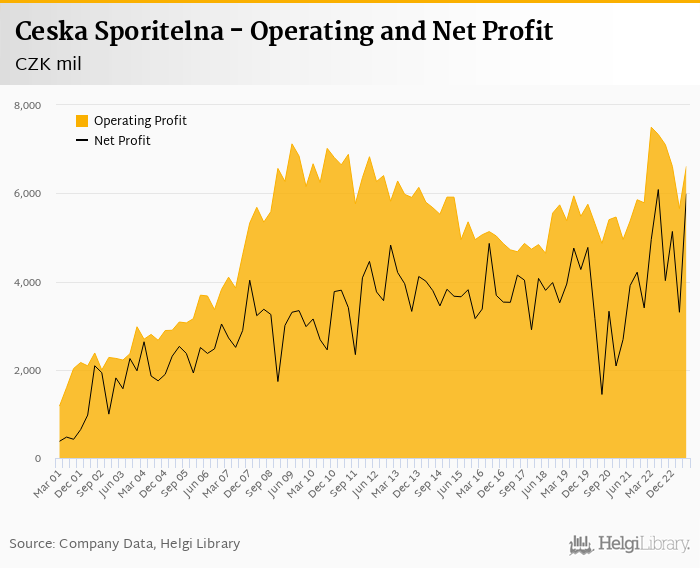

Ceska Sporitelna decreased its net profit 1.58% to CZK 5,988 mil in 2Q2023 and generated ROE of 17.4%.

The operating profit fell almost 10% yoy as higher interest rates have been eating into interest margin and high inflation pushes operating costs higher. Also, cost of risk increased by more than a CZK 1.1 bil yoy due mainly to last year’s provision write-back.

The main positives therefore came from non-core items such as other operating income and lower effective tax rate from expected windfall tax.

Good asset quality, pick up in loan demand and market share increase are other positives worth mentioning.

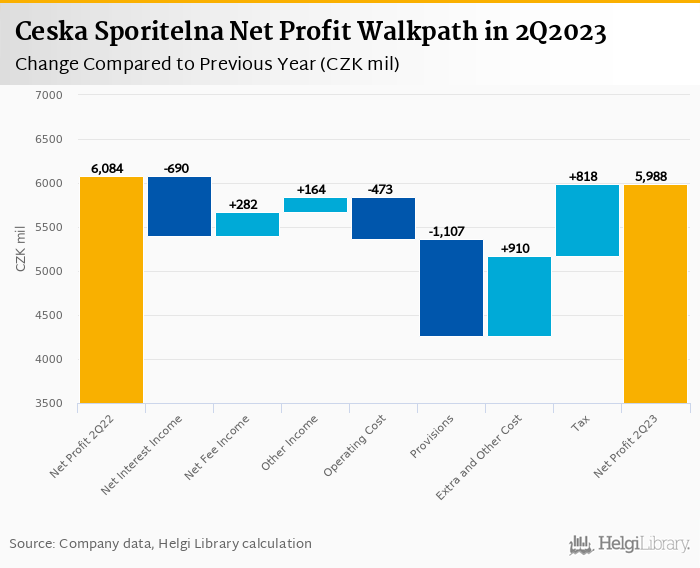

Ceska Sporitelna made a net profit of CZK 5,988 mil in the second quarter of 2023, down 1.58% yoy, or decrease of CZK 96.0 mil in absolute terms. The operating profit fell almost 10% yoy as higher interest rates have been eating into interest margin and high inflation pushes operating costs higher. Also, cost of risk increased by more than a CZK 1.1 bil yoy due mainly to last year’s provision write-back. The main positive contribution in 2Q23 therefore came from non-core items such as lower contribution to Recovery and Resolution Fund, lower losses from sales of bonds and lower effective tax rate from expected windfall tax:

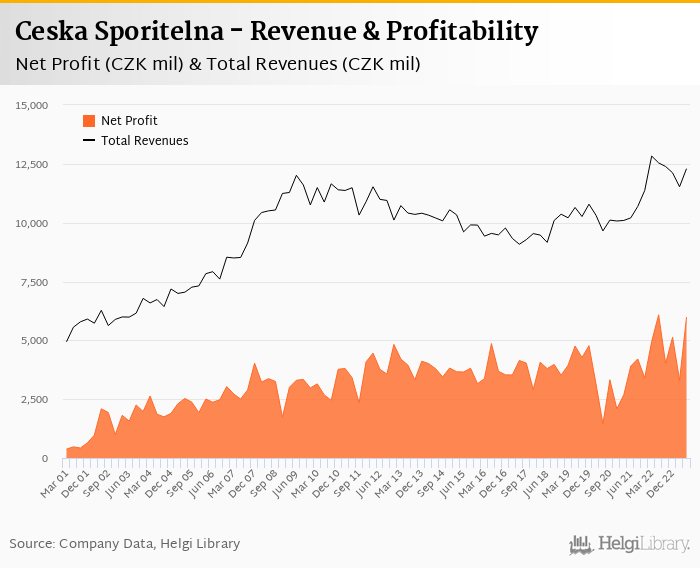

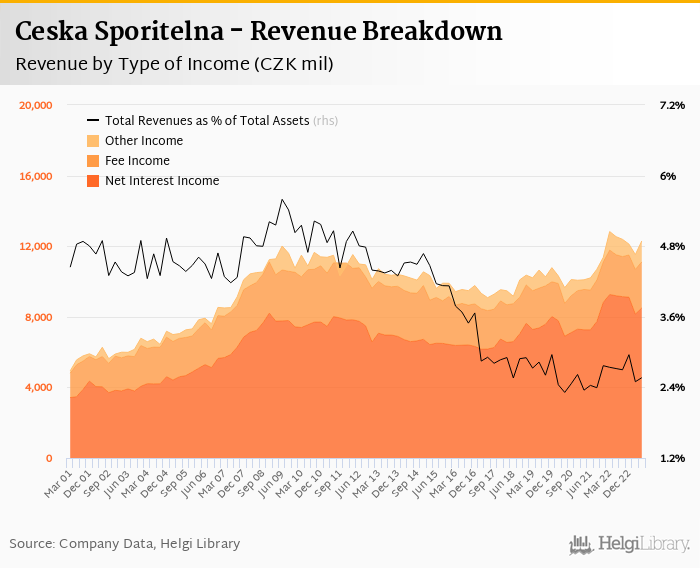

Revenues decreased 1.95% yoy to CZK 12,295 mil in the second quarter of 2023. Net interest income fell 7.50% yoy and formed 69% of total with net interest margin decreasing 0.172 pp to 1.81% of total assets. Fee income grew solid 12.1% yoy and added a further 21.2% to total revenue. When compared to three years ago, revenues were up 27.4%:

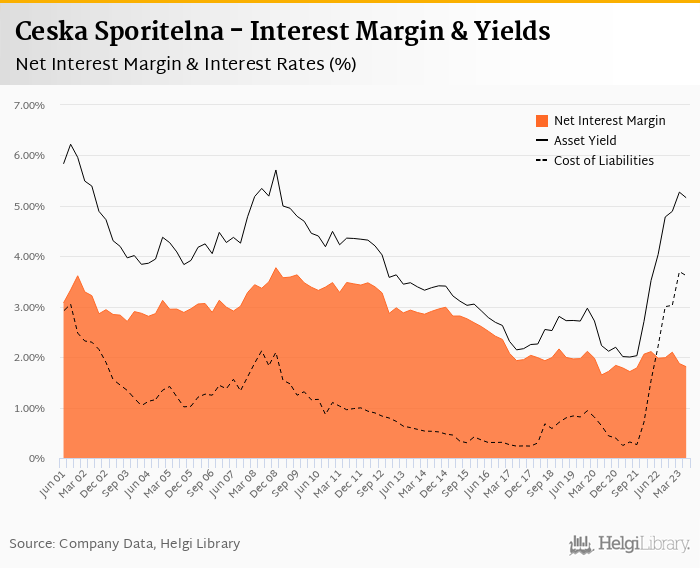

Average asset yield was 5.16% in the second quarter of 2023 (up from 4.04% a year ago) while cost of funding amounted to 3.61% in 2Q2023 (up from 2.22%). Similar to Moneta's results last week, the pressure from higher cost of funding seems to have peaked in 1H2023, so margin might stabilise or improve in the quarters to come:

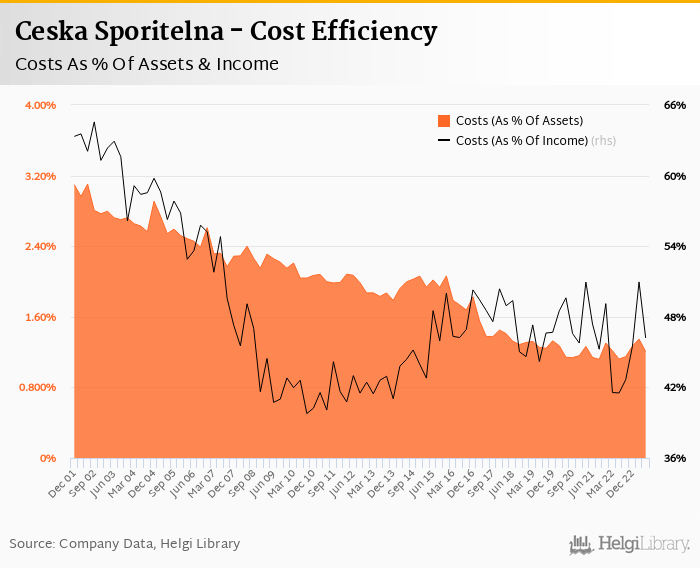

Costs increased by 9.08% yoy and the bank operated with average cost to income of 46.2% in the last quarter. Staff cost rose 9.29% as the bank employed 9,992 persons (up 1.77% yoy) and paid CZK 106,785 per person per month including social and health care insurance cost. The cost pressure from high inflation is seen across the board in spite of Bank's continued effort for cost savings and branch closerures (additional 9 branches down yoy to 389):

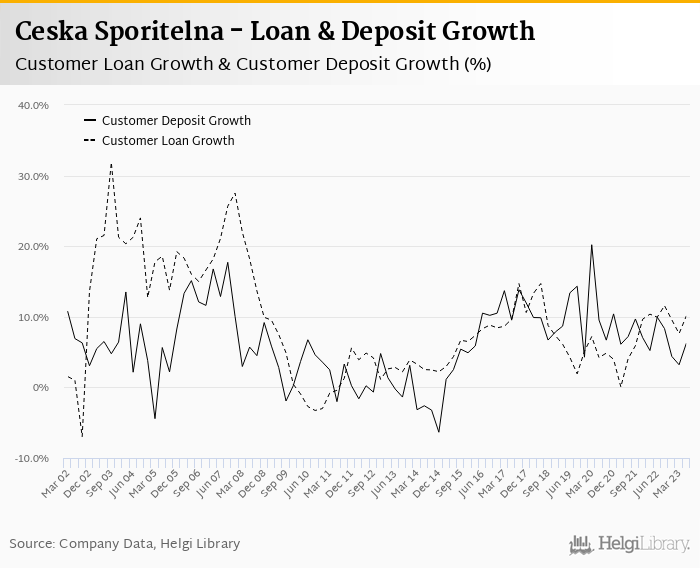

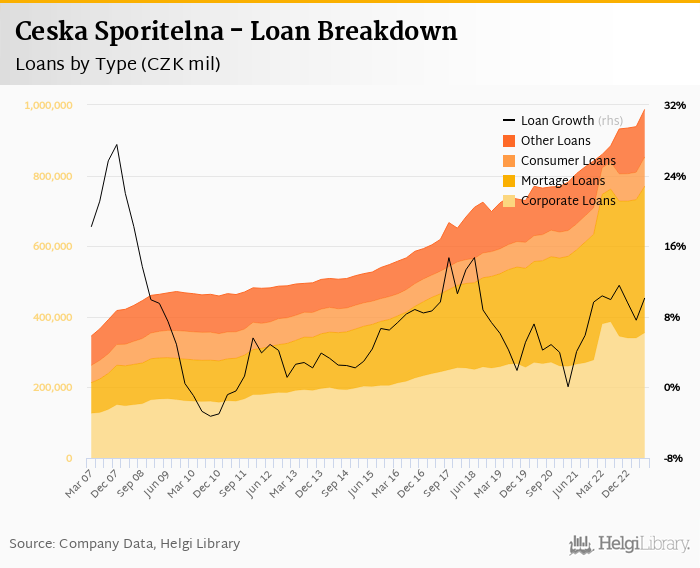

Ceska Sporitelna's customer loans grew 5.4% qoq and 10.1% yoy in the second quarter of 2023 (or 6.0% when adjusted for acquisition of Sberbank’s loan book) while customer deposit growth amounted to 4.5% qoq and 6.3% yoy. That’s compared to average of 7.3% and 7.0% average annual growth seen in the last three years.

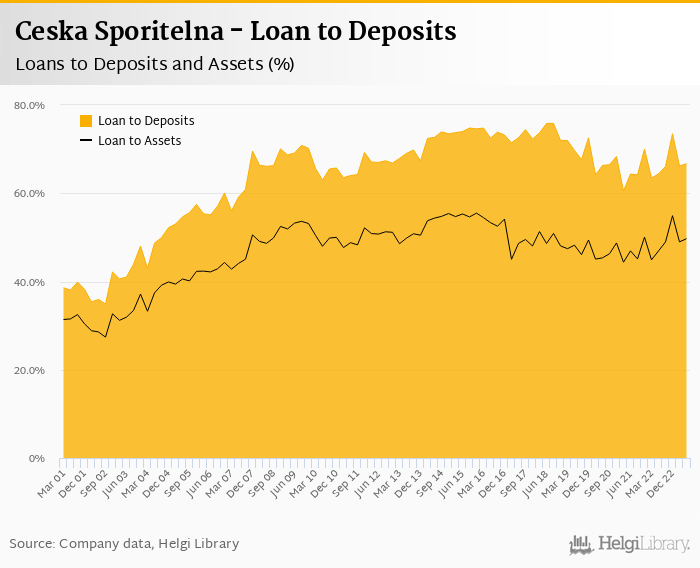

At the end of second quarter of 2023, Ceska Sporitelna's loans accounted for 66.7% of total deposits and 49.7% of total assets.

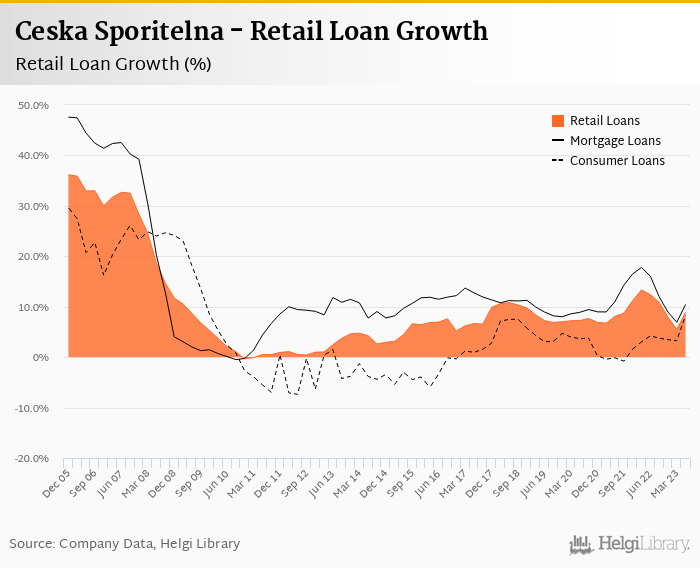

Retail loans grew 5.3% qoq and were 8.9% up yoy supported by a pick up in both, mortgage as well as consumer loans. Average mortgage is provided for 27 years and amounts to CZK 2.7 mil with average LTV ratio of 63%. In the middle of the year, retail loans accounted for 59% of the loan book 2023 while corporate loans increased 4.5% qoq and -8.0% yoy, respectively. Mortgages represented 43.5% of the Ceska Sporitelna's loan book, consumer loans added a further 8.7% and corporate loans formed 37.2% of total loans:

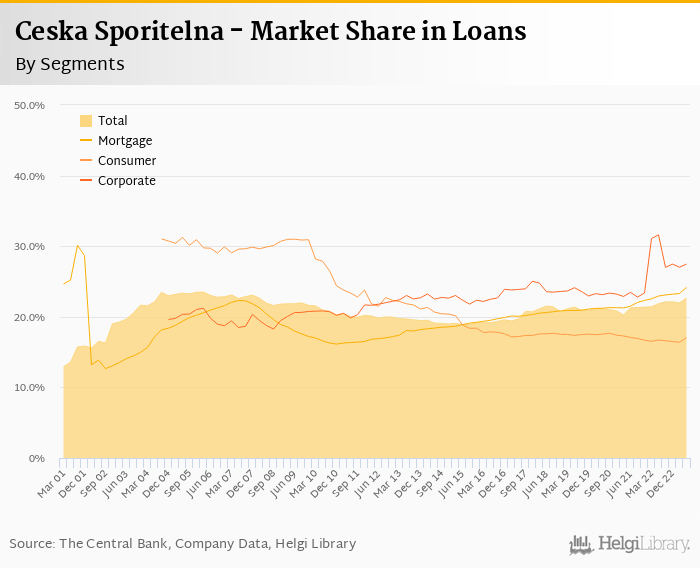

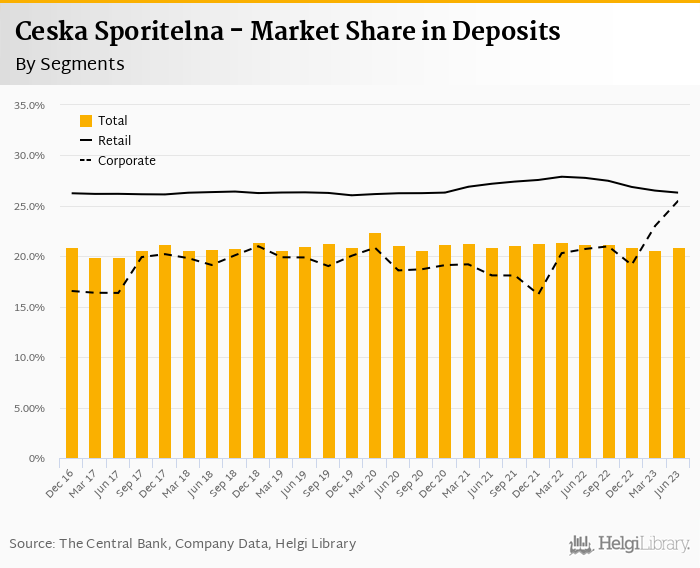

We estimate that Ceska Sporitelna has gained 0.798 pp market share in the last twelve months in terms of loans (holding 22.7% of the market at the end of 2Q2023). On the funding side, the bank seems to have lost 0.292 pp and held 20.9% of the deposit market. While gradually losing its once-dominant market position in household deposits (down to 140 bp to 25.5% in May 2023), Sporitelna continues to increase its market share in retail and corporate loans (thanks partly to Sberbank’s loans) and also in corporate deposits (16.8% vs 14.6% a year ago):

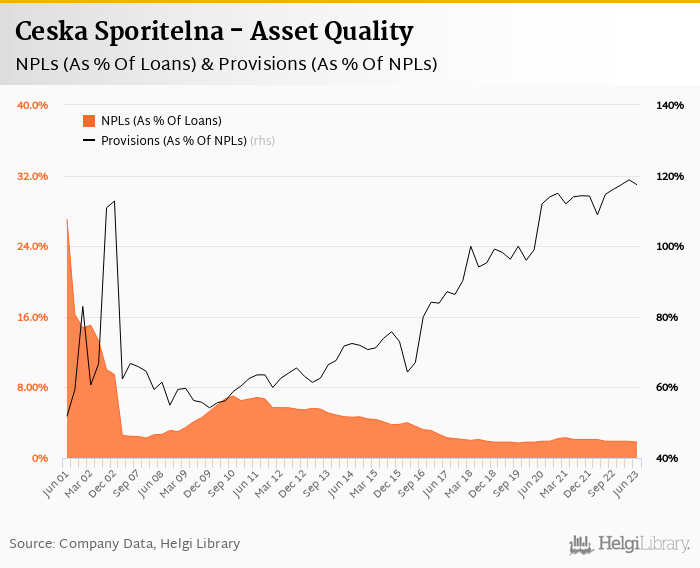

Ceska Sporitelna's asset quality remains good. Non-performing loans reached 1.80% of total loans and provisions covered some 117% of NPLs at the end of the second quarter of 2023, both better when compared to last year.

The higher cost of risk by more than CZK 1.1 bil when compared last year is mainly a result of a last year's provision release and one-off initial net provision creation due to Sberbank acquisition in 2023.

Still, provisions have "eaten" only 1.09% of operating profit in the second quarter of 2023 as cost of risk reached 0.031% of average loans:

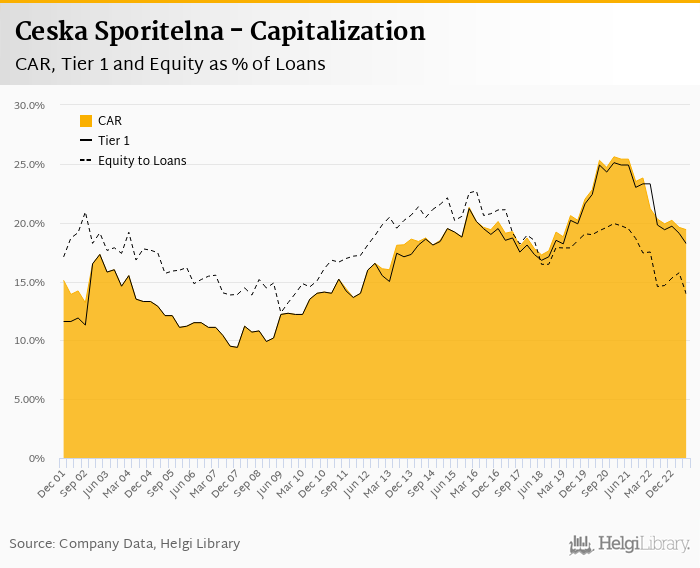

Ceska Sporitelna's capital adequacy ratio reached 19.4% in the second quarter of 2023, down from 20.3% for the previous year. The Tier 1 ratio amounted to 18.2% at the end of the second quarter of 2023 while bank equity accounted for 13.9% of loans:

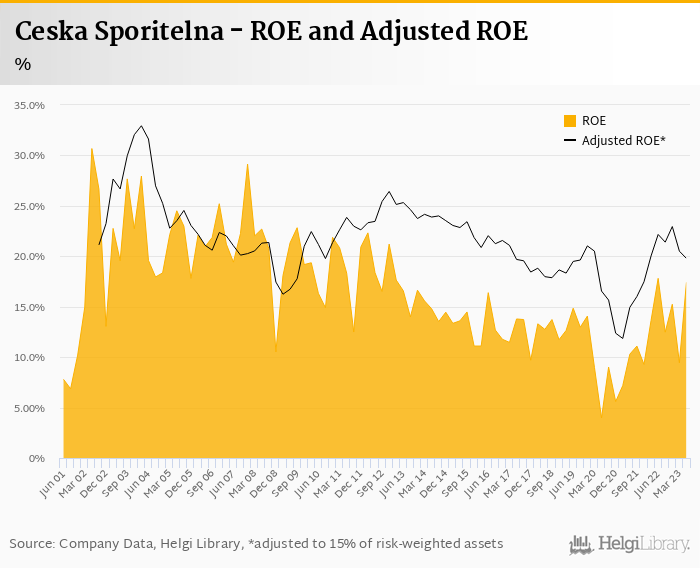

Overall, Ceska Sporitelna made a net profit of CZK 5,988 mil in the second quarter of 2023, down 1.58% yoy. This means an annualized return on equity of 17.4%, or 19.8% when equity "adjusted" to 15% of risk-weighted assets:

Ceska Sporitelna announced solid profit for the second quarter of 2023, though drivers were heavily of a non-core nature. The operating profit fell almost 10% yoy as higher interest rates and inflation have been eating into bank's margins and cost side, so main positives came from non-core items such as lower contribution to Recovery and Resolution Fund, lower losses from sales of bonds and lower effective tax rate from expected windfall tax.

Good asset quality, a pick up in loan demand and rising market share in key business areas are other key points to mention.

Pressure on cost of funding and interest margin, increase in operating cost and loan demand are the key areas to watch for in the coming quarters at Ceska Sporitelna, in our view.