Alior Bank made a record net profit of PLN 506 mil in 2Q2023 implying ROE of 27.7%.

Strong interest margin, absence of contribution to Guarantee Fund and lower provisions were the main drivers

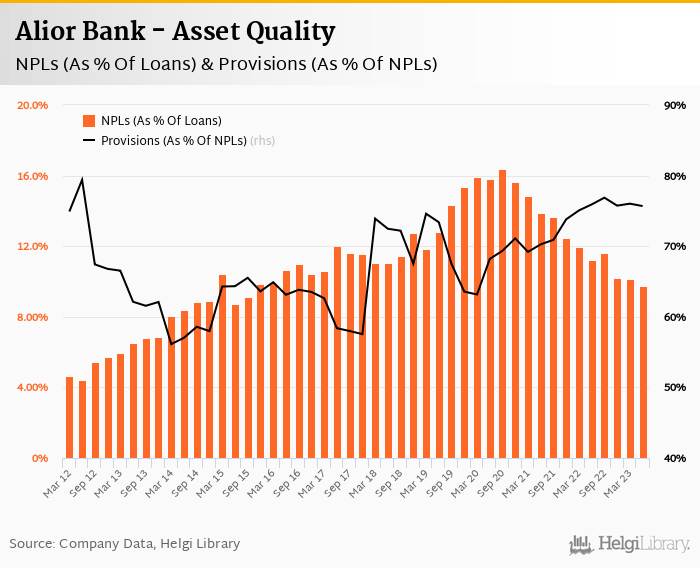

Asset quality continues to improve with NPL ratio falling to 9.74% and cost of risk at 1.05%.

Loan to deposit ratio increased to 82.6% and capital adequacy increased to 15.1%

Alior Bank made a net profit of PLN 506 mil in the second quarter of 2023, up 134% yoy, or increase of PLN 290 mil in absolute terms. Higher net interest income, absence of PLN 194 mil contributiuon to the Guarantee Deposit Fund made last year and lower provisions explain the big profit improvement when compared to last year:

Revenues increased 15.4% yoy to PLN 1,384 mil in the second quarter of 2023. Net interest income rose 19.5% yoy and formed 84% of total. Net interest margin increased by 0.929 pp to a record 5.53% of total assets. Fee income fell 2.0% yoy and added a further 15.6% to total revenue. When compared to three years ago, revenues were up 74.3%:

Average asset yield was 8.74% in the second quarter of 2023 (from 6.39% a year ago) while cost of funding amounted to 3.52% in 2Q2023 (up from 1.91%). With a third of loan book coming from higher-yield consumer loans and two thirds of deposits still being with no term fixation, i.e. cheaper, the Bank enjoys the high interest rate environment like no other listed bank in Poland:

Costs decreased by 17.2% yoy thanks mainly to the absence of PLN 195 mil payment to the Guarantee Deposit Fund last year, so the bank operated with cost to income of 35.4% in the last quarter. When adjusted, staff cost would have risen 16.1% and other costs almost 45% yoy as the wage and inflationaty pressures continue:

Loan and deposit growth remains weak. The former could be a result of high interest rates making loans less affordable (loans grew 1.0% qoq and 0.2% yoy) while the latter could have something to do with Bank's aggressive pricing policy. Two thirds of Bank's deposits remain "at sight", so the cost of funding is lower. Bank's deposits fell 1.6% qoq and were down 0.1% when compared to last year.

At the end of second quarter of 2023, Alior Bank's loans accounted for 82.6% of total deposits and 69.9% of total assets.

Retail loans grew 0.7% qoq and were 2.78% down yoy. They accounted for 60% of the loan book at the end of the second quarter of 2023 while corporate loans increased 1.5% qoq and 5.0% yoy, respectively. Mortgages represented 27.5% of the Alior Bank's loan book, consumer loans added a further 32.6% and corporate loans formed 39.9% of total loans:

We estimate that Alior Bank has lost 0.012 pp market share in the last twelve months in terms of loans (holding 3.69% of the market at the end of 2Q2023). On the funding side, the bank seems to have lost 0.264 pp and held 3.46% of the deposit market:

Alior Bank's non-performing loans reached 9.74% of total loans, down from 11.2% when compared to the previous year (and from 16% in 2020!). Provisions covered some 75.7% of NPLs at the end of the second quarter of 2023. The fall in NPL ratio is impressive, especially, since riskier consumer loans still account for a third of the Bank's portfolio.

Provisions have "eaten" only 17.1% of operating profit in the second quarter of 2023 as cost of risk reached 1.05% of average loans. There were some one-offs, so it will be interesting to see the level of provisioning in the next quarters:

Alior Bank's capital adequacy ratio reached 15.1% in the second quarter of 2023, up from 14.0% for the previous year. The Tier 1 ratio amounted to 14.2% at the end of the second quarter of 2023 while bank equity accounted for 13.2% of loans:

Overall, Alior Bank made a record quarterly net profit of PLN 506 mil in the second quarter of 2023, up 134% yoy. This means an annualized return on equity of 27.7%, or 16.3% when equity "adjusted" to 15% of risk-weighted assets:

Impressive results with a record-breaking quarterly profitability. With the right balance sheet (large share of consumer loans funded with sight deposits), good risk management and aggressive pricing, the Bank has been doing everything possible to use the current high interest rate environment to maximise profits. Trading at PBV of around 1.0x and PE of around 8.0x expected in 2024, the stock has a plenty to offer if the positive trend sustains.