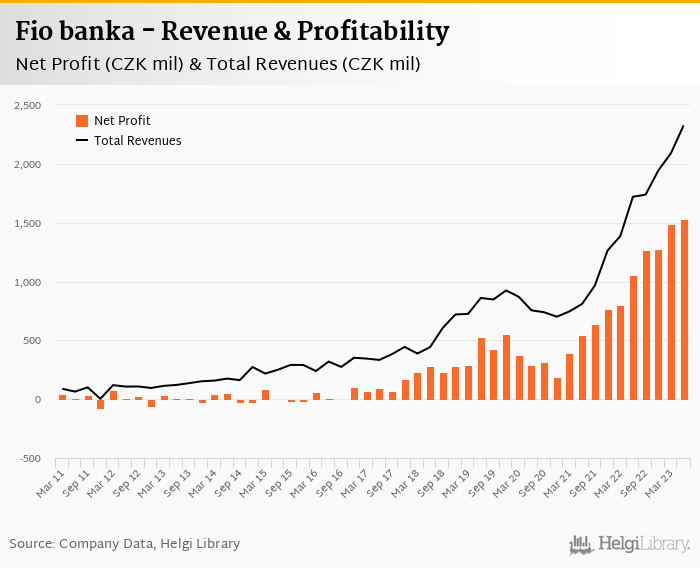

Fio banka announced another record-breaking net profit of CZK 1,52 bil in 2Q2023 implying ROE of 41.8%.

Higher interest margin was again driving the impressive results and pushed revenues 35.3% up. Cost rose 22.1% yoy, so cost to income decreased to 16.0%

Cost of risk amounted relatively high 1.37%. Having no details on asset quality, we suspect management might just have added an extra buffer to its books.

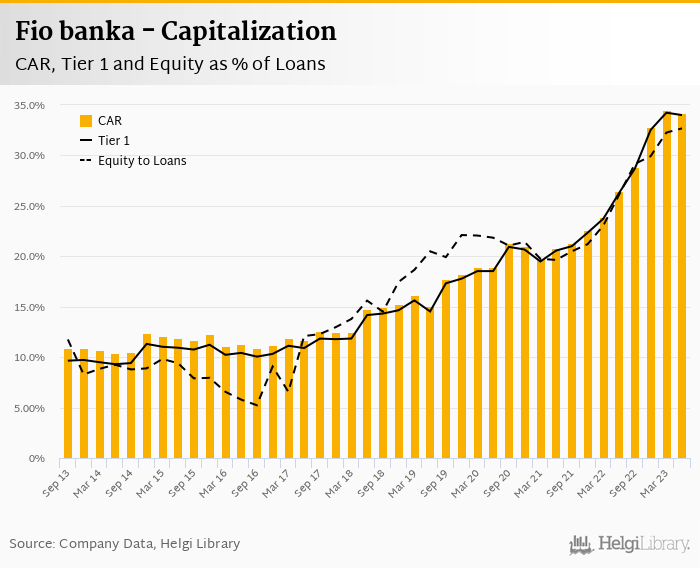

Loan form around a fifth of deposits and capital adequacy might have increased to 33-35%

Fio banka increased its net profit by another 44.5% yoy, or by CZK 471 mil in absolute terms when compared to last year. The whole increase was generated by net interest income, or by higher interest margins, respectively, as volume growth appears relatively modest. All other revenue and cost items from fee or trading income, operating costs or provisions were worse off when compared to last year. That's nicely delivers the margin message and is clearly demonstrated in the chart below:

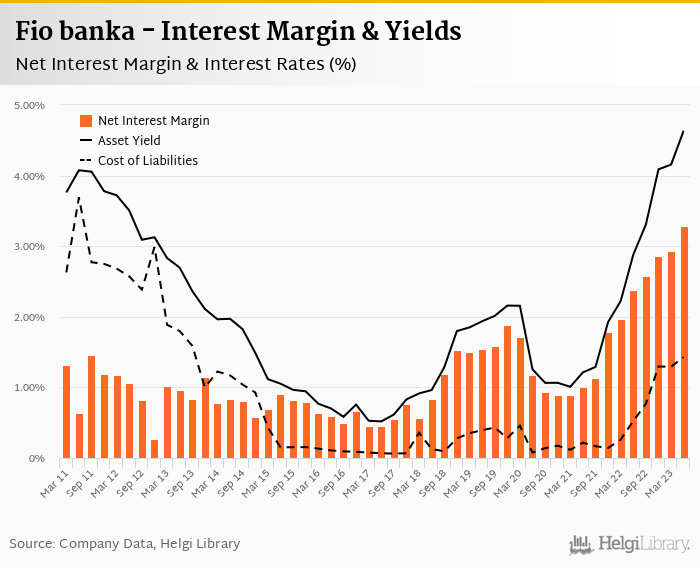

Revenues increased 35.3% yoy to CZK 2,327 mil in the second quarter of 2023. Net interest income rose 53.9% yoy as net interest margin increased 91 bp to 3.29% of total assets (and 35 bp qoq). Both fee income as well as other income fell when compared to last year (fell 36.9% yoy and 4.9%, respectively). When compared to three years ago, revenues were up 208%:

Average asset yield was 4.64% in the second quarter of 2023 (up from 2.88% a year ago and 4.16% in 1Q23) while cost of funding amounted to only 1.43% in 2Q2023 (up from 0.524% last year and 1.29% last quarter).

With more than 80% of assets "parked" in debt securities, or at Central and other banks and funded by very cheap customer deposits, Fio Bank's business model benefits heavily from rising interest rates. The higher margin translates directly into Bank's bottom line:

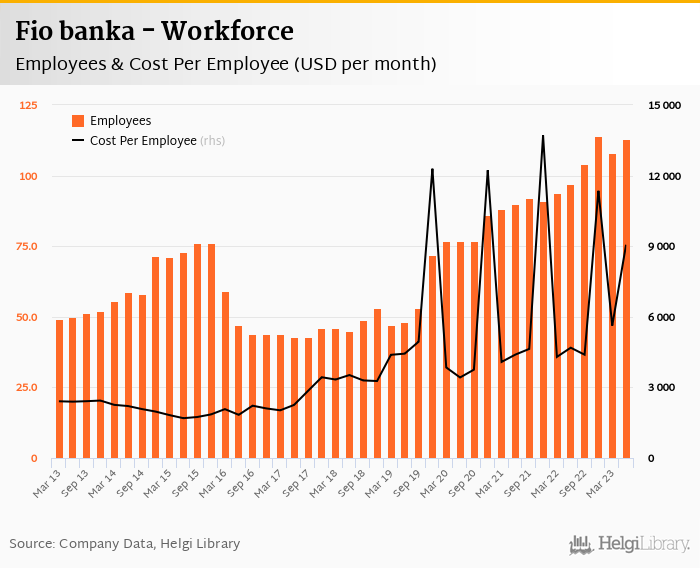

Costs increased by 22.1% yoy and the bank operated with average cost to income of 16.0% in the last quarter. This is one of the lowest figures within the CEE region demonstrating the Bank's operational leverage and cost-efficient business model, especially, in current high interest rate environment:

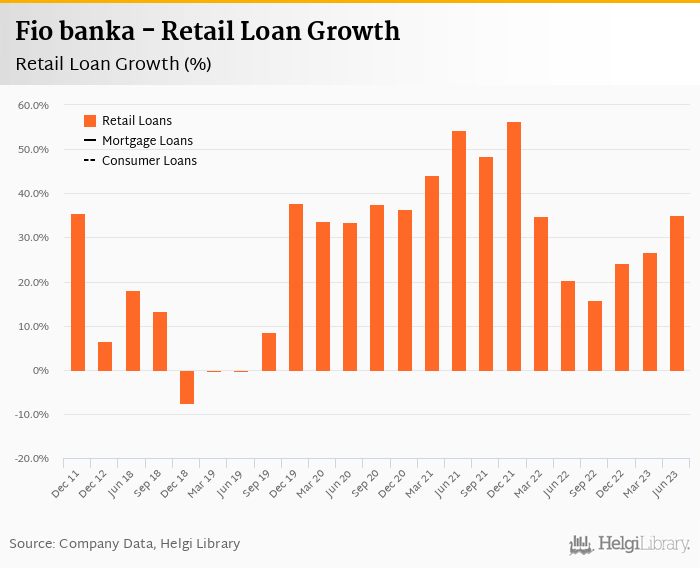

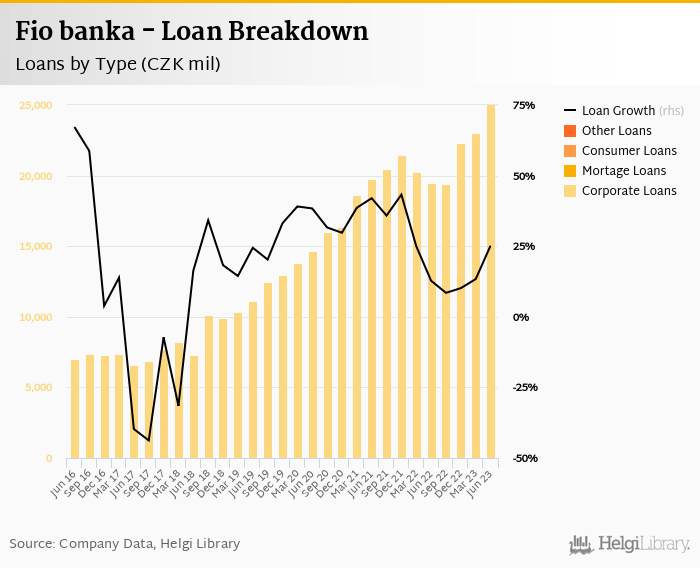

With no official data, we assume Fio banka's customer loans grew 7-10% qoq and 23-27% yoy in the second quarter of 2023 while customer deposit growth amounted to 2-4.0% qoq and 8-10% yoy. That’s compared to average of 26.3% and 12.4% average annual growth seen in the last three years.

At the end of second quarter of 2023, Fio banka's loans accounted for around 21% of total deposits and 19.0% of total assets, on our estimates.

We also estimate that retail loans grew 10.0% qoq and were 35.2% up yoy. They might have accounted for almost half of the loan book at the end of the second quarter of 2023 while corporate loans increased 8-9% qoq and around 28% yoy, respectively:

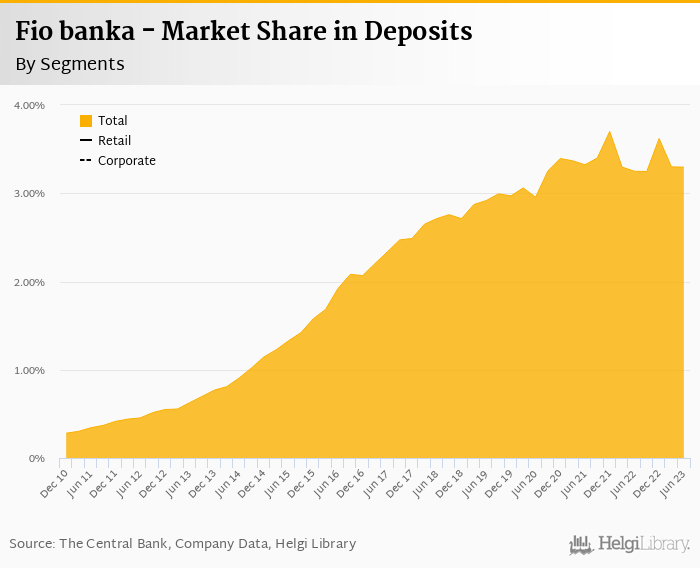

If proved correct, Fio banka would have gained 0.17 pp market share in the last twelve months in terms of loans (holding 1.12% of the market at the end of 2Q2023). On the funding side, the bank would have gained 0.046 pp and would held 3.30% of the deposit market:

Without having any details about Bank's asset quality since the end of 2022, we "guesstimate" that Fio banka's non-performing loans reached 8-9.0% of total loans, down from 9.02% when compared to the previous year. Provisions might have covered some 44-48% of NPLs at the end of the second quarter of 2023, up from 43.4% for the previous year.

The Bank created relatively high provisions in the second quarter (CZK 154.3 mil, which is the highest figure since the end of 2021). Cost of risk therefore reached relatively high 1.37% of average loans on the annualized basis.

Taken into account good asset quality development of other banks in 1H2023 and record-breaking profitability of Fio Banka in 1H2023, we assume the relatively high cost of risk is a creation of a buffer rather than a sign of asset quality deterioration:

Assuming the loan growth and profitability, we expect Fio banka's capital adequacy ratio reached 33-35% in the second quarter of 2023, up from 26.5% for the previous year:

Overall, Fio banka made another record-breaking net profit of CZK 1,529 mil in the second quarter of 2023, up 44.5% yoy. This means an annualized return on equity of 41.8% in the last quarter or 42.3% when the last four quarters are taken into account:

Fio banka announced another record-breaking profitability with CZK 1.52 bil net profit in the second quarter of 2023 and extended the record-breaking series at 8 quarters! That's in spite of delivering worse results in every main revenue and cost line apart from the net interest income.

With ROE exceeding 40% and cost to income well below 20%, Fio banka remains comfortably in a yellow-jersey and the peloton remains well behind.

With more than 80% of assets "parked" in debt securities, or at Central and other banks and funded by very cheap customer deposits, Fio Bank's business model benefits heavily from rising interest rates.