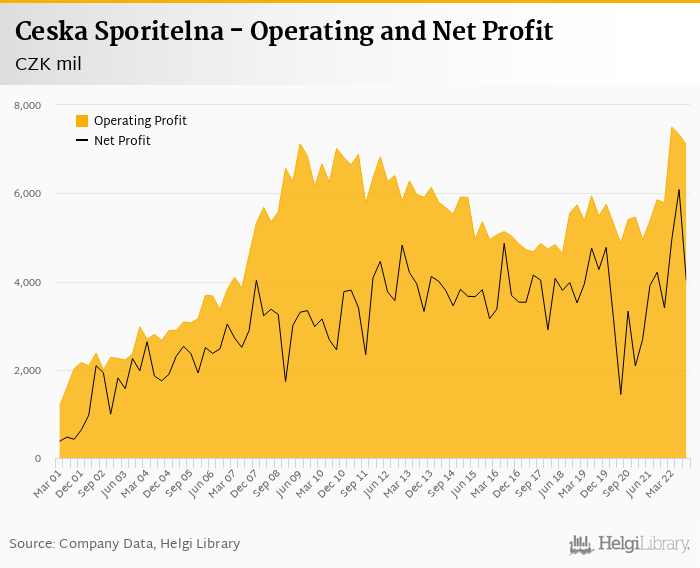

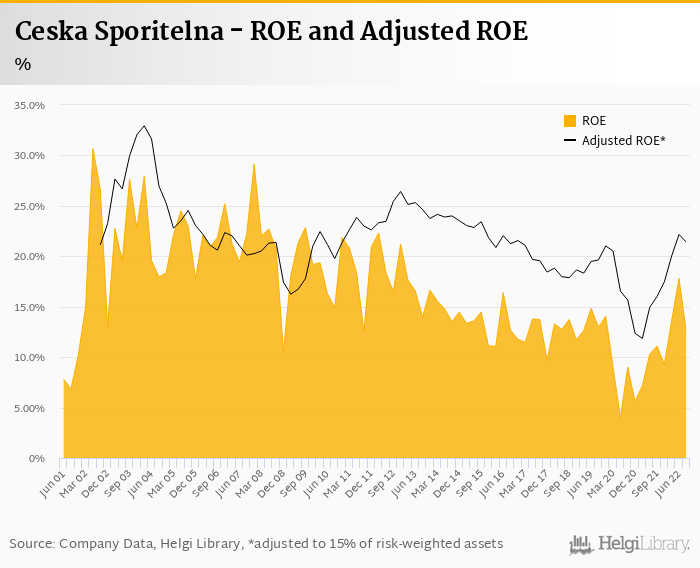

Ceska Sporitelna decreased its net profit 4.54% to CZK 4,020 mil in 3Q2022 and generated ROE of 12.5%.

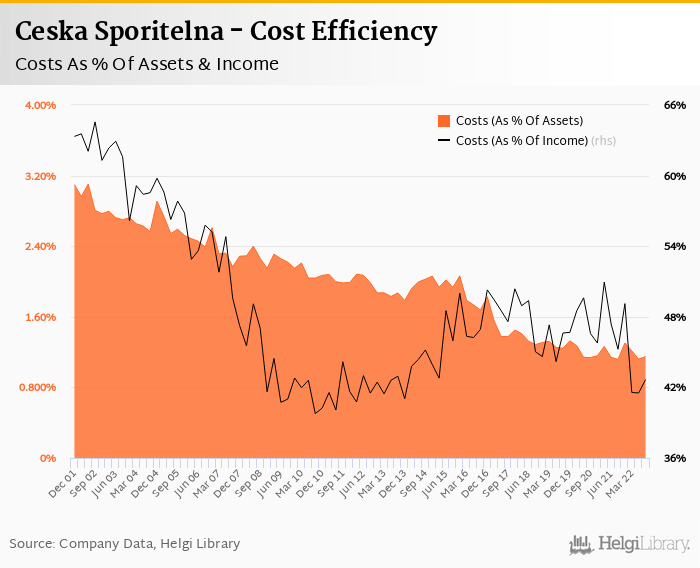

Revenues increased 15.9% yoy and cost rose 9.28%, so cost to income decreased to 42.7%

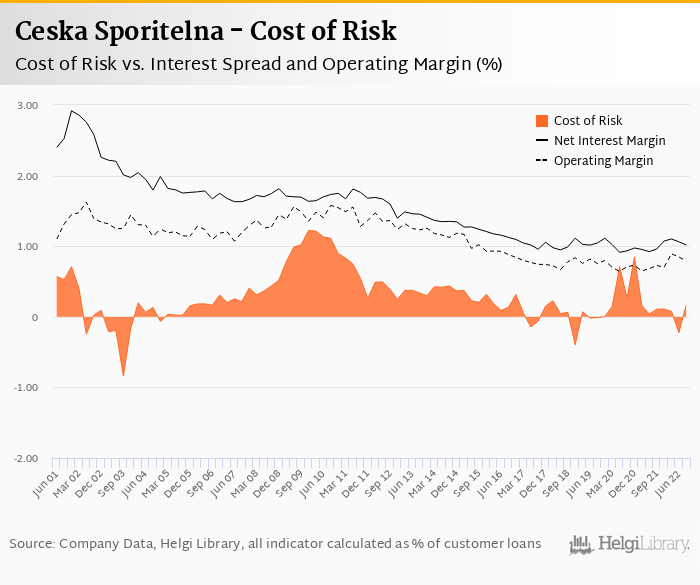

Bad loans fell to 1.90% of total loans and cost of risk amounted 0.357%.

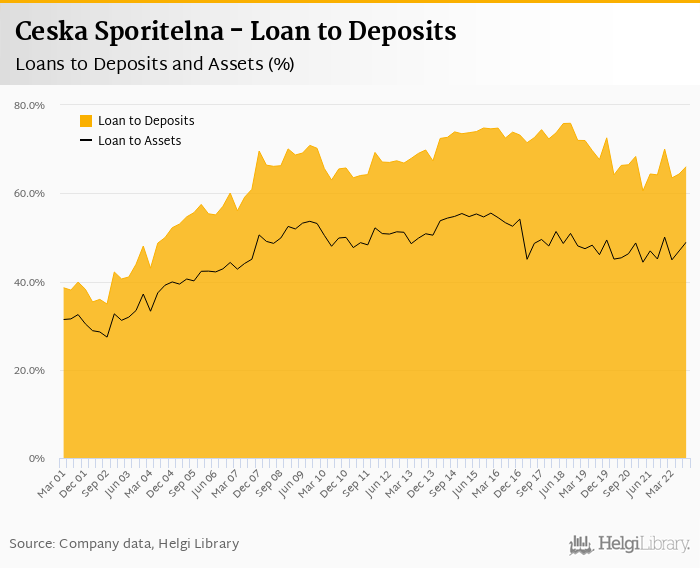

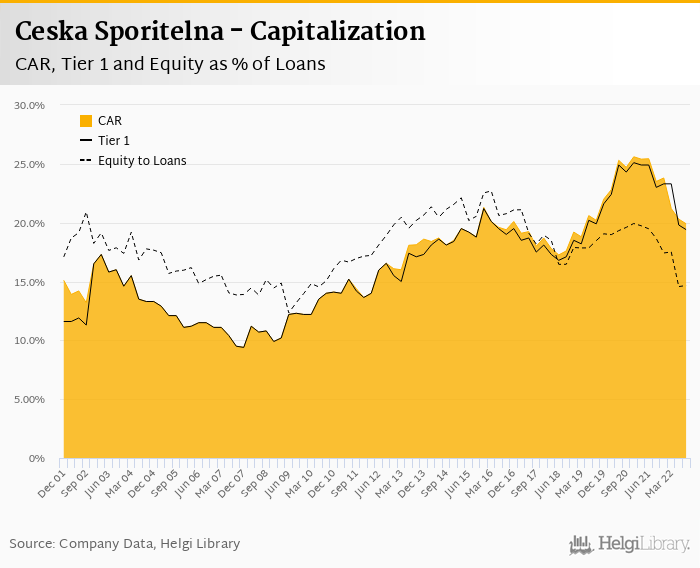

Loan to deposit ratio increased to 66.1% and capital adequacy decreased to 19.9%

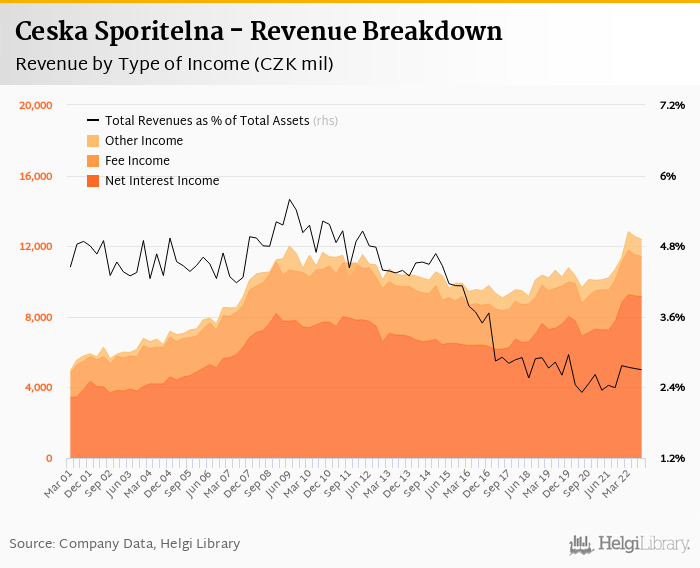

Revenues increased 15.9% yoy to CZK 12,387 mil in the third quarter of 2022. Net interest income rose 18.2% yoy and formed 73.8% of total with net interest margin increasing 0.201 pp to 1.99% of total assets. Fee income fell 3.40% yoy as the Bank continues having a problem to translate asset growth into a fee-generating income. That's in spite of rising number of cards, for example, which increased 227,000 compared to last year. When compared to three years ago, revenues were up 20.7%:

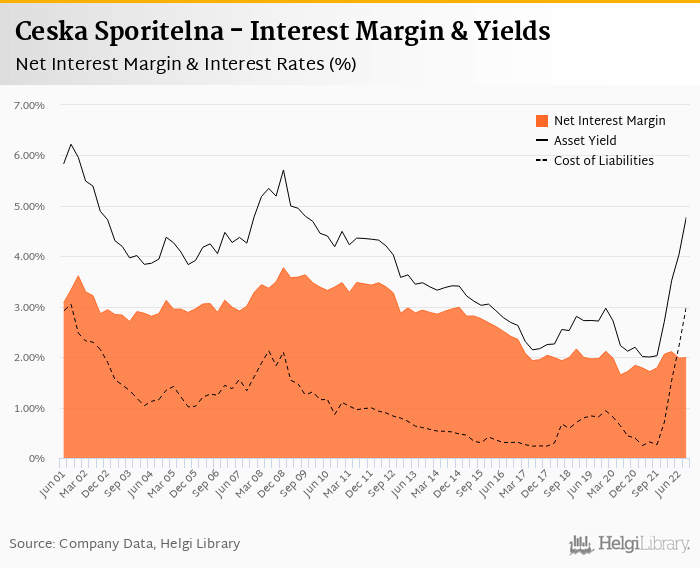

Average asset yield was 4.78% in the third quarter of 2022 (up from 2.03% a year ago) while cost of funding amounted to 3.00% in 3Q2022 (up from 0.265%).

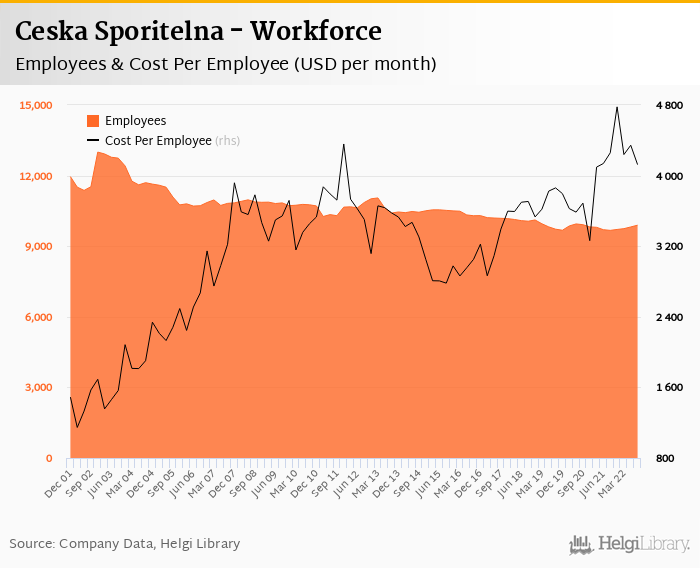

Costs increased by 9.28% yoy and the bank operated with average cost to income of 42.7% in the last quarter. Staff cost rose 10.7% as the bank employed 9,893 persons (up 2.27% yoy) and paid CZK 100,138 per person per month including social and health care insurance cost:

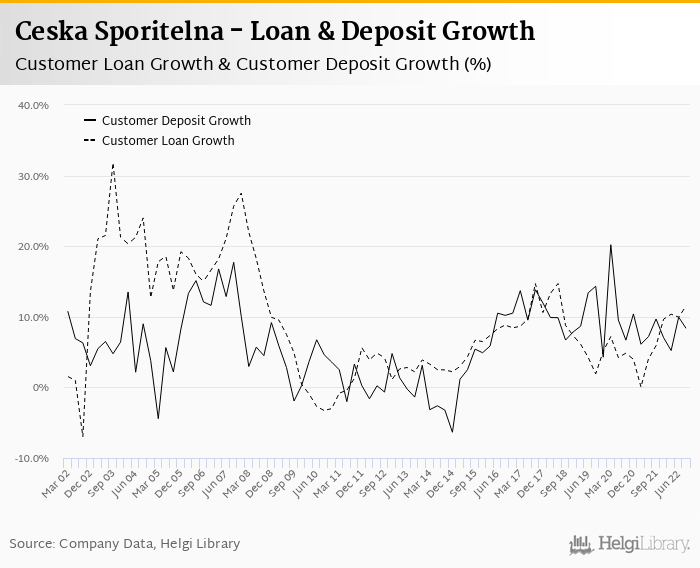

Ceska Sporitelna's customer loans grew 3.84% qoq and 11.6% yoy in the third quarter of 2022 while customer deposit growth amounted to 1.14% qoq and 8.33% yoy. That’s compared to average of 6.41% and 8.72% average annual growth seen in the last three years.

At the end of third quarter of 2022, Ceska Sporitelna's loans accounted for 66.1% of total deposits and 49.0% of total assets.

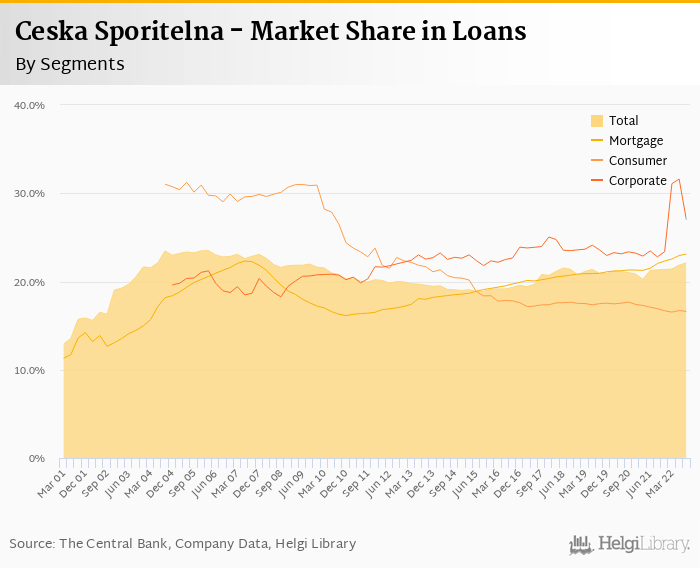

Retail loans grew 1.77% qoq and were 11.2% up yoy. They accounted for 58.2% of the loan book at the end of the third quarter of 2022 while corporate loans decreased 10.6% qoq and 27.8% yoy, respectively. Mortgages represented 42.6% of the Ceska Sporitelna's loan book, consumer loans added a further 8.59% and corporate loans formed 38.4% of total loans:

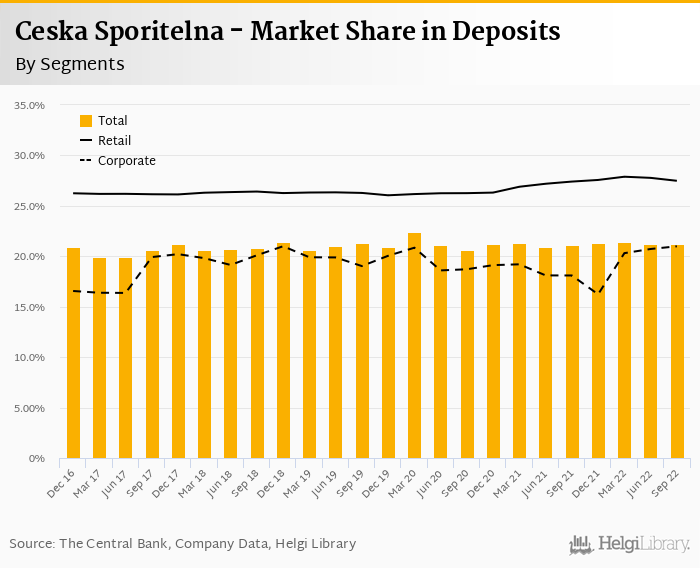

We estimate that Ceska Sporitelna has gained 0.786 pp market share in the last twelve months in terms of loans (holding 22.1% of the market at the end of 3Q2022). On the funding side, the bank seems to have gained 0.089 pp and held 21.2% of the deposit market. The initial numbers suggest the Bank to continue getting stronger in the corporate area, both loans as well as deposits. In addition, it has been gradually increasing its position on the residential mortgage market:

Ceska Sporitelna's non-performing loans reached 1.90% of total loans, down from 2.10% when compared to the previous year. Provisions covered some 116% of NPLs at the end of the third quarter of 2022, up from 114% for the previous year.

Provisions have "eaten" some 11.1% of operating profit in the third quarter of 2022 as cost of risk reached 0.357% of average loans. These are still pretty good numbers although pressure might be increasing as quarterly cost of risk was the highest since the beginning of the year 2021 :

Ceska Sporitelna's capital adequacy ratio reached 19.9% in the third quarter of 2022, down from 23.5% for the previous year. The Tier 1 ratio amounted to 19.4% at the end of the third quarter of 2022 while bank equity accounted for 14.7% of loans:

Overall, Ceska Sporitelna made a net profit of CZK 4,020 mil in the third quarter of 2022, down 4.54% yoy. This means an annualized return on equity of 12.5%, or 21.4% when equity "adjusted" to 15% of risk-weighted assets:

Another strong quarter reported by Ceska Sporitelna purely on the back of rising interest rates. Strong revenue growth driven mainly by rising interest rates and margin, good cost control and limited pressure from asset quality deterioration seen so far. The Bank continues to gradually gain market share in the corporate area, both loans and deposits, as well as in mortgage loans. On the other hand, fee income remains disappointing.

As far the future quarters are concerned, watch for inflation pressure on the cost side, business volume slowdown in balance sheet and fee income generation. And rising pressure on the asset quality, of course...