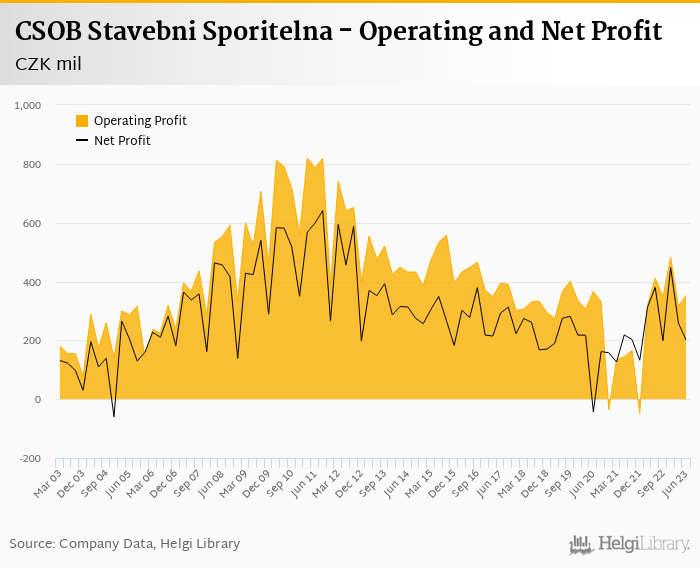

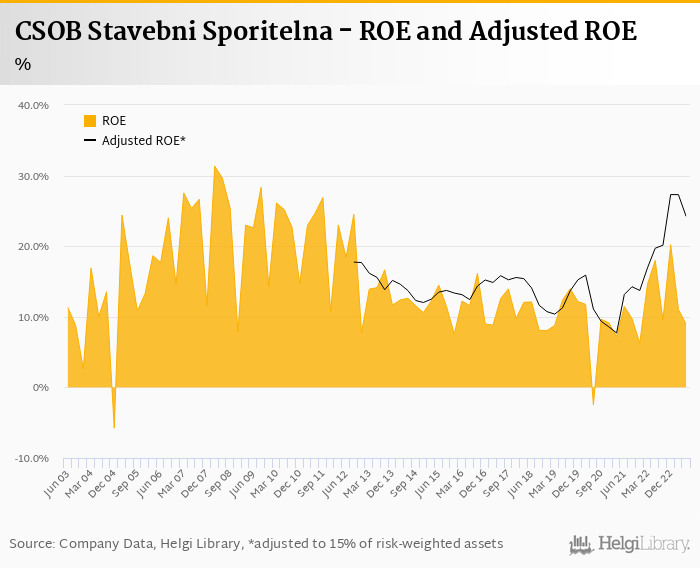

CSOB Stavebni Sporitelna decreased its net profit 47% to CZK 201 mil in 2Q2023 and generated ROE of 8.97%.

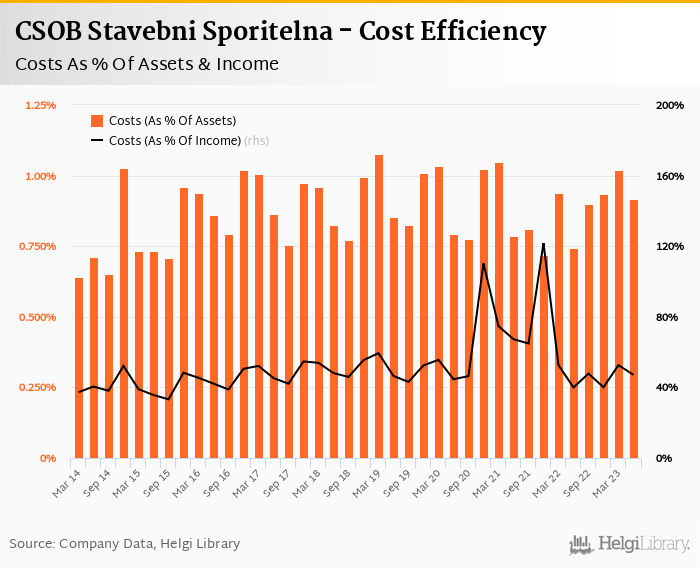

Revenues decreased 2.64% yoy and cost rose 14.8%, so cost to income increased to 47.1%

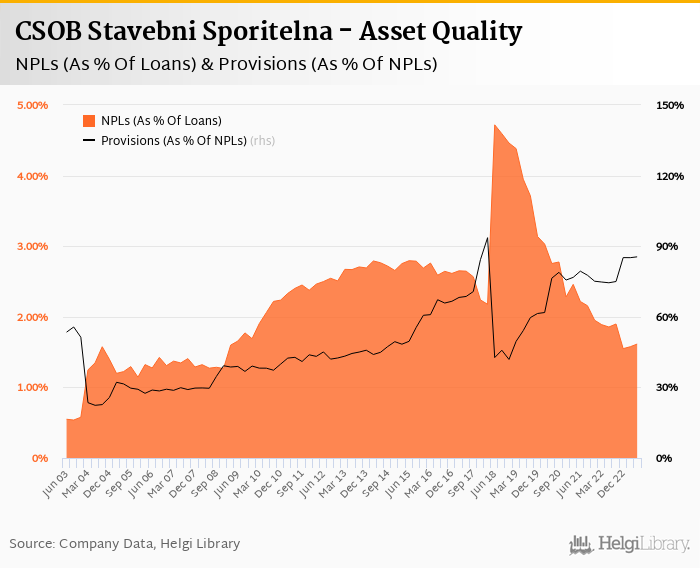

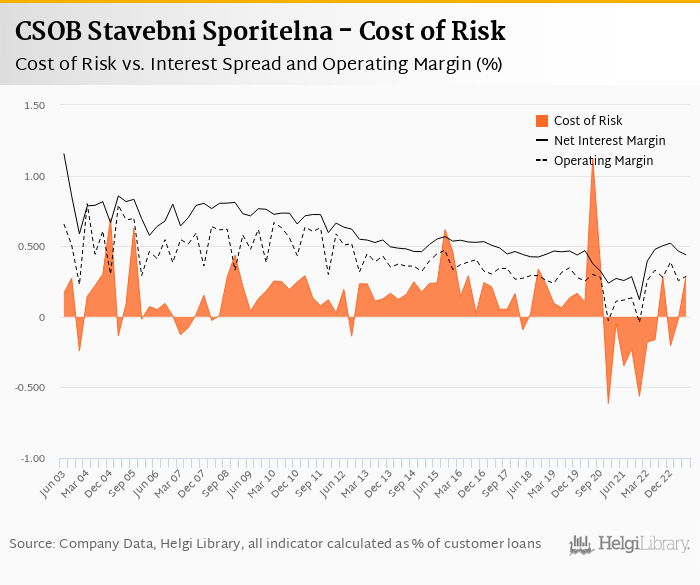

Cost of risk increased to 0.32% and we assume NPL ratio has reached approximately 1.6%.

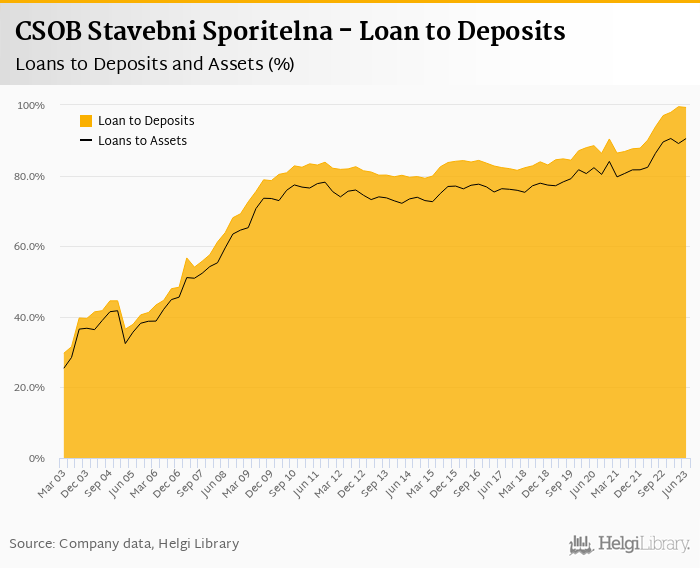

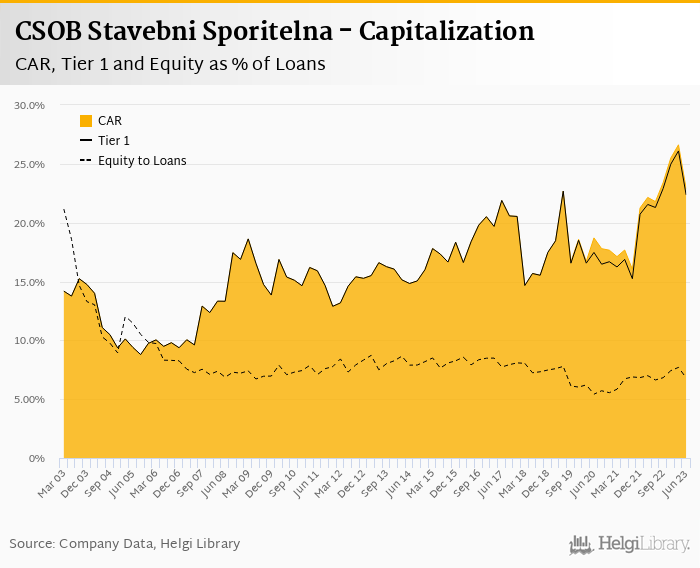

Loan to deposit ratio increased to 99% and capital adequacy might have fallen to 22-23% as dividends have been paid out

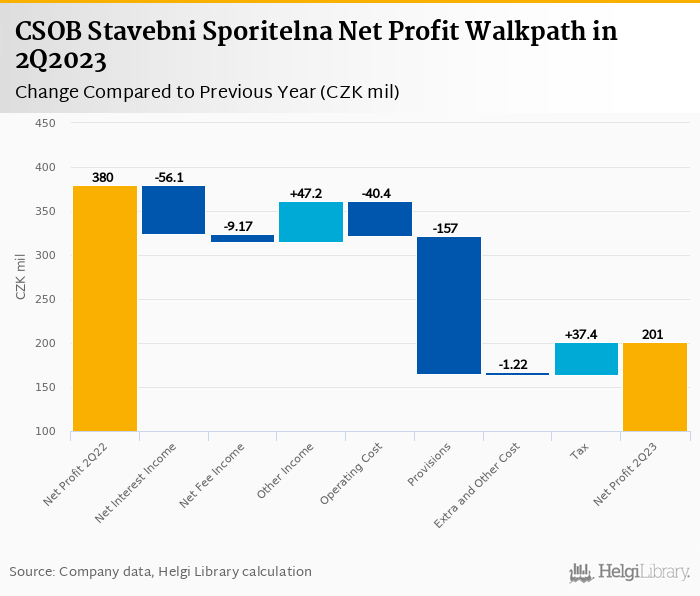

CSOB Stavebni Sporitelna made a net profit of CZK 201 mil in the second quarter of 2023, down 47.2% yoy, or decrease of CZK 179 mil in absolute terms. With the exception of trading/other income, all main revenue and cost items were worse off when compared to last year. Ongoing pressure from cost of funding and higher cost of risk are two main features standing out in the second quarter of 2023:

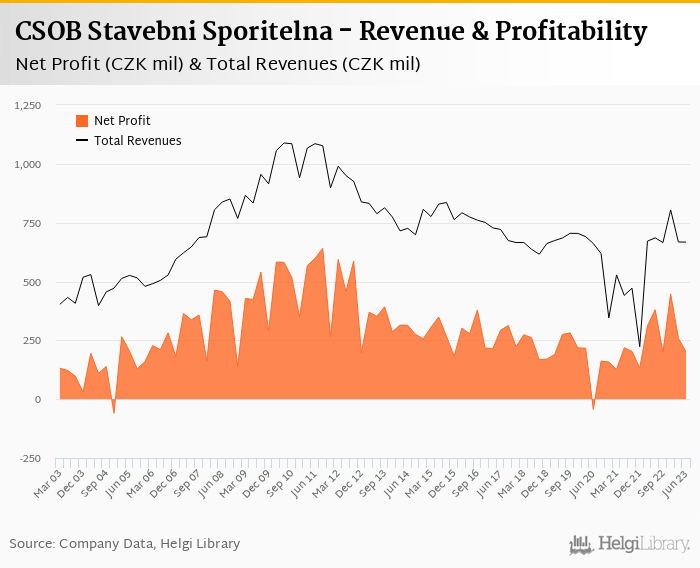

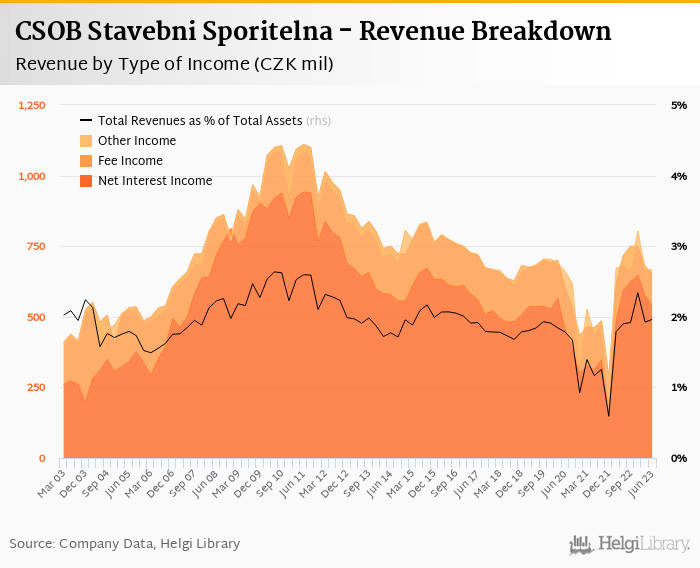

Revenues decreased 2.64% yoy to CZK 667 mil in the second quarter of 2023. Net interest income fell 9.4% yoy as net interest margin decreased 0.046 pp to 1.57% of total assets. Fee income fell 7.5% yoy and only CZK 47 mil yoy increase in other/trading income saved the Bank from a deeper fall. With the exception of the recovery in 2022 on the back of higher interest margin, Bank's revenue side has been under pressure since 2011:

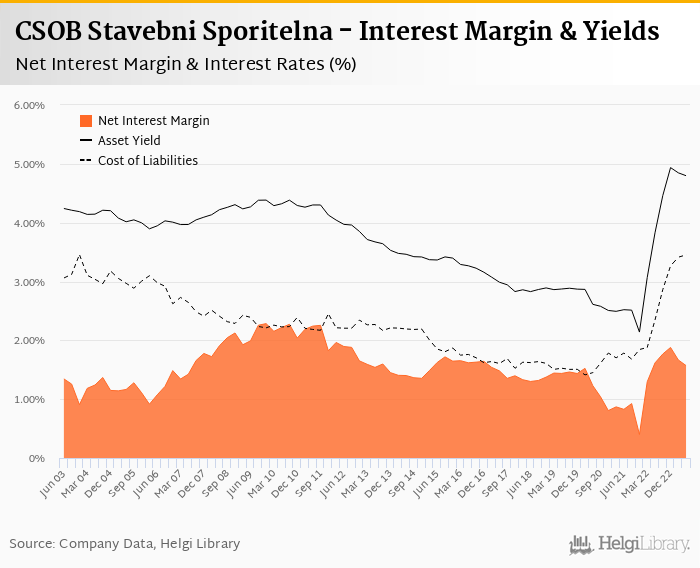

Average asset yield was 4.80% in the second quarter of 2023 (up from 3.83% a year ago) while cost of funding amounted to 3.45% in 2Q2023 (up from 2.35%). When looking at the last six months, however, the margin deteriorated from both, lower asset yield (down) as well as higher cost of funding (up):

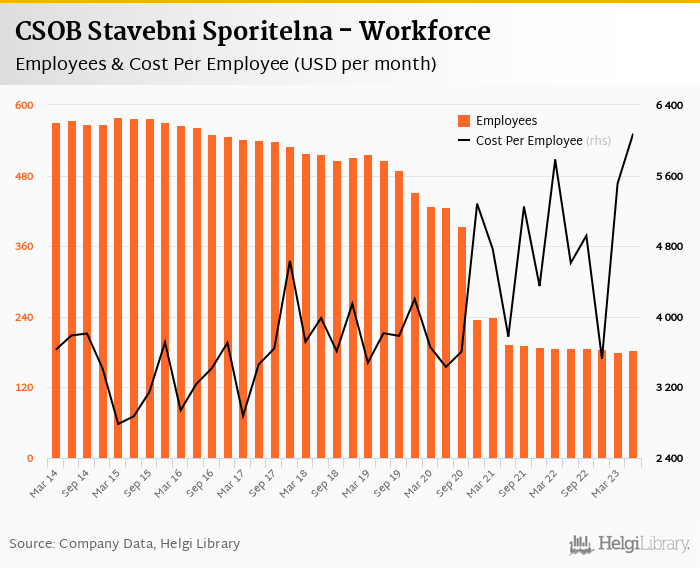

Costs increased by 14.8% yoy and the bank operated with average cost to income of 47.1% in the last quarter:

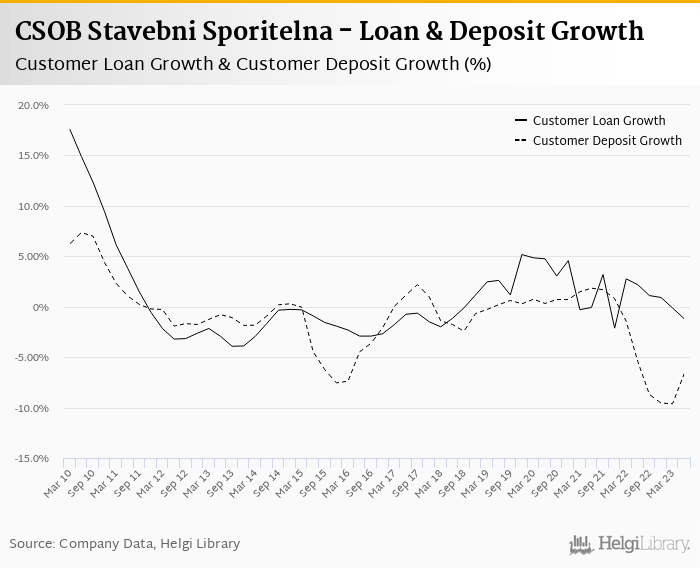

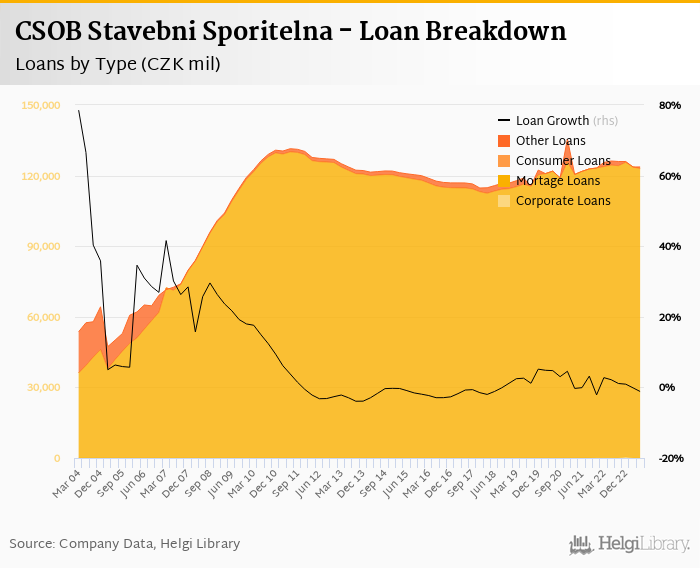

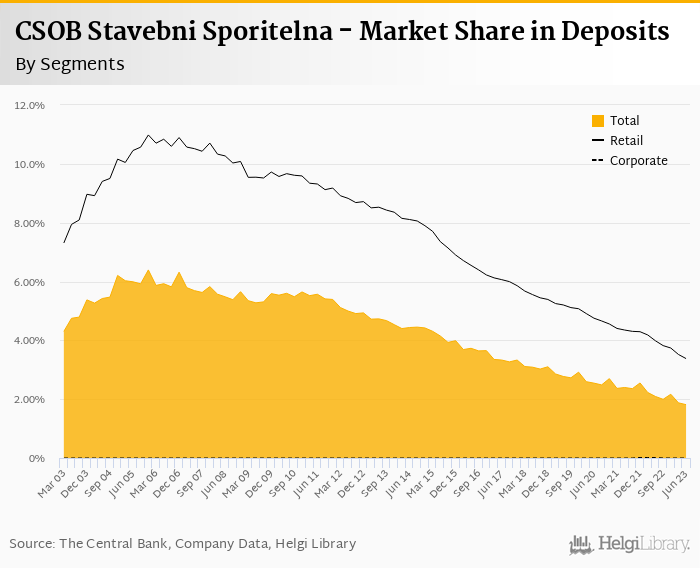

Demand for loans continue to be weak while some depositors seem to be migrating to higher-interest term deposits elsewhere. CSOB Stavebni Sporitelna's loans decreased 0.55% qoq and 1.2% yoy in the second quarter of 2023 while customer deposit growth fell 0.32% qoq and 6.6% yoy. That’s compared to average annual growth of 1.2% in loans and decline of 2.9% in deposits seen in the last three years.

At the end of second quarter of 2023, CSOB Stavebni Sporitelna's loans accounted for 99.3% of total deposits and 90.5% of total assets.

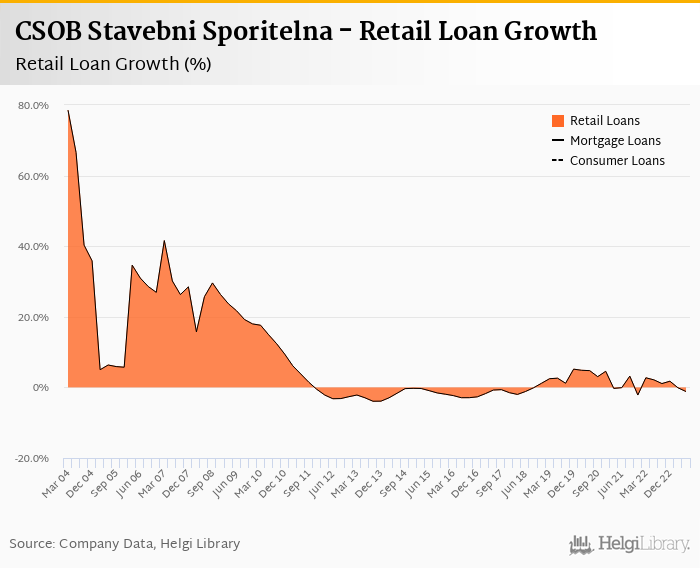

Retail loans consisting mostly of a special type of mortgage loans fell 0.55% qoq and were 1.2% down yoy. They accounted for almost 100% of the loan book at the end of the second quarter of 2023:

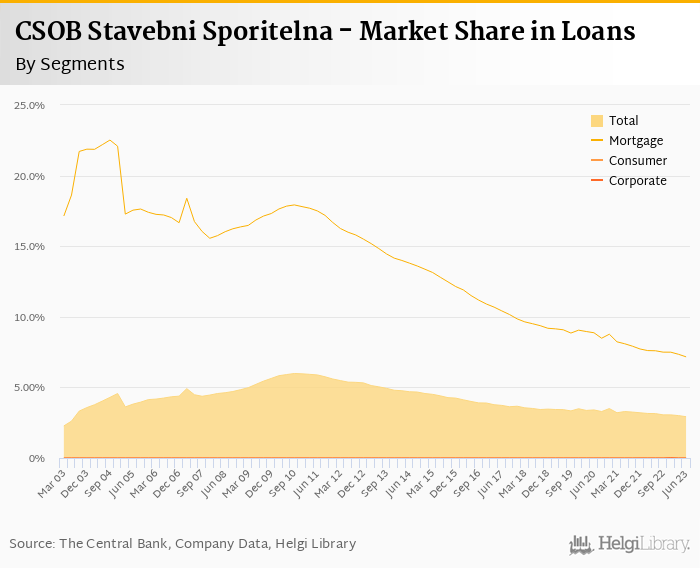

We estimate that CSOB Stavebni Sporitelna has lost 0.22 pp market share in the last twelve months in terms of loans (holding 2.92% of the market at the end of 2Q2023). On the funding side, the bank seems to have lost 0.28 pp and held 1.81% of the deposit market. In terms of mortgage lending, we estimate that the Bank held approximately 7.0% market share in the middle of 2023, down from almost 8.0% in 2021:

Loan loss provisions exceeded CZK 98 mil, so annualized cost of risk reached relatively high 0.32% in the second quarter. Provisions have therefore "eaten" some 27.8% of operating profit in the second quarter of 2023.

Based on that, we assume non-performing loans might have increased slightly to almost CZK 2 bil, or 1.6% of loans while provision coverage might have increased to around 85%:

With CZK 1.35 bil of dividends paid out (calculated based on a change in Bank's equity), we estimate that CSOB Stavebni Sporitelna's capital adequacy ratio reached around solid 22-23% in the second quarter of 2023, up from 21.8% for the previous year:

Overall, CSOB Stavebni Sporitelna made a net profit of CZK 201 mil in the second quarter of 2023, down 47.2% yoy. This means an annualized return on equity of 8.97% in the last quarter or 12.4% when the last four quarters are taken into account:

With margins under pressure, rising costs, higher provisions and decline in loans and deposits, CSOB Stavebni Sporitelna's momentum remains relatively weak. This is a long-term feature resulting from the segment of building savings banks, something the management has been facing for years now.