Bank Millennium made a third consecutive quarterly profit and netted PLN 106 mil in 2Q2023

Revenues increased 13.5% yoy and cost rose 21.0% when adjusted translating into cost to income of 31%

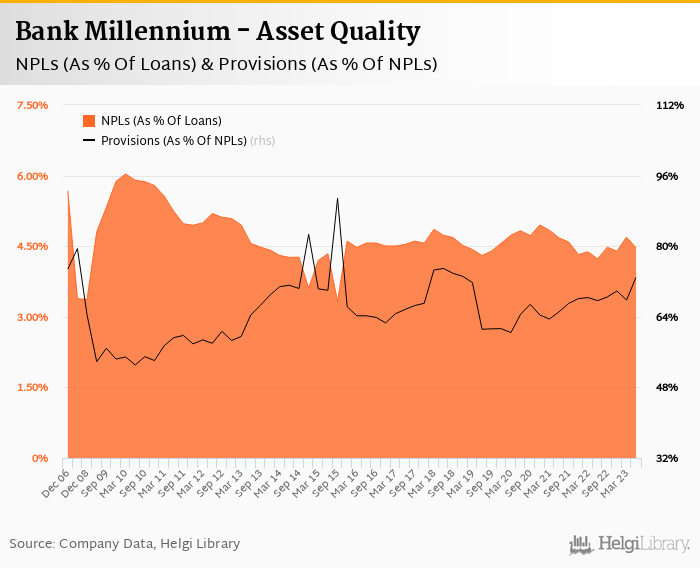

Asset quality remains an issue as cost of risk amounted 4.2%. But, provision coverage increased.

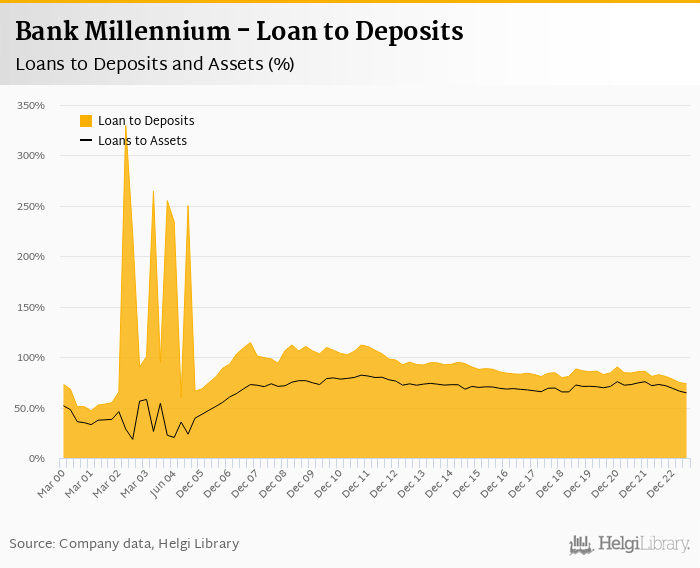

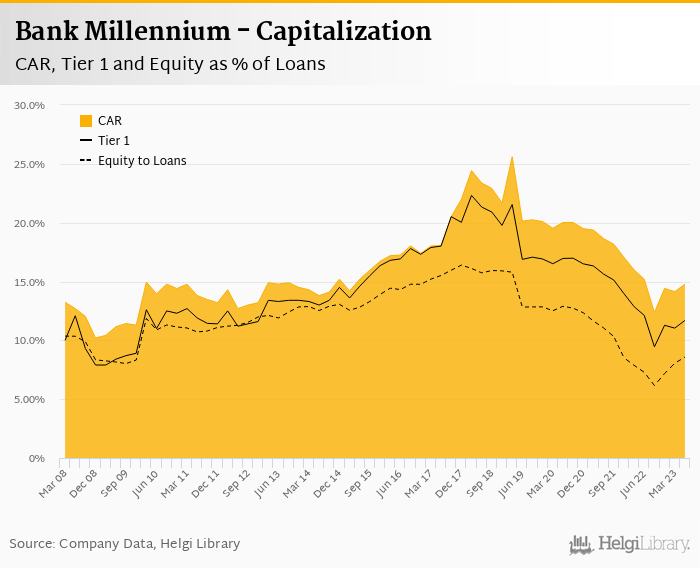

Loan to deposit ratio decreased to 73.7% and capital adequacy decreased to 14.8%

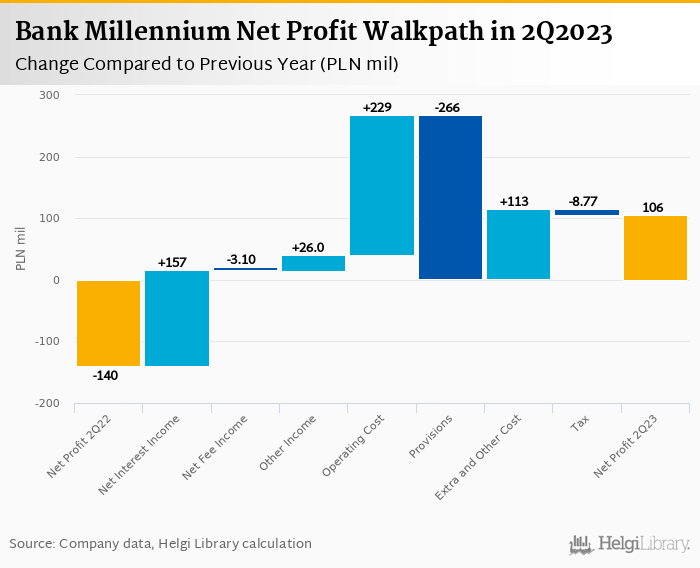

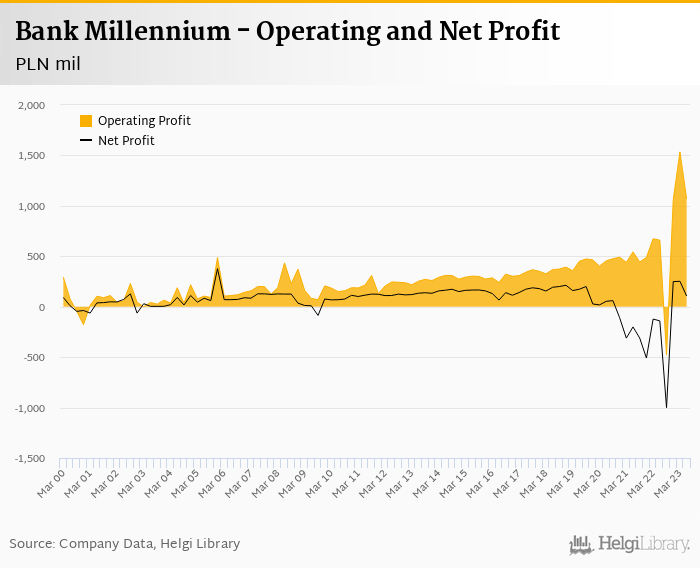

Bank Millennium made a net profit of PLN 106 mil in the second quarter of 2023, or increase of PLN 246 mil in absolute terms. When adjusted for PLN 310 mil change in contribution to the Guarantee Fund, the operating profit would have grown 12.5% yoy and pre-tax profit would have fallen 12.6% yoy. Apart from the above and an absence of PLN 87 mil banking tax booked in 2Q22, net interest income was the single biggest positive contributor to the profitability improvement when compared to last year:

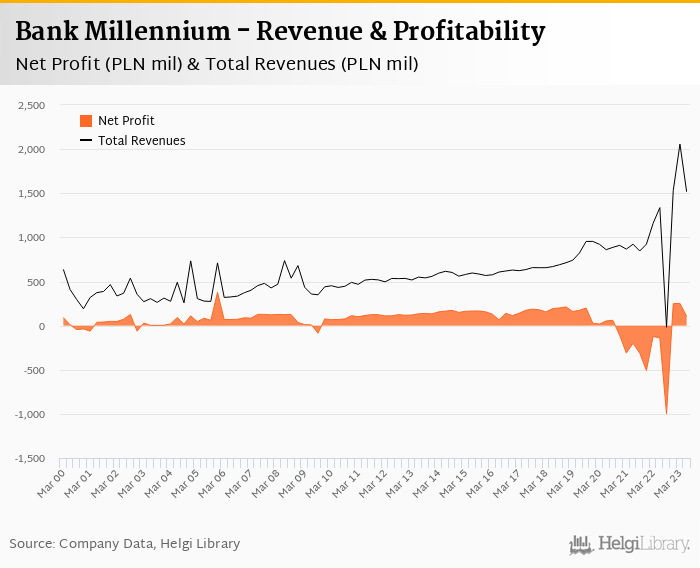

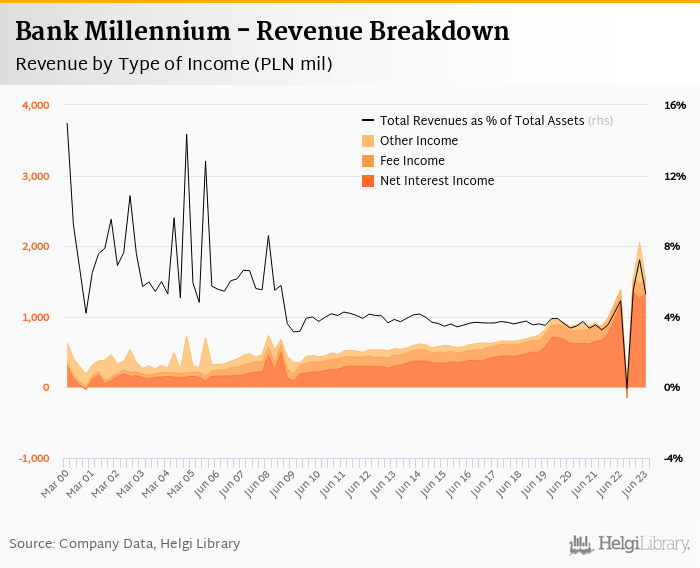

Revenues increased 13.5% yoy to PLN 1,517 mil in the second quarter of 2023. Net interest income rose 13.3% yoy as margin improved again 0.180 pp compared to last quarter to 4.67% of total assets. Fee income fell 1.50% yoy and other income improved due to lower losses on exchange differences. When compared to three years ago, revenues were up 76.3%:

Average asset yield was 7.30% in the second quarter of 2023 (up from 5.46% a year ago) while cost of funding amounted to 2.78% in 2Q2023 (up from 1.21%). The margin improved both on loans as well as deposits last quarter, so it will be interesting to see the development in the second half of 2023:

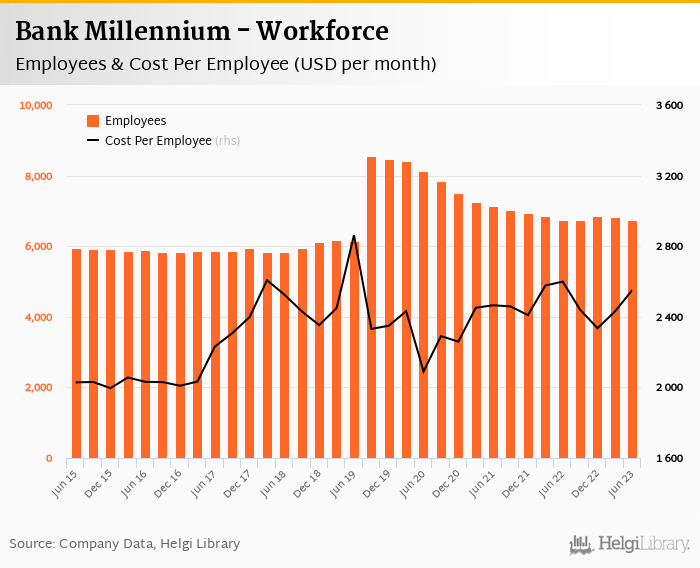

Costs decreased by 33.8% yoy and the bank operated with average cost to income of 29.5% in the last quarter. When adjusted for a contribution to the Guarantee Fund made last year (a change of PLN 310 mil yoy), the underlying costs increased by 21% yoy and cost to income ratio amounted to 31%. Staff cost rose 12.4% yoy amid stable workforce, so watch for other costs in the coming quarters:

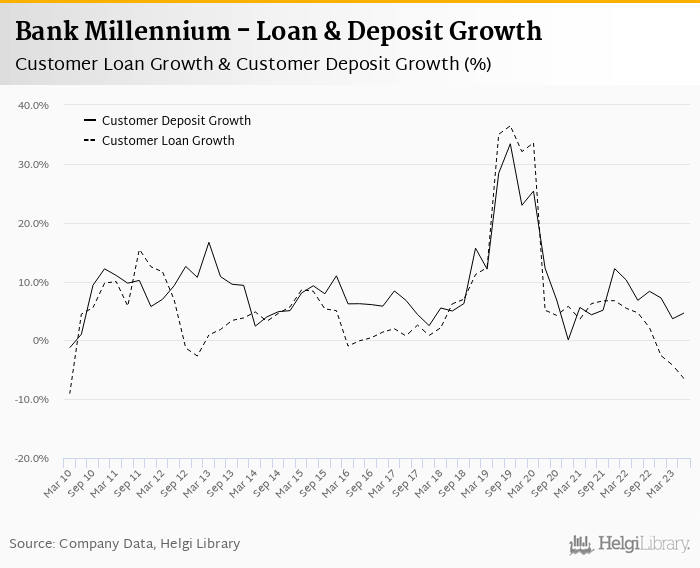

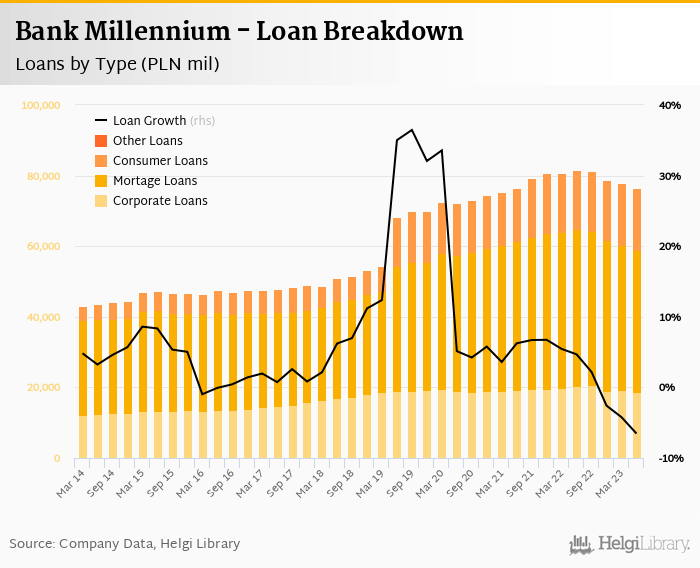

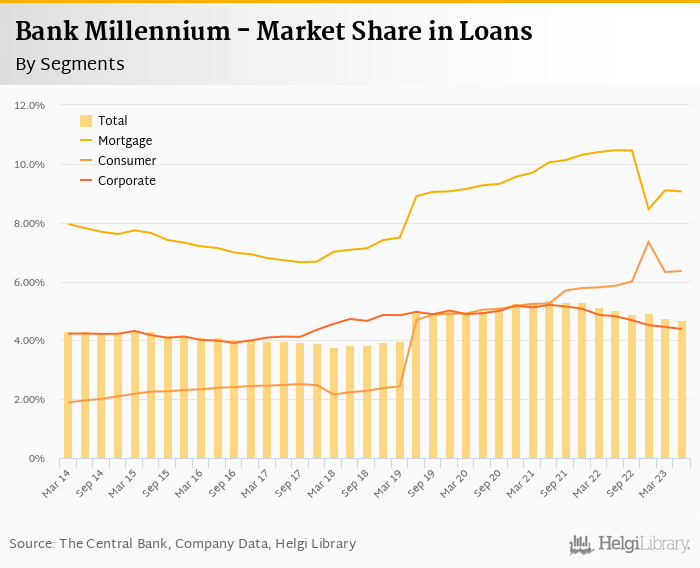

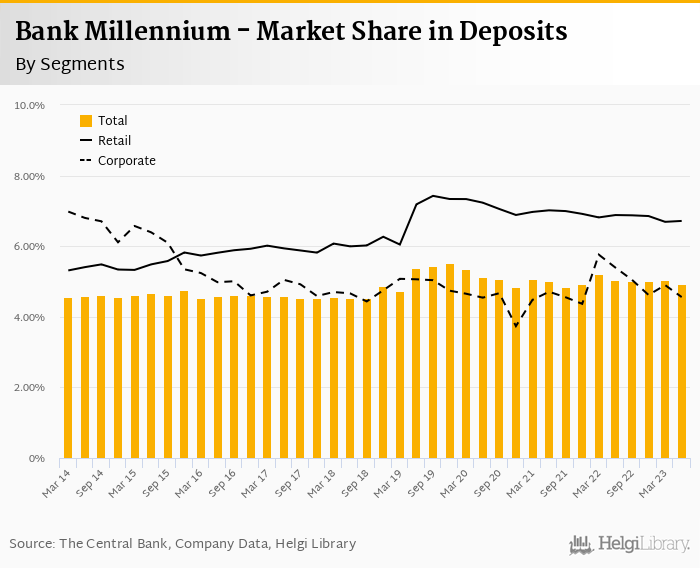

Growth in loans and deposits remains weak. Bank Millennium's customer loans decreased 1.63% qoq and are down 6.54% when compared to last year while customer deposit fell 0.28% qoq and are up 4.7% yoy. That’s compared to average of 2.7% and 6.3% average annual growth seen in the last three years.

At the end of second quarter of 2023, Bank Millennium's loans accounted for 73.7% of total deposits and 64.6% of total assets.

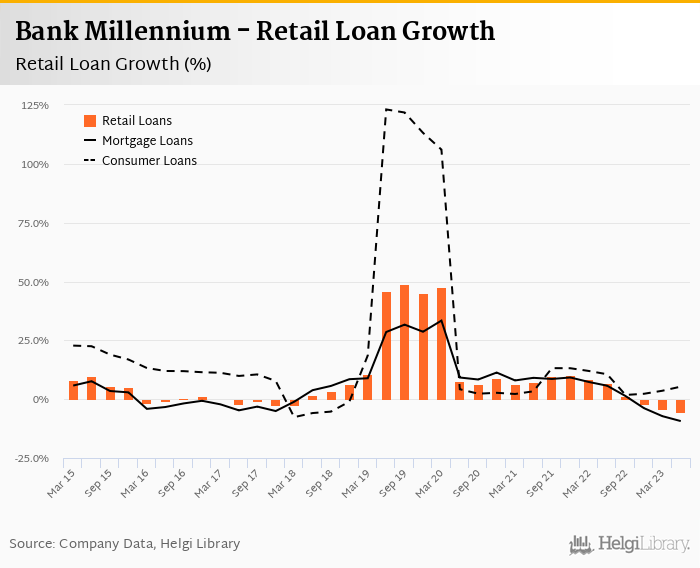

Retail loans fell 0.93% qoq and were 5.3% down yoy. They accounted for 78% of the loan book at the end of the second quarter of 2023 while corporate loans decreased 3.35% qoq and 8.1% yoy, respectively. Mortgages represented 54.4% of the Bank Millennium's loan book, consumer loans added a further 23.7% and corporate loans formed 25.1% of total loans:

We estimate that Bank Millennium has lost 0.35 pp market share in the last twelve months in terms of loans (holding 4.68% of the market at the end of 2Q2023). On the funding side, the bank seems to have lost 0.137 pp and held 4.92% of the deposit market:

Bank Millennium's non-performing loans reached 4.46% of total loans, up from 4.23% when compared to the previous year. Provisions covered some 73.0% of NPLs at the end of the second quarter of 2023, up from 67.7% for the previous year.

Provisions have "eaten" three quarters of operating profit in the second quarter of 2023 as cost of risk reached 4.2% of average loans. Most of the new provisions were again created to cover CHF-denominated mortgage portfolio (PLN 715 mil) and the provision coverage increased to almost 65%.

Bank Millennium's capital adequacy ratio reached 14.8% in the second quarter of 2023, down from 15.2% for the previous year. The Tier 1 ratio amounted to 11.7% at the end of the second quarter of 2023 while bank equity accounted for 8.6% of loans:

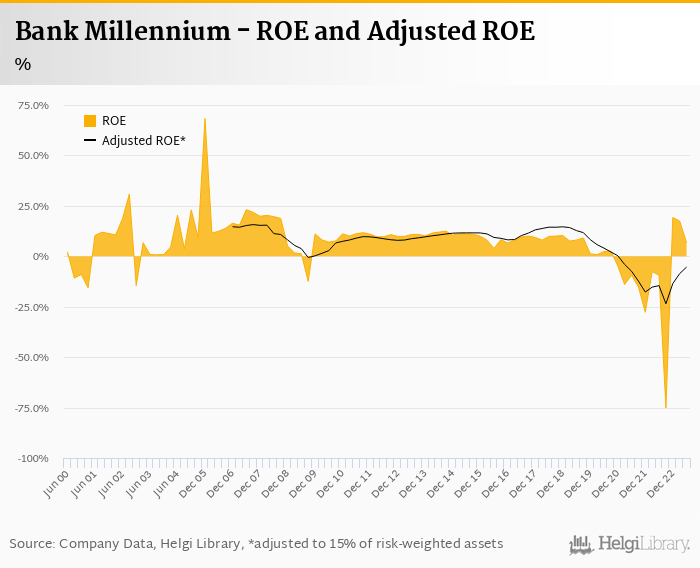

Following two years of losses, Bank Millennium made a third consequtive quarterly net profit of PLN 106 mil in the second quarter of 2023. This means an annualized return on equity of 6.81%. When adjusted for the last year's contribution to the Guarantee Fund, the net profit would have been 12.6% lower than last year due mainly to higher provisions.

Despite profitable and showing signs of further improvement on the operational side, the Bank remains under pressure from the burden of CHF-denominated mortgage portfolio. Provisions continue to eat heavily into Bank's operating profit and this might take some time before the saga ends.