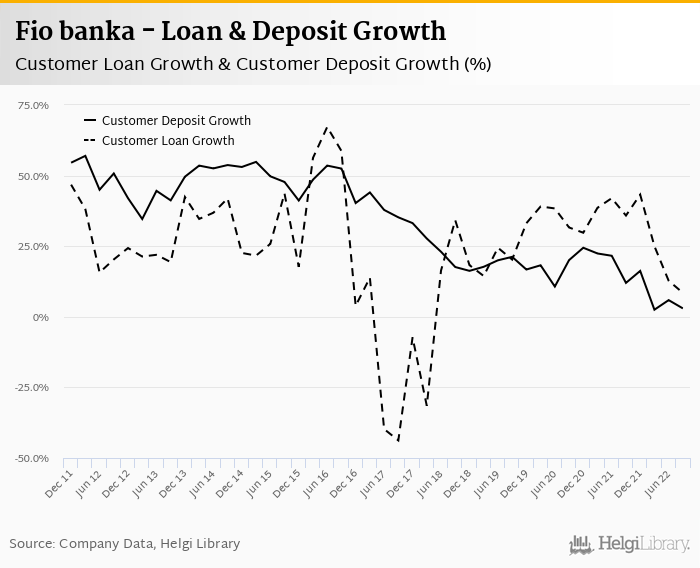

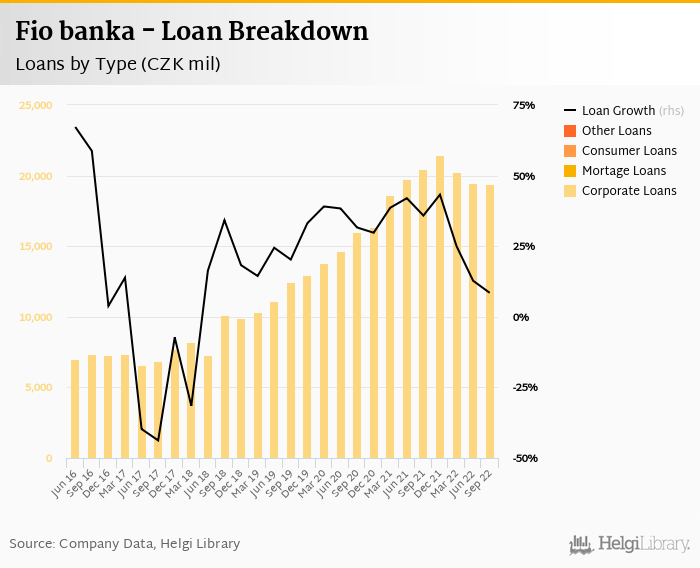

We assume Fio banka's customer loans grew 1.14% qoq and 8.48% yoy in the third quarter of 2022 while customer deposit growth amounted to 1.10% qoq and 2.98% yoy. That’s compared to average of 31.5% and 14.5% average annual growth seen in the last three years.

At the end of third quarter of 2022, Fio banka's loans accounted for 18.2% of total deposits and 16.9% of total assets.

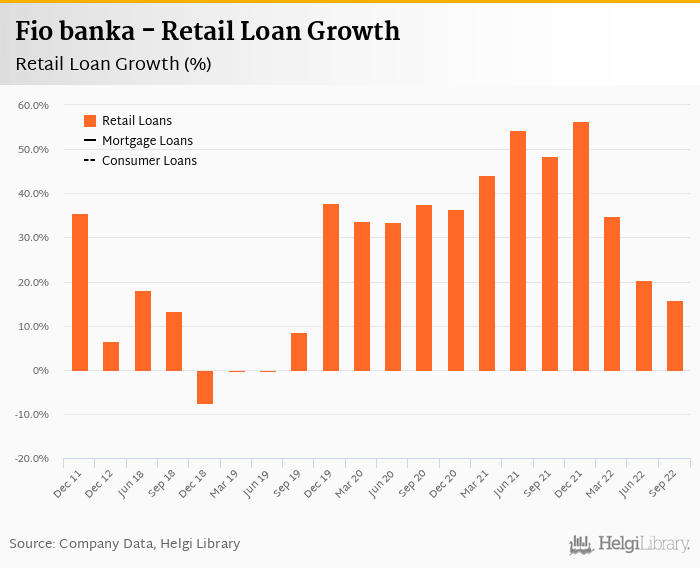

With no official details, we assume retail loans grew 3.07% qoq and were 15.7% up yoy. They accounted for 44.2% of the loan book at the end of the third quarter of 2022. We expect corporate loans decreased around 5.0% yoy and formed 51.1% of total loans:

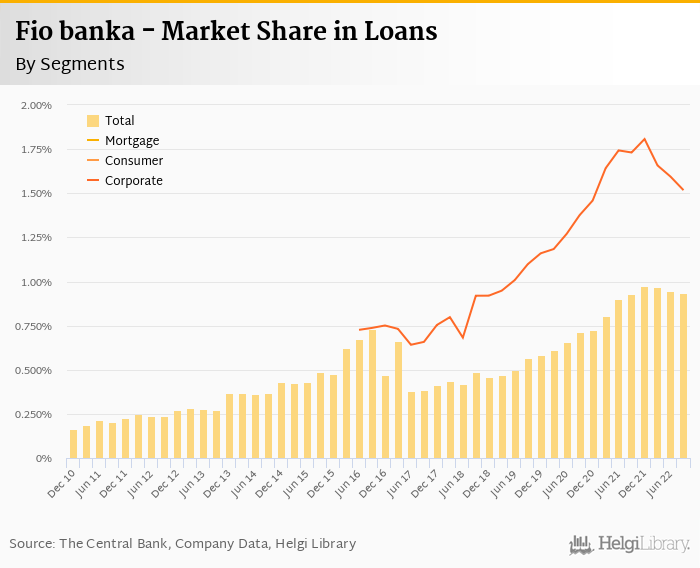

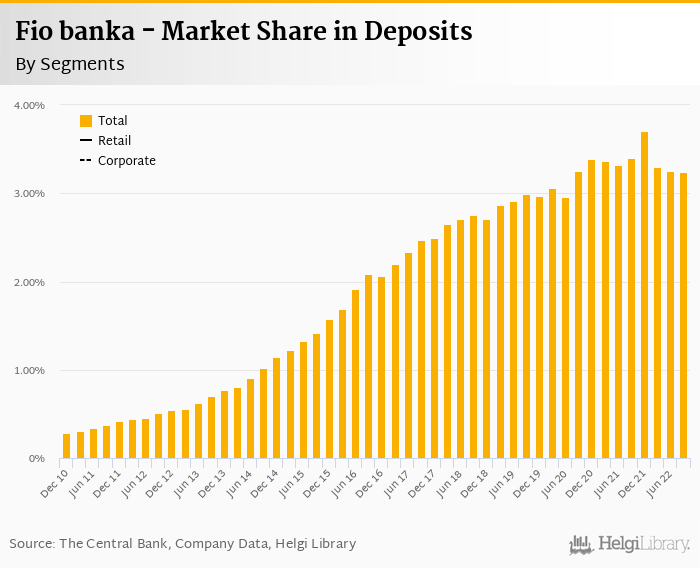

We estimate that Fio banka has gained 0.01 pp market share in the last twelve months in terms of loans (holding 0.934% of the market at the end of 3Q2022). On the funding side, the bank seems to have lost 0.15 pp and held 3.25% of the deposit market:

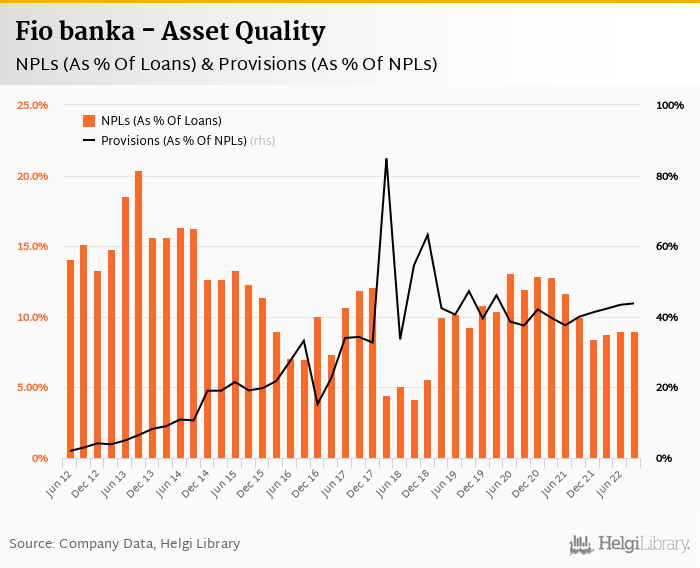

Cost of risk reached 0.52% of average loans in the third quarter and provisions have "eaten" some 3.39% of operating profit in the third quarter of 2022. With no other official details regarding asset quality, we believe Fio Banka's non-performing loans reached 8.5-9.5% of total loans, down from 10.0% when compared to the previous year. Provisions coverage might account for 40-50% of NPLs on our estimates:

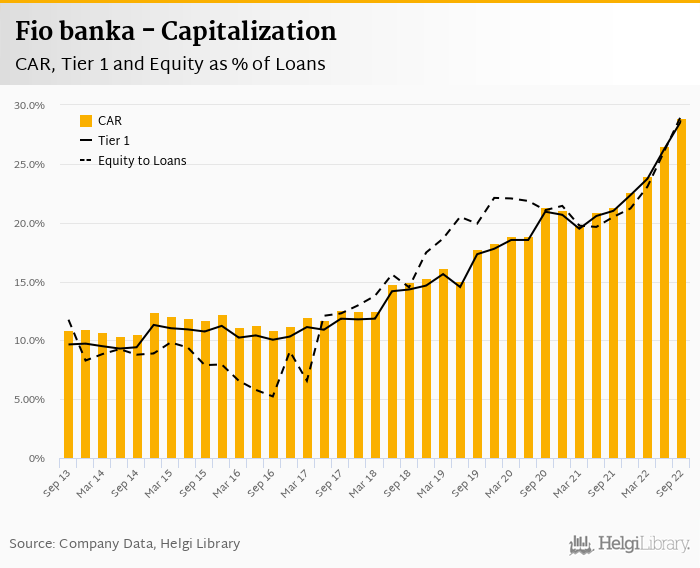

With no details provided since the end of 2021, we estimate Fio banka's capital adequacy ratio reached 28-29% in the third quarter of 2022, up from 21.3% for the previous year while bank equity accounted for 29.2% of loans:

Fio banka made a net profit of CZK 1,270 mil in the third quarter of 2022, up 100% yoy. Operating profit also more than doubled and the Bank recorded the best quarterly results in its history (beating its previous high from last quarter). This means an impressive return on equity of 48.7%, or 74.4% when equity "adjusted" to 15% of risk-weighted assets:

Another impressive set of results in 3Q2022 beating its previous best from last quarter. The Bank clearly benefits from higher interest rates while cost side and asset quality remain under good control.

Details on asset quality and breakdown of loan book and deposits will be interesting to watch when the Bank publishes its full year results due partly to a declining market share the Bank has been witnessing this year.