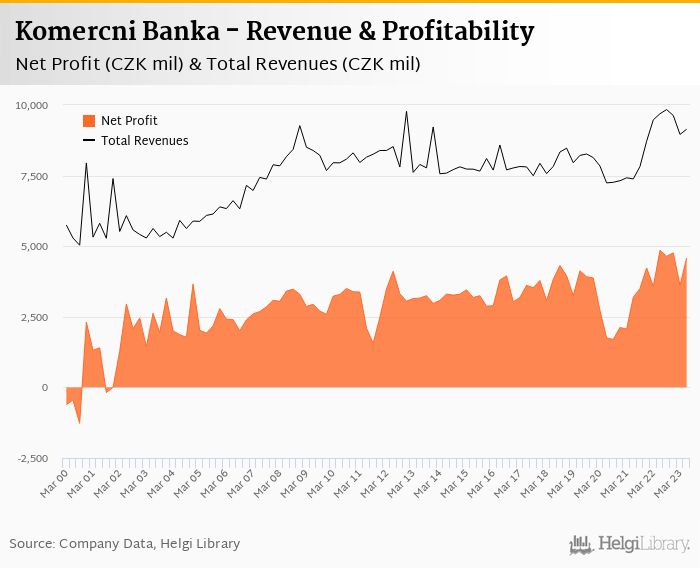

Komercni Banka decreased its net profit 5.96% to CZK 4,525 mil in 2Q2023 and generated ROE of 14.7%.

Operating profitability got under increased pressure as cost of funding bites into margin, demand for loans remains low and inflation pushes costs up.

Asset quality remains very good and saves the date with further provision write-backs. Profitability therefore remains strong profitability and capital buffer high enough the Bank to continue in its generous dividends policy.

Komercni Banka's operating profitability (down 16% yoy) got under increased pressure as customers demand higher rates on their deposits and high inflation pushes operating costs higher. Large provision write-backs, lower effective tax rate and trading income were the main positives last quarter, though not big enough to offset the former:

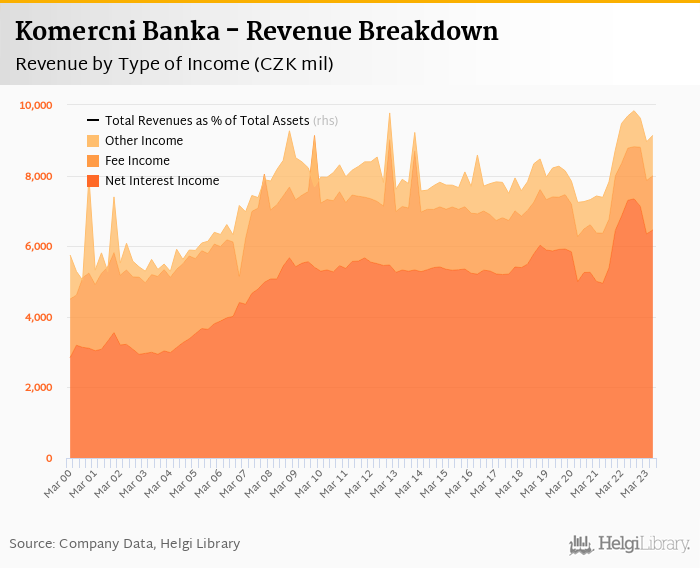

Revenues decreased 5.7% yoy to CZK 9,142 mil in the second quarter of 2023. Net interest income fell 11.5% with net interest margin decreasing 0.238 pp to 1.78% of total assets. Fee income grew 3.9% yoy and trading and other income grew by a quarter partially offseting the negatives on the interest front. In spite of the pressure, bank's revenues are still up 26% when compared to three years ago, just to put things into wider perspective:

Similar to other Czech banks, pressure from increased cost of funding has been driving revenues down as depositors demand higher rates on their savings. Term deposits increased to almost 48% of total from 10% two years ago. Cost of funding therefore increased to 6.84% in 2Q2023, from 4.53% a year ago:

Costs increased by 11.8% yoy and the bank operated with average cost to income of 44.7% in the last quarter. Staff cost rose 10.9% as the bank employed 7,549 persons (up 0.35% yoy) and paid CZK 93,834 per person per month including social and health care insurance cost. The pressure is felt across the board, so it will be interesting to watch the development in the coming quarters :

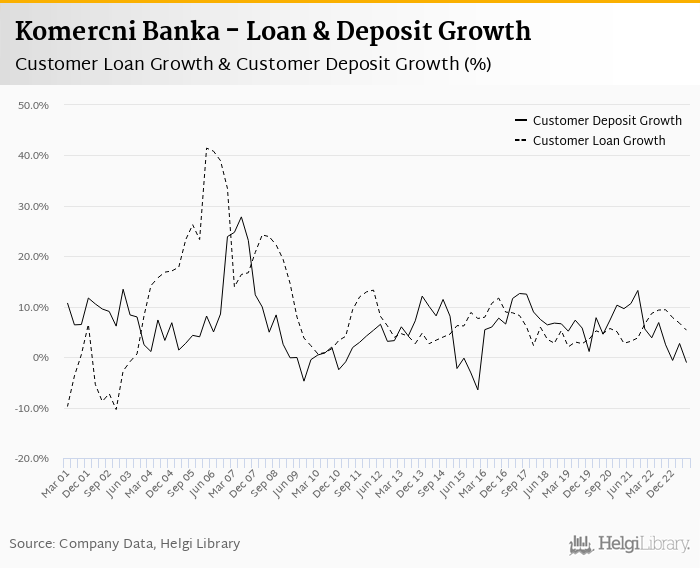

Demand for loans as well as deposits remains subdued. Komercni's loans grew 1.2% qoq and 5.3% yoy only in the second quarter of 2023 and low interest in visible in all segments of lending. Deposit growth amounted to 1.1% qoq and fell 1.1% when compared to last year, so a shift from current to term deposits is the main visible trend here.

At the end of second quarter of 2023, Komercni Banka's loans accounted for 73.1% of total deposits and 54.4% of total assets.

Retail loans grew 1.2% qoq and were 3.8% up yoy. They accounted for almost 50% of the loan book at the end of the second quarter of 2023 while corporate loans increased 0.52% qoq and 3.0% yoy, respectively. Mortgages represented 45% of the Komercni Banka's loan book, consumer loans added a further 4.6% and corporate loans formed 54% of total loans:

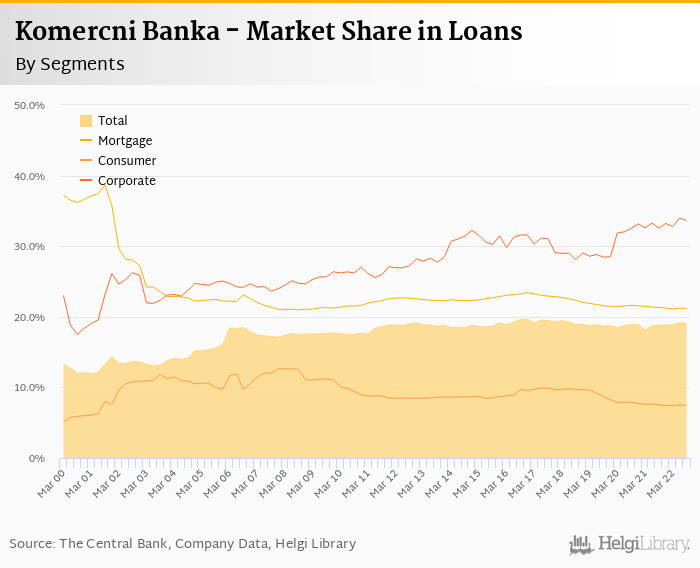

Komercni Banka seems to continue gradually losing its market share especially, in retail banking. We estimate that Komercni Banka has lost 0.165 pp market share in the last twelve months in terms of loans (holding 19.0% of the market at the end of 2Q2023). On the funding side, the bank seems to have lost 1.43 pp and held 16.0% of the deposit market:

Asset quality remains very good in spite of the difficult macro environment. Non-performing loans declined further CZK 2.2 bil compared to last year and formed 2.1% of total loans, down from 2.43%. Provisions covered some 51.3% of NPLs at the end of the second quarter of 2023.

Positive resolution on a few corporate exposures allowed the Bank to release CZK 501 mil of provisions in 2Q23, so overall cost of risk reached -0.236% of average loans:

Komercni Banka's capital adequacy ratio reached 20.0% in the second quarter of 2023, down from 20.3% for the previous year. The Tier 1 ratio amounted to 19.5% at the end of the second quarter of 2023 while bank equity accounted for 15.1% of loans:

Overall, Komercni Banka made a net profit of CZK 4,525 mil in the second quarter of 2023, down 5.96% yoy. This means an annualized return on equity of 14.7%, or 22.4% when equity "adjusted" to 15% of risk-weighted assets:

Komercni Banka stock trades at around 9.0x and in terms of price to earnings at around 1.1x price to book value expected in 2023/2024. With a dividend yield exceeding 7.0%, the stock seems attractively valued compared to the past. Given the lack of growth, high interest rates and more attractive alternatives elswhere in Europe, the short-term upside seems to be rather limited, in our view.

Over the previous five years, the PE multiple reached a high of 15.7x in 1Q2021 and a low of 6.39x in 3Q2022 with an average of 10.6x.

The 2Q23 results show relatively weak operating performance offset by provision write-backs, in our view. While attractively valued, lack of volume growth, pressure on the funding and cost sides and weakening position in retail banking seem to limit Komercni Banka's upside potential for now. Attractive dividends remain the main reason to hold the stock, in our view.