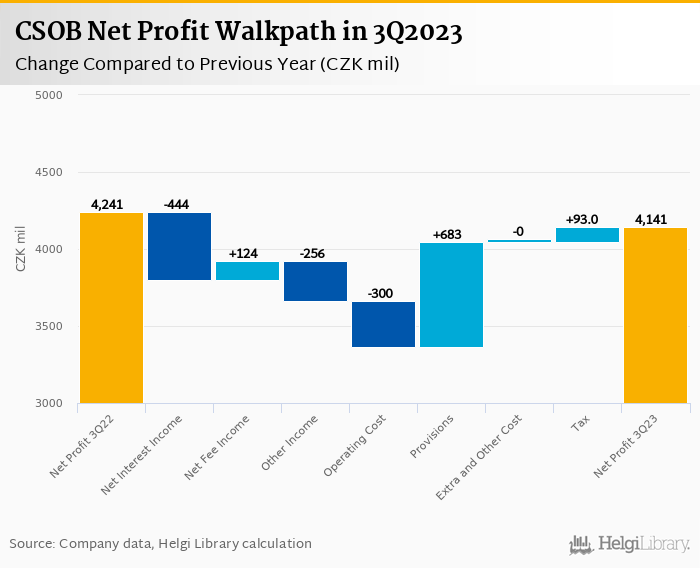

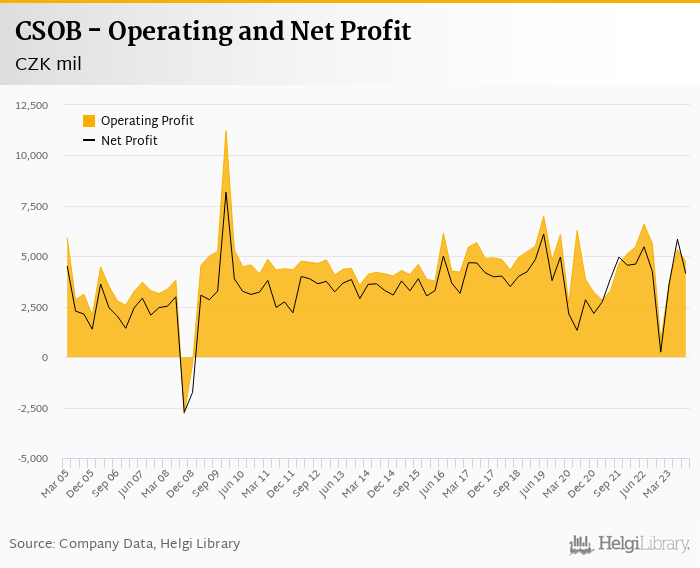

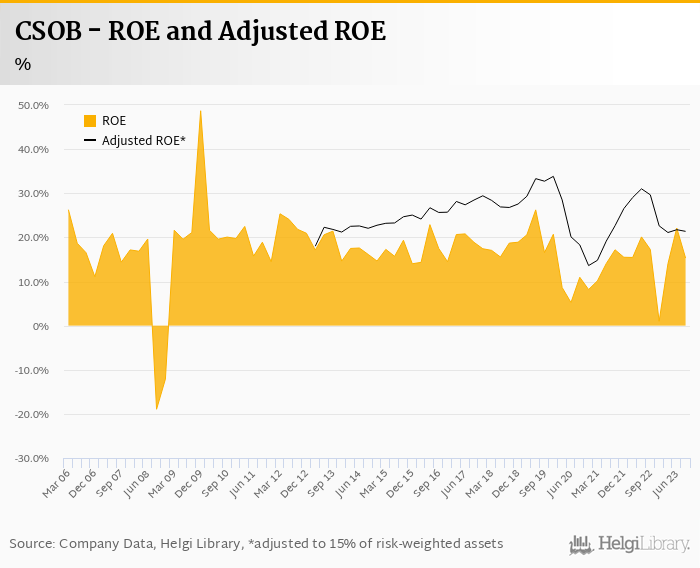

CSOB decreased its net profit 2.35% to CZK 4.14 bil in 3Q2023 and generated ROE of 15.3%.

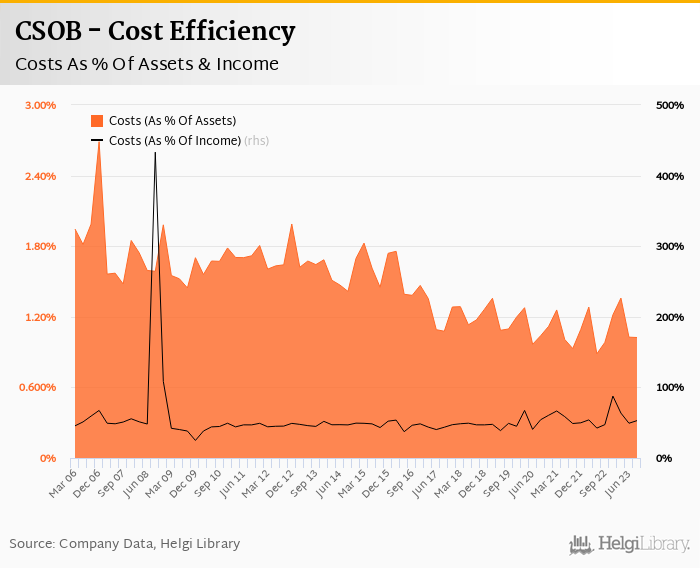

Revenues decreased 5.40% yoy and cost rose 5.95%, so operating profit fell 15.6% and cost to income increased to 52.9%

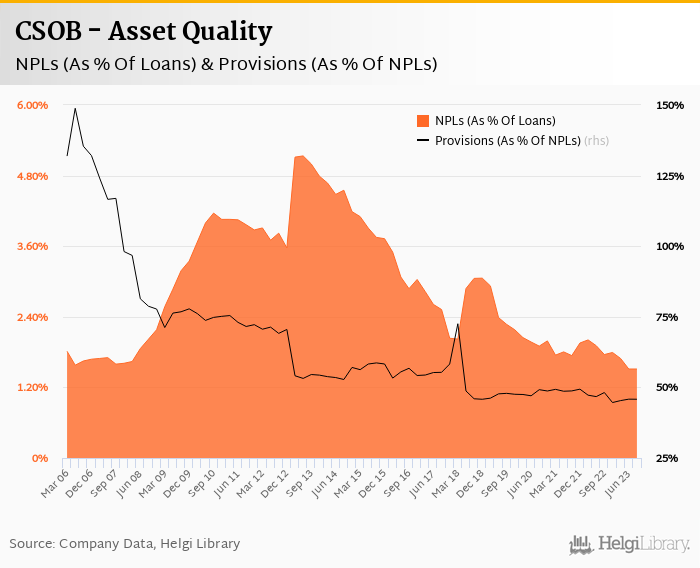

Asset quality remains good with NPLs at 1.51% of total loans, so cost of risk was close to zero

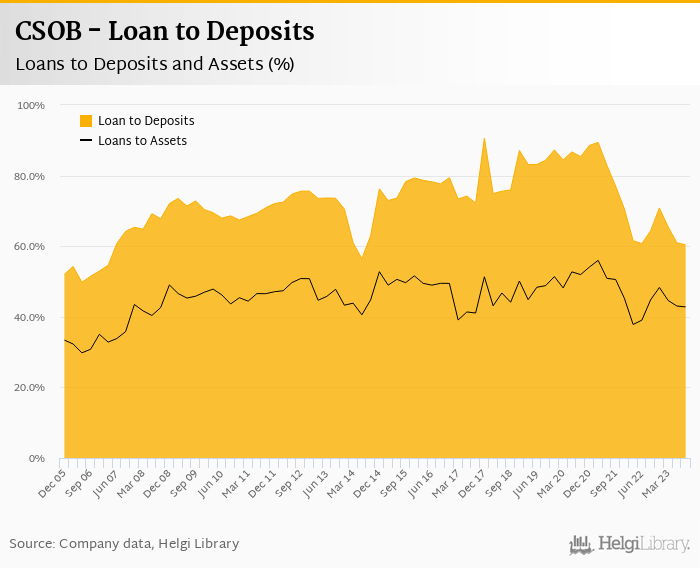

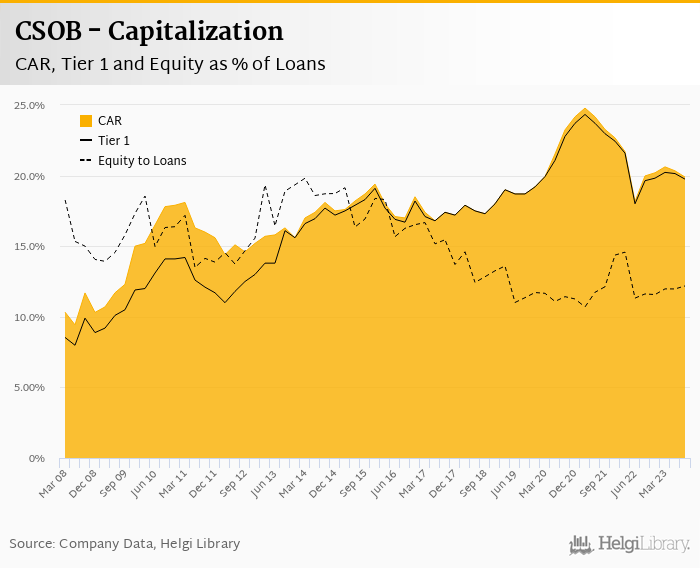

With loans to deposit at 60% and capital adequacy at close to 20%, CSOB's balance sheet is hungry for loan demand to pick up...

CSOB made a net profit of CZK 4.14 bil in the third quarter of 2023, down 2.35% yoy. Operating profit fell 15.8% yoy, so again a low cost of risk and low effective tax rate helped bottom line from bigger deterioration. Revenues fell due mainly increasing pressure on interest margin while costs remain under upward pressure because of wage adjustments:

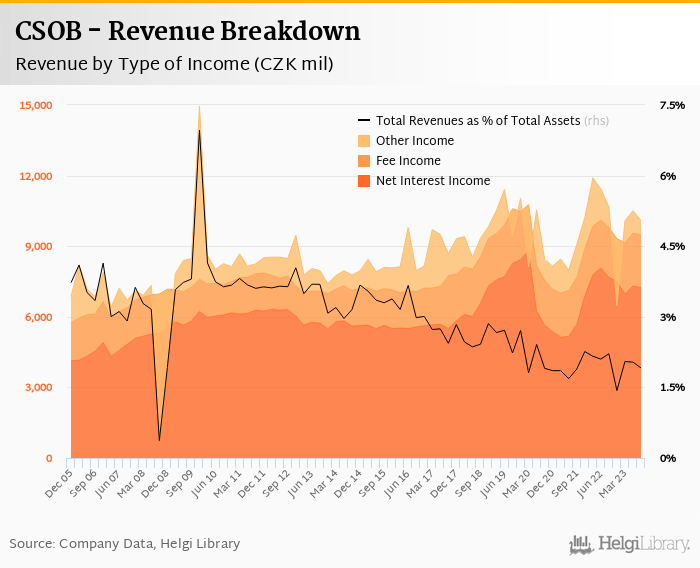

Revenues decreased 5.4% yoy to CZK 10.1 bil in the third quarter of 2023 due mainly to ongoing pressure from the rising cost of funding and also other/trading income were CZK 256 mil lower when compared to last year due partly to one-off sale of bonds and historical legal case. On the positive side, fee income grew 5.8% yoy supported by higher asset management fees. When compared to three years ago, revenues were up 19.6%:

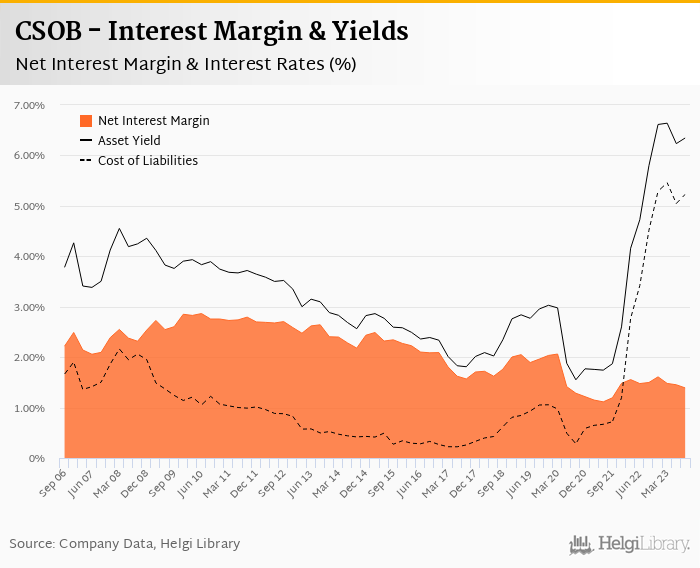

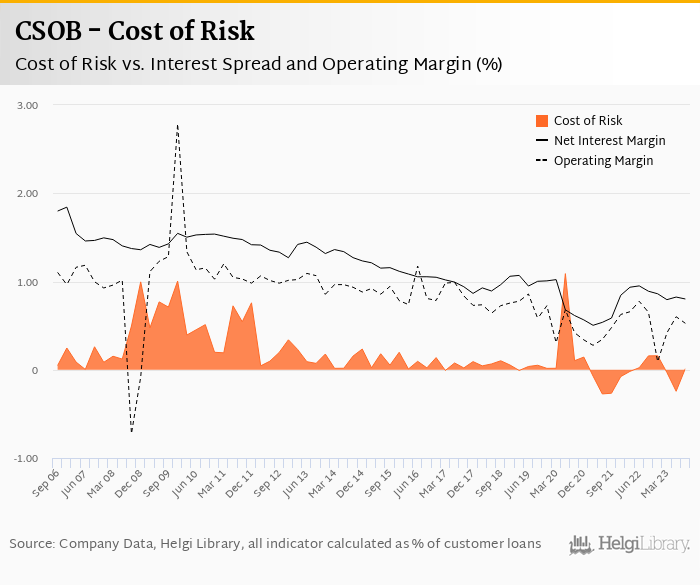

Net interest margin remains under pressure and decreased further 6 bp to 1.39% of total assets in the third quarter (from 1.50% seen last year). Average asset yield increased 12 bp to 6.35% in the third quarter of 2023, though not as much as cost of funding, which rose 18 bp qoq and 72 bp yoy.

Sight deposits fell to below 40% of total deposits (from 48% last year and 57% in 2021), so there might be a light at the end of the tunnel (Komercni banka is still at 51%, for example). On the other hand, Moneta's current account deposits fell to 25%, so things might get worse before getting better.

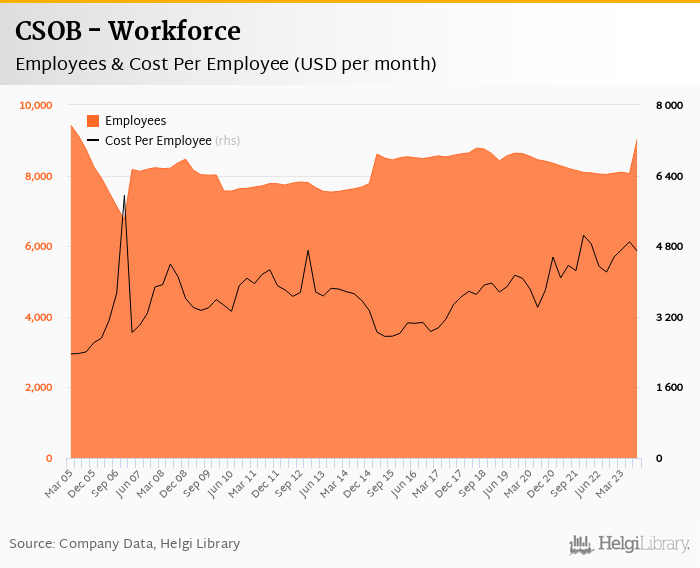

Operating costs increased by 5.95% yoy and the bank operated with average cost to income of 52.9% in the last quarter. The cost growth was driven purely by staff costs (up 14.3% yoy) and wage growth in particular as number of employees fell further 27 persons during last three months:

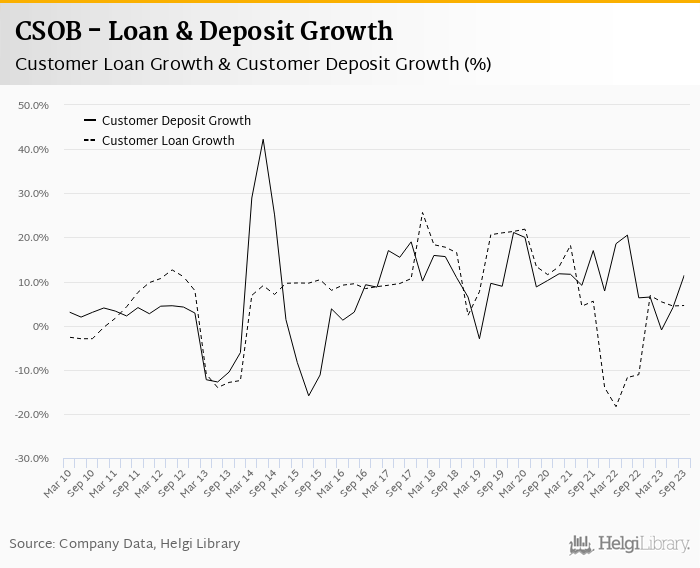

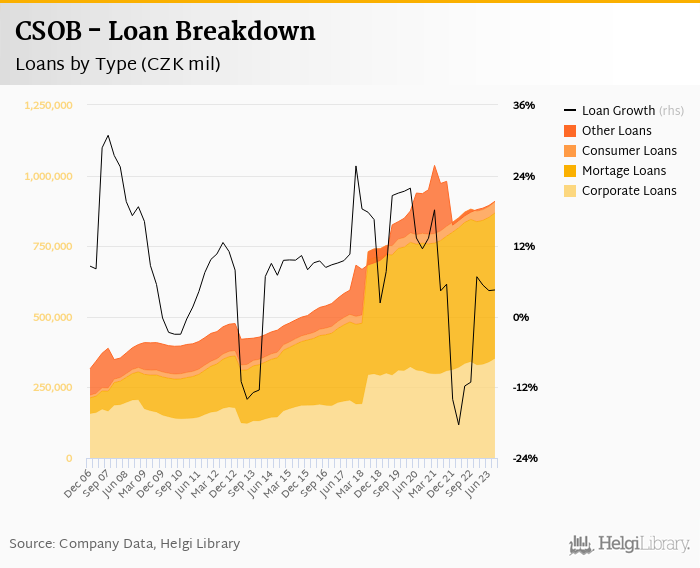

A shift from lending to deposits continues as customers are discouraged/attracted by higher interest reates. Customer loans grew 1.66% qoq and 4.56% yoy in the third quarter of 2023 while customer deposit growth amounted to 2.60% qoq and 11.5% yoy.

At the end of third quarter of 2023, CSOB's loans accounted for 60.4% of total deposits and 42.8% of total assets, the lowest since 2014:

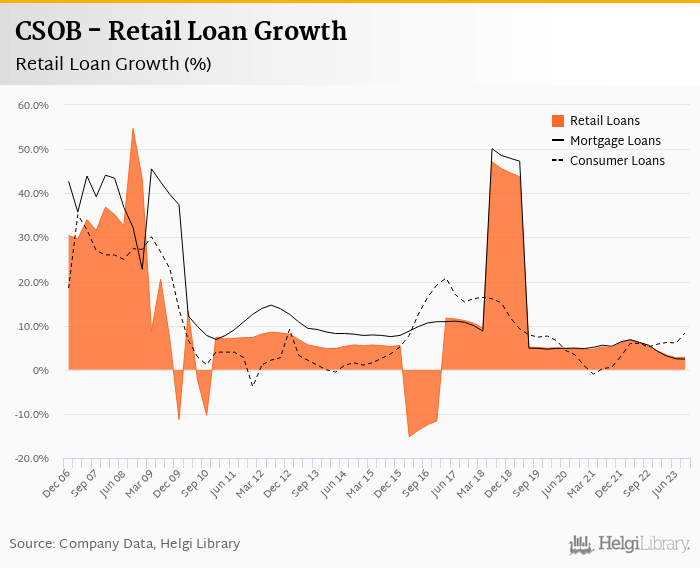

Retail loans grew 0.78% qoq and were 2.8% up yoy while corporate loans increased stronger 3.75% qoq and 3.26% yoy, respectively. Mortgages represented 57.1% of the CSOB's loan book, consumer loans added a further 4.39% and corporate loans formed 39.0% of total loans:

Asset quality remains good and low cost of risk is one of the reasons the profit decline wasn't even deeper when compared to last year. Non-performing loans reached 1.51% of total loans (down from 1.76% last year) while provision coverage declined slightly to 45.8% of NPLs. This is lower than in case of other large banks, though CSOB is most exposed to the residential mortgages, which are better collateralised than other loans.

CSOB's capital adequacy ratio reached 19.9% in the third quarter of 2023, down from 20.0% for the previous year. The Tier 1 ratio amounted to 19.7% at the end of the third quarter of 2023 while bank equity accounted for 12.2% of loans:

Overall, CSOB made a net profit of CZK 4.14 bil in the third quarter of 2023, down 2.35% yoy while operating profit fell 15.8% yoy. This means an annualized return on equity of 15.3% in the last quarter or when the last four quarters are taken into account:

Solid profit numbers overall, though bottom line was heavily supported by low cost of risk and lower effective tax rate. Momentum is not good as pressure on interest margin pressure and wage adjustments continue and demand for lending remains weak.