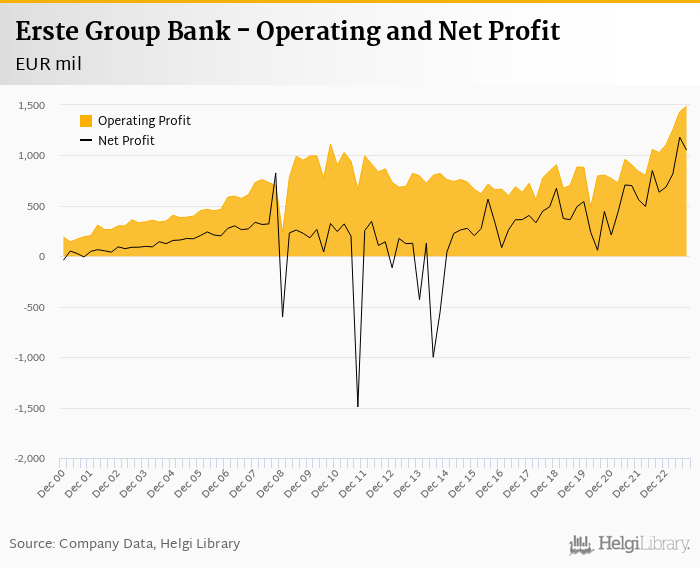

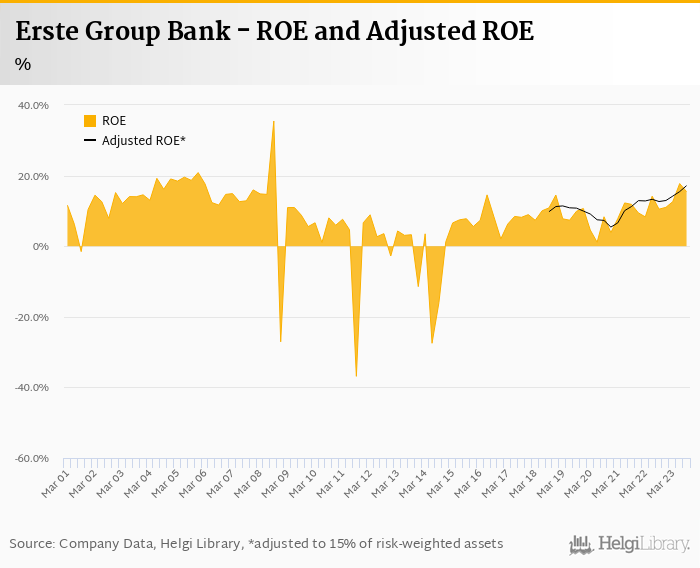

Erste Group Bank beat again market expectations in 3Q2023 with net profit rising 61% to EUR 820 mil and ROE accounting for ROE of 15.5%.

Revenues increased strong 27% yoy driven by rising margin, but fee as well as other income performed strongly

Austria remains the main driver recording historical profits. In the last two quarters, it generated 45% of the Group overall profitability

Trading at PE of around 7.0x, PBV of 0.7x and expected in 2024 and offering potential dividend yield of 8-10%, Erste Bank looks as one of the most attractive banking stocks in the CEE.

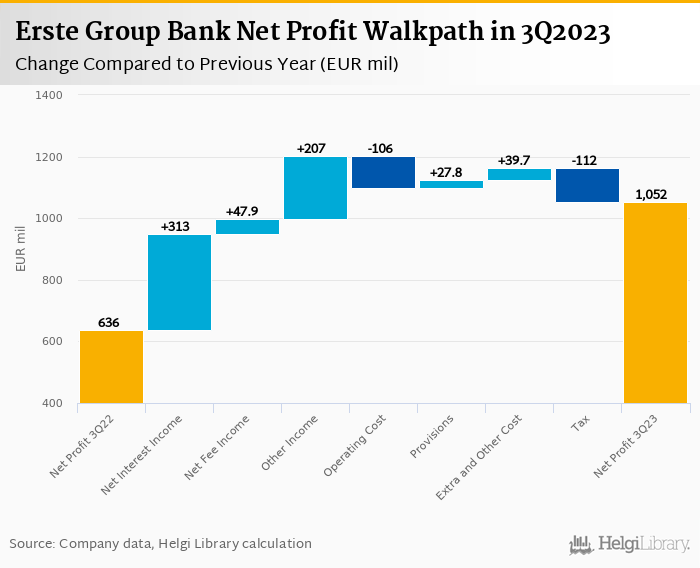

Erste Group Bank made a net profit of EUR 820 mil in the third quarter of 2023, up 60.7% yoy and beating market expectations again by around 8%. Most of the surprises came from the revenue side, which was strong across the board from interest, fees to other income. Austrian business remains the driver of the profit improvement when compared to last year (up 80% yoy in 3Q2023):

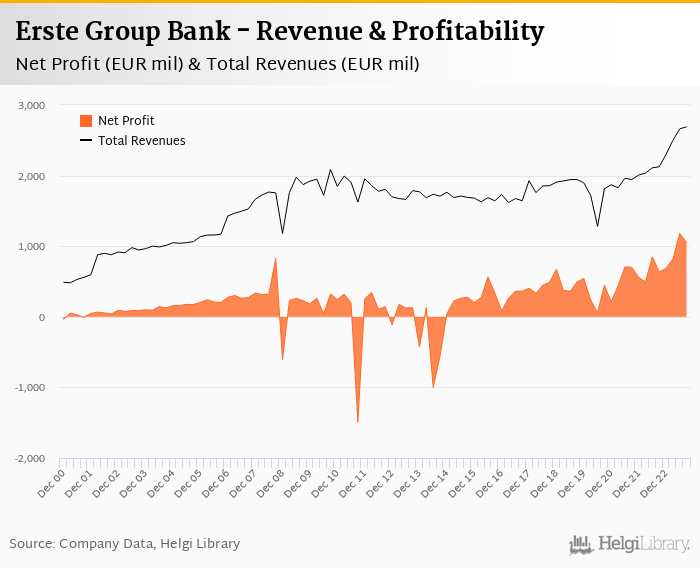

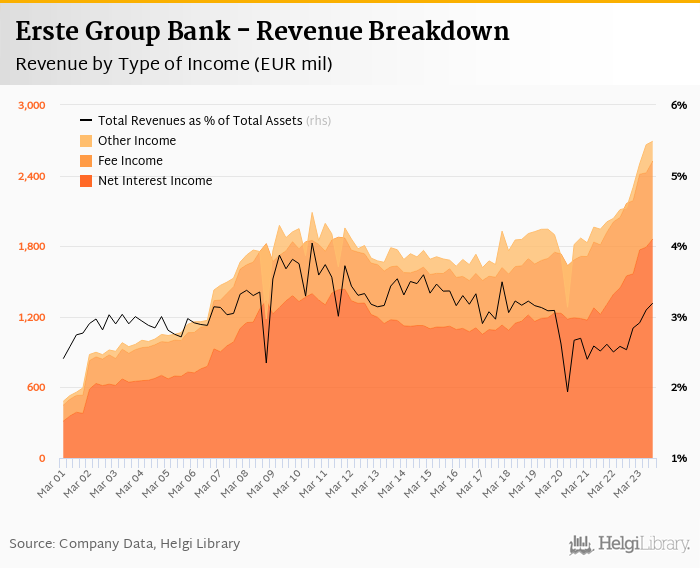

Revenues increased 26.7% yoy to EUR 2.69 bil in the third quarter of 2023 driven by net interest income (up 20.2% yoy), accelerating fee income (up 7.8% yoy) and strong other income (up EUR 200 mil yoy) thanks mainly to absence of last year losses. When compared to three years ago, revenues were up 48.4%:

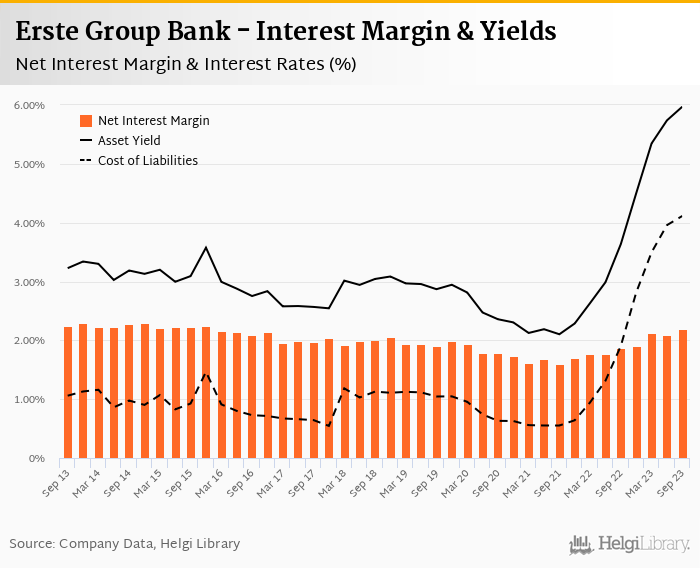

Net interest margin continued improving to 2.19% (up from 2.09% last quarter and 1.87% seen a year ago). While interest margins seem to have stabilised in the CEE region, Austrian spreads continue to improve, and a lot. Austria's net interest margin reached 1.85% in 3Q23, up from 1.20% a year ago and 1.07% in 2021!

Average asset yield was 5.97% in the third quarter of 2023 (up from 3.64% a year ago) while cost of funding amounted to 4.11% in 3Q2023 (up from 1.91%).

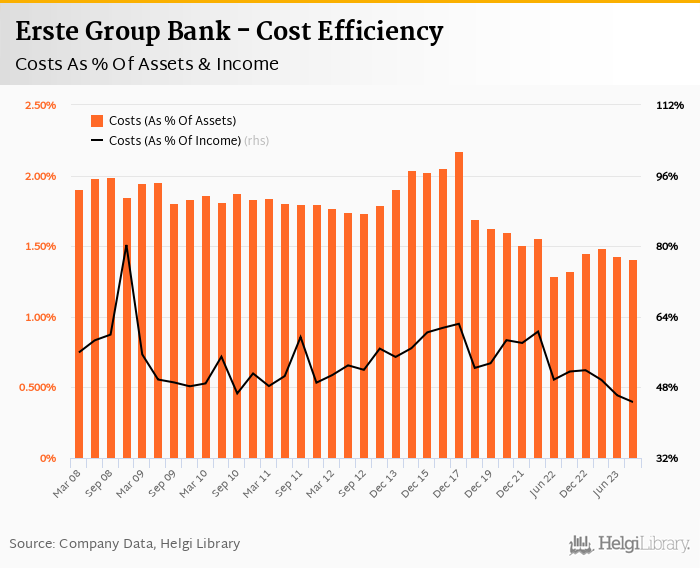

Costs increased by 9.7% yoy and the bank operated with average cost to income of 44.7% in the last quarter. Again, the best figure seen for the last 20 years. In Austria itself, cost to income touched 40% in 3Q2023.

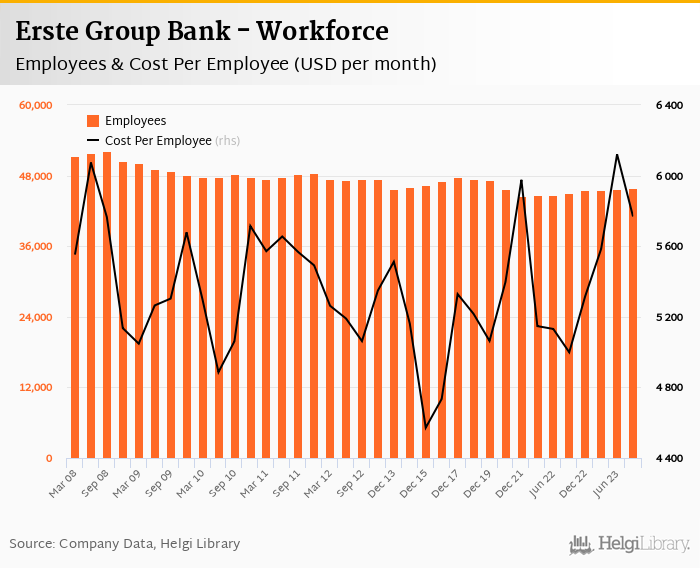

Workforce stagnates at around 44-45,000 persons (up 1.8% yoy) and some 64 branches have been closed within the last twelve months (3.1% yoy), so no aggressive cost cutting have been made within thr Group:

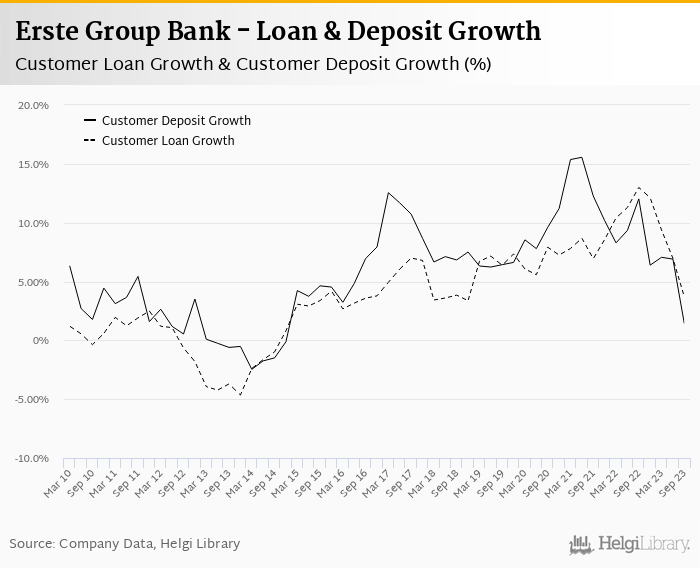

Demand for lending remains low alongside high interest rates (up 0.62% qoq and 3.7% yoy in the third quarter of 2023) while customer deposits fell 2.2% qoq and were up only 1.43% yoy. That’s compared to average of 8.84% and 9.67% average annual growth seen in the last three years.

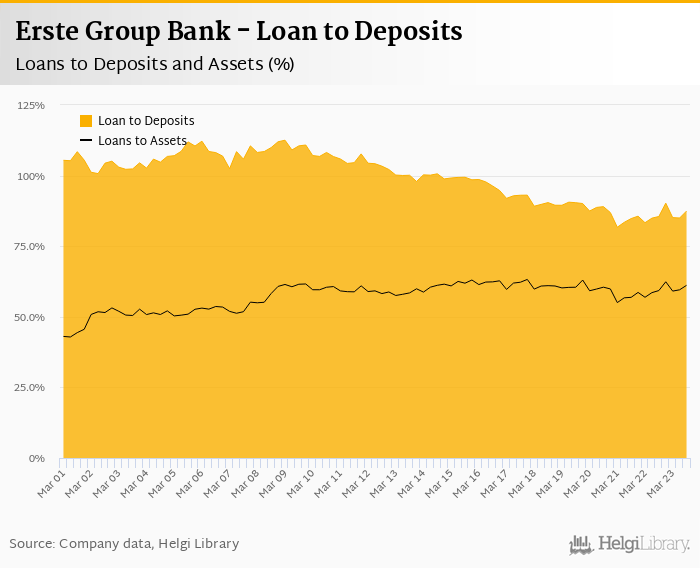

At the end of third quarter of 2023, Erste Group Bank's loans accounted for 87.4% of total deposits and 61.1% of total assets.

Retail loans were flattish and accounted for 49.1% of the loan book at the end of the third quarter of 2023 while corporate loans increased 3.1% qoq and 7.0% yoy, respectively. Mortgages represented 35.4% of the Erste Group Bank's loan book, consumer loans added a further 13.7% and corporate loans formed 50.6% of total loans.

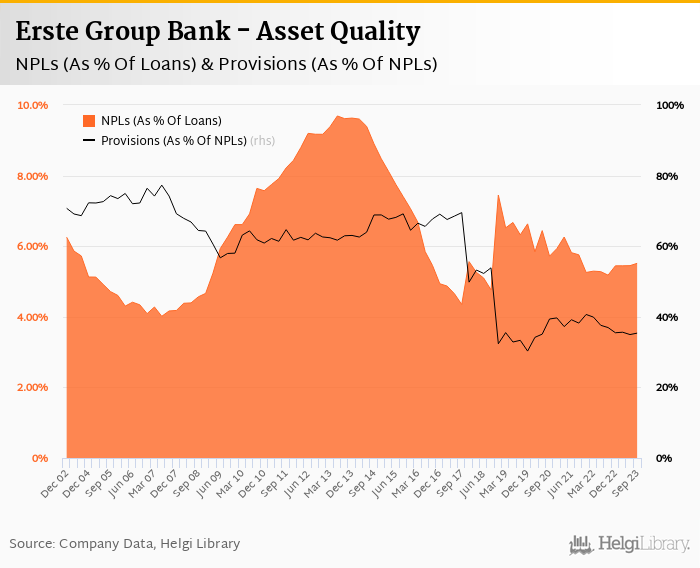

Asset quality remains good and the management does not feel significant pressures on its deterioration. Non-performing loans fell to 2.0% when substandard category is excluded (or 5.52% including). Provisions covered some 97% of NPLs at the end of the third quarter of 2023 (or 35.4% when substandard loans included).

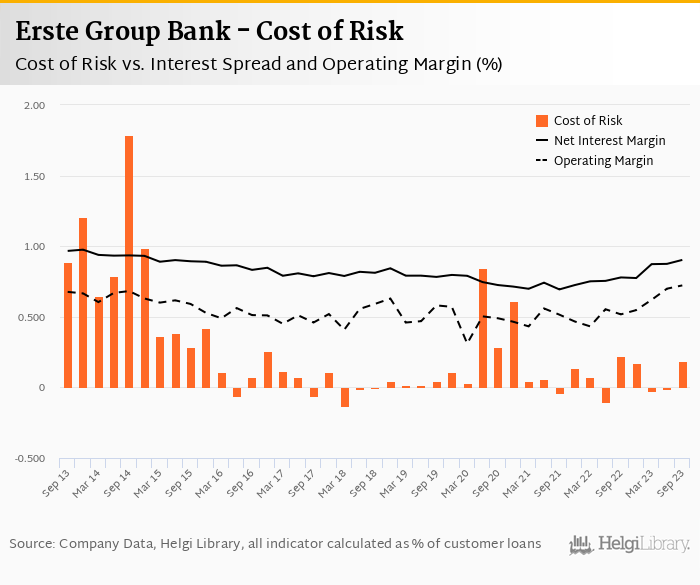

Provisions have "eaten" some 10.5% of operating profit in the third quarter of 2023 as cost of risk reached 0.31% of average loans:

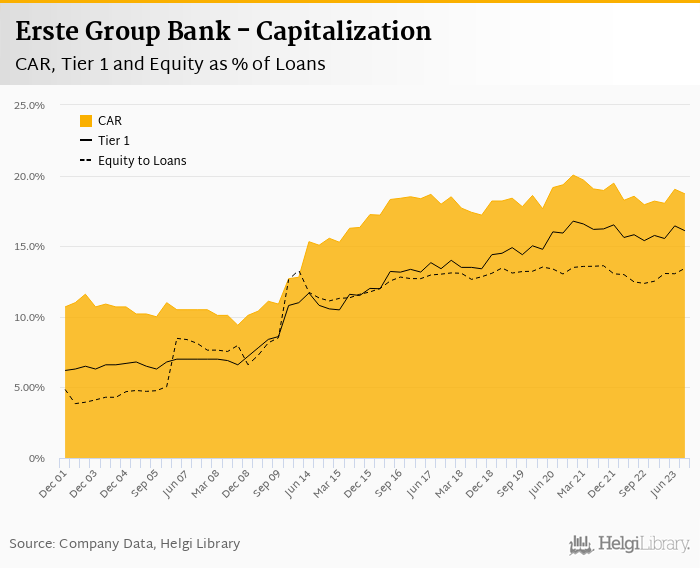

Erste Group Bank's capital adequacy ratio reached 18.7% in the third quarter of 2023, up from 17.9% for the previous year. The Tier 1 ratio amounted to 16.1% at the end of the third quarter of 2023 while bank equity accounted for 13.4% of loans:

Overall, Erste Group Bank made a net profit of EUR 820 mil in the third quarter of 2023, up 60.7% yoy. This means an annualized return on equity of 15.5% in the last quarter or 14.1% when the last four quarters are taken into account:

Following the strong 1H2023 results, the management upgraded its profit guidance for 2023. A few "improvements" have been also made after 3Q2023 results:

- 5% of loan portfolio growth

- increase in net interest income growth of more than 20% (from around 20%)

- fee growth of more than 5.0% (up from around 5.0%)

- operating expenses to grow at around 9% to push cost to income to below 50%

- cost of risk of less than 10 bp (unchanged)

- strong dividend guidance of as much as EUR 2.7 per share from 2023 profits implying 8% yield

- a plan for a share buyback of up to EUR 300 mil adding potentially further 2% to the yield

- CET1 ratio at more than 14.0% (up from 13.5%)

Another set of strong results beating market estimates due mainly to a strong revenue generation and Austrian business in particular. The Bank is heading to a record profitability in 2023 and profit guidance had to be upgraded again.

Trading at PE of around 7.0x, PBV of 0.7x expected in 2024 and offering potential dividend yield of 8-10% and further EUR 300 mil share buyback, Erste Bank share looks attractive compared to the past as well as within the CEE banking universe.