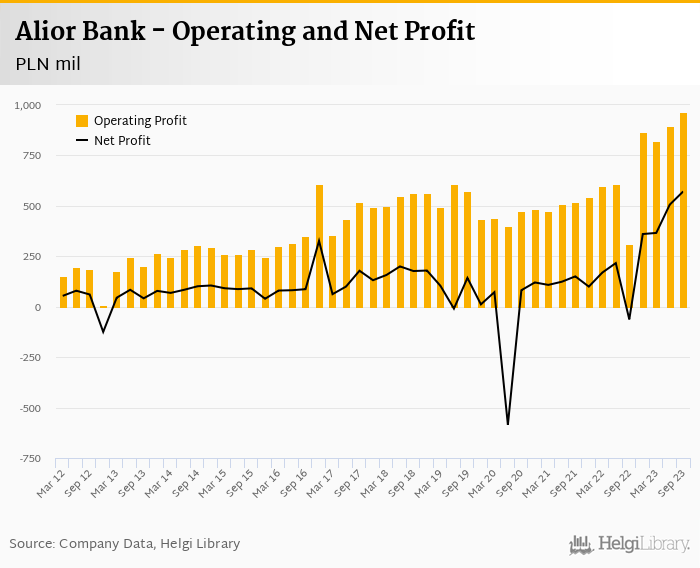

Alior Bank posted another record net profit of PLN PLN 572 mil in 3Q2023 beating market expectations by some 10%.

Revenues increased 12.3% yoy when adjusted for credit moratoria and cost rose by 25.6% when adjusted for contribution to the Bank Guarantee Fund. Still, cost to income decreased to 33.4%

Share of bad loans fell further to 8.93% and provision coverage rose to 77.1%. Management targets cost of risk of only 1.0% in 2024.

Trading at PE of 8.0x and PBV of 1.0x and doing all it can to enjoy current high interest rate environment, the show might still go on for Alior Bank

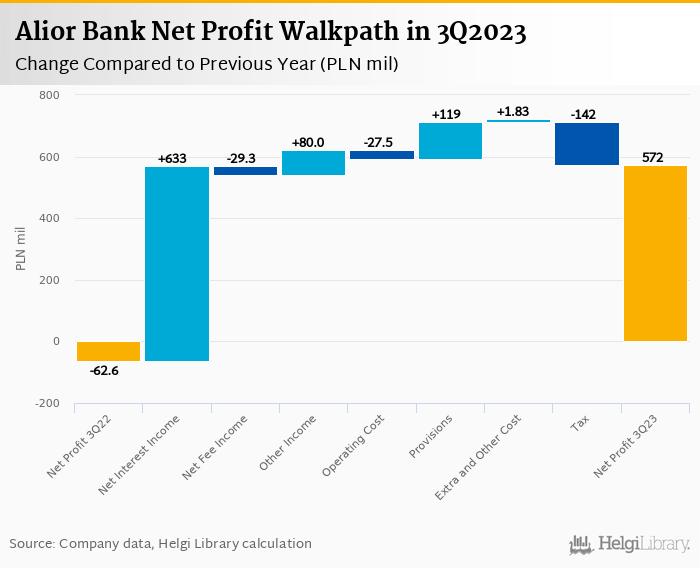

Alior Bank made another record-breaking profit of PLN 572 mil in the third quarter of 2023, up 51% when adjusted for credit moratoria last year. On the adjusted basis, revenues generated more than 60% of the profit growth with lower provisions the rest:

Revenues increased adjusted 12.3% yoy to PLN 1.45 bil in the third quarter of 2023 with net interest income generating more than two thirds of the improvement. Fee income fell 14.5% yoy due mainly to accounting of FX transactions, which was partly recognised in trading/other income (up PLN 80 mil when compared to last year). When compared to three years ago, revenues were up 64.1%:

Net interest income rose adjusted 9.7% yoy and formed 84.1% of total revenues. Net interest margin increased to all-time high of 5.74% of total assets, up further 21 bp when compared to previous quarter. Average asset yield was 8.89% in the third quarter of 2023 while cost of funding amounted to 3.48% in 3Q2023 (up from 3.03% last year):

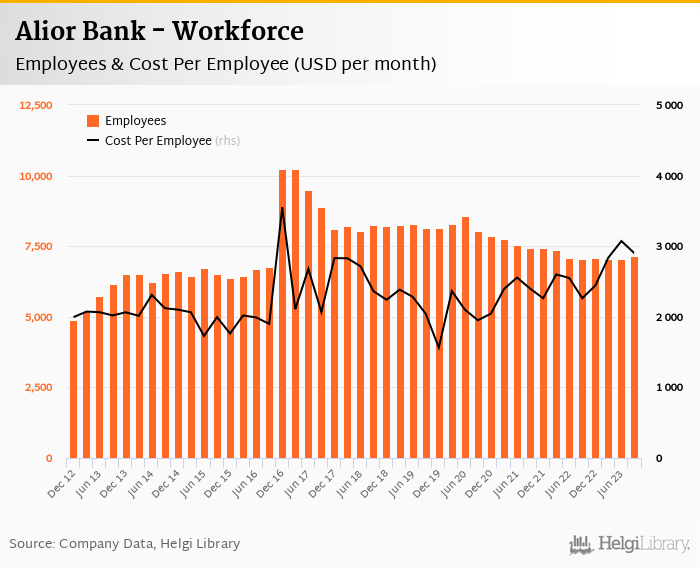

Costs increased by 6.0% yoy, but when adjusted for the contribution to the Bank Guarante Fund, the increase was hefty 25.9% yoy on our calculation. Thanks to strong revenues though, cost to income ratio was still impressive 33.4% in the last quarter.

Staff cost rose 16.9% due to salary increases and other cost went up 60% driven by rent and maintenance, marketing, provisions for legal settlements and other costs):

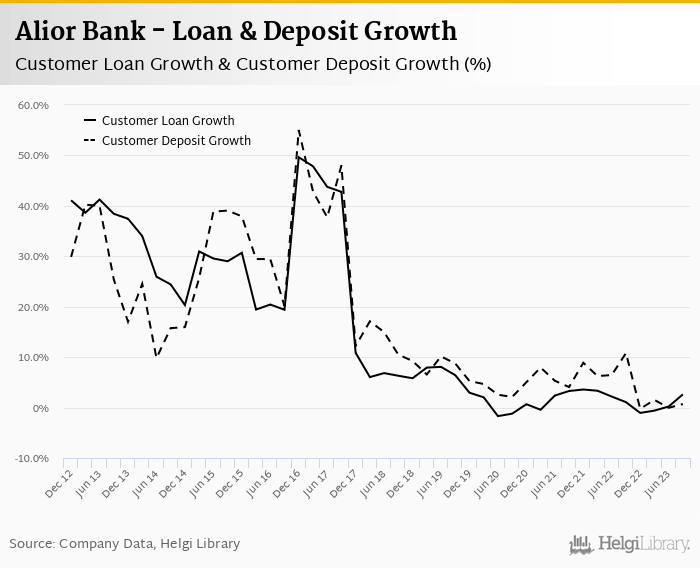

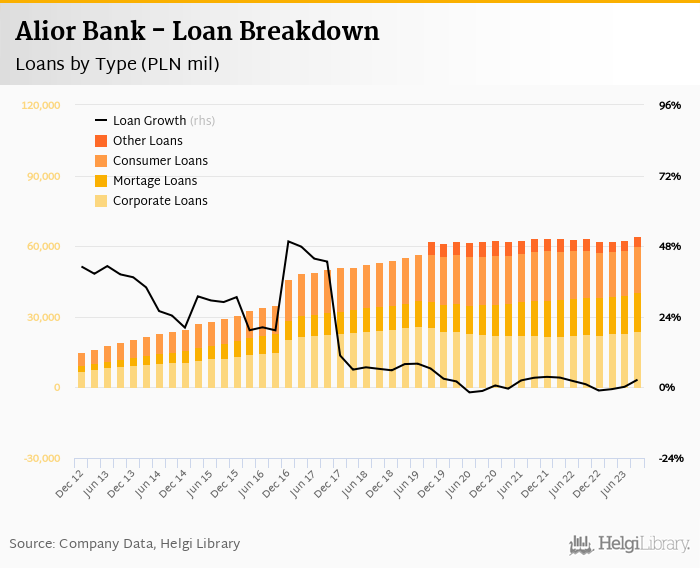

Loan demand remains subdued, though a recovery has been seen last quarter across the board. Loans grew 2.7% qoq and 2.6% yoy in the third quarter of 2023 while customer deposit growth amounted to 3.1% qoq and 0.7% yoy.

At the end of third quarter of 2023, Alior Bank's loans accounted for 82.3% of total deposits and 69.5% of total assets.

Retail loans grew solid 3.0% qoq and were 1.4% up yoy while corporate loans increased 2.4% qoq and 4.5% yoy, respectively. Mortgages represented 28.0% of the Alior Bank's loan book, consumer loans added a further 32.2% and corporate loans formed 39.8% of total loans. The Bank achieved the highest volume of mortgage loans sales in its history when sales exceeded PLN 500 mil in September:

Non-performing loans increased PLN 65 mil and reached 8.93% of total loans, down from 10.7% when compared to the previous year. Provisions covered some 77.1% of NPLs at the end of the third quarter of 2023.

The management does not feel a significant pressure on asset quality deterioration and expects the cost of risk not to exceed 1.1% in 2023 with a stabilisation at around 1.0% in 2024.

Alior Bank's capital adequacy ratio reached 16.7% in the third quarter of 2023, up from 13.7% for the previous year. The Tier 1 ratio amounted to 15.9% at the end of the third quarter of 2023 while bank equity accounted for 14.3% of loans:

Overall, Alior Bank made a net profit of PLN 572 mil in the third quarter of 2023, up 51% when adjusted for credit moratoria last year. This means an annualized return on equity of 28.1% in the last quarter:

Impressive results beating market expectations by 10% with another record-breaking quarterly profitability. Strong interest margin and lower than expected cost of risk are still the main drivers here.

With the right balance sheet (large share of consumer loans funded with sight deposits), good risk management and aggressive pricing, the Bank has been doing everything possible to use the current high interest rate environment to maximise profits.

Trading at PBV of around 1.0x and PE of around 8.0x expected in 2024, the stock has a plenty to offer if the tailwinds in the form of high interest margin and low cost of risk continue to play in Bank's favour.